Exchange Contact And Insurance Information

Contact and insurance information should be exchanged with all other parties involved. Collect information about the collision and if possible, take pictures.

The Collision Worksheet Form will help you to remember the types of information youll need to record at the scene. Keep it in your glove compartment along with a spare pen.

If the driver of a vehicle is incapable of providing the information required, and there is a passenger capable, the passenger should provide that information.

If someone refuses to provide their information, document the licence plate number, vehicle description and driver description before they leave the scene.

After you have exchanged information with all parties involved:

- If your vehicle is not drivable – you must make arrangements for it to be removed from the road otherwise, a police officer may make those arrangements, and your vehicle will be deemed abandoned.

- If your vehicle is drivable – you can leave the collision scene.

If the collision involved an unattended vehicle or other property, you must notify the owner of any damage you may have caused. If you are unable to locate the owner, you must securely attach your name, address, phone number, drivers licence number and licence plate number to the damaged vehicle.

Make Sure Youre Ok And Stay Safe

If youâre involved in a car accident, the first thing to do is step back, catch your breath and make sure you and your passengers havenât been injured. Soft tissue injuries are a concern even in a bumper-bump, and injuries raise the stakes for an insurance claim.

Assuming there are no injuries, it will still be stressful for both parties to the accident. Try to minimize road rage in the inevitable exchange of driver information. Pull your car over to a safe spot if possible. Donât stand on a crowded or high-speed road unless you have to. And if possible, stay inside the car, dial 911 and wait for the police.

The Importance Of Seeking Legal Advice Prior To Making A Statement To Icbc

You should always seek counsel from an experienced Vancouver car accident lawyer before making a statement to ICBC.

It is important to remember that ICBC is an insurance company. While it is not like other insurance companies in certain ways, it is ICBCs intention to pay as small an amount to claimants as possible.

Insurance companies, in general, want to avoid paying claims whenever possible. Insurance companies, including ICBC, simply are not advocates for claimants.

You May Like: How Much Is Car Insurance In Ny Monthly

Consequences Of Not Reporting A Car Accident

If you fail to file a report after a reportable accident in Illinois, you may face penalties like suspension of your Illinois drivers license or fines. If you give false information on the accident report, that qualifies as a Class C misdemeanor. The punishment is a $500 fine and up to 30 days in jail.

The lack of an official report of an accident may also make it difficult for you to recover anything from the at-fault party or his or her insurance company. Without a report, it will be your words against the other drivers word. Unfortunately, drivers can see the facts surrounding the same accident very differently.

The at-fault driver may even agree to pay for the damages you have suffered at the time of the accident. However, the driver may fail to make any payments as time progresses. Even if you file a claim at that point, the time lag combined with the lack of an official record may prevent you from recovering anything. The drivers story about how the crash occurred may change.

Although the driver was friendly at the accident scene, he or she may deny being at the scene or that the accident occurred. He or she may even allege that you caused the accident.

How Long Do I Have To Report An Accident In Ontario

In Ontario, you should report any accident within 24 hours of it occurring. Even if the damage is minimal and you decide not to file an insurance claim, you will have a record of the accident.

Can you report a car accident after 24 hours? If you have let 24 hours lapse, then you should report the accident immediately at your local accident reporting centre.

Recommended Reading: How To Insure A Car

A Quick Overview For Our Spanish Readers So You’ve Had An Accident What Next

What Happens If I Dont Report A Car Accident To Dmv

A common question crash victims ask personal injury lawyers at our law firm is, What happens if I dont report a car accident to DMV? For most people in Illinois, reporting a car accident to the DMV is no longer required. If you are a state employee who was in a crash and you do not report an accident involving a state vehicle to the local Department of Motor Vehicles , however, you could be fined or have your drivers license suspended.

You May Like: How To Add Freon To Ac Car

What Happens If Someone Hits You And They Dont Report It

If someone hits your vehicle and they dont report the accident, they could be charged with “Leaving The Scene Of An Accident”. Failure to file an accident report is very serious.

