Get An Initial Figure By Using A Car Loan Calculator

The interest rate you receive on an auto loan plays a big part in calculating your monthly payment amount. A higher credit score will score you a lower interest rate, which will ultimately lower your monthly payment and your total overall loan cost.

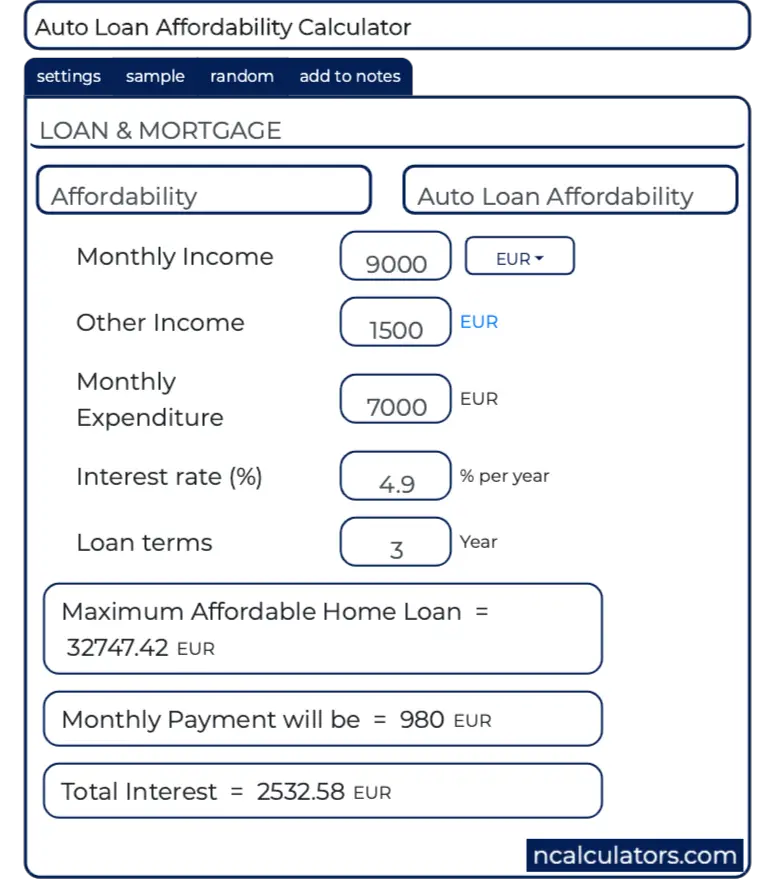

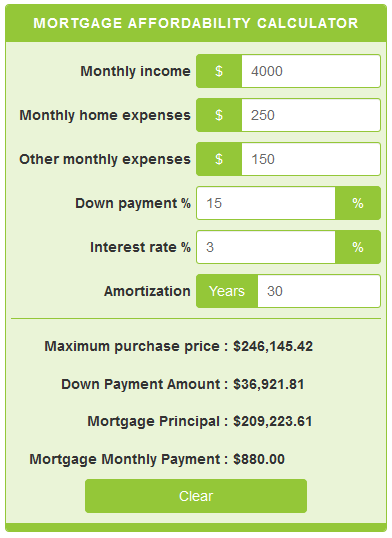

You can use a car loan calculator to determine how different interest rates will affect your monthly payment. Heres how:

- Pull a copy of your credit report and find out your .

- Get prequalified with a few lenders to determine the average interest rate you could be offered.

- Plug in your interest rate, desired repayment term length and car price to the calculator.

How Much Should You Spend On A Car

If you are a driver, then you have probably asked yourself the question “what car can I afford?” more than a hundred times. Unfortunately, the answer to this question is not easy.

First of all, you have to take into account that the people’s financial situation differ significantly. A well-off banker from Wall Street can buy a brand new luxurious limousine. A school teacher from Wisconsin will be probably looking for an affordable used car. An unemployed hairdresser who lives in a small town in Nevada will probably need to calculate her car affordability very carefully. So how to calculate car affordability for different people?

We believe that we can set a rule of a thumb which says that average earner should spend between 20 and 60 percent of his annual income on a car.

