How To Spot A Fake Demo Vehicle

Sometimes, car dealers try to pass off a used car as a demo car to make more money off of it or to make the car look more attractive to buyers so that it will sell faster. Theres nothing wrong with buying a used car, but a used car should be priced like a used car. Furthermore, if your dealer is trying to pawn off a used vehicles to you as a demo, he or she may be obscuring the vehicles true condition.

So how do you separate real demos from fakes? Ask how much the car has been used and by whom. If the owner of the dealership was driving the car, but then replaced it a few months later with the same type of car but customized with fancy upgrades or special rims, then the vehicle is not likely being sold because of overuse or hidden damage.

Similarly, if the dealership formerly used the car as a test vehicle, but then a new model of the vehicle rolled out and the dealership wanted to show that model to prospective customers, then it makes sense that theyd want to sell off the old demo. The lack of used vehicle records for demo cars can make identifying a fake demo a little challenging.

But by asking the right questions, test driving the car yourself and having a licensed mechanic from an outside shop look the vehicle over and give it a seal of approval, you should be able to avoid unknowingly driving off the lot in a lemon.

/4/10 Rule: How Much Should Your Monthly Car Payments Be

Financial budgeting is a bit of a touchy subject. Since we cant stop you from spending money on your daily Starbucks or online shopping, we can help you determine how much you should spend on your car compared to your salary. Understanding your budget for a vehicle will allow you to be confident in your decision and prepare you for the dealership.

If you are unsure how much you should spend on a car, we recommend using the 20/4/10 rule. 20/4/10 is a simple rule of thumb that helps you find a vehicle that will fit your budget. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other car-related expenses. The 10% for car-related expenses include loan payment, gas, car insurance, and maintenance.

For example, lets say you make $65,000/year and want to finance a car with a purchase price of $30,000. With the 20/4/10 rule, your down payment would be $6,000, and your car-related monthly expenses would need to be $541. So in this scenario, your budget for car payments, gas, insurance, and maintenance would be $541/month.

How To Buy A Car From A Dealer Or Private Seller With Cash

Follow these steps to get the best deal when buying a car from a dealer or seller with cash. The same guidelines apply for both, but if youre buying a car from a private seller with cash, you wont have an option to trade in.

1. Start saving up.

If you dont already have the money on hand, start setting aside money from each paycheque for your new car. You might want to consider opening a high-interest savings account just for your car savings. Youll collect interest on the money you deposit and wont be as tempted to touch the funds.

Having trouble figuring out how much to save? Budgeting apps like Mint can help you figure out how much money you can afford to set aside and track your progress.

2. Research cars.

If you dont already have a specific car in mind, think about what youll need to use it for and go from there. Is it only you or do you need to drive your family around? Do you use it to get around town or are you interested in long trips?

Consider these questions to narrow down the type of car youre looking for. Also, weigh whether you want a used car or a new car. Used cars often cost less and lose value at a slower rate than new cars, but youll have fewer options to choose from and typically have a shorter warranty.

