What Is Interest Rate

Interest rate is the amount charged by lenders to borrowers for the use of money, expressed as a percentage of the principal, or original amount borrowed it can also be described alternatively as the cost to borrow money. For instance, an 8% interest rate for borrowing $100 a year will obligate a person to pay $108 at year-end. As can be seen in this brief example, the interest rate directly affects the total interest paid on any loan. Generally, borrowers want the lowest possible interest rates because it will cost less to borrow conversely, lenders seek high interest rates for larger profits. Interest rates are usually expressed annually, but rates can also be expressed as monthly, daily, or any other period.

Interest rates are involved in almost all formal lending and borrowing transactions. Examples of real-world applications of interest rates include mortgage rates, the charge on a person’s outstanding debt on a credit card, business loans to fund capital projects, the growth of retirement funds, amortization of long-term assets, the discount offered by a supplier to a buyer for paying off an invoice earlier, and much, much more.

Simple vs. Compound Interest

Fixed vs. Variable Interest Rates

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvanas most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

Recommended Reading: What Are Home Improvement Loan Rates

Don’t Miss: What Is The Average Car Insurance Payment

Financing With A Personal Loan

Using a personal loan to buy a car will definitely be a better idea than using your credit card. If you have a good credit score, this will probably be one of your cheaper options.

You can either take out a secured personal loan or an unsecured loan. If you are confident about your ability to repay your loan, you can consider taking out a secured personal loan as this will get you a better interest rate. Keep in mind the risk that, if you default on your loan payment, you might lose your asset.

Although personal loans are one of your cheaper options, the interest rate will probably be a little bit higher than traditional auto loans. If this is your only option this is definitely the way to go.

Historical Auto Loan Rates

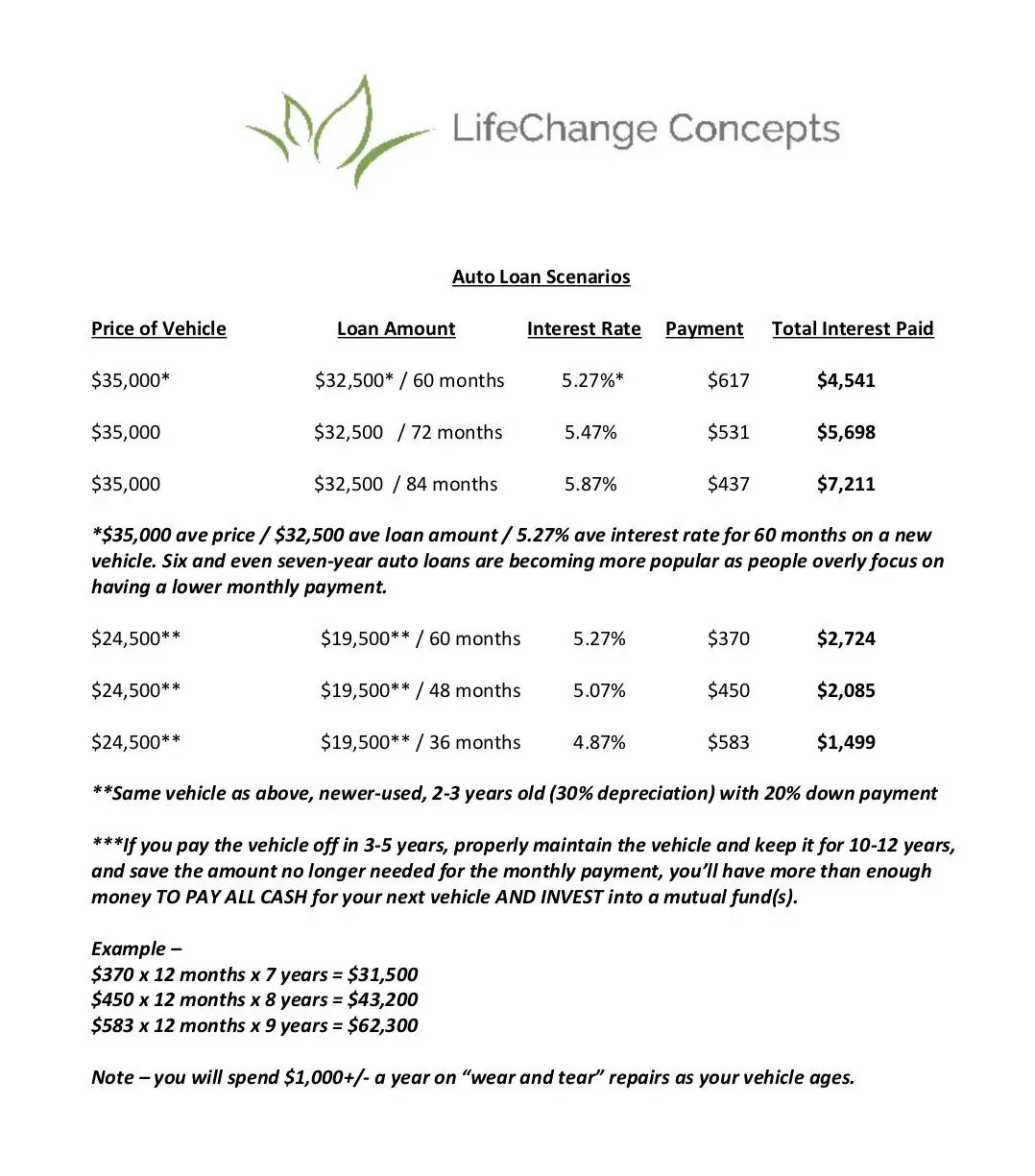

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

Read Also: How To Add Oil To Car

How To Use Credit Karmas Auto Loan Calculator

A car could be one of the biggest purchases youll ever make. Thats why its important to understand how various factors can affect how much you pay to finance a car.

