Free Car Insurance Comparison

Secured with SHA-256 Encryption

|

Zaneta Wood, Ed.S. has over 15 years of experience in research and technical writing bringing a keen understanding of data analysis and information synthesis to reach a wide variety of audiences. She studied adult education and instructional technology at Appalachian State University as well as technical and professional communication at East Carolina University.Zaneta has prepared technical p… |

Written byZaneta Wood Team Writer |

|

Joel Ohman is the CEO of a private equity backed digital media company. He is a CERTIFIED FINANCIAL PLANNER, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida.Jo… |

National Average Cost Of Car Insurance For Younger And Older Drivers

| Age |

|---|

| $165 |

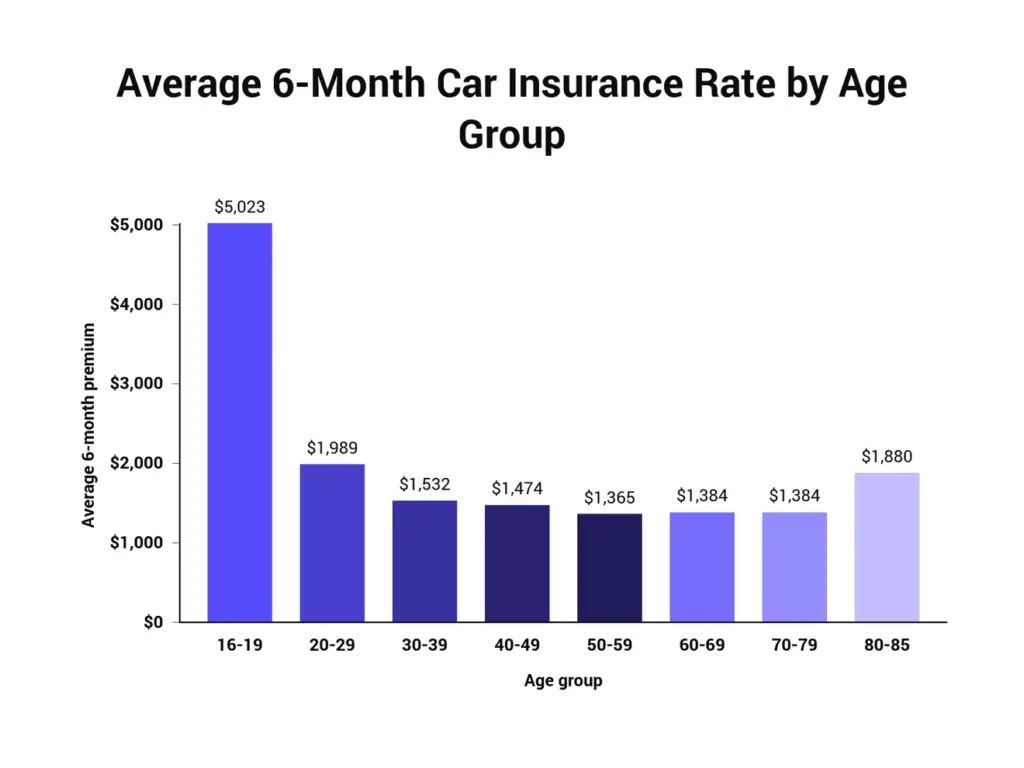

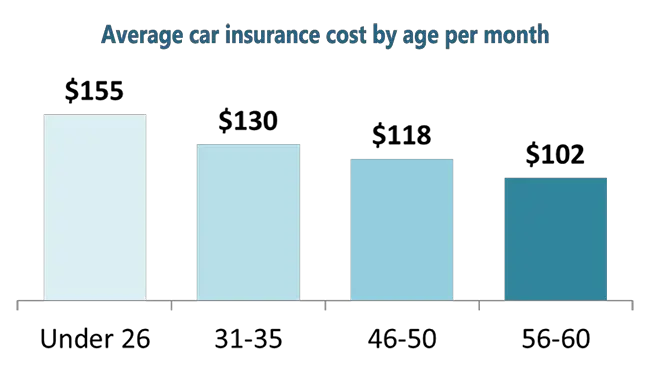

Younger drivers have much higher car insurance premiums than any other group due to the risk they present. Because they’re inexperienced and more likely to drive recklessly, they’re also more likely to be involved in accidents.

