Cheapest Auto Insurance In Livonia: Frankenmuth

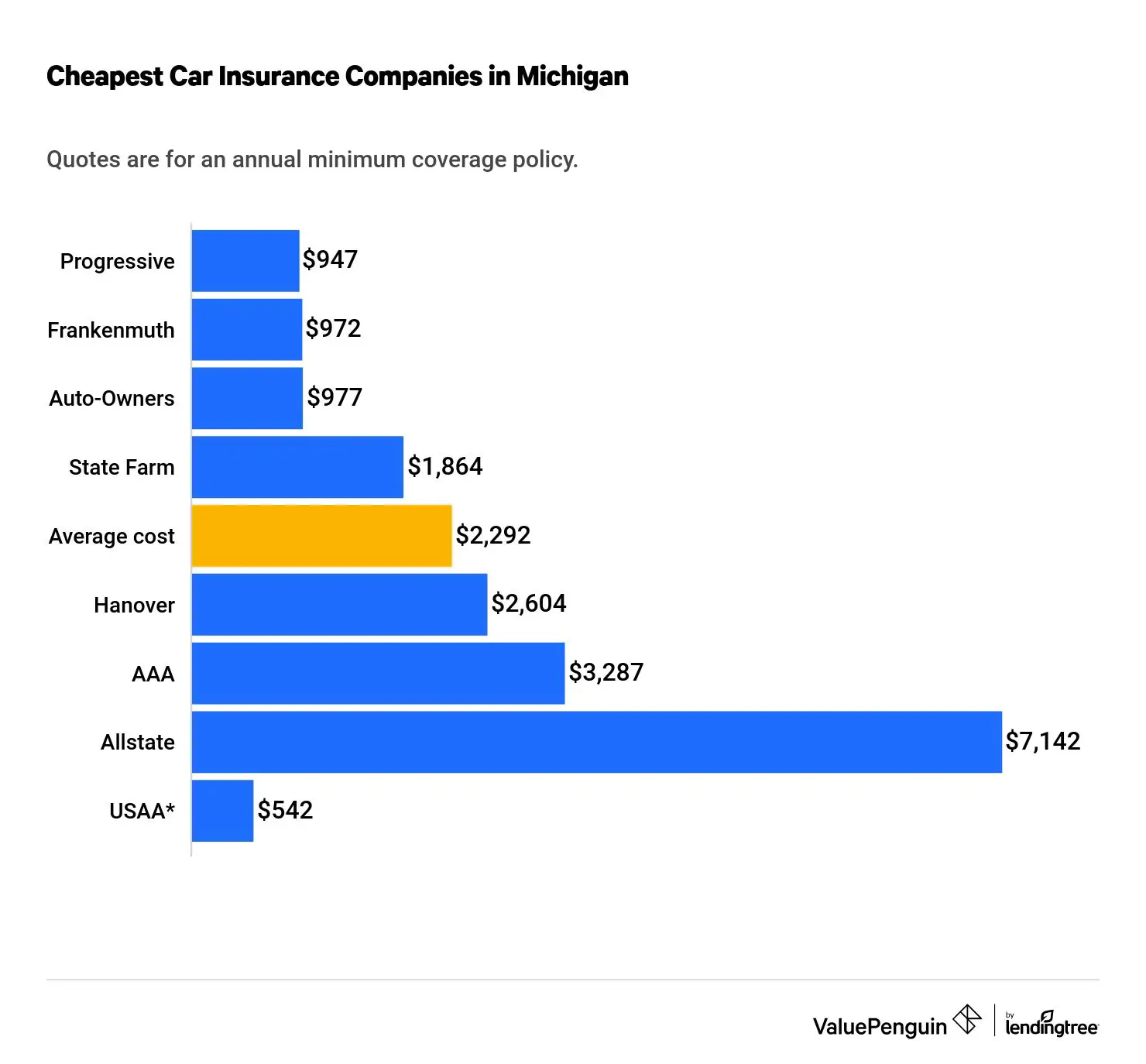

For drivers looking for the minimum coverage available to Livonia residents, we recommend Frankenmuth. This Michigan-based insurer offered us sample rates of $942 per year for state-minimum coverage, including state-mandated personal injury protection. That’s 64% less expensive than the typical price we found across all insurers in Livonia.

