The Cheapest States For Car Insurance

Car insurance is least expensive in North Carolina. Rates for car insurance in North Carolina are $54 per month cheaper than the national average.

Car insurance costs are also low in Ohio, Wisconsin, Idaho, and Vermont, according to our analysis. In these states, the monthly cost of car insurance is $49 cheaper than the national average.

States that have the lowest insurance costs sometimes have lower minimum coverage requirements, making it tempting to opt out of certain types of coverage. But this is a bad way to save money, since going without enough insurance can leave you on the hook for after an accident.

Compare rates and shop affordable car insurance today

We don’t sell your information to third parties.

Cheapest Car Insurance For Young Florida Drivers

GEICO is the overall cheapest insurer for teen drivers in Florida for both minimum- and full-coverage auto insurance. It also has the cheapest rates for teen drivers with accidents on their driving records.

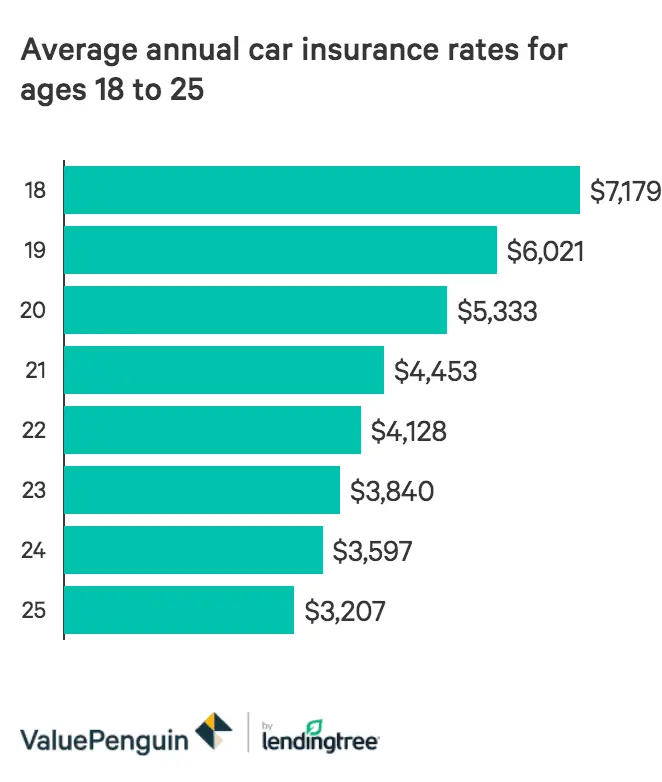

An 18-year-old driver in Florida pays an average of $536 a month for minimum-coverage car insurance. Teen drivers are the highest-risk car insurance demographic due to their inexperience behind the wheel and higher likelihood of getting into an accident. This means that teen drivers usually pay higher rates for car insurance than any other age group and makes shopping around and comparing quotes important.

Average Cost Of Car Insurance By Vehicle

In other analyses, we used a 3-year-old Toyota Camry to show how rates vary by personal history and demographics. But the make and model of your vehicle will certainly affect rates.

Insurers charge more to cover certain cars, including:

-

Sports cars, which have higher top speeds. People tend to drive them faster, increasing the likelihood of a wreck or traffic violation. If you get a speeding ticket, insurers think youll be more likely to cause an accident, which increases rates further.

-

Luxury cars because they tend to have expensive parts and details that are costlier to replace if damaged in a crash.

-

Electric vehicles, which have more expensive engine parts to replace. The batteries alone can cost thousands each.

-

Cars that are stolen often, which tend to be the nations more popular makes and models. These vehicles generally have higher rates for comprehensive insurance, the part of an auto policy that pays out when your car is stolen or damaged by something non-traffic-related, such as floods, fire and vandalism. It is typically optional unless you have a loan or lease.

