Average Cost Of Car Insurance In Ohio By Category

- Clean driving record: $36 per month

- After an at-fault accident: $55 per month

- Driver with poor credit: $63 per month

- Teen driver: $145 per month

- After a DUI: $68 per month

The average cost of car insurance in Ohio is 43% lower than the national average auto insurance premium, and Ohio ranks 7 out of 50 for the most affordable car insurance rates in the U.S.. Every insurer has their own way of calculating premiums, so it’s a good idea to get quotes from at least three different companies to make sure you find the best deal.

Finally, it’s worth noting that car insurance premiums in Ohio are low, compared to the cost of coverage in neighboring states like Kentucky and Michigan. You can find more details in the table below.

Average Car Insurance Rates By Age And Gender

| Age |

|---|

| $1,604 |

Along with your location and your driving history, age is one of the most important factors when it comes to your car insurance rates. Younger, less experienced drivers pay more because theyâre more likely to have an accident and file a claim.

Your gender can also have an effect on your rates, although some states donât allow car insurance companies to use gender as a factor when calculating how much to charge for coverage.

Understanding Your Car Insurance Coverage Options

When it comes to your car insurance, you deserve more than a card tucked in your glove box thats why our car insurance goes beyond a piece of paper or app to give you smart, customized coverage and real peace of mind.

No matter how your life changes, you can feel confident youll have the right auto protection and support every step of the way.

Not sure how much or what type of coverage is right for you? An American Family Insurance agent is the perfect person to talk to. Find your agent today.

You May Like: Credco Auto Loan

Check Out A New Quote

You are about to leave geico.com

GEICO Insurance Agency, Inc. has partnered with to provide insurance products. When you click “Continue” you will be taken to their website, which is not owned or operated by GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you directly provide is subject to the privacy posted on their website.

How To Get Cheap Car Insurance In Ohio

Most Ohio insurance companies offer ways to save money on your car insurance. These are some of the discounts available to customers:

-

Bundling discount: When you get more than one insurance policy from the same insurer

-

Safe-driver discount: For drivers without any accident claims during a given time frame or for those drivers who take a defensive driving course

-

Group or association discount: A discount for members of a certain profession or university

-

Military discount: A discount for active-duty military and their family

Not everyone will qualify for these discounts. Comparing quotes from top companies can help you make the right choice.

Find car insurance in your city:

Don’t Miss: Upholstery Cigarette Burn Repair

Cheapest Car Insurance In Ohio For Drivers With An Accident History

The cheapest auto insurance in Ohio for drivers with an accident history is Erie, at $95 per month, and State Farm, at $102 per month. Both companies raise their insurance prices by around $20 per month for drivers who are found at-fault for an accident.

| Company | |

|---|---|

| $4,011 | $334 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

Having an accident on your record indicates to insurers that you are a high-risk driver, and that usually causes your insurance rate to go up. However, accidents typically stop affecting your rates after three to five years, or you can take advantage of companies that offer accident forgiveness as an optional add-on.

Ohio Drivers With Bad Credit: You Can Still Save On Car Insurance

Car insurance for drivers with bad credit costs significantly more than it does for those with good credit. Ohio is in the middle of pack among the worst states for drivers with bad credit, as CarInsurance.com’s data analysis shows it has the 28th highest percentage increase for bad credit drivers. Compared to good credit drivers, those in Ohio with bad credit pay 68 percent more, on average. The good news is that you can still shave some money off your coverage costs if you compare car insurance companies. You’ll see below that the difference among major insurers is nearly $1,522 for a full coverage policy for a driver with bad credit. That’s how much you can potentially save by comparing car insurance quotes.

