Typical Car Insurance Coverage Types

Remember, all liability coverages apply only to other people and their property – not to your car or the people in it. Collision and comprehensive together would cover your damages and injuries.

With all forms of coverage, the question isn’t just what type of coverage you have, but what the dollar limit on that coverage is. Many car owners choose to go well beyond the legal minimum limits to better protect themselves from paying for losses out-of-pocket.

How Much Auto Insurance Coverage Do I Need

An auto insurance policy can include several different kinds of coverage. Your independent insurance agent will provide professional advice on the type and amount of car insurance coverage you should have to meet your individual needs and comply with the laws of your state. Here are the principal kinds of coverage that your policy may include:

Liability for Bodily Injury The minimum coverage for bodily injury varies by state and may be as low as $10,000 per person or $20,000 per accident. Many auto policies stop at a maximum of $300,000 or $500,000 per accident for Liability coverage. If you injure someone with your car, you could be sued for a lot of money. The amount of Liability coverage you carry should be high enough to protect your assets in the event of an accident. Most experts recommend a limit of at least $100,000/$300,000, but that may not be enough. This is no place for cheap auto insurance. If you have a million-dollar house, you could lose it in a lawsuit if your insurance coverage is insufficient. You can get additional coverage with a Personal Umbrella or Personal Excess Liability policy. The greater the value of your assets, the more you stand to lose, so you need to buy liability insurance appropriate to the value of your assets.

Average Car Insurance Rates For Young Drivers

Insurers see less experienced drivers as a bigger risk and typically charge them heftier prices. Insurers may categorize young drivers as anyone 16 to 25 years old, and sometimes even anyone under 30 years old. For our analysis, we analyzed rates for 20-year-old drivers.

As you age, rates tend to go down. On average, car insurance rates are about $1,700 a year higher for a 20-year-old driver than a 35-year-old, our analysis found.

Recommended Reading: How Long Does It Take To Paint A Car

Ask Yourself These 4 Questions To Figure Out How Much Auto Insurance You Really Need

| Covers medical expenses regardless of fault | Mandatory in certain states and often recommended in states where its not required | Minimum of $10,000 | |

| Collision | Pays for the cost of repairs to your vehicle if its hit by another vehicle | Some lenders require it when leasing or financing a new car if you have an older car that isnt worth much, you may not need it | Depends on the vehicle being insured |

| Comprehensive | Pays to repair or replace your vehicle if its stolen or damaged in an incident that is not a collision | Those with newer or nicer cars | Depends on the vehicle being insured |

Car insurance companies also usually offer optional coverage choices like car rental coverage, gap insurance and roadside assistance. If your car breaks down or youre in an accident and your car is at the shop, rental coverage will cover the cost of a rental car for the days your car isnt driveable. Typically, youll be eligible to rent a car up to a certain dollar amount and youll be reimbursed by the insurance company for the cost of the car. Gap insurance helps pay off your loan if your car is totaled or stolen and you owe more than the cars depreciated value, but this type of coverage is only available if youre the original loan or leaseholder on a new vehicle.

What kind of car do you have?

For older cars that arent worth a lot of money, it may be wise to waive comprehensive and collision coverage since the policy many not pay more than the car is worth when theres a loss or accident.

How Much Liability Coverage Do I Need

Liability insurance covers the costs if you cause an accident, damage property, or injure someone with your vehicle. Liability insurance will cover resulting bills, legal, and settlement costs up to your policy limits after an accident you cause.

Liability coverage is made up of two parts:

-

Bodily injury liability covers the costs if you injure someone else with your car

-

Property damage liability covers the costs if you damage someone elses property with your car

You should buy as much liability coverage as you can afford, and make sure you have enough liability coverage to cover the full value of your assets .

We recommend limits of at least $100,000 per person, $300,000 per accident in bodily injury liability, and $100,000 per accident in property damage liability coverage. If you have teen drivers on your policy, you should increase your liability coverage limits even more.

