How Does The 20/4/10 Rule Of Thumb For Car Buying Work

The 20/4/10 rule uses straightforward math to help car shoppers figure out their budget. According to the formula, you should make a 20% down payment on a car with a four-year car loan and then spend no more than 10% of your monthly income on transportation expenses. That 10% spent on monthly transportation includes your auto loan payment, maintenance, gas, and car insurance.

For instance, under the 20/4/10 rule, a person making the U.S. median annual income of $68,703 should aim to spend less than $573 per month on transportation costs.

You can decide whether to use gross or net income to calculate the 10% amount. Using your gross income allows you to spend more on your vehicle, while using your net income provides a more conservative number.

When you calculate 10% of your own monthly income, you can then use your budget to figure out whether you can afford that monthly payment. For example, if your annual income is $68,703, your monthly budget should show you whether you have a surplus of $573 to dedicate to an auto loan payment, plus other transportation expenses.

What Costs Do You Need To Consider When Buying And Driving A Car

Weve put together a checklist to help you calculate and understand how much it will cost on average. Below this list, weve given you more detail for each item.

Heres what you need to consider if you want to get a clear picture of the total expense of owning and driving :

Assess Income & Ongoing Expenses

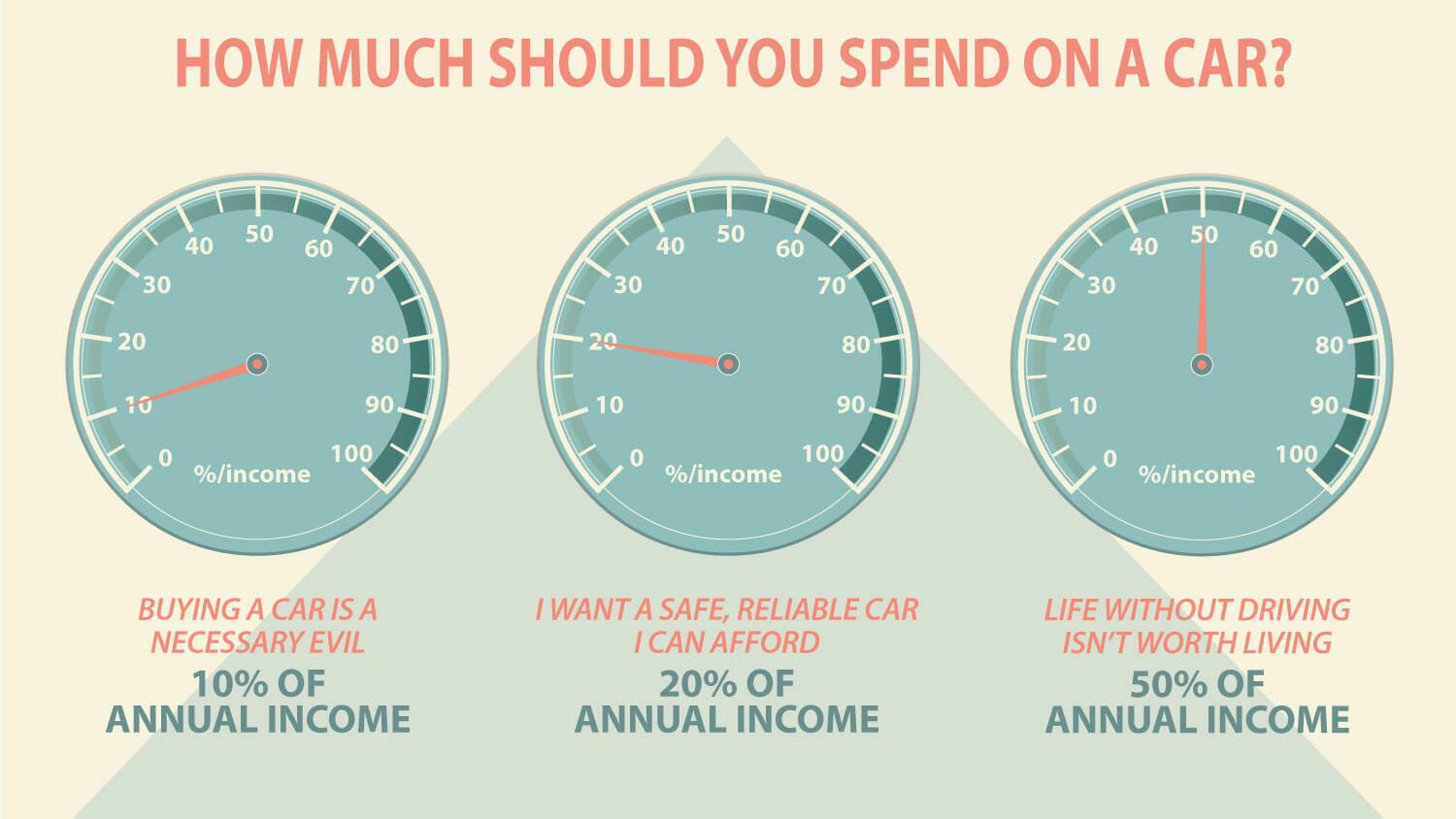

The next step is to figure out what percentage of your annual income you want to put towards your car, as this will help you stick to a reasonable budget. Start by subtracting your essential expenses from your salary, as well as any existing debt obligations you might have . Youll then have a rough idea of your disposable income which can be allocated towards a car. We recommend basing these projections over a year if possible so you can figure out what % of your annual salary can be put towards a car .

For example, if you have an annual income of $70,000 and you spend $40,000 per year in essential expenses that leaves you with $30,000, of which you can then decide, based on your personal financial preferences, how much of this you want to contribute towards a vehicle. As a general rule of thumb, you shouldnt spend more than your annual income on a car. It is actually advisable to spend just 10-20% of your household income on your new car, and if you want to buy a higher-end, luxury vehicle, you might consider spending 20-30% of your household income.

Don’t Miss: What Commision Does A Car Salesman Make

Examples Fuel Efficiency For Vehicles In Different Classes

We did a little research on fuel consumption ratings and yearly costs using the Ministry of Transports Fuel Consumption Ratings Search Tool. We put together some charts to help illustrate fuel efficiency and consumption for cars from various classes.

NOTE : Estimated annual fuel cost is based on the combined rating, a driving distance of 20,000 km and forecast prices of $1.09/L for regular gasoline and $1.24/L for premium gasoline.