| Company |

|---|

| 10 |

Don’t Miss: How Much Car Salesmen Make Per Car

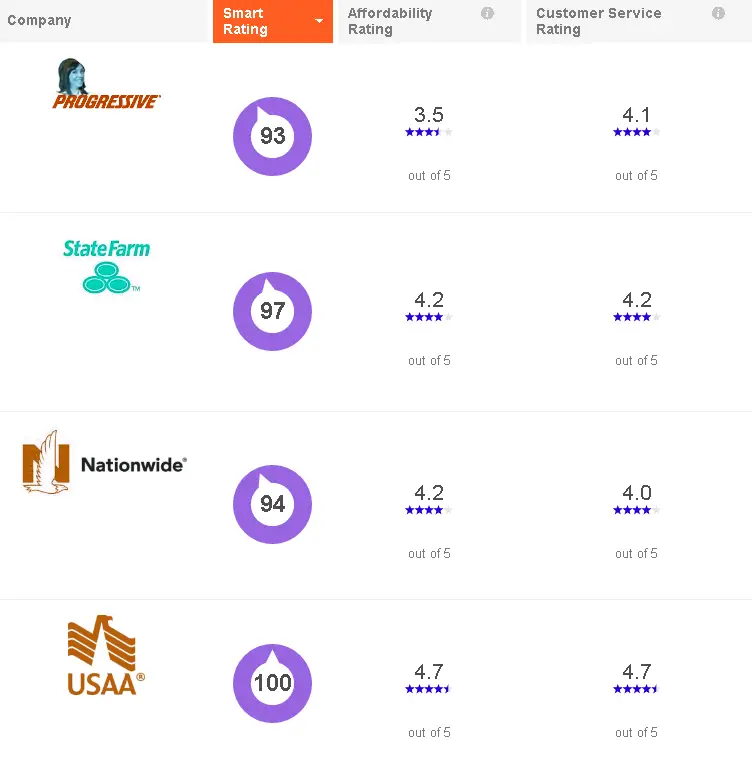

Companies With The Best Ratings

From financial ratings, we move on to what the customers have to say. First, lets look at the ratings provided by J.D. Power, the most trusted name in consumer survey ratings.

So what are the best Ohio car insurance companies?

J.D. Power ranks companies on a 1000-point scale

USAA ranks the best on the scale for 2020, but since they are open only to military members and their families, J.D. Power doesnt list them.

The other top insurance companies on the latest survey are Geico, Farm Bureau, and Erie Insurance Erie Insurance is among the largest companies in Ohio. Erie Insurance is located in Kenton, Ohio, as well as, Vandalia, Belpre, Wadsworth, and Poland, Ohio.

State Farm car insurance fell below average on the latest ratings.

The takeaway? The biggest car insurance companies arent always the best-rated. Its still a good idea to look at options beyond the insurers that own the biggest market share.

How Much Is Car Insurance In Ohio By Age

Younger drivers and first-time drivers are rated as a “high-risk” category and attract higher car insurance premiums. The average cost of car insurance in Ohio for a 40-year-old is $803 per year. However, for a 16-year-old purchasing their own insurance, the average rate climbs significantly to $1,778.

Ohioans new to driving, regardless of their age, will also pay similarly high rates for car insurance. The best way for young teens to save on insurance costs is to join their parents policies. Young drivers and first-time drivers can research the most affordable policies to find the cheapest options.

Average Costs of Full Coverage Car Insurance in Ohio – By Age

Scroll for more

You May Like: Can I Use My Synchrony Credit Card Anywhere

Cheapest Cities For Car Insurance In Ohio

Some cities in Ohio have cheaper car insurance premiums than others because insurance companies take a driver’s ZIP code into account when calculating their premium, alongside other factors. For example, drivers who live in dense urban areas typically pay more for coverage than drivers in rural areas because they’re more likely to get into an accident. And if an area has a particularly high theft rate, car insurance may be more expensive due to the risk of vehicles being stolen.

You can get car insurance discounts in Ohio based on how you drive, the car you own, and your relationship with your insurance company. In Ohio, car insurance companies are allowed to consider factors like employment, residential, and marital status when setting premiums. That means there are also discounts available for being married, owning a home, or being affiliated with certain employers or educational institutions.

Almost anyone can get a discount on car insurance in Ohio because most insurance companies make it easy to qualify for a variety of savings. Ohio insurers typically offer discounts that fall into one of three categoriespolicy discounts, driver discounts, and vehicle discounts.

