Comparison Shopping For The Best Rates

No matter what your age or gender, regularly reviewing your policy and comparing rates offered by other insurers gives you the best chance to pay the lowest premiums. If you deal with an insurance agent, youre dealing with just one company. Most motorists use insurance brokers, professionals who represent a range of insurance companies. Brokers can compare options from these companies to provide you with the best coverage.

That still restricts you to the companies the broker represents though. There is no guarantee that youre receiving the best rates the industry has to offer. Using the power of the Internet, you can search the products from dozens of auto insurance providers using a tool called a car insurance calculator. Providing your information once, the right calculator searches through many companies for not only the best price but the best match.

Ratelab gives access to over 50 insurance industry partners, directing you to the best car insurance coverage at the lowest rates. Start today by entering your home postal code in the space provided below. Youre already on your way to car insurance savings, no matter what your age.;

When Do Car Insurance Premiums Go Down

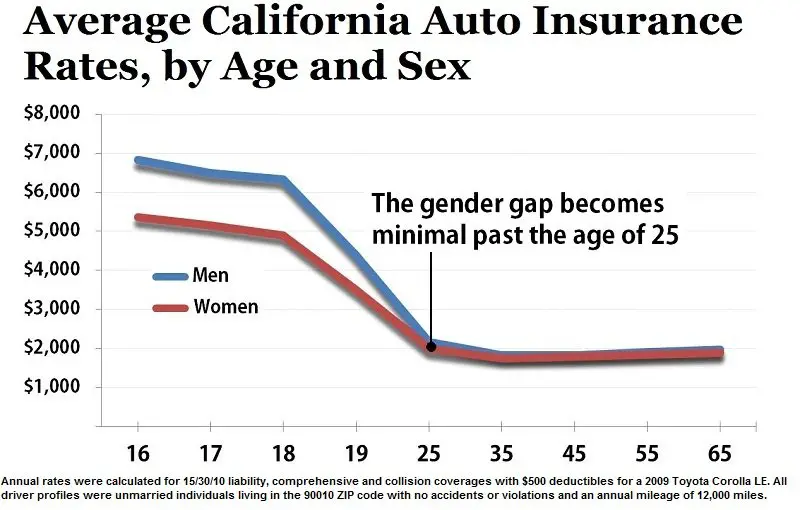

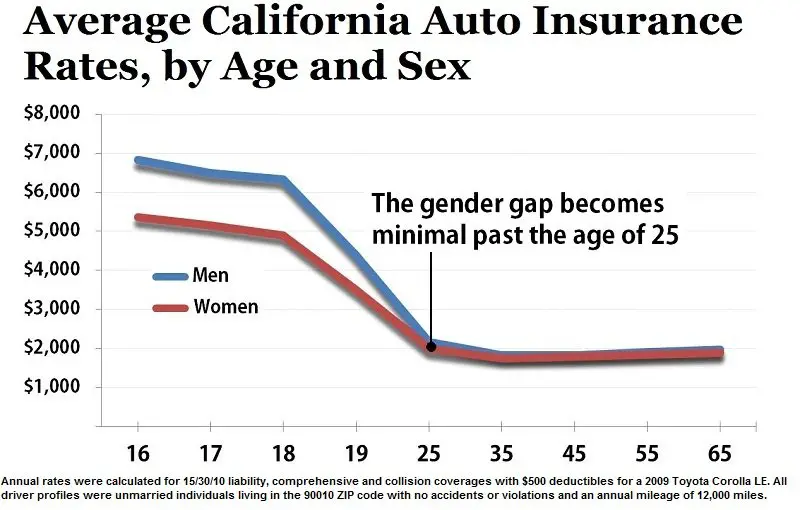

From ages 16 to 25, your car insurance rates will steadily go down for every year that you keep your driving record clean. Car insurance rates go down at age 25 by a large margin. Rates then decrease slowly but surely until age 65, before increase again. Keep in mind that these average rates can be affected by other factors such as your driving and insurance claim histories.