Notice that yearly fuel consumption costs range between $1,482 for a Honda CR-Z which is a sub-compact car and $2,594 for a Ford F-150 which is a standard pickup truck. In general larger vehicles consume more fuel as they are heavier and have larger engines.

Remember that fuel prices fluctuate, sometimes widely, so this can change your annual costs for owning a car.

Tips For Negotiating The Price

Use these tips when settling on a price for your vehicle.

- Compare other models. When settling on the price, compare other models. Exploring other options, including older models, helps you stay on budget while getting the extras you want.

- Avoid buying extras. Extended warranties, window etching theft protection of a VIN number, key fob protection, tire nitrogen costs, paint and fabric protection, and windshield, tire, and dent protection. These are just some of the add-ons dealers will try to upsell during the sales process. Many times you dont need these protections because the car comes with them. You can also ask your car insurance provider what, if anything your policy covers. Sometimes the add-on is only a few dollars.

- Ask for price upfront. Yes, its a tactic for dealers to lure buyers into the showroom. But its also a safety net for you to see the price first. For example, it gives you a starting point from which to negotiate a car if you pay with cash. If the car gets financed, never give out what car payment range you prefer. By seeing the price first allows you to keep the upper hand during the deal while buying within your budget.

- Consider No-haggle pricing. Many wonder if no-haggle pricing truly comes without the haggling. In a word, yes. But know its a fixed price. It makes the process easier but its probably not the best price a dealer offers.

Also Check: What Is An Equus Car

What Is The Average Markup On New Cars

Lets face it, buying a new car gets expensive. In 2020, average transaction prices for cars, SUVs, and pick-up trucks reached $39,920, compared with $38,058 in 2019, according to data from Cox Automotive, the parent company Autotrader.

That means average transactions last year were $1,764 below MSRP vs. $2,286 in 2019, the research shows.

According to Cox Automotive Senior Economist Charlie Chesbrough, transaction price averages steadily increased during the past four months. In February, the average transaction price reached $41,066, while the average MSRP for those vehicles was $40,688. Buyers looking for new cars now pay more than manufacturers ask and thats rare.

The coronavirus pandemic initially halted car manufacturing causing tight car inventory for the second half of 2020.

When you use our fair market tool for car prices, you will know exactly the sales price range of what you should be paying when buying a new car.

Just dont forget the things to consider before buying, such as your monthly payment, interest, destination fees and more.

What is the Average Markup on Used Cars?

What the dealer paid to acquire that car is somewhere around those two numbers. Its a way to ballpark what the dealer probably has invested in the used car.