Whether youre just starting to shop for a car or are ready to finance a particular make and model, getting a sense of your monthly loan payment can help with your decision.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Itll also help you figure out how much youll pay in interest and provide an amortization schedule .

Keep in mind that this calculator provides an estimate only, based on the information you provide. It doesnt consider other factors like sales tax and car title and vehicle registration fees that could add to your loan amount and increase your monthly payment.

Here are some details on the information you might need to estimate your monthly loan payment.

The First Necessary Step In The Car Buying Process

Whether you buy new or used, it’s wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. A FICO score can be between 300 and 850. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren’t concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

You May Like: How To Get The Best Car Lease Deal

Top Tip: Lower Your Credit Utilization

His top tip? Lower your credit utilization ratio. “This is the amount of credit you’re using on your credit cards divided by your credit limits,” Rossman said.

He said that even if you pay off your balances every month, the credit-reporting firms Experian, Equifax and TransUnion often receive balance data before you’ve paid it.

“It’s typically reported on your statement date, so consider making an extra mid-month payment and/or asking for a higher credit limit to bring your ratio down,” Rossman said.

Check For Mistakes On Your Credit Report

Additionally, he said make sure there are no errors on your credit report.

To check for mistakes and get a sense of what lenders would see if they pull your credit report, you can get a free copy from each of the three big credit reporting firms. Those reports are available for free on a weekly basis through the end of next year.

Read Also: How To Sell A Car On Facebook

Defining Car Loan Terms

How Can I Buy A Car Without A Car Payment

Unlike popular belief, it is possible to buy a reliable used car with cash and not have a monthly payment strapping you down.

The first step is to buy a car you can afford with the cash you have in the banklets say its $4,000. Next, take what you wouldve spent on a car paymentaround $500and put it in your savings account each month for a year.

And as one of our fave money experts, Rachel Cruze, points out, there are a ton of great cars out there for under $10,000, like these:

- 2010 Subaru Outback

- 2010 Honda Accord

- 2011 Toyota Camry

But heres the best partyou dont have to stop with an $8,000 or $10,000 used car. Take that same principle we just taught you, and do it again. Then, in another year, youd have $6,000 more dollars to put toward another upgraded car!

Now, you have a paid-for car you loveand you still did it quicker than the average five-to-six-year loan term. Take that, car payment!

The truth is, this concept goes beyond freeing up your monthly budget. It frees up your lifeand helps you have more money to put toward important things that matter to you, like saving more money or investing for retirement.

Remember, youre the superhero herenot the car payment. Get that cape ready, Superman. You can do this!

You May Like: How Much Are Car Brakes

Outlook For Auto Loan Interest Rates

2022 has already proven to be a complicated one in all facets of American finance. And, unfortunately, the automotive industry has not come out unscathed. Decisions made by the Federal Reserve and the remaining supply chain issues all play a part in how much its going to cost to finance your next car.

The increased Fed rate, sitting at 2.25-2.5 following the July meeting, will indirectly affect your rates. But, while the federal funds rate determines what lenders base their rates on, it is not the only consideration.

When combined with the tumultuous state of the car-buying market, it results in a more expensive experience overall. Kelley Blue Book reports that new vehicle costs were as high as $48,000 in June 2022.

With all of this in mind, consider approaching your next loan with extra care. Be sure to apply for preapproval and shop multiple lenders.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How To Deal With Car Dealers

Calculate Your Total Interest Paid

Once you have the interest rate, it is time to calculate the total interest. Luckily, you can find free calculators online. Look for a vehicle interest calculator, as these take into account amortization, which means the principal and interest are reduced at different rates, with the interest being paid off more at the beginning of a loan and then gradually switching over to paying off more of the principal toward the end of the loan.

Step 1: Use an online amortization calculator. This calculator takes the information you provide and figures how much interest is paid each month and for the life of the loan. You can find auto loan calculators online at such sites as Bankrate, Auto Loan Calculator, and Amortization Schedule Calculator.

Input your data, such as the principal loan amount, loan term, and interest rate. Some calculators allow you to look at the amortization schedule and add extra payments to see how they affect your overall payment schedule.

- Warning: Check with your lender before making any extra payments. Some put provisions in the loan paperwork stating that you will be penalized for paying off the loan early.

Step 2: Print or save the calculations you receive. Find the area that gives you the total amount of interest paid and highlight it.

Car Loans For International Students

Getting an auto loan if you are an international student can be hard. You might not be able to provide a Social Security Number , U.S credit history or credit score as an international student, which means that you wont be able to get a loan from many of the traditional lenders. Some traditional lenders might offer you a car loan as an international student, but the interest rate charged for the risk they take could be extreme.

There are many non-traditional lenders that will offer international students in the U.S car loans. Some lenders will provide you with a personal loan to buy your car, or will offer you an actual auto loan.

These lenders consider factors like your educational or financial history in your home country into account and might even consider your foreign credit score. They will also look at your earning potential in the U.S or allow a cosigner as extra security to them. All of these factors mean that you will not only be able to get a loan to get a car in the U.S but you might even get a relatively competitive interest rate.

Read Also: When To Change Car Seats

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the following:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.