What Are The Average Car Insurance Costs

Relying on average car insurance costs to estimate your car insurance premium may not be the most accurate way to figure out what youll pay. But its a start. Insurers use multiple factors to determine rates, and you may pay more or less than the average driver for coverage based on your risk profile.

For example, younger drivers are generally more likely to get into an accident, so their premiums are typically higher than average. Youll also pay more if you have an at-fault accident, multiple speeding tickets, or a DUI on your driving record. On the flip side, if you have 20 years of driving experience under your belt, a clean driving record, and pristine credit, you may qualify for lower than average rates.

What If The Other Drivers Limits Arent High Enough To Pay My Bills

If the other drivers policy limits arent high enough to pay for all your car repairs, file a claim with your insurance company. Your collision or uninsured/underinsured motorist coverage should pay the difference. If you file a claim with your insurance company, youll have to pay a deductible.

If the other drivers limits arent enough to cover all your medical bills, file a claim with your auto insurance company or your health insurance company. Your auto insurance company will use either your PIP coverage, medical payments coverage, or your uninsured/underinsured motorist coverage to pay the difference. You might have to pay a deductible.

Reduce Coverage On Older Cars

Consider dropping collision and/or comprehensive coverages on older cars. If your car is worth less than 10 times the premium, purchasing the coverage may not be cost effective. Auto dealers and banks can tell you the worth of cars. Or you can look it up online at Kelleys Blue Book . Review your coverage at renewal time to make sure your insurance needs havent changed.

Read Also: What Does Oil Do In A Car

Average Car Insurance Costs For Full And Minimum Coverage By State

|

State |

|---|

Here are the cheapest states for auto insurance:

Idaho: $1,027 a year, or about $86 a month, on average.

Ohio: $1,066 a year, or about $89 a month, on average.

Vermont: $1,074 a year, or about $89 a month, on average.

Maine: $1,074 a year, or about $90 a month, on average.

Hawaii: $1,128 a year, or about $94 a month, on average.

These are the most expensive states for auto insurance:

Louisiana: $2,986 a year, or about $249 a month, on average.

Florida: $2,775 a year, or about $231 a month, on average.

Nevada: $2,489 a year, or about $207 a month, on average.

Kentucky: $2,423 a year, or about $202 a month, on average.

Michigan: $2,084 a year, or about $174 a month, on average.

Note that full coverage isnt a type of policy you can select from a list. In our analysis, full coverage insurance rates include comprehensive and collision insurance, liability and uninsured/underinsured motorist coverage.