Cheapest Car Insurance Quotes For Married Drivers: State Farm

State Farm has the best auto insurance rates for married couples in Ohio. Married drivers pay $786 annually, or $66 monthly, if they take out a full coverage policy from State Farm 40% below the state average.

| Company | |

|---|---|

| $1,823 | $152 |

Tying the knot brings a number of financial benefits, including reduced auto insurance rates. Insurance companies offer cheaper quotes for married drivers because they’re statistically less prone to get in car accidents.

In Ohio, we found that married drivers pay an average rate of $1,318 annually, which is 4% less per year than what unmarried drivers pay.

Many married couples can earn even lower rates through car insurance discounts like multicar and multipolicy discounts.

Don’t Miss: How To Repair Damaged Clear Coat

How Do You Get Sr

Ohio drivers whose licenses have been suspended because of a high-risk violation can file an SR-22 with the Bureau of Motor Vehicles through their insurance providers. To do this, you will first need to purchase car insurance or a financial responsibility bond that meets the state’s requirements.

Drivers receive a notification once their SR-22 gets filed at the Ohio Bureau of Motor Vehicles . Some insurers do not file SR-22s. If this is the case with your provider, you may need to find another one that does. Even after finding a provider that will file an SR-22 on your behalf, your rates will most likely be higher than when you had a clean driving record.

Cheapest Auto Insurance In Ohio For 20

Drivers with poor credit in Ohio should look at the following insurers with the lowest average rates for minimum coverage:

Erie: $432 per year, or about $36 per month.

Geico: $652 per year, or about $54 per month.

Central Insurance: $955 per year, or about $80 per month.

Allstate: $986 per year, or about $82 per month.

Encompass: $1,078 per year, or about $90 per month.

Don’t Miss: How To Repair Cigarette Burn In Car Headliner

Cheapest Car Insurance For Military Families

If you’re an active member of the military or a veteran or have an immediate family member who is chances are you’ll get a relatively cheap rate with USAA, a company that isn’t available to the general public.

Because of that restriction, USAA isn’t ranked with the others, but it was the cheapest auto insurance option for 4 of the 24 driver profiles we examined.

Average Cost Of Car Insurance In Ohio: Full Coverage Vs Minimum Coverage

In Ohio, one of the factors that will impact the cost of car insurance is the coverage level that you purchase. A full-coverage policy comes with comprehensive and collision insurance, making it more costly than a minimum liability policy. Minimum coverage only provides liability per state guidelines.

The average cost of a full-coverage car insurance policy in Ohio, as defined in MoneyGeeks methodology, is $803 per year. Ohio’s annual average for minimum coverage is $487.

Average Cost of Car Insurance in Ohio by Coverage Level

Recommended Reading: What Commission Do Car Salesman Make

Average Cost Broken Down By Coverage Type

| Type of coverage | |

|---|---|

| Comprehensive | $167.91 |

The specifickinds of car insurance coverage that make up your policy will also help determine the price of your monthly premiums. A so-called full coverage auto insurance policy includes comprehensive and collision coverage in addition to liability.

Liability coverage, which is the backbone of a policy, covers the costs if you injure someone or damage their property with your car, while collision coverage covers damage to your own car after an accident, even if you caused it, and comprehensive coverage covers damage not from car accidents, like if a heavy tree branch falls on your car.

Insurancequotescom Auto Rate Methodology

Rates are based on one vehicle and one driver who has state minimum coverage with $500 deductibles. The hypothetical driver is 35 years old, female or male, employed, a college graduate, and has good credit. She has no traffic violations, claims, or lapse in coverage. The vehicle is assumed to be a sedan that is garaged on premises, used primarily for commuting, and driven 16,000 miles per year. Rates include commonly available carrier discounts and are estimates and not guaranteed.

Don’t Miss: Repair Cigarette Burn In Car

What Is The Average Cost Of Car Insurance In Ohio For High

“Safety first” is not just a mantra that saves lives. It also saves money. Common sense tells us that the safest drivers will pay the least, and safe drivers qualify for “good driver” and “accident-free” discounts. But what if your record is less than perfect?