This range is quite broad as it is intended to fit all situations. Where you fit on this range depends on your personal financial situation and⦠how keen you are on automobiles and vehicular activities. From a strictly financial perspective, the less you spend on a car, the better. However, if cars are your passion and every night your dream about driving, then, of course, you can buy a more expensive vehicle. In this situation, in your personal finance you will treat this expense more like a hobby, or realization of your dream, than the necessary costs of the vehicle that allows you to commute to work. Another way to drive the car of your choice without a lot of fuss is to lease it.

Shop Around For Your Loan

Credit Unions generally offer car loans at 1% to 1.5% lower than banks. So if you dont belong to one, its a good time to think about joining. Get pre-approved for the loan before you start shopping. This gives you more choices. You will already know what rate your credit union offers, so when the salesman begins talking about financing, you will immediately know if he is giving you a good deal or not. Walking into the dealership without being pre-approved, gives the salesman the opportunity to charge you a higher rate since you will be uninformed and will have no ammunition with which to negotiate.

Don’t Miss: How Much Commission Does A Car Salesman Get

Set A Target Purchase Price

The total loan amount you can afford isnt necessarily the price of the car you can afford. If youre making a down payment or trading in your old car, youll be able to buy a higher-priced car, or borrow less money.

Additionally, there will be sales tax and fees, so think about more than just the price on the window sticker. Once you estimate the car loan amount you can afford, and assuming no trade-in credit or down payment, you can begin to get a realistic idea of the purchase price you should consider.

Youll need to factor in sales tax and fees, which vary by state, to the advertised cost of the car to get your total car price. An easy way to estimate these extra expenses is to add 10% to the advertised price of the car . For example, if you see a car advertised for $20,000, you should assume your total cost the out the door price will be $22,000.

If you want to get a more precise estimate, heres a breakdown of the typical extra costs:

-

Sales tax: Typically 5% to 10%, and may include state, county and local taxes.

-

Registration fees: Estimate these fees by using your states department of motor vehicles site.

-

Documentation fee: Ranges from $80 to $400, depending on your state.

This means that if you can afford a $20,000 car loan, again, assuming no down payment or trade-in credit, youll want to shop for a car with a sticker price of around $18,000 so that youll be able to cover sales tax and fees with your total loan amount.

How To Use Our Car Affordability Calculator

Are you curious how much you can spend on a car? Try our car affordability calculator and find out. Using the calculator is simpler then you think.

All you need to do is to provide some basic information:

- Monthly payment you can afford is a maximum amount you can spend on a car loan each month. When establishing this value remember the rule of one third, which we presented in the previous section.

- Money you have is money you have and can spend on a car .

- Current car trade-in value is a value of your current car .

- Interest rate is the cost of a car loan (in our calculator it should be provided on a yearly basis â APY.

- Loan term is the term of your car loan. We suggest it to be no longer than 48 months.

- Sales tax is the car sales tax rate. It is different in each state .

After you fill in the last field, our car affordability calculator will immediately show you your results. The most interesting value is the maximum car value. It informs you what the upper limit of value is that you can afford to spend on a new car.

The car loan affordability calculator will also estimate the loan amount which is calculated on the basis of the monthly payment you can afford. Moreover, it will also compute the total sum of interest paid and the total value of sales tax .

Don’t Miss: How Much Are Registration Fees In Texas

Whats The Truth About Car Loans

Auto loan debt in America is now sitting at a whopping $1.37 trillion, with 81% of all vehicles being financed.3,4

So, while yes, those numbers prove that financing a car is a way of life in America, lets stop and think about that for a minute.

Why?

Do you really want another monthly payment added to your plate, or do you just feel like financing is the only way to buy a car?

Remember, the car dealerships number one job is to convince you to finance a car . The truth is, dealers make more money when you finance, so theyre winning if they convince you to borrow morewhether thats by extending your loan term, encouraging you to put down a smaller down payment, or selling you a pricier car if you have a larger down payment.

But what the car dealer wont tell you is that your shiny new car will lose 60% of its valuewhat we call car depreciationwithin the first five years!5

That means if you bought a car for $32,000, when youre done paying it off , youd have paid about $36,000 for a car thats now worth maybe $13,000. And until you pay it off, youre in an upside-down car situation. Yikes.