To see how rates differ depending on your vehicle, we looked at average car insurance rates for the most popular vehicles based on sales in a separate analysis from 2021. As you can see below, the Camry is far from the cheapest model. That honor goes to the Subaru Outback, with an average car insurance cost of $1,336 per year.

|

Rank |

|

|---|---|

|

25. Tesla Model Y |

$2,268 |

Recommended Reading: How Do You Know If Your Car Needs Transmission Fluid

Auto Insurance Coverage Types

| What it does | |

|---|---|

| Liability coverage | Your legal defense is covered if a lawsuit is filed against you due to an accident. Property damage and bodily injury are two forms of liability coverage that must be included in your insurance policy if you live in Washington. |

| Property damage | If you are held legally responsible for an accident, this policy protects your assets, and it protects you against certain types of harm to another person’s property or car. |

| Bodily injury | If you’re held legally responsible for an accident, it protects your assets, including some expenses related to bodily harm suffered by the other parties. |

| Comprehensive | When non-collision-related accidents cause physical damage to your car, this sort of Washington auto insurance coverage is used to fix it . |

| Collision | When your car sustains physical damage due to a collision with another car or item, collision coverage is utilized to fix it . |

| Uninsured/underinsured motorist | Protects you if the other party is at fault in an accident and either does not have insurance or is underinsured. |

How Much Car Insurance Costs In Each State

Where you live, including your state, city, and even your ZIP code are some of the most important factors that determine your car insurance rates.

The average cost of car insurance is $1,652 per year, but we found that the cost of car insurance in the most and least expensive states is separated by $1,905 per year.

There are a few reasons why the cost of car insurance varies so much based on your location. If your area is more densely populated, has higher crime rates, lots of uninsured drivers, or frequent natural disasters, that means more claims and higher rates.

|

State |

|---|

|

$1,398 |

Average rates for male and female drivers ages 30, 35, and 45. Rates provided by Quadrant Information Services. Rates provided are a sample of costs. Your actual quotes may differ.

Don’t Miss: How Long To Jump A Car

How Much Is Insurance For A Sport Car

The cost of insurance for a sport car will vary depending on a number of factors, including the make and model of the car, the drivers age and driving record, the location where the car will be driven, and the amount of coverage desired. However, as sport cars are generally more expensive to repair or replace than other types of cars, insurance companies typically charge higher premiums for them. As such, drivers of sport cars can expect to pay more for their insurance than drivers of other types of cars.

An insurance policy must be purchased if you want to own a sports car. Sports car insurance is the same as any other type of auto insurance. In order to obtain the necessary insurance, you must first identify a provider who specializes in high-performance auto insurance. You will be in a position to obtain coverage if your driving record is clean and you have never been convicted of any traffic violations. Your vehicles collision coverage will compensate you if it damages someones property. You will be compensated if your property is damaged in an unexpected way as a result of comprehensive coverage. When you have personal injury protection, you will have medical coverage in case of an accident.

What Are The Procedures For New Residents To Get A Florida Drivers License

Even if you have a residence outside of Florida, you can be considered a new resident if you have done any of the following in the Sunshine State:

- Enrolled your children in public school

- Registered to vote in the state of Florida

- Filed for a homestead exemption

- Accepted employment within the state

- OR resided in Florida for more than six consecutive months

As a resident, it is your responsibility to know that a motor vehicle is required by law in the State of Florida to be registered within 30 days of the owner either becoming employed, placing children in public school, or establishing residency.

If you have an out-of-state license, it might be possible to convert it to one from Florida without having to take the written or road test.

All those seeking to obtain a drivers license in Florida are required to show proof of valid car insurance from a licensed company in the Sunshine State.

Additionally, proof of identity will be required of anyone seeking to procure a Florida state drivers license.

Now that you know how to get a drivers license in Florida, let us help you understand how to keep it. Keep reading to get a better grasp of how the driver point system works in the Sunshine State.

Don’t Miss: How To Make Your Car Faster

What Are The Car Insurance Laws In Florida

As discussed in the earlier section, there are minimum coverage requirements for drivers and car owners in Florida. According to the NAIC, the Sunshine State also requires that you file the proper forms before your insurance can be used.