If you hit a vehicle and dont stop, you may be subject to criminal prosecution. The FSCO recommends this course of action :

Call the police if anyone is injured, if the total damage to all the vehicles involved appears to be more than $2,000, or if you suspect that any of the other drivers involved are guilty of a Criminal Code offence . Follow the instructions given to you by the emergency operator. Police will arrive as soon as possible. Do not try to move anyone injured in the accident you may aggravate their injuries.

If no one is injured and total damage to all the vehicles involved appears to be less than $2,000, call a Collision Reporting Centre within 24 hours.

If Your Insurer Recommends A Repair Shop

An insurance company cannot require that your vehicle be repaired at a specific repair shop. However, an insurance company can recommend that the damage be estimated and repaired at a specific repair shop.

When an insurance company states or implies that they guarantee repairs if you take your vehicle to a shop they choose ask about the details of that guarantee and ask to see the written guarantee. Often, an insurance companys guarantee is actually the shops guarantee, and the responsibility for a satisfactory repair job will remain a contractual matter between you and the shop just as if you had chosen the shop.

Read Also: When Was The First Car Made In America

Take Photos And Videos

One of the biggest advantages of smartphones is that they make it easy to record information. Use yours to take photos and videos of the accident scene, including the damage done to your car and the surrounding area of the accident. Visual evidence is a powerful and very convincing method of proving your case.

How To Report A Car Accident To The Dmv

To report a car accident within 24 hours, contact the DMV directly. Schedule an appointment after a call is made to the police. File a report to a local officer at the scene of the accident and assess any property damage. Should the police not file a claim for any reason, call the DMV and let them know about the accident.