Also Check: Where Can I Get My Car Battery Replaced

What Factors Might Affect My Car Insurance Coverage

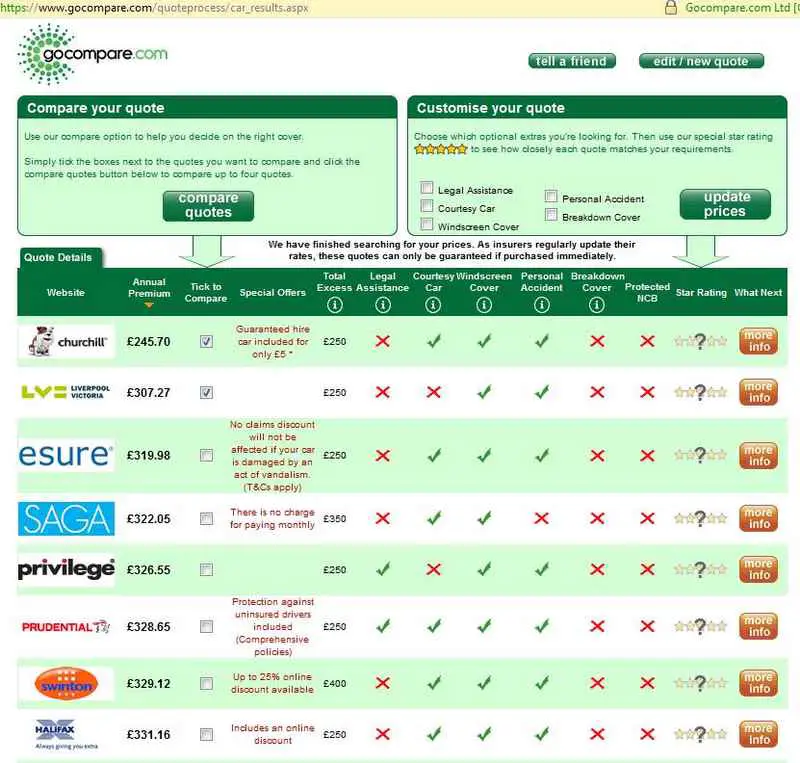

Choosing coverage types and amounts isnt the only thing that determines your car insurance premium. Instead, companies consider a range of individual factors that impact car insurance rates. This means that even if you and a friend have the same policy selections, your premiums may be very different. For this reason, it can be very helpful to shop around with different carriers to compare rates when looking for the cheapest car insurance policy.

Keep in mind that some states restrict or ban car insurance companies from using some personal factors when setting your car insurance premium. You may want to check your states laws to see if they ban or restrict the use of information such as your age, gender or credit-based insurance score when setting your premium. If your state does not have those restrictions, your personal information may affect your premium even more than the factors below.

Some car insurance rating factors include:

How Much Auto Coverage Do I Need

Almost every state requires you to buy a minimum amount of liability coverage. Chances are that you will need more liability insurance than the state requires because accidents cost more than the minimum limits. If youre found legally responsible for bills that are more than your insurance covers, you will have to pay the difference out of your own pocket. These costs could wipe you out!

You may want to talk to your agent or company representative about purchasing higher liability limits to reflect your personal needs. You may also consider purchasing an umbrella or excess liability policy. These policies pay when your underlying coverages are exhausted. Typically, these policies cost between $200 and $300 per year for a million dollars in coverage. If you have your homeowners and auto insurance with the same company, check out the cost of coverage with this company first. If you have coverage with different companies, it may be easier to buy it from your auto insurance company.

In addition to liability coverage, consider buying collision and comprehensive coverage. You don’t decide how much to buy. Your coverage reflects the market value of your car and the cost of repairing it.

Recommended Reading: How Hot Does A Car Get In The Sun

Does It Ever Make Sense To Have Liability

There are some instances where only carrying liability coverage makes sense. If your car doesnt have much in the way of cash value, it might not be worth it to carry comprehensive or collision coverage. Drivers who can afford to replace their car out-of-pocket may not want to spend the extra money on full coverage car insurance.

Commonly referred to as the 10% rule, if your annual cost for full coverage would be more than 10% of the vehicles actual cash value, you can drop your comprehensive and collision coverage.

What Car Insurance Coverages Do I Need

The amount of auto insurance coverage you need depends on your location. Some states have similar minimum coverage limits, but theyre unique in some way.

However, most drivers only need liability car insurance, which includes bodily injury liability and property damage liability.

Some states include uninsured/underinsured motorist coverage as part of their minimum requirements.

Meanwhile, a handful of states have personal injury protection or medical payments attached to their states minimum requirements.

