Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Balance Your Budget Your Life And Your Car Payment

NerdWallet recommends using the 50-30-20 rule, dividing your take-home pay into three general spending categories:

-

50% for needs such as housing, food and transportation which, in this case, is your monthly car payment and related auto expenses .

-

30% for wants, such as entertainment, travel and other nonessential items.

-

20% for savings, paying off credit cards and meeting long-range financial goals.

The monthly payment for your auto loan definitely falls into the needs category. For many people, a car is a lifeline, connecting them to essential tasks such as holding down a job or transporting the kids to school.

However, there’s some flexibility in the balanced budget approach. If you want a more expensive car, you could consider part of your monthly payment as spending in the “wants” category, so long as you keep the budget balanced overall.

So, while 10% of your take-home pay for your car payment may sound restrictive, if you economize in other budget areas, then you could choose to spend more on your car.

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Recommended Reading: Geico Suspend Car Insurance

Ways To Lower Insurance Costs

No matter if the buyer purchases new or used, the car will need to be insured. Unless the purchaser pays cash for the vehicle, they will be required to carry a full coverage policy in order to protect the lenders interests in the case of a collision, weather damage or if the vehicle is stolen or vandalized. If the buyer purchases with cash and no portion of the purchase price is financed, the new owner may carry liability only insurance. In most states, at least a liability policy is required. However, depending on the vehicle age, buyers who pay in full upfront may still want to consider full coverage. In at fault” states, liability covers only the other driver and vehicle in case of an accident. In no fault states, liability will cover only the minimum required for the policy for property damage and bodily injury. If the car is five years old or newer, the driver probably needs to carry full coverage insurance to make sure they are able to cover the cost of repairs in case of an accident or damage.

A Longer Term To Get A Lower Monthly Payment

Lets say you talk to the lender to get your monthly payment down. They return, letting you know that lo and behold, they were able to get your payments down by extending the lease. The truth is, you arent saving any money. While a longer lease term can mean youll pay less each month, youll pay more interest during the lease.

Takeaway: Dont be fooled by a lower monthly payment that comes with a longer lease term. The average lease term is two to four years. If the lender suggests stretching that term, youll pay more in the long run.

Read Also: Sell Leased Car To Carvana

Understanding Your Car Payment

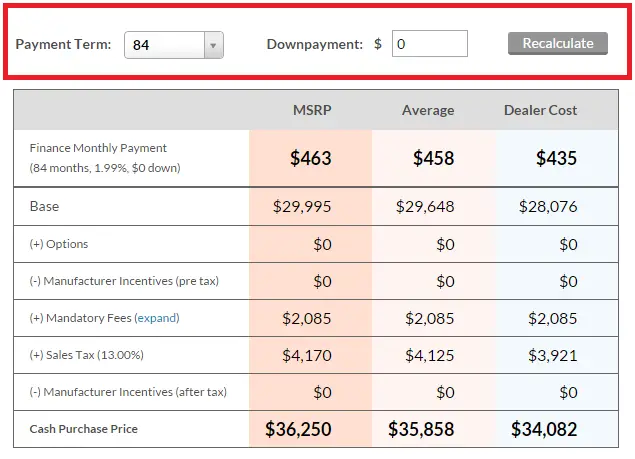

Now you have an estimated auto payment youll have a better sense of what kind of new or used vehicle loan could work for you. Is your payment too high? Do you have more room for an auto payment in your budget? Adjust the terms to see how the figure changes.

While the monthly amount is important, also think carefully about the total cost of the purchase and how much you would pay in total interest charges.

Refinance Your Car Loan For A Better Interest Rate

Not everyone can refinance a car loan, but for those who can, its a much easier process than refinancing other loans such as a mortgage.

If youre upside down on your auto loan, that is to say, that the car is worth less than the current balance of the loan, then you can likely not refinance. However, if that is not the case and you meet other criteria, you may want to consider refinancing.

If your credit score has improved since you made the purchase, its worth looking into a refinance. In addition, if interest rates have dropped since you took out your original loan, it may also be an excellent time to refinance.

Additionally, if your rate is above 6%, it cant hurt to seek out a better rate. It could lead to significant savings in your interest rate.

You May Like: Colombo Car

Figure Out If You Have A Cosigner

If your credit report turns out to not be that great, lenders may require that you have a cosigner on the lease agreement or loan agreement. Lenders require cosigners as they absorb some of the risks in lending you money. As the cosigner is equally responsible for paying any amounts due, lenders can claim outstanding payments from the cosigner.

Even if your lender doesnt require a cosigner, having a cosigner might be beneficial if you dont have a good credit score. As cosigners lessen the risk for lenders, you might be able to get a more favorable rate if you make use of a cosigner.

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Recommended Reading: Cookie Cutters For Car Freshies

Buying New Versus Used Vehicles

Buying new has its advantages, such as the fact that it has never been previously owned. It has that new car smell and everything about it is brand new. The engine is clean and the interior has no stains, burns or defects. However, the individual who purchases new pays a much higher price than if they had purchased the same make and model used.