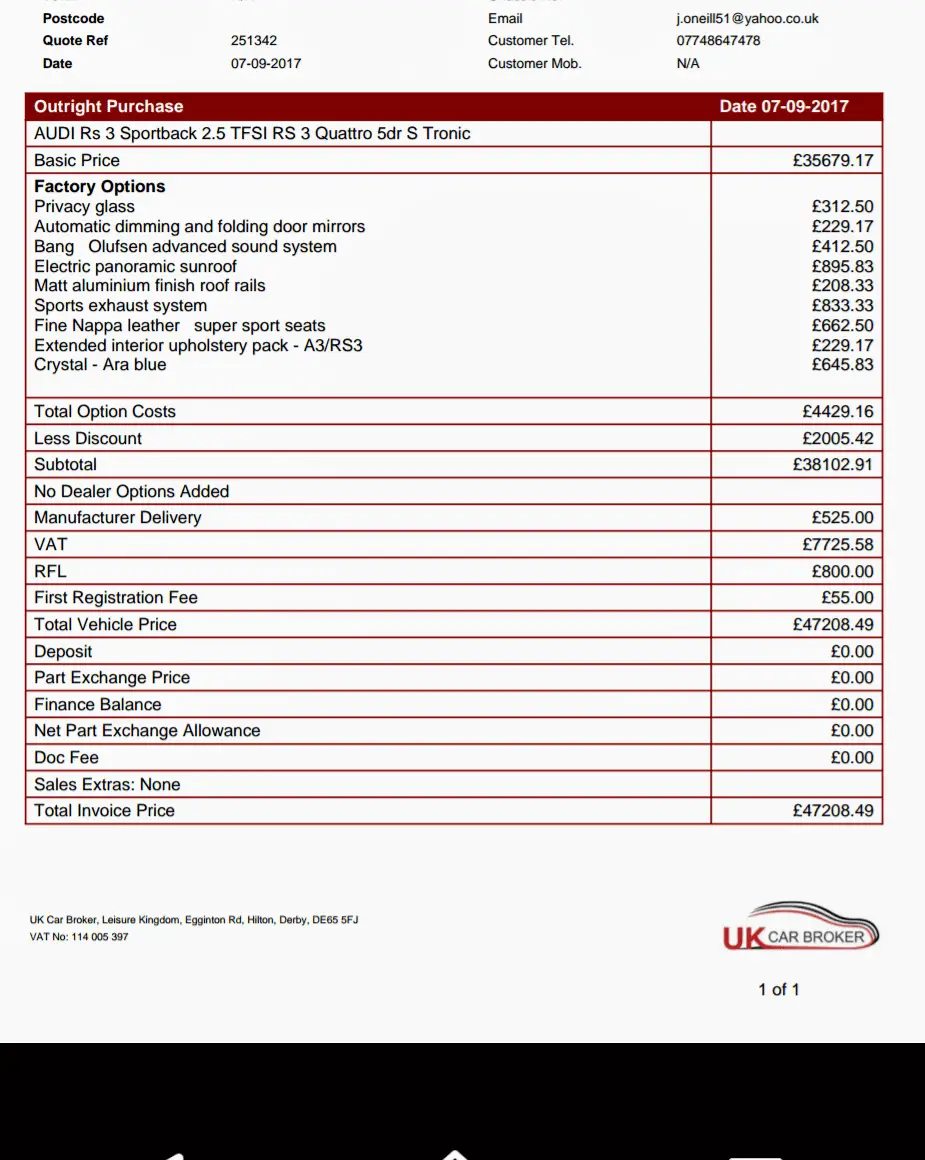

3. Calculate the total cost.

Once you have a car in mind, research how much you need to have saved up to avoid financing. Consider the following costs when buying a car with cash:

4. Calculate your current cars trade-in value.

Read Also: How To Get Puke Smell Out Of Car

What Is Msrp And How To Use It

MSRP, or manufacturers suggested retail price, is a factory-set price. The car dealer doesnt have anything to do with it. Because of automotive franchise laws, the dealer is free to sell the car for more or less than the MSRP. But the MSRP is the amount at which the automaker would like to see that car sold.

As a consumer, its the number you want to whittle down when you can. The only issue is that the chip shortage is among the many reasons for the tight inventory of vehicles. So, instead of buyers being able to negotiate the price below MSRP, many are finding the window stickers show markups. Some dealers call it market adjustment costs. Some will list them as dealership fees. Those two are the dollar amounts to negotiate down. Yes, vehicles remain in short supply. But you can refuse to pay those and pit one dealers price against anothers to get the best deal.

RELATED STORIES: Tips for Buying a Car During the Chip Shortage

The automakers only real interest in the amount a car dealer charges for its car is establishing a consistent sense of value for its products. Thats not important to sustain demand but to motivate lenders to finance the brands products. Moreover, its in the automakers best interest to remain fiscally sound for its dealers.

What is Dealer Cost vs. Invoice Price?

Heres where things become seriously murky. Whatever amount you get paid by your employer each month isnt all yours to keep, right?

Calculate Your Car Loan Amount

Once youve calculated your affordable monthly payment, you can begin to determine how much you can borrow. The amount a lender will let you borrow depends on several factors, including:

- Your credit score: This will affect the annual percentage rate on the loan and how much the bank is willing to lend you.

- Your loan term: This is how many months youll have to pay your auto loan off.

- Whether you buy a used or new car: New car loans tend to have lower APRs than used cars.