Other factors may impact a used cars value, like if its been in a crash, been well maintained and so on. If its certified pre-owned, the dealer has an even bigger investment in a car.

Tools To Help You Research Car Costs

When researching the cost of a car, its important to know that like other retail goods and services, prices can be marked up or down. For cars, its important to know theres the invoice price, or what the dealer pays for the car from the manufacturer. Then theres the window sticker price, or the manufacturer suggested retail price .

As a consumer, you will not know the exact invoice price. But Autotrader offers tools that will help you find out the of the vehicle you want to buy.

Start by researching a specific vehicle make and model on Autotrader. On the site you will find car MSRPs. Then, use the car valuation tool. It helps you know the fair market value of the vehicle once you key in the make and model that youre considering.

From there, youll find a suggested purchase price based on factors, including the cars popularity and the spread between the base price and invoice price. Understand that you could pay a little less than the cars value or you might pay a little more, depending on market conditions. Either way, this tool offers an accurate representation of where you should expect to be.

Using both tools together helps you determine new and used car values and also points you to actual vehicles listed for sale.

Tip: Dont lose sight of your car buying criteria. Keep in mind reviews, lists, and comparisons to refine your search.

You May Like: What Kind Of Car Does Columbo Drive

What Should I Pay For A Car: Everything You Need To Know

Price is one of the biggest considerations when shopping for a new or used vehicle. Know what price range is within your budget before visiting a dealership.

Price is one of the biggest considerations when shopping for a new or used vehicle. Know what price range is within your budget before visiting a dealership. When asking yourself, ‘What should I pay for a car?’ don’t forget to factor in maintenance and upkeep, repairs, car insurance, and fuel, in addition to the down payment and monthly payments.

How Can I Avoid Paying Interest On My Car Loan

If you pay off the loan early, youll make fewer interest payments.

then How can I pay less interest on a car loan? How to Pay Off Your Car Loan Early

Is it better to pay car loan twice a month? Biweekly savings are achieved by simply paying half of your monthly auto loan payment every two weeks and making 1.5 times your monthly auto loan payment every sixth month. The effect can save you thousands of dollars in interest and take years off of your auto loan.

Recommended Reading: Can I Get A Duplicate Title The Same Day In Florida

Factor In Your Vehicle Expenses

Youll need gas to get from A to B, and youre also going need auto insurance to protect it. Youll also need to set aside some money for oil changes, tune-ups and other regular maintenance work.

According to a AAA report on the cost of owning a vehicle in 2017, the average new vehicle will cost you nearly $8,500 annually for the car payment, insurance, maintenance costs and gas. Thats about $706 per month.

Heres a breakdown of those car ownership expenses:

License, registration and taxes: $753 annually, which comes to roughly $63 per month

Maintenance and repair: $1,200 annually, or $100 per month

Fuel: $1,500 annually, or $125 per month

Full-coverage insurance: $1,194 annually, or $100 per month

How To Calculate An Affordable Car Payment

It’s important you know how much you can afford to pay each month before you go car shopping. To figure this out, take into account all your monthly billssuch as your rent or mortgage, utilities and debt paymentsas well as food and other necessary costs. After calculating all of your monthly expenses, take a portion of what’s lefthow much will depend on your lifestyle and incomeand earmark it for your monthly transportation costs.

Another way to calculate how much money you’ll have for a car payment is with the 50-30-20 rule, which is a popular budgeting ratio. With this method, you take your after-tax income and divide it into three portions. The first 50% goes toward necessities the next 30% goes to things you want and the final 20% is for savings.

The 50% for necessities includes obvious items like your rent or mortgage, utilities, health care, food, debt payments, transportation costs and any other unavoidable costs you have each month.

The 30% for things that you want includes entertainment costs, retail purchases and other spending for your enjoyment and quality of life. The key with this portion is to try to limit yourself as much as possible so that anything left over can be put toward savings.

The 20% for savings is simple, and these funds can be allocated as you wish depending on your specific saving goals. Some could go toward a retirement account some could be put toward an emergency fund and some could be kept in a general savings account.

Read Also: Will Aaa Tow A Car I Just Bought

What Fees Will You See

There are three categories of typical new car fees: vehicle registration fee, sales tax and a documentation fee, or “doc fee.” Here’s an explanation of each:

Vehicle registration fee: This is the amount the state charges to register a new vehicle, assign a title and cover the cost of license plates. The dealer provides this service for you, saving you a trip to the Department of Motor Vehicles. Usually, the more expensive the car is, or the more it weighs, the higher the registration fee.