Don’t Miss: How To Repair Weather Stripping On Car Door

Getting Caught Driving Without Auto Insurance

Driving without minimum auto insurance coverage is very risky. It could even have potentially life-changing consequences. If youre pulled over and dont have insurance, you could be hit with fines, license and registration suspensions, and costly insurance premium surcharges. If youre uninsured or underinsured and get into an accident, you could end up paying thousands out of your own pocket to cover the costs of property damage and medical bills. And if you cant pay, your wages could be garnished and your assets seized.

Even going with the bare minimum could be a risky choice, since youll still be held responsible if something disastrous happens. Remember, insurance only pays up to your coverage limits so the recommended auto insurance coverage is dependent on your net worth.

How To Choose Car Insurance Coverage

Car insurance is not one size fits all. What’s most important to one car owner isn’t necessary for another.

That’s why it’s critical to understand the different types of car insurance, whats required by law, and what additional coverage you might need.

Insurance.com’s car insurance calculator is a quick way to find the right car insurance limits and options for you. While getting the cheapest car insurance rate is most important for some drivers, another person may want the broadest possible protection. Answering a few quick questions can help you find the best car insurance coverage for your situation.

Recommended Reading: Can You Get Wifi In Your Car

Average Auto Insurance Rates For Drivers With Good Versus Bad Credit

|

Type of policy |

|

|---|---|

|

$561 |

$973 |

Remember, insurers use a credit-based insurance score, similar to a regular credit score, to help set rates in most states. The insurance score uses all the same factors as a regular credit score things like on-time payments and delinquencies but weighs them differently.

California, Hawaii, Massachusetts and Michigan dont allow insurers to use credit when determining car insurance rates.

Insurance companies point to data linking poor credit to more frequent insurance claims to justify the higher prices to state regulators.

The scores impact on your premium depends on where you live and which car insurance company you choose.

For instance, average rates more than double in four states: Nebraska, New York, South Dakota and Wisconsin.

Some companies are more forgiving of bad credit than others, so its worthwhile to shop for quotes while youre trying to build your credit. For example, heres what we found for a 35-year-old buying full coverage:

-

State Farms rates for a driver with bad credit in Arizona, South Dakota, Tennessee and Wisconsin are more than quadruple its rates for someone with good credit.

-

On the other hand, Nationwides rates in North Carolina and Indiana are about $25 a month higher for a driver with poor credit than for one with good credit.

What Happens If I Buy A New Car Is It Covered

If you get a new car, your current insurance will automatically cover it for about 20 days. The type of coverage depends on whether the car is an additional or replacement car.

- An additional car gets the same coverage as the car with the most coverage on your policy.

- A replacement car gets the same coverage as the car it replaces on your policy.

Tell your company about a new car as soon as you can to avoid a lapse in coverage.

Don’t Miss: Where To Sign Florida Title When Selling Car

How Much And What Kind Of Optional Car Insurance Should You Have

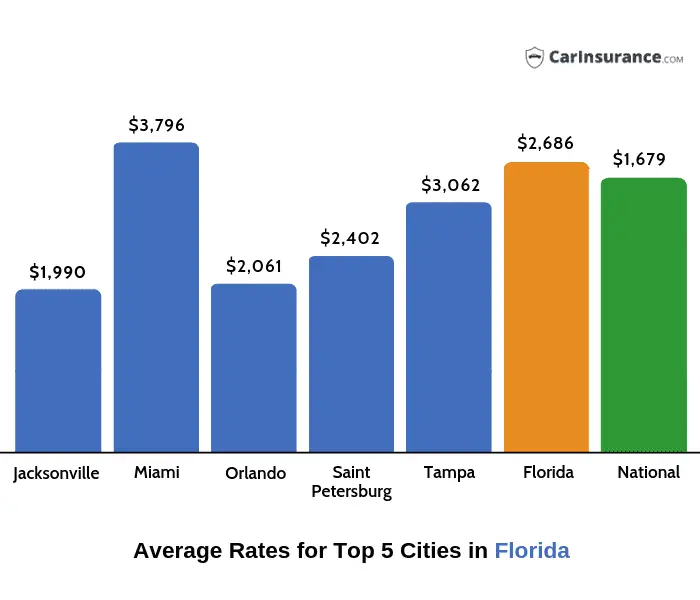

The question of how much car insurance to buy is difficult to answer because it becomes a personal decision, often based on each individualâs or familyâs finances. Plus, Floridaâs car insurance laws and requirements are confusing at best.