Read Also: How Long Do Car Wraps Last

Set A Budget When Buying A New Carand Stick To It

Buying a new car is expensive, especially when you consider how quickly the little things add up. On top of monthly car payments, fuel, insurance and standard maintenance all contribute to the total cost of ownership. Thats why its important to create an overall budget before moving ahead with a new car purchase.

Shop Around For Car Insurance

My first two car insurance quotes for my 2001 Mazda Miata were $200 and $1,000 for six months. Same car, same goober driving it 400% price difference.

Every insurance provider sees each driver and car pairing differently, so it absolutely pays to shop around for at least five quotes. Check out our list of the best car insurance companies for young adults to compare multiple insurers so that you dont end up overpaying.

Also Check: How To Connect Google Maps To Car Bluetooth

How Much Can I Haggle Isnt The Price On The Car The Actual Price

No, its not. Purchasing a new vehicle is not just a big expense, but an investment, and it is definitely a negotiable endeavor.

Certain purchases are non-negotiable. Like when you walk into Walmart, you cant walk up to the guy and say, Hey, I know that TV has a $2,000 price tag, but Ill give you $1,500 for it. They will simply say No. and let you walk. Same thing at the supermarket, and so on. They know someone will be along in the next minute paying the posted price.

But when youre spending tens of thousands of dollars on something, you better believe you should be negotiating, and they do not want to let you walk.

How To Determine If You Can Afford A Car

If you go into the car purchasing process with some key numbers, youll be more prepared to buy. And the numbers are fairly simple. You earn an income and you have fixed expenses, like rent, healthcare and food. The amount left over after paying those expenses is the money you have to spend on cool things like cars!

If youre thinking, how much of my income can I spend on the car, remember the 20% rule. Financial experts say your car-related expenses shouldnt exceed 20% of your monthly take-home pay. So, lets say you bring home about $2,500 each month. The total amount you should spend on your car including loan payment, gas, insurance and maintenance is right around $500. If you stay within these limits, you should have no problem paying for your ride. Want to spend a little more, you can always cut back somewhere else.

However, everyones budget is different based on the expenses that you have. Take your personal finances into account to ensure that adding a new car payment wont add additional stress.

Read Also: What Is The Best Hybrid Car

New Vs Used Car Costs

Plainly put, used cars cost less to buy. Americans borrow an average of $34,635 for new vehicles and $21,438 for used vehicles. Yet, used cars generally have higher maintenance and repair costs due to breakdowns and diminishing warranty coverage. Its part of the trade-off when you consider whether to buy a new or used car.

Data from the U.S. Bureau of Labor Statistics shows that in 2020, people spent $879 a year on car repairs and maintenance.

To lessen the risk of having to shell out money for maintenance or repairs:

Look into dependable vehicles: According to J.D. Powers most recent vehicle dependability study, Lexus, Porsche, Kia, Toyota and Buick are the top five highest-ranked brands for reliability. Kelley Blue Book also features annual awards for specific cars based on their five-year cost to own ranking.

Perform regular vehicle maintenance: The best way to avoid a major repair is to keep up with your cars maintenance schedule.

Have a rainy day fund: Its a smart idea to put aside money each month in case something turns sour. A traditional budget rule recommends you use 50% of your income to pay bills, 30% on extras like entertainment and put 20% directly into your savings account.

Consider an extended warranty. A high-tech, basic or powertrain vehicle service contract can prevent you from having to pay any large repair fees out of pocket. Heres how to find the best extended-car warranty.

Become The Pricing Expert In Your Area

The market is always changing, and prices fluctuate rapidly. So it’s important to shop around for the best deal. The car pricing terms here will guide you as you get quotes and consider various offers. As you shop, you will become an expert on car pricing in your area during the period of time you’re shopping for your car. And when you know the numbers behind the deal, it will make you a better negotiator.

Also Check: How To Remove Hard Water Spots From Car

What If Im Purchasing A Used Car With Cash

Buying a used car, as a rule of thumb, means youre saving money out of the gate. The reason: New cars depreciate as soon as buyers drive them off the lot.

When you buy a used car, paying in cash also brings more savings on the offer price most times. That is, except pick-up trucks, which retain their value. One of the biggest savings for buying a used vehicle comes if you can leverage your cash for a discount on the purchase price while negotiating, just as you would with a new car.

For the buyer of a used car, though its important to weigh the cost benefits to your bottom line. For example, would paying for the car outright deplete all your cash? And how long would it take to build up your cash reserves in case of an emergency?