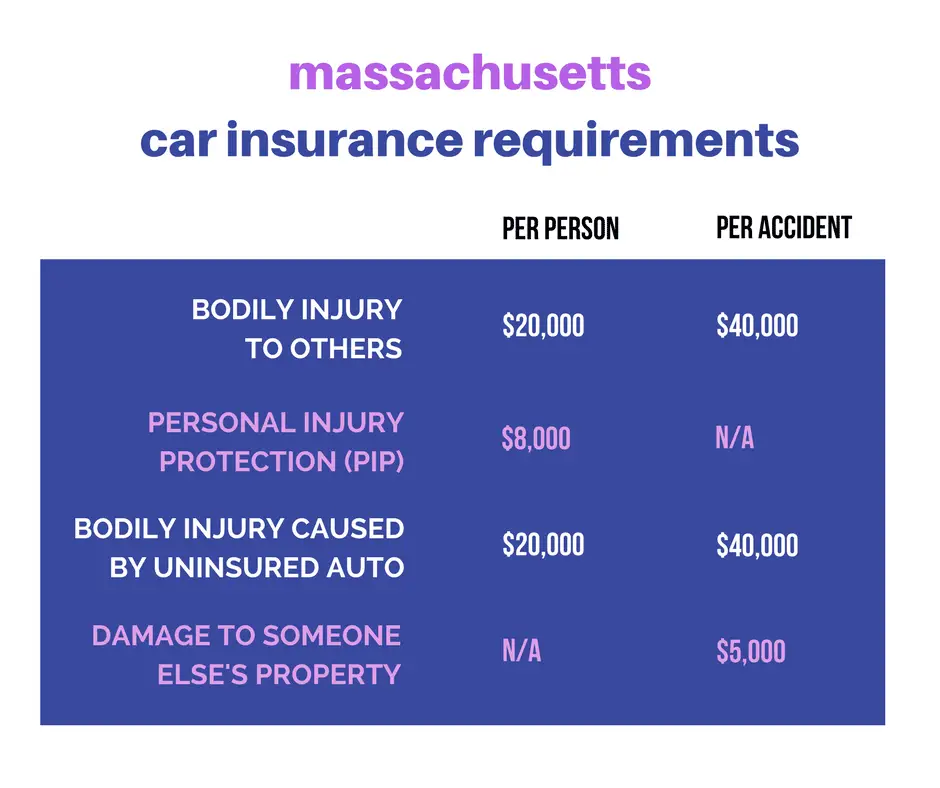

Is Insurance Required In Every State

Other than New Hampshire and Virginia, every state in the country requires drivers to maintain a minimum amount of liability coverage to drive legally. Depending on where you live, you may also need to maintain other types of coverage, such as uninsured and underinsured motorist or personal injury protection and medical payments.

It may be tempting to stick with the minimum limits your state requires to save on your premium, but you could be putting yourself at risk. State minimums are notoriously low and could leave you without adequate protection if youre in a serious accident. Most experts recommend maintaining enough coverage to protect your assets.

Related Auto Insurance Stories:

You May Like: How Much Is The Average Used Car

How Much Car Insurance Costs By Marital Status

Your car insurance costs can be affected by whether youre married, divorced, or single. We found that the cost of auto insurance is lowest for married drivers. If youre married, your rates cost $5 less than average per month.

Being single or divorced means that your insurance costs will be more expensive. Car insurance costs drivers who are single $6 more per month than average, while rates are about $5 more expensive than average for single drivers.

Table sorted alphabetically by violation.

When do you need an SR-22?

After a DUI or serious driving violation, your state may require you to prove that you have insurance by getting an SR-22 or FR-44 form. Both of these forms carry an additional fee on top of your increased insurance costs.

Average Cost Of Car Insurance Based On Credit

Auto insurance companies say drivers with lower credit scores are more likely to file claims. Thats why car insurance rates for drivers with poor credit are often very high.

Our rate analysis finds that drivers with poor credit pay 76% more than drivers with good credit, on average.Thats a price hike of over $1,200 a year, from $1,601 to $2,818.

Not all states allow your credit score to be used in pricing car insurance. Using your is banned from auto insurance rate calculations in California, Hawaii, Massachusetts and Michigan.

Read Also: How To Get Wifi While Traveling In Car

How Much Auto Insurance Do I Really Need

You need at least enough coverage to meet your states minimum requirements to drive legally. If youre not sure what they are, check with the department of motor vehicles or your insurance agent.

But keep in mind that state minimum insurance requirements are notoriously low. And they dont typically provide adequate protection if youre in a serious accident. Plus, your state may not require certain types of coverage that can help protect your finances after accidents and other incidents.

Having the right types of coverage and adequate policy limits is essential to preserving your financial health. The more money you have, the more insurance you need, says Shane Page, president of Piedmont Insurance Associates, an independent insurance agency in North Carolina.

If you dont have enough coverage and someone sues you, you might have to dip into your savings or other assets to cover accident-related expenses.

New York Car Insurance Rates By Company

The best car insurance companies in New York not only offer high customer satisfaction ratings and financial strength, but also provide competitive rates for New Yorkers. Progressive and Erie offer some of the cheapest full coverage rates, although as shown below, many other carriers also come in below or close to New Yorks average car insurance rate.

| Car insurance company |

|---|

| -7% |

Recommended Reading: How Much Is An Aston Martin Car

Need More Liability Insurance Grab An Umbrella

Your car insurance company might not allow liability limits high enough to cover all your assets many auto insurers have a maximum bodily injury limit of $500,000 or lower.

If you think youll need more liability coverage than your auto insurer will provide, consider an umbrella insurance policy. Umbrella policies expand auto and home liability insurance beyond your carriers normal limits.