Though purchasing a used car means that there may be imperfections left behind from the previous owner, the cost of ownership is typically lower. The advantages of purchasing used include:

There are several advantages for purchasing used instead of new. However, purchasing used does have a few disadvantages, too. For example, the vehicle typically will no longer be under any type of warranty & third party warranty services can be quite expensive. It may also have significant wear and tear on the engine and other vital drive train parts, especially if it has been used as a fleet vehicle or owned by an individual who traveled a great deal, such as a sales professional. When purchasing used, if you want to avoid expensive repair fees it is typically best to purchase something that is only two or three years old with low mileage. On average, cars clock about 12,000 miles per year. If a three year old vehicle which has over 100,000 miles on the engine is probably not a good bet.

How to Make Sure to Buy a Quality Used Car

How to Prevent Buying a Lemon

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Don’t Miss: How To Make Aroma Bead Vent Clips

How To Use Credit Karmas Auto Loan Calculator

A car could be one of the biggest purchases youll ever make. Thats why its important to understand how various factors can affect how much you pay to finance a car.

Whether youre just starting to shop for a car or are ready to finance a particular make and model, getting a sense of your monthly loan payment can help with your decision.

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. Itll also help you figure out how much youll pay in interest and provide an amortization schedule .

Keep in mind that this calculator provides an estimate only, based on the information you provide. It doesnt consider other factors like sales tax and car title and vehicle registration fees that could add to your loan amount and increase your monthly payment.

Here are some details on the information you might need to estimate your monthly loan payment.

Which Auto Loan Calculator Should You Use

Use the auto loan payment calculator if you know what you expect to spend.

For example, perhaps you think you can afford a $20,000 loan on a new car. A 48-month loan for the most creditworthy borrowers would be 3% or less. At that rate, you’d pay about $440 a month and $1,250 in interest over the life of the loan. A subprime rate might be 11%, making the payments about $515 and you’d pay more than $4,500 in interest.

Many people reduce payments by lengthening the term of the loan. If you change the term to 60 months, payments on that $20,000 loan at 11% fall from $515 to $435. However, you would pay nearly $6,100 in interest, or an additional $1,600, for doing so.

Use the reverse auto loan calculator if you have a specific monthly payment in mind. Say you have decided that you can afford to spend $350 a month on car. Depending on the interest rate and length of loan you choose, a $350 car payment could repay a $15,600 car loan at 3.66% in 48 months or a $19,100 loan at 60 months.

Don’t Miss: Home Depot Laser Cut Car Keys

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Average Auto Loan Rates By Credit Score

Because FICO doesnt share or sell the FICO Auto Score to consumers, its only possible to show the average auto loan rates using a typical credit score.

While this is not as accurate as the credit score used by those in the auto industry, it gives you a close approximation of the average interest rate when purchasing a car.

| 12.99% | 19.85% |

As you can see, your on your interest rate when purchasing both new and used cars.

Those with very good credit, or well-qualified buyers, will have lower interest rates than those with average to poor credit scores. For instance, those with a credit score in the 601 to 660 range will pay close to 5% less than those in the lower bracket.

Used cars will have a higher rate because they are more likely to have mechanical issues or go underwater .

Keep in mind that these are averages, and actual rates will vary. The lowest right now for a new car is about 1.74%. The highest for a new car can hover around 24.9%.

Read Also: What Car Dealerships Use Equifax

Calculate Your Automotive Budget

Take a few minutes to run down what you spend every month. From your monthly take-home pay, deduct rent or mortgage, bills, groceries, child expenses, savings, and spending on entertainment. You will then discover how much car you can afford.

Not sure what kind of vehicles can you buy with this monthly payment ? Take a look at the Edmunds affordability calculator, which lists vehicles that fall into the price range you’ve predetermined. Keep in mind that the prices on the calculator results page will change based on the trim level, options, sales tax and registration fees, etc.

Does it seem like you might not be able to afford the purchase? We know that feeling. New vehicles have gotten more expensive over the years and our salaries haven’t kept up. In any case, this amount now represents your automotive budget, which, as we’ve noted, is more than just the monthly payment. On to estimating fuel costs and insurance fees.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Recommended Reading: Car Freshie Cookie Cutters

Consider Improving Your Credit Before Applying

If you’re financing your new car and think you might be able to get a lower interest rate with a higher credit score, consider working on your score for a few months before making a purchase.

The best way to improve your credit score is to make all your debt payments on time, as this is the biggest factor credit scoring models consider when calculating your score. Also pay close attention to your credit utilization, or amount of available credit you’re using, which is the second-largest factor in your credit score. Be on the lookout for any inaccurate information that might appear in your credit reports. If you find something in your reports that shouldn’t be there, file a dispute with one or more of the three major credit bureaus to see if you can get the information removed from your report.

Consider getting a free copy of your credit reports and from Experian to understand what a lender will see when they consider you for new credit.

Financing a car can get complicated, so determining how much you can put toward a monthly payment before going into a dealership will help you make sure you’re getting a car you can afford.