The good news for teen drivers is that insurance rates drop considerably every year for a few decades — at least for those who avoid negative marks on their driving records. There are also insurance companies that offer relatively cheap auto insurance for teens and young drivers.

The fifties and sixties tend to be when drivers pay the lowest auto insurance rates. By that point, most people have decades of driving experience.

Insurance rates can start to rise once drivers hit their seventies. Slower reaction times, vision loss, and hearing loss are all common among senior citizens and lead to an uptick in insurance rates.

Urban Hotspots Skew The Numbers

Ontario is home to one of North Americas most densely-populated metropolitan regions the Greater Toronto Area. Research has shown that residents of any such populous region experience higher incidences of car accidents.

As a result, they pay higher premiums that subsequently skew numbers for the entire province.

Brampton, for example, has an average annual premium cost exceeding $2,300. Its population of 603,000 means its average insurance premium is weighted heavier at the province level than, say, Dufferin Countys $1,200.

Don’t Miss: How To Fill Out Florida Title

National Average Cost Of Car Insurance

| National average car insurance paid annually | National average car insurance paid twice per year | National average car insurance paid monthly |

|---|---|---|

| $2,646 | $221 |

Americans pay an average auto insurance cost of about $221 per month. Since that’s an overall average, it includes everyone, from drivers with spotless records to those who have had accidents, a poor credit history, or other issues.

Drivers with good credit and clean driving records can often qualify for cheap auto insurance. However, this also depends on where they live and the type of coverage they want.

How Are The Average Auto Insurance Rates Calculated

To get an average figure, the IBC took the total amount for premiums based on the province and divided it by the total number of vehicles owned by residential drivers in that province.

Heres how it works:

- Alberta has $3,640,470,499 / 2,766,202 = $1,316 average auto insurance premiums.

- British Columbia has $5,575,221,831 / 3,043,436 = $1,832 average auto insurance premiums.

- Ontario has $11,673,687,017 in premiums) / 7,759,059 = $1,505 average auto insurance premiums.

ICBC 2019 Service Plan

Average Car Insurance Rates by Province

- British Columbia: $1,832

- Ontario: $1,505

- Alberta: $1,316

- Saskatchewan: $1,235

- Newfoundland and Labrador: $1,168

- Manitoba: $1,080 in 2017

- $891

- New Brunswick: $867

- Prince Edward Island: $816

- Quebec: $717

Recommended Reading: Duplicate Title Fl

Take Advantage Of Multi

If you obtain a quote from an auto insurance company to insure a single vehicle, you might end up with a higher quote per vehicle than if you inquired about insuring several drivers or vehicles with that company. Insurance companies will offer what amounts to a bulk rate because they want your business. Under some circumstances they are willing to give you a deal if it means youll bring in more of it.

Ask your insurance agent to see if you qualify. Generally speaking, multiple drivers must live at the same residence and be related by blood or by marriage. Two unrelated people may also be able to obtain a discount however, they usually must jointly own the vehicle.

If one of your drivers is a teen, you can expect to pay more to insure them. However, if your childs grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a good student discount on the coverage, which generally lasts until your child turns 25. These discounts can range from as little as 1% to as much as 39%, so be sure to show proof to your insurance agent that your teen is a good student.

Incidentally, some companies may also provide an auto insurance discount if you maintain other policies with the firm, such as homeowners insurance. Allstate, for example, offers a 10% car insurance discount and a 25% homeowners insurance discount when you bundle them together, so check to see if such discounts are available and applicable.

Faq About Car Insurance Rates By Age And State

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Recommended Reading: Florida Paper Title

How Much Does Insurance Cost For A New Driver In Ontario

Average insurance rates for young new drivers in Ontario fall within the $3,000 to $7,000 range. New drivers aged above that high-risk bracket will typically pay rates that deviate less drastically from the provincial average .

Keep in mind, its not just the length of your driving record that matters. to read more about the experience-related factors insurance companies take into account. One of these factors, notably, is your ticket history. As you might expect, more tickets for moving violations will lead to higher insurance rates.

Young new drivers can save money on insurance by being listed as a secondary or occasional driver on a parents policy. In addition to waiting until theyre older to purchase a vehicle of their own, they can make sure to progress through Ontarios graduated licensing system as promptly as possible.