In general, umbrella policies cover those who have a lot of assets or more opportunities to encounter risk. You might have the sort of risk an umbrella policy is meant to cover if you:

-

Host lots of parties.

-

Have a swimming pool, trampoline or other feature that could be considered an attractive nuisance.

-

Own one or more dogs. Depending on the breed of your dog, your insurer may not cover your animal.

-

Own rental properties.

Factors Affecting Your Premiums

How much you should be paying for your premiums is largely affected by varying personal factors in addition to your specific location. While any factor can indicate how much of a risk you will be to insure as a driver, the most important factors are generally the same across all insurance companies, though there are exceptions.

How much you should pay for car insurance depends on several factors all working together. Because of this, there is no one-size-fits-all answer to your car insurance needs. Remember to shop around and compare quotes so that you can find the best rates for the coverage your specific driving habits call for.

Don’t Miss: How To Mirror Android To Car Screen

The Most Expensive States For Insurance

On average, auto insurance is most expensive in Florida, where rates are 71% more expensive than for most drivers nationwide. We found that the cost of car insurance in Florida is $96 more expensive per month, or $1,156 per year, compared to the national average.

Besides Florida, Louisiana, Michigan, New Jersey, and Nevada are the states with the most expensive average car insurance rates.

What if car insurance costs are too high in your state?

You can still get affordable coverage in states where average insurance costs are high. You can keep costs low by avoiding accidents and tickets, taking advantage of discounts, and by comparing quotes when its time to renew your policy and switching companies if you find a better deal.

Average Cost Of Minimum

Below is a table showing the minimum-coverage car insurance, also known as “liability insurance,” rates for all 50 states. North Carolina has the cheapest average rate of $59 a month. Connecticut has the highest rate at $391 a month. For comparison, the overall average cost of liability car insurance is currently $2,040 a year, or $170 a month.

| State | |

|---|---|

| $747 | $62 |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

It’s also important to point out that particular states do not have cheaper or more expensive car insurance rates for the same reasons. For example, New York has an average monthly rate of $280 a month. This is largely due to the extensive minimum-coverage requirements New York drivers need. Michigan has a fairly similar average rate of $294 a month. Its high premiums are due to the large number of uninsured drivers in the state.

Also Check: What Are Car Tires Made Of

The Cheapest States For Car Insurance

Car insurance is least expensive in Ohio. Rates for car insurance in Ohio are $84 per month , which is $630 cheaper than the national average.

Car insurance costs are also low in Vermont, North Carolina, Idaho, and Maine, according to our analysis.

States that have the lowest insurance costs sometimes have lower minimum coverage requirements, making it tempting to opt out of certain types of coverage. But this is a bad way to save money, since going without enough insurance can leave you on the hook for after an accident.

Compare rates and shop affordable car insurance today

We don’t sell your information to third parties.

How Much Car Insurance Costs By Age

Along with your location and the amount of insurance you have, age is one of the most important factors when it comes to auto insurance rates. Drivers under 25 tend to pay much more for coverage because of their inexperience behind the wheel.

The average cost of car insurance before you turn 25 can be thousands of dollars more expensive per year than for older drivers. For example, car insurance costs a newly licensed 16-year-old $378 more per month than someone whos 25.

Join an existing policy for lower insurance costs

One of the best ways that you can find lower car insurance costs as a young driver is by joining your parents existing policy. We found that its $225 cheaper per month for a teen to join an existing policy than to get their own.

Gen Zers have the most expensive costs of car insurance of any age group. Rates are $203 more expensive each month than average for these drivers and $200 more expensive than for the next youngest generation, millennials, and $213 higher than rates for Gen X.

|

Generation |

|---|

Also Check: Which Car Brand Is The Most Reliable

How Much Car Insurance Costs For Different Vehicles

We found that the cost of car insurance can change by hundreds of dollars a year depending on the car that you drive. Our analysis shows that electric cars cost $49 more each month than an SUV does. In fact, the costs to insure a small and regular-sized SUV are nearly the same.

The cost of car insurance for electric vehicles is $68 more than average per year, making these EVs the most expensive vehicles to insure.