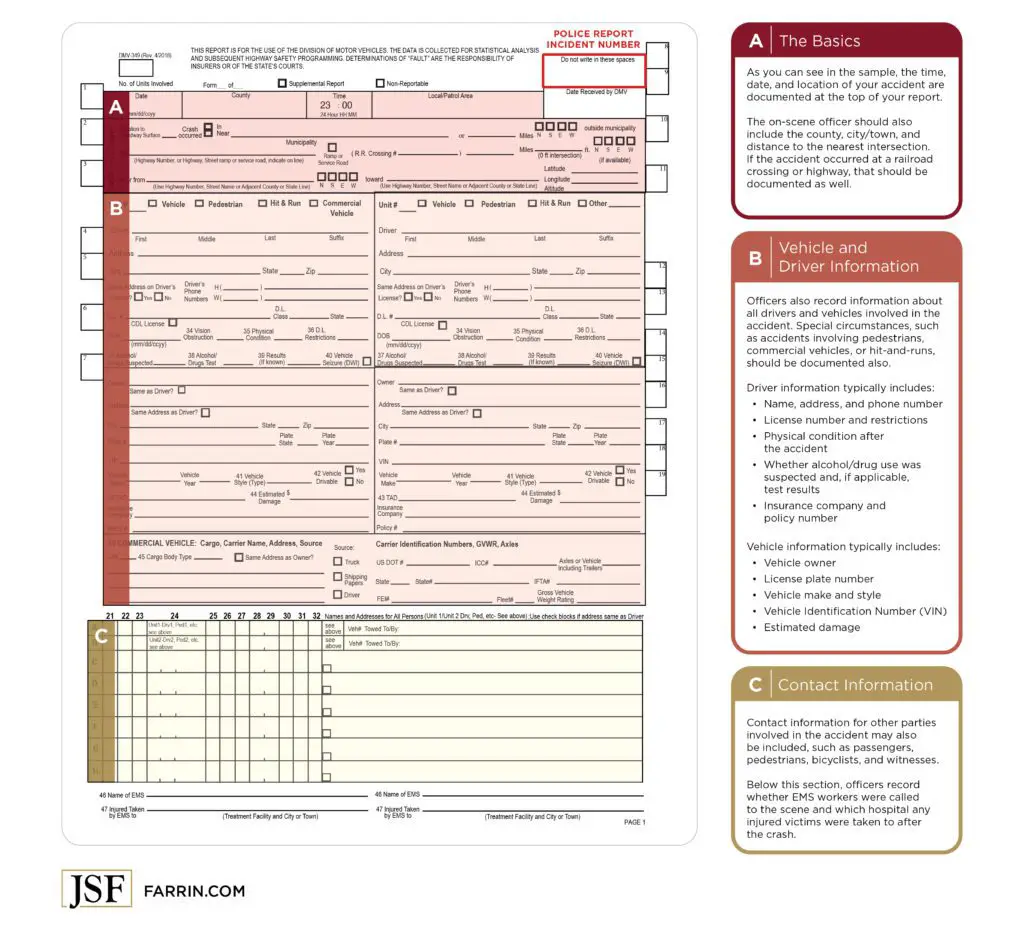

They have a form known as the Form SR 1. Anyone can fill it out online by entering the necessary information. It includes vehicle registration, insurance company name, and policyholder name. These forms are also used to report traffic accidents, not just serious ones.

Nonetheless, it is the full responsibility of the driver to perform this specific action. Take the time of the day to fill out the entire form. Make it a main priority to avoid financial penalties. The sooner the situation is taken care of, the more free time is available for everyone involved in the process.

Read Also: How To Make Car Insurance Cheaper

Penalties For Not Reporting An Accident In California

Failure to report a reportable accident typically results in suspension of your driving privilege.

However, according to California law, should you have an accident and leave the scene without complying with any portion of California Vehicle Code Section 20002, you could be charged with a misdemeanor punishable by a jail term of up to six months, or be fined up to $1,000, or both.

Keep in mind just because the other driver initially agreed to bypass his or her auto insurance company and not file a report with the DMV, doesnt mean they wont have a change of heart if they find out the damage to their vehicle is more extensive than they originally thought. If you exchanged insurance or drivers license information along with your phone number, you could be staring at a very scary outcome.

Not only could the driver of the other car lay all the blame on you for the accident, he could report the fender-bender to his auto insurance company, claiming you left the scene after hitting him. As things continue to spiral against you, your insurance company will undoubtedly find out and could get really grumpy if the agreeable driver files a damage claim against you through them for an unreported accident.

As unpleasant as it may be to report a minor accident to your auto insurer and the DMV, it could save you a lot more, including policy cancellation, a fine and/or six months in jail even a lawsuit. In the end, it really isnt worth the risk.

What Happens If You Fail To Report A Car Accident In Georgia

If your car accident meets the legal criteria above and you did not report the accident, you could face criminal charges.

A victim could claim the crash as a hit and run accident because you drove away and left the scene of an accident. That means fines between $300 and $1,000, drivers license suspension, and up to 12 months in jail. When someone gets seriously hurt or dies from an accident, leaving the scene can mean a felony hit and run charge. A felony charge can result in one to five years of imprisonment.

In addition to the above charges, not reporting an accident can also lead to legal action from an injured victim in the crash. For example, if you caused the car accident and left without reporting it, the injured driver can file a claim or sue you for damages.

Recommended Reading: How Long Does Car Battery Last

How Long Do I Have To Report An Accident To The Police

When reporting the accident to the police, the sooner-the-better rule applies even more.

In Ontario, police will generally only attend the scene if someone is seriously injured or if the damage appears to be over a certain amount. This can be a challenging thing to identify when youre shaken up after an accident. But if someone is hurt, then you should call the police immediately.

When it is safe to do so, make sure you exchange details with the other driver, including your address and insurance information. Note: If no details are exchanged after the car accident, filling out the collision report will be challenging, as will making a claim.

Get yourself to the nearest auto collision reporting centre within 24 hours.

There, you will fill out a car collision report with the following information:

- Your insurance policy number

- Your vehicles make, model, year, and licence plate number

- The details of the accident

- The other drivers name, licence plate number and insurance information

- Any injuries that happened as a result of the accident

- The damage to the vehicle

- The name of the police officer who attended the scene, if applicable

The collision reporting centre should instruct you on how to report the accident to your insurance company. Additionally, they will send a copy of the collision report to them.

How Long Do You Have To Report An Accident To Insurance

In general, its best to report a car accident to your insurance company as soon as possible.