If you prefer to pay cash, be sure you research used car prices before purchasing because it will help you negotiate the best deal and dont forget to ask for a cash discount price. Well get into more on that later.

Another consideration is the payment difference each month for a new vs. a used vehicle and how that works with your budget. Clearly, used cars may need more repairs down the road, especially if theres no warranty on the vehicle.

But dealerships often provide extra warranties on top of existing ones, especially if you purchase a Certified Pre-Owned vehicle.

Also remember, you will still pay extra for the used car during the life of the loan.

S To Take To Return A Vehicle

- Start with the dealer. Reputable dealers, in general, prefer to make good on a sale rather than read bad reviews on social media.

- Consumer affairs. Your states consumer affairs division can be another great place to start if you dont get satisfaction with the dealership.

- Lemon laws. Laws exist in every state in the nation. Know what yours says even before buying the car. Read more about returning a vehicle.

More Car Buying Related Articles:

Don’t Miss: How To Jack Up A Car

Are High Prices Here To Stay

Dealers are encouraging the manufacturers to make lower inventories and higher prices a permanent feature. To be fair, dealers argue that new-vehicle margins were too low, before the pandemic. Historically, dealerships make most of their profits from used cars, service and parts and finance and insurance, while new-vehicle margins are thin. On individual sales, dealers may charge $500 to $1,000 in paperwork, processing and computer fees in states that dont cap those charges. Dealers say costs are cited on the documentation customers say theyre not mentioned until they see the paperwork.

Were pressing very hard for them not to bring inventory levels back to pre-pandemic levels. And so, margins are going to stay high. The margins prior to the pandemic are low. We should be selling cars at MSRP, said Jeff Dyke, president of another dealership chain, Sonic Automotive, Charlotte, N.C.

Sonic Automotive CEO David Smith said customers are less surprised to pay over sticker price now For most people, its common knowledge we have supply issues with vehicles, Smith said. People are having to wait to get what they want, for a lot of different products.

What Car Should I Buy New Vs Used

The biggest question you might ask yourself to start is “What car should I buy?”, and it makes sense. Of course, buying used cars will save you money upfront but owning a new car has other advantages. So, which one is better?

The simple way to answer this question is to look at the money you would save over time by buying a used car. Think that on average, a person will own 13 cars in a lifetime, each car’s price averaging around $30,000. Another thing you must keep in mind is depreciation.

Indeed, your car will lose its value over the years. It is estimated that by the end of the first year of owning your car will lose approximately 30% of its original value.

The impact of depreciation will affect you differently depending on whether you have a new car or a used car. Imagine you bought a new car for $30,000 and then you sell it after 3 years for $15,000. In this case, depreciation costs you $15,000. But if you instead bought a used car for $15,000 and sold it 3 years later for $10,000, the cost of depreciation only amounts to $5,000.

There are some disadvantages to buying a used car. First of all, there is the problem of maintenance and reliability. However, a used car will have lower car insurance rates and lower costs to register.

Read Also: How Can I Get My Title For My Car

Pros And Cons Of Buying A Demo Vehicle

There are many great advantages to buying a demo car, but there are some potential disadvantages as well that you may want to consider before making a purchase.

Pros

- Qualifies for special offers and rebates

- Qualifies for new car warranty

- Low mileage and less wear and tear than many used vehicles

- If used by dealership employees, then the car may have been handled more carefully to comply with dealership rules such as no pets and no smoking

- May come with upgrades and added features

Cons

- Pre-existing mileage may be considered usage under the new car warranty , which would lessen the coverage you get

- May have been more heavily used than the dealer advertises

- Cannot choose your colour or features

- No used-vehicle records exist to verify the cars true condition

- Many experts say that demo cars are not sufficiently discounted to be worth purchasing

What Is The Blue Book Price

Kelley Blue Book is one of many resources that dealerships use to evaluate the pricing on a trade-in or used car. The value of a vehicle from its data is called the “Blue Book price” or “Blue Book value.” Like Edmunds, Kelley lists its own used car values, using its own proprietary methods. Dealers will also consult NADAguides or the “Black Book,” which are less consumer-oriented and are designed to help them determine wholesale prices. Learn more

Read Also: What Is Comprehensive Car Insurance