Plus, think about thisduring your loan term, youd still be paying the same monthly payment for a car thats decreasing in value each month you pay. Let that sink in.

Budgeting For Additional Car Expenses

Once you approximate how much car you can afford based on your salary, its important to sit down and list the other costs that come with owning a vehicle. If you can budget your vehicle costs along with your other costs of living , itll help you plan a well-rounded budget and give you a full picture of what is realistic for your lifestyle.

Here are some additional costs to keep in mind as you create your budget:

- Fees and add-ons. Oftentimes the vehicle thats advertised is the base model with basic features. If you want a custom paint job or specialty features, youre probably looking at a price increase. Make sure you clarify if the vehicle you want is the base model.

- Dealer-installed options. Some vehicles already have specialty features pre-installed, like command start, expensive tires or an alarm system. You can always ask the dealer if there are any installs that can be removed so the price is lowered.

- Additional warranties. Some finance managers at other dealers may try to sell you extended warranties or add-on features, which will bump up the price. If you purchase a vehicle with us, that wont happen. Were committed to transparency and sharing how certain options can benefit you, without any obligation to upgrade.

- Regular maintenance. Every so often our cars need a tune-up, whether its an oil change, tire rotation or regular washes. Allocate some of your budget to these types of expenses and youll never have to worry when they come up.

You May Like: Mercury Mountaineer Hood Wont Open

Ways To Lower Insurance Costs

No matter if the buyer purchases new or used, the car will need to be insured. Unless the purchaser pays cash for the vehicle, they will be required to carry a full coverage policy in order to protect the lenders interests in the case of a collision, weather damage or if the vehicle is stolen or vandalized. If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. In most states, at least a liability policy is required. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. In at fault” states, liability covers only the other driver and vehicle in case of an accident. In no fault states, liability will cover only the minimum required for the policy for property damage and bodily injury. If the car is five years old or newer, the driver probably needs to carry full coverage insurance to make sure they are able to cover the cost of repairs in case of an accident or damage.

Pay Off Your Loan In 4 Years Or Less

You pay interest on each car payment you make, so the longer your loan term, the more interest youll pay. The faster you can pay off your loan, the less interest youll pay. 4 years is a good benchmark to budget for.

Another thing to consider is some lenders may require you to pay a higher insurance premium while youre paying your vehicle off . Youd likely have a higher monthly charge and it would be an added cost to budget for. This varies by lender so its always a good idea to ask.

You May Like: Cost To Get Car Painted

How To Calculate Your Car Finance

While this 10 -15% method might not work for all buyers, its a baseline for you to make a calculation. Depending on whether you are going for a new or used car, this amount may differ.

Lets take a look at how you can customise your own budget.

Have A Customised Budget

Set your car finance budget according to what you can afford to pay each month. Have a breakdown of all your daily expenses. From your take-home salary, deduct expenses such as groceries, mortgage or rent, council tax, and utility bills, to determine how much money is left.

With this budget, you can decide which type of car you need, whether used or new. Also, it clearly shows how much you can afford to spend on running costs. If your net salary is £3,000, you can afford to make £300 payments each month.

It’s best to be realistic on the budget so it’s not too strenuous to keep up with the monthly repayments. You can additionally use car affordability calculators to assist you in coming up with the loan budget.

Calculate The Car Loan

For this calculation, you first need to know the payment you can afford to borrow from the lender. The amount will also depend on your credit score, loan term, and whether the car is new or used. All these factors determine your annual percentage rate on a loan.

Determine The Car Running Costs

Have A Target Purchase Price

Analyse your Buying Patterns

The Term Of Your Car Loan Should Be No More Than Four Years

The longer the term of your loan, the more interest you pay. The longer your loan term, the longer youll have to meet your lenders insurance requirements, which often means higher rates.

Plus, by the end of four years, your car will have lost a lot of its value, and you wont want to still be paying it off.

Four years is the maximum most personal finance experts recommend. If you can swing paying off your car in three years, thats even better. If you feel you absolutely must stretch your payments further, you could get a five-year loan, but never longer.