While it is common knowledge that you must be covered by car insurance to tag a vehicle or drive in Florida, many people are shocked to learn that they can also be denied car insurance coverage simply because they are considered to be a high-risk driver.

This is why it pays to be proactive by driving defensively when you are on Floridas roads, and why you should always obey all traffic laws. By practicing safe driving, you can keep your driving record clean and thereby prevent yourself from being labeled a high-risk driver.

You can also do your part by understanding how the laws in the state of Florida are determined.

What Are Floridas Safety Laws

There are several laws on the books in Florida that are designed to keep Floridians safe while on the road. Some of these include DUI laws and laws that regulate distracted driving.

Partying and texting have their place, but not behind the wheel. Scroll down to find out how the state of Florida deals with such bad decisions.

What are the DUI laws in Florida?

Drinking and driving is nothing to celebrate. According to Responsibility.org, Florida suffered 839 Alcohol-Impaired Driving fatalities in 2017 alone.

The penalties for driving while impaired are stiff, and they should be. Take a look at what it could cost you to take your party on the road.

- First Offense up to six months in jail, $500-$2,000 fine/penalty, and between 180 days to a year of license suspension.

- Second Offense up to nine months in jail, $1,00-$4,000 fine/penalty, and between 1-5 years of license suspension.

- Third Offense 30 days to five years in jail, $2,000-$5,000 fine/penalty, and 2-10 years of license suspension.

It is just not worth the risk. As we say in Florida: Arrive Alive.

Does Florida have marijuana-impaired driving laws?

While it is now legal to partake in medical marijuana in the Sunshine State, it is still illegal to drive while under its influence.

Penalties and fines for driving while under the influence of drugs are just as stiff as they are for DUIs. Take a look:

In short, Florida is not kidding around, so make sure that you choose not to get behind the wheel while under the influence.

Don’t Miss: How To Clean Car Battery Terminals With Vinegar

Average Cost Of Car Insurance

The average cost of car insurance in the United States is $1,682 per year for 100/300/100 full-coverage insurance for drivers with a clean driving record and good credit score, based on a 2022 rate analysis by CarInsurance.com.

This is just an average and your actual costs could be higher or lower depending on your circumstances. However, its helpful to know the average insurance cost so you know how much you can expect to pay.

Insurance companies have different ways of calculating premiums. This means that the same driver could find varying quotes from different insurance providers for the same coverage. For this reason, drivers need to shop around and compare quotes apple to apple before purchasing a policy.

What Is The Average Auto Insurance Cost By Coverage Level In Florida

Your level of coverage will influence your auto insurance premium, with those who have liability-only coverage paying less than those with low-deductible comprehensive coverage. In Florida, you’ll pay $690 more for a comprehensible coverage with a $500 deductible than for a liability-only coverage. To meet Florida’s minimum law requirements, according to ValuePenguin.com, you need at least minimum coverage. Such coverage, however, does not include comprehensive and collision coverage. If you opt for full coverage, your insurance policy will include comprehensive and collision coverage, which means that you’ll be protected against damage to your vehicle.

Don’t Miss: How To Cancel Extended Warranty On Car

Average Car Insurance Cost In Florida Per Month

In Florida, the average premium for car insurance is $219 per month.

The price for the same coverage may differ between companies, which is true of every auto insurance company. When looking for car insurance rates in Florida, it is a promising idea to get quotes from many firms.

As per the rate analysis conducted by Insure.com, the company which offers cheapest car insurance premiums in Florida is GEICO General Ins Co. The average annual cost is $1,550 while the average cost per month is $129. The second-best option available is, State Farm Mutl Automobile Ins, offering insurance at an average per month cost of $148.

The table below lists the other available car insurance companies which offer car insurance in Florida, along with their average cost per month and average annual cost.

| Company name |

|---|

Read our guide to best car insurance companies of 2022

How Much Is Gap Insurance: Average Gap Insurance Cost Per Month/year

How much does gap insurance cost? the average gap insurance cost when buying your gap insurance directly from insurers will be a few dollars a month or $20 to $45 per year.