Sales tax: Sales tax on a new vehicle can take people by surprise. For example, a 9% sales tax on a $30,000 car is $2,700. Cities and counties frequently add their own tax on top of the state tax, so the amount you pay can vary within a state. We’ve listed the “maximum sales tax” rate here, but note that the sales tax on vehicles sometimes varies from the state’s usual sales tax rate. You could pay more or less than what’s shown here depending on your city, state or county.

How Much Car Can I Afford Its A Question Asked By Many Car Shoppers And Its Easy To Understand Why For Many Of Us A Car Purchase Is A Big Expense Second Only To Purchasing A Home

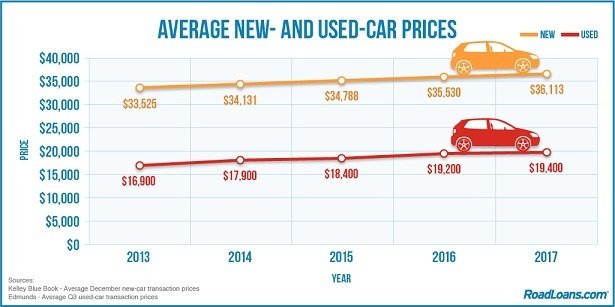

In September 2020, the estimated average price of a new vehicle in the United States was $38,723, according to Kelley Blue Book. But whats a comfortable fit for your budget?

To answer this question, you have two choices: You can follow conventional wisdom, or you can take a more customized approach to budgeting.

Read Also: What Do Car Dealers Use For Credit Score

The Bottom Line Of Down Payments

An excellent way to get safe and reliable modern transportation without having to squirrel away money for years is to finance a new or used car with an auto loan at a reasonable interest rate. Just be sure to have at least 20% of the purchase price including any trade or rebate.

On the other hand, a new car lease typically requires less upfront cash and produces lower monthly payments than a loan for the exact vehicle. Knowing that there is no return on your down payment and no car ownership at the end of the term are the two most significant downsides of leasing.

Do a little homework before going to the dealership:

- Know the fair market value of the car you have your eye on.

- Consider the value of any rebates or trade-ins.

- Evaluate how much cash you can comfortably afford to put down.

From there, you can ask the dealership for a quote on a lease or loan or seek financing from an outside institution so you can get the keys to your new ride.

Related Car Financing Articles:

Set A Monthly Loan Limit

If you’ll finance your vehicle with an auto loan, you’ll need to decide how much you can comfortably pay each month.

- Don’t even think about the price of the car. Start by tallying all of your other monthly expenses and comparing the total to your monthly net income to get an idea of how much money you have to spare.

- Keep your total vehicle expenses less than 20% of your net household income. This is not just your monthly vehicle payment, but also all related costs such as gas, maintenance, etc. For example, if you and your spouse bring home $5,000 per month, you should be spending less than $1,000 a month on your cars.

- Consider your current debt load. Even if your car expenses are less than 20% of your pay, they could still detract from your ability to pay off other debt, such as credit card balances or student loans. To keep your debt under control, a common rule of thumb is to limit your total household debt payments including mortgage or rent to less than 36% of gross income. So if you and your spouse make a combined $80,000 annually, you should pay less than $28,800 toward all debt each year.

Also Check: How Much Do Car Salesmen Make A Year

Fair Profit Offer With Rebate And Incentive

In the next example, the vehicle has both a customer rebate and a factory-to-dealer incentive.

Your Fair Profit New Car Offer = ) * 3-5%

This time youre looking to buy a Hyundai Elantra GLS. Go to Edmunds and enter your desired options. You find the MSRP before the destination fee to be $19,900. The invoice price with options on the car is $16,461. Now calculate the holdback amount of 3% of the total MSRP which is $597. Lets see how this one breaks down.

| Incentive & Rebate Available | |

|---|---|

| = | Your calculated fair profit new car offer. |

The above offer saves you almost $6,000 off the sticker price of the vehicle. Deals go down in dealerships like this every day, you just have to catch them at the right time.

Negotiate deals – Insider tips for car buying

- Motor Trend – new car price quote review A look at Motor Trend and their quote process to see if it benefits the new-car shopper.

- Endurance Vehicle Protection Endurance believes if you can buy a car online, you should be able to cover it online as well.

- LightStream get pre-approved financing LightStream charges no fees on its personal loans and is even willing to beat competitor rates.