You May Like: How To Repair Cigarette Burn In Car Headliner

The Right Time To Get A Car Loan

While its tempting to jump into the first car that catches your eye, remember that your payments can be very difficult to manage if youre not ready for them. There is a right and a wrong time to apply and its essential to know which is which.

Only consider applying for a car loan if you have:

- Researched the vehicle youre looking to finance. Have seen what various makes and models are going for, as well as how much they will cost to finance and how much value they could lose over time.

- Compared lenders and dealerships in your area to find a reputable source of financing. They should have a good reputation with customers, offer reasonable rates, and possess valid business credentials.

- Gotten a proper, affordable price quote. All legitimate lenders/dealerships should be willing to answer any questions you have concerning their fees/rates and must display those costs within their contracts.

- , cut down on unnecessary costs, and saved up an emergency fund. Some vehicles take years to finance, so be sure you can afford all costs throughout your payment plan, even during a period of reduced income or unemployment.

- Saved for an appropriate down payment. Although a down payment isnt always necessary, a sizeable one can reduce the length of your debt and make you more qualified for a favourable loan.

- Had the vehicle inspected by your own mechanic. Though this may require a deposit, it will be worth to avoid buying something thats unreliable or unsafe.

How To Use A Car Affordability Calculator

The car affordability calculator helps you to calculate what’s right for your budget, quickly and simply. You just need to input how much you want to borrow, the loan term or number of years/months, and whether you need a new or used car.

This calculation gives you the estimated APR and repayment amount. If you are using an online tool, you can adjust different inputs until you get a loan within your means.

Recommended Reading: How To Remove Scratches From Black Plastic Car Interior

Check Out Our Other Tools & Calculators

- Prepayment penalty

Breaking a Cycle of Debt

Dealing with a car loan that you cant afford is one of the fastest ways to fall into a cycle of debt, which can last a very long time if youre not properly prepared. Since this debt can harm your finances and credit, its best to act quickly and resolve the situation.

Dont worry, there are plenty of simple debt management tactics that you can try, such as:

- Purchase a certified pre-owned vehicle

- Borrow from friends or family

- Ask for a raise or getting a second job

- Transfer the loan to another buyer

If necessary, there are also several debt management products and programs available in Canada, such as:

- Debt consolidation loan or program

- Debt settlement

- Home equity loan or line of credit

Car Loan Repayment Plans

A car loan is a type of financing that you can apply for through select lenders and dealerships across Canada. This financing exists to make a new or used vehicle more affordable over time through recurring payments with interest.

Depending on the policies of the lender you apply with, what kind of vehicle youre looking at, and how strong your finances are, this payment plan can last several years and, when necessary, be adjusted to suit your needs.

Generally, the majority of lenders and dealerships can offer you various payment frequency options, such as:

- Monthly

- Semi-monthly

- Weekly

- Bi-weekly

Although the length, frequency, and overall cost of your plan will be arranged in advance, many lenders will also permit you to make accelerated payments so that you can pay down your debt faster through larger or more frequent installments. Just make sure you read your contract, as some lenders will charge a prepayment penalty.

Don’t Miss: How Do I Transfer An Electronic Title In Florida

How Much Is The Car Payment Really Costing Me

Its just $350 a month.

Everyone has a car payment.

Sound familiar?

See, on the surface, $350 or even $500 a month seems innocent. But then, your dog needs surgery. Or your almost-teenager needs braces. Ordang ityou just need more room in your monthly budget for life.

Wheres your margin? Oh yeah, its going to the bank for five more years.

On a practical level, your monthly car payment is costing you, well, money. And lots of it.

But even if you could squeeze out that monthly payment without too much stress, think about the extra youre paying in interest. Thousands of dollars. And oh yeaha new car with a loan will jack up your auto insurance.

Instead, that money could be beefing up your savings account. Or you could even have enough to buy a reliable used car in straight-up cash. Then you could get the right auto insurance at the right price and keep your costs down.

Let’s say you bought a used car with cash, and instead of wasting $500 a month on a car payment, you invested that money in a Roth IRA instead. After a 40-year period, that investment will be worth $4.3 million dollars.

So, back to our original questionhow much is a car payment really costing you? More than 4 million dollars over the course of your life. Thats how much.