Which Circumstances Can I Control

Pursuing higher education can save on your premiums as, statistically, educated drivers take fewer risks on the road.

Similarly, people with good scores statistically drive safer than people who have poor scores.

The insurance companies figure that you, as an educated or financially cautious individual, will drive safely like all the others.

Your occupation and the driving distance to your job are two important, controllable factors.

The insurer considers the total number of miles driven each year.

If you are hoping to decrease your premiums, you could start taking the bus or carpooling to work or stop frequently driving your work vehicle.

How can I battle the average?

Though you contend with the average premium rate for your state and city, there are measures you can take to pay low rates.

You can look into multiple car or multiple-policy insurance discounts, or you can drop comprehensive or collision damage and simply pay for liability insurance.

Remember, the averages compiled for each state are based on full coverage contracts that include liability, comprehensive and collision coverage.

If you take definite steps to decrease your personal and the insurance companys risk, you can enjoy a much higher discount than the average person. But it may be beneficial to pay the standard rate for full coverage.

How are average car insurance rates by state determined?

Currently, Louisiana has the highest cost in the United States with $209.24 per month

- Michigan

- Montana

- California

Also Check: Carvana Car Leasing

How Much Is Car Insurance For An 18

Car insurance for an 18-year-old will average at $2,172 annually for a standard liability policy with limits of 50/100/50. That stands for bodily injury of $50,000 per person and $100,000 per accident plus property damage of $50,000. A state minimum policy is cheaper at $1,910 but not recommended as novice drivers are more likely to crash and thus carry higher limits. A full-coverage policy comes in at $5,399 pricey but worth it if you need collision and comprehensive on your vehicle.

How Much Is Car Insurance For Drivers With Accidents Tickets And Dui

Drivers with recent accidents and traffic violations generally pay more than drivers with clean records. If you have several infractions or accidents, you will certainly have higher rates, especially if youve been convicted of a more serious violation, like a DUI. Below are average yearly insurance costs and percentage increases for such common scenarios, based on a full coverage policy:

- DUI: $2,652, or 79% more

- One at-fault bodily injury accident: $1,889, or 32% more

- One property damage accident over $2,000: $1,880, or 31% more

- Speeding: $1,709, or 20% more

Bear in mind, though, that even if you dont have a clean driving record, you can still save by comparison shopping. Some insurers will raise your rates by a lot, others by a little, depending on how they assess risk and set rates.

You May Like: Get Car Detailed Cost

What Is A Car Insurance Premium

A car insurance premium is the amount you agree to pay to the insurance company in exchange for auto insurance coverage. Auto insurance premiums are based on many factors, including the type of coverage you select, your age , driving history, the vehicle’s make, model and age and the insurance company you choose. Premiums can change each renewal cycle or even mid-term if you or the insurance company make changes to the policy.

What Factors Affect The Cost Of A Car Payment

Before you apply for car financing anywhere in Canada, make sure to get a loan cost estimate from your lender . It might also help to learn about the factors that can cause your payments to fluctuate in cost, such as:

Loan Amount

The more money youd like to borrow, the more risk your lender is taking on. As such, a larger car loan often results in a longer repayment term and more interest paid overtime. While you can apply for a shorter loan term, your payments and interest rate would be higher.

Find out if youre paying too much for your monthly car loan payment.

Interest

If you have bad credit, unhealthy finances or a lot of outstanding debts, you could once again be considered a riskier client and may only qualify for a higher rate . Additionally, some lenders charge variable interest rates, which go up and down with the Bank of Canadas prime borrowing rates.

Check out how much the average car loan interest rate is in Canada.

Loan Term

The length of your repayment term can also affect how much interest you pay for your car loan. Although a longer-term often has a lower rate and smaller payments, which can be more affordable, you could end up paying far more interest than you would with a shorter-term, even if it had a higher rate.

Fees

Don’t Miss: What Oil Do I Use For My Car

Whats The Average Car Accident Settlement

If you have been involved in a car accident, youre probably dealing with medical bills, insurance payments and emotional distress. Auto wrecks always seem to happen at the wrong time, and they can leave you hassling with issues that you never thought you would have to deal with.

A car accident settlement can reimburse you for the money that youve paid out. It can also make up for lost wages, physical or psychological trauma, and the cost of replacing your car.