Drivers with a speeding ticket in Ohio will pay $14 more per month on averageâplus fines. Drivers with an at-fault accident on their insurance record should expect to see monthly rates increase by around $37. Accidents happen, but driving safely and keeping a clean record are the best ways to avoid rate hikes. Remember, violations and accidents will stay on your insurance history for years to come. Still, you can still take a defensive driver course to reduce your monthly payment.

| Driving History |

|---|

| $166 |

Average Car Insurance Rates By State

Car insurance rates vary widely by state .

There are a few reasons why location matters so much when it comes to car insurance rates â if your area is densely populated, crime rates are high, or natural disasters are frequent, that means more claims, which means higher rates.

So where does car insurance cost the mostâand least? Below is a breakdown of the average annual cost of auto insurance by state, according to our analysis.

| State |

|---|

Read Also: How Much Can I Make Selling Cars

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships dont influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Ohio Statistics Summary

| Road Miles in State: 122,926Vehicle Miles Driven: 113.7 billion | |

| Vehicles | |

| Get Your RatesQuote Now | #blank# |

Unless youre a part of the big Amish population that calls Ohio home, you need car insurance.

Ohio law used to randomly select uninsured drivers and suspend them for not showing proof of insurance. As of July 3, 2019, the Ohio BMV government canceled random selection suspension.

You do still need car insurance in Ohio, however. Drivers can compare rates and switch insurance companies to find the best car insurance in Ohio.

Compare cheap car insurance quotes in Ohio right now by entering your ZIP in our FREE comparison tool.

Cheapest Minimum Coverage Car Insurance In Ohio For 20

Drivers in Ohio who want just the state minimum coverage may want to check with these companies, which had the lowest average rates:

Erie: $432 per year, or about $36 per month.

Geico: $439 per year, or about $37 per month.

Central Insurance: $533 per year, or about $44 per month.

State Farm: $582 per year, or about $48 per month.

Westfield: $663 per year, or about $55 per month.

Also Check: Best Aarp Car Rental Deals

Start Your Quote See For Yourself Why Our Customers Love Us

Begin your quote and be on your way to great coverage in minutes. Connect with us and see how we do insurance better.

The average customer who bundles can save these discounts on each policy. The KnowYourDrive discount will vary based on driving behavior. Discounts vary and may not apply to all coverages.

For J.D. Power 2021 award information, visit J.D. Power Awards.

Cheapest Minimum Coverage Car Insurance In Ohio For 50

Drivers in Ohio who opt for the state minimum coverage may want to consider the following companies, with the lowest average rates:

Erie: $207 per year, or about $17 per month.

Hastings Mutual: $225 per year, or about $19 per month.

Geico: $252 per year, or about $21 per month.

State Farm: $254 per year, or about $21 per month.

Auto-Owners: $260 per year, or about $22 per month.

Also Check: Who Owns Avis

Cheapest Full Coverage Car Insurance In Ohio: State Farm

The most affordable auto insurance company for full coverage is State Farm with an annual rate of $786. Quotes from State Farm are 43% cheaper than the state average and $145 less per year than the next-cheapest insurer, Geico.

| Company | |

|---|---|

| $1,849 | $154 |

Full coverage car insurance quotes include bodily injury and property damage liability coverage, plus comprehensive and collision coverage. Drivers also have the option of adding medical payments coverage, which helps pay for injuries after an accident.

Least Expensive Vehicles For Insurance In Ohio

In Ohio, the Jeep Wrangler JL Sport, Honda CR-V LX and Subaru Crosstrek are among the cheapest cars for insurance, based on average rates for 50 top-selling 2021 models. The 20 least expensive are below.

The most expensive cars for insurance in Ohio among popular models are the Tesla Model S Performance and Lexus ES 300H .

| Vehicle |

|---|

Related:Most and least expensive cars to insure nationwide

Don’t Miss: Transfer Title Az