It’s worth noting that the absolute lowest price we found for basic coverage in Michigan was from USAA, at $585 per year on average. However, USAA only sells insurance to people affiliated with the military: you’re only eligible if you’ve served in the military yourself, or if a direct relative has had USAA insurance. As a result, we excluded it from our main rankings, though we did include it in our average rates.

Cheapest Car Insurance For Drivers With A Dui: Progressive

Driving under the influence is one of the most serious offenses you can commit behind the wheel, and insurers typically raise your rates substantially as a result. We found an average price of $15,977 per year for full coverage for a driver with a DUI, but some insurers charged much more than that. Allstate quoted us an eye-popping $65,262 for coverage after a single DUI.

If you’ve been convicted of a DUI, you may be able to find affordable rates at Progressive, which gave us a quote of $1,856. However, keep in mind that instead of offering you a more expensive quote, an insurer may simply choose not to insure you at all. If that happens, you may need to look to a non-standard insurer, which specializes in providing coverage to drivers with imperfect records â albeit at a typically higher price than a mainstream company.

| Rank |

|---|

*USAA is only available to current and former military members and their families.

Factors That Impact Michigan Car Insurance Rates

Although most people would guess that snowy winters or poor road conditions would be the main cause of such high rates, thats actually not the case. Here are the main factors driving the cost of Michigan car insurance:

- Around 26 percent of Michigan drivers are uninsured, according to the Insurance Research Council.

- According to the Insurance Information Institute , only 12 states run under a no-fault insurance system, including Michigan.

- Michigan struggles with excessive amounts of insurance fraud, and this problem is passed onto policyholders in their rates.

Also Check: How Much Does A Car Salesman Make Per Car

Cheapest For Military Families

If youre an active member of the military or a veteran or have an immediate family member who is chances are youll get a relatively cheap rate with USAA, a company that isnt available to the general public.

Because of that restriction, USAA isnt ranked with the others, but it was among the cheapest five auto insurance options for more than half of the driver profiles we examined.

» MORE:Best car insurance for veterans and military

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

Recommended Reading: How To Watch Siriusxm Video In Car

Faq: Car Insurance In Michigan

How much does car insurance cost per month in Michigan?

According to the III, the average cost of car insurance in Michigan is $1,470. That comes to about $123 per month.

How expensive is Michigan car insurance?

The III rates Michigan as the second most expensive state for auto policies at an average rate of $1,470 per year. Thats more than $400 above the national average of $1,056.

What are the best auto insurance companies in Michigan?

Our research experts found that MetLife, Auto-Owners Insurance, and Geico are solid options due to their prices and perks for customers. Progressive is another good choice for high-risk drivers seeking coverage.

How Much Does Car Insurance Cost In Michigan

In Car Talks deep dive on affordable car insurance, we found that a national average for auto insurance was $1,440. In Michigan, depending on what city and county you live in, youre probably going to be paying more. Our prior research also revealed that the overall average is about $2218 in the Mitten State.

| Rates we found reported as typical or average online | Average | Adjusted average* |

|---|

The adjusted average is computed by eliminating the highest and lowest values and averaging the remaining values.

You may need to be a current or former service member to apply.

Also Check: How To Burn Mp3 Cd For Car

Grand Rapids Mi Auto Insurance Coverage Requirements

Before we tell you who has the cheapest auto insurance in Michigan, lets go over the legal requirements. This will give you a better idea of what type of policy will work best for you.

Take a look at the following short video explaining the different types of Grand Rapids auto insurance coverage available.

Now that you have a better understanding of how individual factors influence your policy lets take a look at the minimum requirements you must meet. In short, driving legally in Grand Rapids requires:

Michigan Auto Insurance Coverage Requirements

| Auto Insurance Coverage |

|---|

Liability insurance may be a good and economical way to insure an older, easily replaceable vehicle. But if you have a newer automobile, you may want to think about additional coverage. After all, liability wont pay out on claims for things like weather damage, and it wont cover damage to your vehicle.

It would be advisable to get more than the minimum coverage to avoid finding yourself with a bigger problem or even seeing your totaled car sent off to Insurance Auto Auction Grand Rapids, Michigan. Continue reading to learn about other auto insurance coverages that save you money in the long run.