Ensure Your Car Is Safe And Secure

Insurance providers like to know that the vehicle being insured is likely to be as secure as possible to avoid the risk of theft. This concerns security inside the vehicle, and where it is stored when not being driven.

If your car is fitted with an alarm, immobiliser or another security device, this may help in reducing the cost of insurance for new drivers. Much like car insurance groups, Thatcham Research has categorised alarms the higher the rating of the security system in your vehicle, the more money you could save on your car insurance.

Theres a more detailed explanation on Thatchams category alarms here and a selection of security products available from the RAC Shop here.

When the car is being driven, where is it left? Youll be asked for this information when comparing car insurance quotes. If the vehicle will be kept in a garage overnight, or parked on the driveway of your house, that should result in a saving on your insurance policy.

If you can only park the car on the street, you probably wont see a saving.

Dont Miss: Does Dental Insurance Cover Veneers

Don’t Miss: How Much Does An Equus Cost

Auto Insurance In Your 50s

Car insurance for people over 50 is usually cheaper than it is for younger and older drivers. That’s because drivers in their 50s are among the safest — you have lots of experience but still have good health, quick reflexes, and reliable hearing and vision.

The average rate for full-coverage auto insurance for a 55-year-old is $1,519.;

Is It Cheaper To Be On A Parents Auto Insurance

Is it cheaper to be on your parents car insurance? Without a doubt, being on a parents car insurance will be cheaper for the child . According to the Insurance Information Institute, for teen drivers, who are extremely expensive to insure, being on the parents insurance will decrease costs dramatically.

The insurance company essentially takes an average of the risk of the parent and the risk of the teen driver. Of course, this means that the parents rates will increase. Although, for the teen driver, this is often the only option that will be affordable.

Also Check: Nada What Is My Car Worth

How Can I Lower My Car Insurance After An Accident

The bad news is that if youre in an at-fault accident, or your insurance company thinks youve been involved in too many incidents, your insurance premium will likely go up. One at-fault incident, for instance, can raise your rate anywhere from 12% to 80%, depending on the severity. But there is a chance it wont change. Unfortunately, your rate could still increase due to losing a good driver discount.

How Much Will Your Auto Insurance Premium Decrease After 25

Your auto insurance premium, which is the amount you pay for auto insurance, will change over time. The biggest decrease will come when you turn 25. At that point, youll pass out of the high risk category into real adult driving.

Factors that Affect Rates

There are many more safe young drivers than those who take risks. However, the age group running between 16 years to 24 years is more likely to have accidents than any other. If you have a record of accidents, or if you have moved a great deal, then your rates wont decrease much when you hit 25.

For many, car insurance for those under 25 can swallow a large chunk of any budget. The best way to keep down costs is to just take out the minimum coverage, although youll only be able to do this if you dont have an auto loan.

Tips for Getting Car Insurance for 22 Year Olds >>

Rate Decrease

On average, youll find that the auto insurance premium will decrease by up to 20 percent for males when they turn 25. That figure is generally less for females and is usually between 12 percent and 15 percent. This is because young females are generally deemed to be safer drivers than young males and pay less at a younger age.

Over 25

You May Like: Can I Turn In My Car Lease Early

How Much Should I Pay For Car Insurance

A good rule of thumb is to buy as much car insurance as you can afford. You might be tempted to skimp and buy only your states minimum car insurance. But many optional forms of car insurance are worth considering, often providing benefits worth far more than the amount they add to your premium.

Neither comprehensive insurance nor collision insurance is required, but both are smart choices. Comprehensive insurance covers damage from non-collision accidents, like vandalism or theft. Without it, youre stuck paying all the bills if a tree falls on your car during a storm, for instance. And collision insurance handles your car repair bills, even if you caused an accident. You might also consider buying medical coverage if your health insurance has a very high deductible.

Finally, whether youre 16 years old or 65, make sure to shop around for the best deal on whatever coverage you decide to buy. This will ultimately allow you to afford higher coverage limits.

Find Cheap Auto Insurance Quotes In Your Area

Car insurance does go down at 25. The average price of car insurance for a 25-year-old is $3,207 for an annual policy. By contrast, drivers pay an average of $7,179 at 18 and $4,453 at 21 which demonstrates that car insurance does go down as you age.