How Much Is Car Insurance For A 25

Hitting 25 years of age helps bring down the cost of auto insurance. The annual average nationwide for a 25-year-old is $737. That is for a standard liability policy that includes $50,000 for bodily injury per person, $100,000 max for all injuries and $50,000 of property damage . A bare-bones state minimum policy cost is a bit less at $657. You need a full-coverage policy for sure if your car is leased or financed has an average annual rate of $1,957.

Also Check: Protect Car From Hail No Garage

How Can Comparison Shopping Lead To Low Insurance Rates

You can check all the boxes of being a low-risk driver, but it is still essential to find an insurer with competitive pricing. Monthly car insurance costs can vary greatly, even for the most low-risk drivers.

If you know you have the advantage of being a low-risk driver, you know you deserve a great price, and you can likely find it by getting quotes from multiple insurance companies.

On the contrary, are your traits as a driver preventing you from getting the lowest rates? Here are some other ways to save money on car insurance.

How Much Does Car Insurance Cost In My State

Where you live can have an enormous impact on auto insurance rates, because each state has different regulations for auto insurance. Average prices in the most expensive states are at least two times higher than those in the cheapest ones.

How much insurance you have matters, too: Full coverage car insurance is more than double the price of minimum coverage, on average, according to our analysis.

Heres what our state-by-state analysis of 2021 car insurance rates shows for drivers with good credit and no recent accidents:

-

Maine is the cheapest state for full coverage car insurance with an annual average rate of $963, followed by Ohio and Idaho.

-

Louisiana is the most expensive state for full coverage auto insurance at $2,762 per year on average, followed by Michigan and Kentucky.

-

Iowa is the cheapest state for minimum required coverage, at an annual average car insurance rate of $255, followed by South Dakota and Idaho.

-

For minimum required coverage, Michigan is the most expensive state at $1,128 per year, on average, followed by New York and Louisiana.

Read Also: How Long Do New Car Batteries Last

Who A Car Insurance Policy Covers

If you get into a car crash, your insurance may cover:

- the driver

- all passengers

- other people who are involved

In some provinces, injured passengers or other people involved in the accident who have their own insurance policy must make a claim under their policy first.

The principal driver is the person who drives the car most often.

Additional drivers are other drivers in the household who may use the car as part of their routine, such as driving to school or work. Your insurance policy must list additional drivers. If additional drivers have a poor driving record, your premiums may increase.

Occasional drivers are drivers who only use the car from time to time.

Usaa: Best For Military

As you can see from the data, USAA car insurance has some of the lowest average rates in the industry by far. This, along with its great customer service, makes it one of our top choices for car insurance. However, USAA is only available to current and former military and their family members.

With that being said, if you or your loved one is a current or former military member, USAA is a no-brainer. Its low prices on both home and auto insurance, plus its wide variety of additional discount offerings, make it a great choice for young adults just starting out and seasoned drivers. Current military who live on base or are deployed overseas can receive discounts up to 60 percent.

USAA offers all of the basic types of car insurance, including:

- Bodily injury liability

- Uninsured motorist coverage

- Personal injury protection and medical payments

Additionally, USAA offers rideshare coverage and optional car replacement assistance coverage, which helps drivers in the event of a total loss. Customers also receive 24/7 roadside assistance and towing coverage with every insurance plan. To learn more about USAA, read our USAA insurance review.

Recommended Reading: How Much Commission Does A Car Salesman Make Per Car

Average Cost Of Auto Insurance Summary

The average costs of car insurance depend, in part, on how you pay: annually or monthly. The figures below are based on the average annual premium, but be aware that drivers may pay more if they opt for monthly payments. This is because theres usually a discount for paying in full. Thats why its essential to get a personalized quote to understand your options fully.

Average Car Insurance Rates

- $1,633

What Is The Monthly Average Car Payment

Your monthly average car payment in Canada will depend on a number of factors, such as the price of your vehicle, what interest rate you get and how long you take your loan out for. That said, you can expect to pay the following average car payment for a new or used vehicle based on the national average for each category.

| Car price |

|---|

Factors that affect your loan payment

The following factors can cause your monthly average car payment in Canada to fluctuate:

Also Check: How Much Horsepower Does My Car Have