How Can You Get Car Insurance Discounts In Michigan

The most significant discount you can realize in Michigan is to move to an area with lower rates. Even just being outside of the downtown area can help. Move to a county or city or town with lower claim rates and you may save as much as 50% per year. We looked at the comparative costs of insurance in Michigan and found that a move from Detroit to Pontiac would likely save a driver 70%. Unfortunately, moving isnt always an option.

The easier way to manage your insurance costs is to avoid crashing and getting traffic tickets. And your car and phone apps can help. Avoiding accidents has gotten easier in recent years as vehicles with automatic emergency braking systems have become the norm, even in affordable vehicles like the Hyundai Elantra and Toyota Corolla. Ironically, insurers dont discount cars with those systems yet because they cost a lot to repair

Avoiding speeding tickets in Michigan is a little easier than in other states. The maximum speed limit in Michigan is 75 mph, but pay attention because you will need to slow down as the speed limit changes along a highway. Apps like Google Maps Waze help you know where the speed traps are and warn you to slow down.

Recommended Reading: Suspend Car Insurance Geico

Best Cheap Car Insurance Quotes For Michigan

Wayne County Car Insurance

The largest county in Michigan by population, Wayne County has shoreline along both Lake Erie on its southeast end, and Lake St. Clair on its northeast. At its eastern boundary located on Detroit River is the county seat of Detroit, which is the largest city in the state.

Known as motor city for its ties to the auto industry, Detroit is also hailed as the birthplace of Motown Records and its original headquarters, Hitsville U.S.A., remains. The city is also famous for the industry murals painted by artist Diego Rivera at the neoclassical Detroit Institute of the Arts. The city is also a main port on the Detroit River.

County| $2,043.00 |

CheapCarInsurance.net Methodology

Car insurance quotes are for one car and one driver who has state minimum coverage with $500 comprehensive and collision deductibles. The hypothetical driver is 40 years old, female, married, employed, a college graduate, and has good credit. She has no moving violations, accidents, claims, or lapse in coverage. The vehicles are assumed to be garaged on premises, used primarily for commuting, and driven 16,000 miles per year. Car insurance quotes include commonly available discounts and are estimates and not guaranteed.

Cheapest Car Insurance For Low

If youre a driver who logs less than about 12,000 miles a year, you qualify for cheap auto insurance. Driving less means you have less of a chance to get into an accident, so insurance rates for a low-mileage driver will generally be lower than for a driver who is on the road more, all else being equal. Farmers is the cheapest auto insurance company for low-mileage drivers.

| Company |

|---|

| $2,495 |

Don’t Miss: How Much Is It To Register A Car In Texas

How To Find The Best Car Insurance In Michigan

To find the best car insurance in Michigan, you may want to evaluate your unique situation. All insurance companies also offer different rates, so getting quotes from multiple auto insurers may help you find a carrier that fits your needs and budget. In general, there are a few ways you can assess your insurance needs to help you find the coverage that is right for you.

Work Loss Waiver Discount For Seniors And Retirees

If you are age 65 or older, Michigan car insurance laws require insurers to offer you a discount if you drive your vehicle less than 3,000 miles a year. If you are age 60 or over with no salary from a job, you can also get a lower PIP rate by waiving coverage for work loss that is paid out under PIP. You can waive this coverage for yourself and your eligible retired spouse, but you must still carry it for other persons who may be injured in your car or by your car in an accident.

Recommended Reading: Sirius Xm Manage My Account

Rates For Drivers With A Clean Driving Record And Poor Credit In Michigan

If you’ve got a good driving record, you might still see higher yearly rates if you have a low credit score. Sometimes a poor credit history can severely affect your quotes, even more so than a DUI or recent accident in which you were at fault. It’s important to shop around before committing to a higher rate, even if it’s because of your credit. However, if you improve your score and keep a clean record, your available rates could lower over time, so you’ll want to check every so often.

- Geico: $1896

- Frankenmuth: $2457

- State Farm: $2886

If you stay accident and infraction-free after you switch rates, be sure to shop for lower rates again five years after the accident or infraction.

Michigans Rates Vs Other States

Michigan car insurance rates are much more expensive than anywhere else in the US. While estimates vary depending on where in the state you live, most Michiganders can expect to pay more, on average, than all fellow US citizens in other states.