However, this milestone isn’t as magical as you might think. Yes, car insurance for drivers under 25 is more expensive. But the difference between how much 24-year-olds and 25-year-olds pay on average for car insurance is relatively small only 11%. Our analysis found that rates go down much more at other one-year intervals.

Read on to learn more details about when car insurance does go down.

Read Also: How Much Commision Does A Car Salesman Make

When Does Car Insurance Go Down

Lets dig in deeper to understand how premiums tend to change during drivers 20s. While average car insurance rates dont tell the whole story, they can point to trends in what groups may pay more or less for insurance.

According to one study, the average six-month premium for teens who are on their parents insurance started at $2,617 for 16-year-olds. The cost dropped every year, down to $2,037 for 19-year-olds.

Theres also a big jump once drivers are outside their teens. Rates then continue to decrease each year but actually start leveling out once drivers turn 25.

Senior Car Insurance Discounts: Tips For Saving

There are plenty of discounts available to older drivers, and you should pursue all that apply to you. Below are eight specific actions you can take to reduce your premium costs:

Insurance.com’s coverage calculator can help you set an appropriate level of coverage for the coming years.

Don’t Miss: How Much Mileage Is Too Much For A Used Car

How Gender Affects Car Insurance Rates

The notion that women are safer drivers than men is not just anecdotal. According to Barry, decades of insurance data show that women are, on average, less likely than men to file a claim. And this means men pay more.

According to the study, a single 20-year-old male driver will pay 23 percent more than his female counterpart. The good news for men is this difference begins to drastically level off as male drivers get older.

For instance, a single 25-year-old male driver will only pay an average of 4 percent more for auto insurance than his female counterpart. Whats more, between the ages of 30 and 60, men actually pay slightly less for auto insurance than women.

Across the board you see young men paying more for insurance, which makes sense, says Barry. Statistically, young men are riskier drivers, which means they are, on average, more expensive to insure.

According to the Hawaii Department of Commerce and Consumer Affairs Insurance Division, Hawaii is the only state that doesnt allow car insurers to use age, gender, or length of driving experience when setting rates.

How Marriage Affects Car Insurance Rates

According to the study, there can be a significant difference between what a married person and a single person of the same age will pay for car insurance. On average, a single, 20-year-old male will pay 24 percent more for auto insurance than his married counterpart. And for a single, 20-year-old female the difference is 28 percent.

The way marital status plays a role in setting premiums can be a contentious issue, but its based on the assumption;that individuals particularly young individuals get more serious about being better drivers when theyre married, says Bob Hunter, former Texas Insurance Commissioner and current director of insurance at the Washington, D.C.-based Consumer Federation of America, a consumer advocacy organization. Its questionable, but insurers maintain that claims data backs it up.

Premium differences between married and unmarried drivers drop off significantly as they get older. For instance, a single, 25-year-old male driver will only pay 9 percent more for auto insurance than a 25-year-old married male. For 25-year-old women, the difference is 7 percent.

Also Check: How Do I Get My Car Title In Florida

How Old Do You Have To Be To Have Your Own Car Insurance

In Ontario, there is no set age for purchasing car insurance. Age isnt a factor as much as the drivers license level. Drivers at the G1 and G2 levels may find that insurers hesitate to issue personal insurance. However, adding a G1 or G2 driver to existing policies is usually no problem. This is typical. A new driver gets added to a parents car insurance policy. G1 drivers dont add additional costs, since conditions of their license mean they are always accompanied by an experienced driver. G2 drivers earn increasing independence with fewer restrictions, so insurers begin to levy premiums then. Insurers will issue policies regardless of the age of the driver when attaining full G status.

At What Age Do You Get Cheaper Car Insurance

With no blemishes on your driving record, prices drop substantially around ages 18, 19, 21, and 25. Drivers of 55 years may see additional discounts offered by some insurance companies. Base rates continue to drop, but at a much lower level, after age 25.