The following explanation is provided to demystify your insurance options, and to help you understand why certain types of insurance create the best way to protect yourself and others.

How Much Car Insurance Should I Get

For middle-class families, many insurance experts recommend purchasing at a 100/300 policy that is, liability coverage of $100,000 per person, $300,000 per accident. But the wealthier you are, and the more assets you have that could be seized to satisfy a personal injury judgment against you, the more insurance you ought to have.

One often-overlooked type of auto insurance coverage pays the policyholder and people riding in his or her car for injuries caused by an uninsured or underinsured driver. This would be useful if you are hit by an at-fault driver from Arkansas who carries only the $15,000 minimum in liability coverage.

Suppose as a result of the accident you break an arm, are hospitalized overnight, have to return for outpatient checkups and physical therapy, and lose two weeks of work. Your doctor then advises you that as a result of the fracture, its likely that you will develop osteoarthritic changes in your elbow that will plague you for the rest of your life.

In that situation, you can see how the other drivers $15,000 in liability coverage wont cover anywhere near all of your damages. Thats where underinsured motorist coverage kicks in and pays you what the other drivers insurer would have paid if hed had more insurance. In effect, underinsured motorist coverage insures you against being hit by someone who doesnt have enough insurance.

You May Like: Where Can I Weigh My Car

Auto Coverage Types To Consider

While both excess liability insurance and umbrella insurance can provide needed coverage, there are important differences between the two. Excess liability raises the automobile coverage limits, while umbrella coverage is broader. An umbrella policy offers an extra layer of liability protection for your assets if youre in a serious auto accident or if there is a serious accident on your property. Umbrella coverage protects you from liabilities above your current auto or homeowners limits. So, if you buy an umbrella policy, youre only buying one policy that provides coverage over and above all of your policies, Salvatore explains.

If you are financing the purchase of a new car, you should consider gap insurance, Salvatore suggests, because the value of the car depreciates quickly. If the new vehicle is totaled, you may find you owe more than the car is actually worth.

On the other hand, if you have an older car, you may want to reconsider your deductible levels. You could consider getting a higher deductible for comprehensive and collision, Salvatore says. Ultimately, it is a question of crunching the numbers for your vehicle and weighing the cost to repair or replace your vehicle against how much the policy will cost.

How Car Insurance Works

An automobile insurance policy is actually a package of several different types of insurance. The most common ones are:

- Bodily injury liability

- Medical payments or personal injury protection

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

Depending on the state you live in, some of these coverages may be mandatory, others optional. If you have an auto loan or lease, your lender may also have certain requirements. But beyond what your state or lender requires, you may want to purchase additional insurance to protect yourself. Here’s a closer look at each type of coverage and how to decide how much you really need.

Don’t Miss: My Summer Car How To Start Van

Coverage To Protect Your Assets

Despite the required minimum requirements for bodily injury liability, it is probably in your best interest to purchase higher limits. If someone else is injured and you’re at fault, the minimum liability coverage may not cover the other motorist’s medical expenses, in which case he or she will most likely come after your assets. Insurance experts generally recommended that you purchase 100/300 limits of bodily injury liability . On the other hand, if your personal assets don’t amount to much, there’s little for another driver to get if he were to sue you. The minimum requirements might actually suit you and will save you some much-needed cash.

How Much Liability Car Insurance Do I Need

Nearly every state requires drivers to carry liability insurance. The minimum amount of coverage a motorist must carry depends on their state. To find out what your state requires, go to your state’s department of motor vehicles website. Alternatively, you can talk with an insurance agent who works in your state.

When it comes to coverage, snagging low cost car insurance is not the only thing that matters. It’s important for a driver to purchase enough coverage to feel financially secure if they happen to be part of an accident.

As you shop for auto insurance, you’ll see requirements that look like this: 25/50/25. Here’s what they mean:

First number: The first number represents $25,000, the amount of bodily injury liability coverage per person required.

Second number: The second number represents $50,000, the amount of bodily injury liability coverage per accident required.

Third number: The last number represents $25,000, the amount of property damage liability coverage per accident required.

Liability policies are designed to compensate other parties if the policyholder causes an accident that leads to property or bodily damage. That means if the policyholder hits another car or someone walking across the road, liability insurance will cover it. If the driver runs off the road and crash into someone’s fence, liability will cover that type of incident too.

An example:

Key takeaways:

Read Also: How Much To Junk My Car