That said, each insurance company will have a different policy around this, so its important to look at the details of your insurance policy to find out how many days you have to report an accident.

According to the Financial Services Regulatory Authority of Ontario, which regulates auto insurance within the province, you should report an accident to your insurance company within seven days or as soon as possible after that.

In Alberta, the government recommends that you advise your insurance company, regardless of which driver was at fault, as soon as possible.

If youre unsure whether its worth it to make a claim, you can always ask your insurance company first. Youre not likely to be penalized simply for asking that question. But you could have your claim denied if you fail to report the incident.

You May Like: Car Not Accelerating When Pressing Gas

Should I Call The Police

This is one of the first things that will come up to everyones mind when they find themselves in this kind of situation. The answer to this question depends a lot on your location, state, or country.

Some states will require you to report any kind of accident. Whether it is damage above $10,000 or below $100, you will still have to do it. Some states require you to call law enforcement, only if the damage is above $1000 or $1500. This amount can vary by state.

Keep in mind that if there is any kind of injury from the accident, you must call the police. Whether it is minor or serious, the law is that you have to report it to the authorities.

When To Report An Accident To The Police

There are a few situations in which reporting a car accident to the police is required immediately so that they come directly to the scene of the collision. Be sure to call the police if:

- Anyone has been injured or killed

- The damage to all vehicles involved appears to exceed $2,000.

- Any driver involved appears to be intoxicated or under the influence of drugs

In any of these situations you should call emergency services immediately by dialing 911. Its also crucial to await their arrival before moving anything or anyone from the scene. The police will tell you how to proceed.

Recommended Reading: What To Do In The Car

Do I Have To Report An Accident To My Insurance Company

Many drivers make the incorrect assumption that this means you do not need to notify your insurer if the damage is less than the threshold. This is incorrect. Your policy states that you need to report all accidents, regardless of the amount of damage, even if you are paying for the repairs out of pocket.

Accident Guidelines That Require The Filing Of A Report

The law states you are required to file the SR-1 if:

- There is clearly damage in excess of $750 to the vehicles or other property.

- Injury or death to any party in either vehicle results from the accident.

Furthermore, the DMV states:

This report must be made in addition to any other report filed with a law enforcement agency, insurance company, or the California Highway Patrol as their reports do not satisfy the state filing requirements.

Your plans to avoid reporting the accident could also take a turn for the worse, in the event your vehicle becomes disabled making it no longer drivable and blocking lanes of traffic. Under this scenario, its more than likely law enforcement personnel will be dispatched to the scene to get you towed. And, you can rest assured the responding officer will file an accident report himself, which will automatically go to the DMV.

Of course, certain circumstances could prevent you from making the report within the required 10 days, such as having been injured in the accident. Should that be the case, a passenger riding in your vehicle could file the report for you or have a third party, including an attorney, make it for you.

Read Also: How Much Is It To Get Your Car Detailed

Always Stick Around To Secure A Police Report After Getting Into A Car Accident

People are always in such a big rush these days. So they dont always think that they can afford to spend a bunch of time waiting for police to arrive on the scene of a car accident. But the truth is that you cant afford not to stick around so that you can get a police report.

As youve seen here, there are going to be all kinds of consequences that youll have to deal with for not getting a copy of a police report. If you want to avoid them, you should make every effort to get the police report that youll need.

Browse through our other informative blog articles for additional tips on how to handle the aftermath of a car accident.

Disagreements And Dispute Resolution

If the amount of damage to your vehicle is being disputed, or other disagreements arise over your vehicles repair, and all attempts to negotiate have failed, a formal arbitration process is open to you.

If you choose to follow this procedure, you will be responsible for your share of the cost involved.

To start the appraisal procedure, submit a proof of loss claim form available from your insurer and send a written request to your insurance company.

A 3-member group will resolve the dispute. You choose an appraiser, your insurance company chooses one, and the 2 appraisers appoint an umpire. An appraiser can be anyone either party considers to be qualified to present its side of the dispute. Each side pays for its own appraiser and half the cost of the umpire. The decision of any 2 of these 3 people is binding.

You May Like: How To Value Your Car