According to conservative Business Insider estimates, Michigan car insurance can cost anywhere from from $1,272 dollars to $8,723 dollars per year, about $3,343 dollars on average. Hereâs how those numbers stack up against other statesâ:

-

The next-highest average annual cost is Louisianaâs $2,480 dollars

-

The average cost in Michigan is almost as much as Louisianaâs high point, $3,525 dollars

-

Some states are much lower:

-

Iowaâs range is $702 to $1,482 dollars, with an average of $1,100 dollars

-

Idahoâs range is $680 to $1,777 dollars, with an average of $1,122 dollars

Outside of individual state-by-state comparisons, Michiganâs average annual insurance is more than double the estimated national average of $1,566 dollars. So, any way you slice it, Michiganâs auto insurance rates are expensive.

But why?

Don’t Miss: How Much Do Car Salesman Make Per Car

How We Conducted Our Auto Insurance Analysis

We calculated our average auto insurance rates based on the following metrics: a married, 34-year-old male with good credit, a 12-month history of maintaining auto insurance, a clean driving record, who owns his own home. Miles driven annually were based on the national average. The average rates were also calculated based on a financed 2015 Honda Accord with a pre-installed anti-theft device.

Now that you have a better understanding of how to secure an affordable Grand Rapids, MI auto insurance policy, enter your ZIP code in our FREE online tool. Well help you to find and compare auto insurance quotes in Grand Rapids, MI.

Who Has The Cheapest Car Insurance In Michigan

Get a fast and free car insurance rate comparison

This is a question many Michiganders have asked, especially since The Wolverine State has some of the most expensive auto insurance in America. Thatâs because Michigan also boasts some of the most robust protections of any auto insurance in the entire country.

In this blog, weâll answer questions like why is Michigan car insurance so expensive? But first, weâll get into the more pressing matter at hand: how to save money, despite the high cost.

Letâs get started.

Also Check: How To Transfer Car Title In Az

The Average Cost Of Car Insurance In Michigan

Michigan is one of the most expensive states in the nation for car insurance. Because its a no-fault state, all drivers end up paying more for their car insurance, as they have to carry personal injury protection. The state also requires drivers to purchase unlimited lifetime medical benefits, which adds to the cost even more.

The price of minimum liability coverage, as required by Michigan state law, averages $1,219. To purchase full coverage insurance, youll pay roughly $2,105. Overall, prices vary significantly. You could end up paying anywhere from $628 to $3,547 for your policy.

Its not just your car insurance company that can make a difference in the price. Living in an area with a high crime rate or inclement weather can increase your premiums. And individual drivers may pay more due to their age, driving record, , and more.

Cheapest For Married Drivers: Progressive

Often rates can fall slightly for married drivers, as drivers may be viewed as less likely to take risks while behind the wheel. However, the same law that prohibits insurers from using credit scores as a factor in insurance pricing also bars companies from changing rates based on a driverâs marital status. Progressive remains the cheapest option, as rates are unchanged.

Don’t Miss: How To Remove Hail Dents Yourself

What Causes Rates To Go Up In Michigan

Where you live in Michigan can cause your car insurance rates to go up significantly. If you call the Motor City home, then youre looking at rates 154 percent higher than the state average. Move out of the city and you could see rates go in the other direction with Ann Arbor costing 18 percent less than the state average and Warren coming in at 77 percent less than the state average.

Who Has The Cheapest Auto Insurance In Michigan

Looking for who has the cheapest auto insurance in michigan? Get direct access to who has the cheapest auto insurance in michigan through official links provided below.

Follow these easy steps:

- Step 1. Go to who has the cheapest auto insurance in michigan page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access who has the cheapest auto insurance in michigan please leave a message below .

Michigan has more than 6.9 million licensed drivers, which is nearly 70 percent of the states population. Thats more drivers than most other states have. Based on our study of seven of the largest insurance companies, the Great Lakes State has an average insurance representative rate of about $2,680, which is more than double the study rates in neighboring states like Indiana and Ohio.

Who has the cheapest insurance in michigan. Get great auto insurance coverage at an even better price. Chubb offers the cheapest minimum auto insurance in Michigan with a 615 average annual premium. Our Top 4 Picks for the Best Cheap Car Insurance in Michigan. That is about 1300 less than the states average representative premium and about 400.

Don’t Miss: How To Remove Scuff Marks From Car Door Panels