Whatever you do, don’t buy gap insurance at the car dealership, as it will cost you a lot more unjustly.

Also Check: How Much To Fix Small Scratch On Car

How Can Comparison Shopping Lead To Low Insurance Rates

You can check all the boxes of being a low-risk driver, but it is still essential to find an insurer with competitive pricing. Monthly car insurance costs can vary greatly, even for the most low-risk drivers. By looking at multiple rates from different carriers, you can find an insurer that offers the lowest rates for your profile.

Cheap Florida Car Insurance For Drivers With Prior Incidents

The cost of Florida car insurance is typically more expensive for drivers who have been in crashes or who have gotten citations for DUIs or traffic violations. Geico and State Farm were the cheapest car insurance companies in Florida for high-risk drivers.

| $412 |

You may see your car insurance quotes go up as you get older because insurance companies find that some senior drivers may be more likely to get into accidents as their driving skills decline. To save on car insurance as you get older, you could get savings of 10% to 20% per discount if you qualify for a mature driver discount, defensive driver discount or low mileage discount.

Also Check: How Much Do Car Salesmen Make Per Car

What About Your Credit History

Your credit history will determine whether an auto insurance underwriter will view you as reliable or not. TheZebra.com states that statistics have illustrated that those with good credit records generally pose less of a risk to insurance companies. That is, people with good credit records typically file claims less often than those with a poor credit rating. If you live in Florida and you have a good credit rating, you’ll spend $1889.03 per annum less on your auto insurance premium than those with a less favorable credit rating. Here are the average car insurance premiums you can expect to pay annually according to your credit score:

- Very poor : $3,470.05

- Exceptional : $1,581.01

Proof Of Auto Insurance In Florida

Insurance ID cards must be kept in your automobile at all times and presented to authorities upon request or following an accident. If you refuse to cooperate, the police may give you a ticket for failure to provide evidence of insurance.

Insurance firms are required by the Florida Department of Highway Safety and Motor Vehicles to report all-new or canceled personal injury protection policies electronically. Suppose your insurance carrier informs the department that you have canceled your policy and have not yet activated a new one. In that case, the department will send you a notification requesting updated insurance details.

If you can’t show that you replaced the insurance without a coverage gap, you’ll have to pay a $150 reinstatement fee for the first violation.Your driver’s license and license plate will be suspended for up to three years if you cannot present proof of insurance

See what you could save on auto insurance

Also Check: What Would My Monthly Car Payment Be

How Many Insurers Are There In Florida

There are 14 domestic insurance providers in the state of Florida and 953 foreign ones. This means that you have 967 to choose from as you shop for the best rates and coverage.

So, what is the difference between a foreign or domestic insurer?

- Domestic insurer means that the insurer is one that has been formed under the laws of the state of Florida.

- Foreign insurer means that the insurer is one that has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Florida.

Neither type of insurer is better or worse when it comes to providing you with the coverage you need. Ultimately then, it is a personal choice about which one you are more comfortable dealing with.

Dealing with either type of insurer is easier when you understand the laws that they are formed under. We have provided you a brief overview of these laws in the next section.

What Do You Need To Know About Driving In Florida

As you have seen so far, driving in Florida does not come without risk. The risks extend off the road as well.

Everything from road debris to vehicle theft and break-ins can cause you frustration and confusion that you never signed on for. Keep scrolling to find out how you can prevent theft or loss of your property and road fatalities.

You May Like: How Much To Expect From Car Accident Settlement

So How Do I Get Car Insurance

Getting a car insurance estimate from Nationwide has never been easier. Get a free car insurance quote today. Simply enter your zip code to begin the auto insurance quote process. Within a few minutes, youll have an auto insurance estimate based on your specific circumstances. You can also talk to a Nationwide agent and get a quote over the phone.

, Accessed September 2021. , Accessed September 2021. , Accessed September 2021. , Accessed September 2021. , Accessed September 2021. , Accessed September 2021.