Motorists of any age;who have traffic tickets or insurance claims may see premiums go up. This doesnt have anything to do with age-related factors, but it will take time for the effects of an incident to disappear from insurance costs. Once again, there are many factors that contribute to a car insurance policys cost.

Don’t Miss: How To Change Car Interior Color

Auto Insurance In Your 70s

Does car insurance go up when you turn 70? Sorry; it probably does.

Data from the National Transportation and Safety Bureau and National Automotive Sampling System show that drivers 70 and up experience much higher rates of intersection-related accidents and fatalities than younger drivers. More accidents mean more claims and higher rates. However, this is just the point at which accident rates begin to increase — it isn’t until drivers reach their late 70s or early 80s that their abilities degrade significantly. Some insurers recognize this and continue to offer reasonably-priced car insurance for those over 70.

The average rate for full-coverage auto insurance for a 70-year-old is $1,626.;

The average rate for full-coverage auto insurance for a 75-year-old is $1,808.;

What Age Does Car Insurance Go Down For Good Drivers

Its not your imagination. If youre in your twenties, you really do pay more for certain things than older generations.

Average rents, college education, health insurance and even tickets to shows all cost more than they did for previous generations.

Auto insurance rates have gone up for everyone, but if youre under 25 and looking for a policy, the chances are youll pay some of the highest rates.

The only silver lining? These higher premiums wont last forever.;

So when does car insurance go down and what can you do about it in the meantime?

You May Like: How To Get Sap Off Car

Best Car Insurance Companies For Seniors

There is no single “best” car insurance for seniors. Different insurers calculate their rates with proprietary methods and each has a different set of behaviors it chooses to encourage, deter or ignore. The cheapest auto insurance for seniors depends on the driver, vehicle and location. However, to get an idea of what you’ll pay, we provide average rates for full coverage, with a $500 deductible. The data is based on rates from up to six major insurers in nearly every ZIP code of the country. The table below shows average rates for drivers age 60, 65, 70 and 75 in all states.

Does Car Insurance Lower At A Certain Age

Getting a driver’s license is a rite of passage for many teens. The promise of the open road, the freedom of mobility without adults — it’s all rather intoxicating. Until your parent or guardian sees the hike on the insurance bill. If you’re paying your own driving expenses and you’re under a certain age, you’re likely shelling out more than your elders for a similar level of coverage.

For most drivers, the “magic age” when your rates go down is 25, just as you’ve probably heard. But many factors determine your insurance rates, so these age distinctions may not hold for everyone. The secret to decoding insurance rates and premiums lies in understanding where they come from. Understanding how and why rates can change is essential to making sure you’ve got the best coverage for your unique situation.

All insurance rates arise from complicated sets of data the insurance company has gathered over the decades they’ve been in business. Every fender-bender, every total loss, every break-in that’s ever happened to someone they cover goes into their databases, and what comes out is a picture of you — or at least who they think you are based on your relevant statistics. The more information a company is able to gather about everybody, then, the more accurately they’ll be able to predict what’s likely to happen to you and your car — and that’s where the rate comes from.

Read Also: What Is Draining My Car Battery

What We Can Do About It

It’s true: The magic number is still 25. But that doesn’t mean that you’ll automatically get the best possible rate available on your 25th birthday. By doing your research online and plugging in the numbers, you can do a lot more good for your own safety — and pocketbook — than you can by waiting around for better rates to kick in. And even if you fall into that lucky majority for whom the magic number holds, the responsibility’s still on you to make sure you’re getting all the discounts and best prices available to you. After all, it’s not in the company’s interest to do that work on your behalf.

Being proactive and realistic with your insurance selections means making sure you have the best plans for yourself and your family. Don’t wait for the insurance company to just hand you a discount , and don’t wait to investigate the changes you could make to your particular plans that could save you money. Raising your deductibles, bundling your insurance services with the same carrier, driving safely and make your kids pay for their own insurance are all possibilities you should explore. In the short and long term, that’ll save you more money and give you the peace of mind that insurance is intended to give you, without having to depend on anybody else.