The average cost of car insurance for SUVs is the cheapest, but we found that the Ford F-150 is the most affordable vehicle to insure. Auto insurance rates for Teslas tend to be much more expensive. Insurance for a Tesla Model 3 and Y costs $1,000 more per year than for a Ford truck.

|

Vehicle |

|---|

Our team of data and insurance experts at Policygenius found the cost of car insurance for different types of drivers by analyzing hundreds of thousands of rates from every ZIP code and every state .

Our rates for most people used the sample profile of a 30-year-old driver of a 2017 Toyota Camry with a clean driving record. This sample policy included coverage limits of:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

- Comprehensive: $500 deductible

- Collision: $500 deductible

Some carriers may be represented by affiliates or subsidiaries. Rates provided are a sample of costs. Your actual quotes may differ.

Average Car Insurance Costs By Car Model

Certain car models can be extremely expensive to insure, but most car models will alter a drivers rates by less than a few hundred dollars per year. For example, the top selling sedan , truck and SUV models in the country all cost our sample driver an average of $1,266 to $1,414 to insure.

On the other hand, sports cars and electric car models can be much more expensive to insure than the average car. MoneyGeek found that the most expensive car to insure is a Nissan GT-R. The cheapest car model to insure is a Honda CR-V.

Scroll for more

Also Check: How Often Should You Change The Oil In Your Car

How Much Does Car Insurance Cost By State

On average, car insurance costs around $1,771 per year for full coverage and $545 per year for minimum coverage. However, when determining how much does car insurance cost in a specific area, the answer can vary depending on a variety of factors. The state where you live, individual rating factors, accident and claim reporting frequency, and even cost of labor and parts can cause one city or state to be more expensive than others.

Average Cost For Seniors

While insurance rates lower as drivers age and gain more experience, premiums for seniors typically begin to rise around the age of 65 as risk and vulnerability to injury increases. According to the CDC, drivers over the age of 70 have higher crash mortality rates than drivers aged 35-54.

Average Costs for Seniors by Coverage

- 100/300/100 Full Coverage

You May Like: How To Save On Car Rentals

Regional Average Cost Of Car Insurance

| Region | |

|---|---|

| Mid-Atlantic | $3,264 |

| Southeast | $3,007 |

| Southwest | $2,896 |

| Midwest | $2,722 |

| Northeast | $2,542 |

| Northwest | $2,242 |

| $148 |

The Mid-Atlantic has the most expensive car insurance rates, followed by the Southeast. Car insurance is much more affordable in the non-mainland states of Alaska and Hawaii. In the other lower 48 states, the Northwest is the region with the lowest prices on car insurance.

Average Cost Of Car Insurance In 2022

By: Lyle Daly |Updated June 29, 2022

Image source: Getty Images

The average cost of car insurance is $2,875 per year, according to a 2022 rate analysis by The Ascent, a Motley Fool service.

That’s the overall average, but it can change quite a bit depending on a variety of factors, including a driver’s age, driving record, and location. Keep reading for a detailed look at auto insurance rates across the nation.

Read Also: What Makes A Car Overheat

Average Car Insurance Cost By Gender

| Gender |

|---|

| $3,058 |

Note: Premiums are representative only individual premiums will be different

The most expensive type of car to insure is a sports car, followed by a truck. In general, the faster a car can go or the more expensive it is to repair or replace, the more its insurance will cost.

Drivers tend to assume that if a car is more expensive, it automatically costs more to insure than a cheaper car. However, this is not always the case. WalletHubs analysis found that only 22% of the difference in insurance premiums for cars in the same category can be attributed to the cost of the car. The remaining 78% depends on other factors such as the cars body type, make, and age, which affect how much damage a car can cause and how much it costs to repair.

What Are Minimum Levels Of Liability Car Insurance Best For

Minimum levels of liability coverage arent good for much, but its better than having no insurance at all. If you dont have any assets, you may face little financial risk by maintaining your states minimum requirements. But if you have any assets to protect, you could be putting them at risk. The minimum is almost never enough to pay for a new car or serious injuries after an accident.

You May Like: How To Pay Car Payment