Assess Income & Ongoing Expenses

The next step is to figure out what percentage of your annual income you want to put towards your car, as this will help you stick to a reasonable budget. Start by subtracting your essential expenses from your salary, as well as any existing debt obligations you might have . Youll then have a rough idea of your disposable income which can be allocated towards a car. We recommend basing these projections over a year if possible so you can figure out what % of your annual salary can be put towards a car .

For example, if you have an annual income of $70,000 and you spend $40,000 per year in essential expenses that leaves you with $30,000, of which you can then decide, based on your personal financial preferences, how much of this you want to contribute towards a vehicle. As a general rule of thumb, you shouldnt spend more than your annual income on a car. It is actually advisable to spend just 10-20% of your household income on your new car, and if you want to buy a higher-end, luxury vehicle, you might consider spending 20-30% of your household income.

How To Buy A Car Without Busting Your Budget

If youre trying to figure out how to make your first car purchase happen, know that you can do it even if your finances are currently in disarray. If you look at a website like Kelley Blue Book before visiting a dealership, youll have a better idea of what different makes and models cost. From there, you can set a goal and work towards reaching it by saving more and keeping your excess spending to a minimum.

Once you find a car you like , you can save money by challenging or cutting out certain fees. For example, you can lower or bypass dealer fees for shipping and anti-theft systems. If youre planning on getting an extended warranty, you can shop around and see if theres another company offering a better deal on it than your car manufacturer.

Meeting with more than one dealer and comparing offers can also improve your chances of being able to find a vehicle within your price range. So can timing your purchase so that youre buying a car when a salesperson is more open to negotiating, like near the end of a sales quarter.

Try out our budget calculator.

If you need financing, its important to make sure youre not getting saddled with a car loan thatll take a decade to pay off. Long-term car loans are becoming more common. In 2015, the average new car loan had a term of 67 months versus the 62 months needed to cover the average used car loan.

Monthly Payments Should Be Less Than 10

I used the neuvoo income tax calculator to figure out that a $50,000 salary means you take home $38,869. If we calculate 15% of that take-home pay, we end up at $5,830.35 or car payments of $485.86 per month.

If you want the best car you can afford at that salary, you could buy a $30,000 car, put a $6000 down-payment, get a 5-year loan at 4% interest and end up at monthly payments for 5 years at $442.

But, you still need to compare car insurance plus evaluate the gas mileage and maintenance costs of your new vehicle. If youâre setting aside $100 per month in maintenance, $200 for gas, $200 of insurance, and $50 in parking fees â youâre spending almost $1000 per month to drive a vehicle.

That $100 transit pass might not look so bad anymore.

If weâre staying with above example, at about $1000 per month on your car, youâre left with $26,869, or roughly $2,200 a month, for rent, groceries, clothes, dining out, tax free savings accounts, GICs, etc. for 5 years.

You May Like: Cigarette Burn In Car

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.

More Than Just Sticker Price

We shouldnt forget that newer models often have advantages over their older counterparts. For instance, in 2012, electronic stability control was mandated for all cars, and side curtain airbags became standard in most vehicles. Backup cameras were available on many 2012 models. Other advanced active safety features became more widely available in the 2012 model year, so its a good place to start if safety is your primary concern in purchasing a used car.

Newer vehicles often have better mileage, too, which can save you money in the long run. And you often find more gadgets and better stylistic choices in newer model years.

Read Also: Diy Hail Car Cover

If You’re Selling Privately

This option takes the most time and effort, but it could also yield the highest payment. You’ll need to photograph your vehicle and list it on a classifieds site, meet with strangers safely , and exchange money and file paperwork to close the sale. Selling privately can take anywhere from a few days to a few months, so this method generally isn’t best if you need the money quickly. We don’t mean to scare anyone off we just want to be honest about the work involved.

Once you’re ready to publish your listing, use the Edmunds private party-value to set the asking price. There’s a strategy to setting a price, which we elaborate on here. Essentially, you’ll want to ask more than the private-party value to build a cushion for buyers who want to negotiate. The same rules mentioned above regarding the vehicle condition level apply to private-party prices as well.

Calculate Your Car Loan Amount

Once youve calculated your affordable monthly payment, you can begin to determine how much you can borrow. The amount a lender will let you borrow depends on several factors, including:

- Your credit score: This will affect the annual percentage rate on the loan and how much the bank is willing to lend you.

- Your loan term: This is how many months youll have to pay your auto loan off.

- Whether you buy a used or new car: New car loans tend to have lower APRs than used cars.

Also Check: How To Get Cigarette Burns Out Of Car

How Do You Know If Your Throttle Body Needs Cleaning

Multiple elements help prove that the throttle body needs cleaning. First, excessive grime build-up indicates that you need to clean this throttle body instantly. This build-up compromises the engines functioning, as it muddles air-fuel flow.

Monitor the efficiency of your engine. Usually, its performance will indicate whether or not it is time to clean the throttle body. Poor fuel economy shows that the machine is not clean.

Unless you unclog the throttle body, your gas consumption will remain significantly high.

Electrical problems are also common when the throttle body requires cleaning. Grime and dirt will build up to affect computer controls, electronic sensors, and wiring functions. In addition, substantial air disruptions will suffice, exposing you to diminished, slow, or uneven acceleration.

How Much Do You Care About Your New Car

Are you a car person? While some people buy cars in order to get to and from their workplace, other people buy cars because theyre passionate about driving or like a certain make and model.

The amount you should spend on a car as a percentage of your salary really depends on how much you care about cars. Are you buying a car just to get to and from work or are you buying a vehicle youll use for road trips and weekend drives?

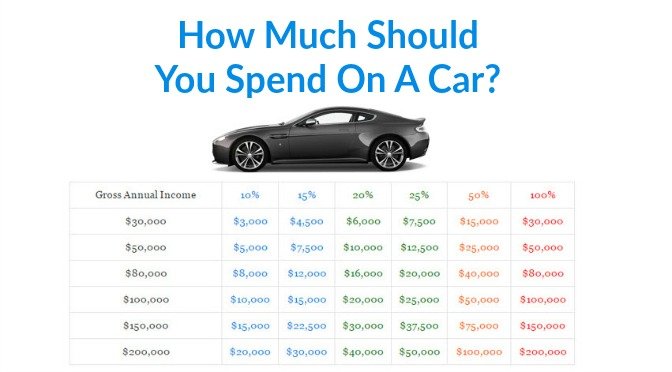

MoneyUnder30 recommends using one of three percentages to work out how much you can afford to spend on a new car based on your needs:

- If youd like a cheap, affordable and simple vehicle thats good enough to get to and from work, budget about 10 to 15 per cent of your annual income.

- If youd like a safer, more reliable and more comfortable car for travelling to and from work and on using on weekends, budget about 20 to 25 per cent of your income.

- If youre a car person and you view a car not just as a means of getting to and from places, but as a lifestyle item, budget about 50 per cent of your annual income.

Sound a little too simple? Dont know which category you fall into? These rule are designed to make budgeting for a car easier, but theyre not set in stone. Read on to work out how much you should spend on your next new car.

Also Check: How To Protect Car From Hail If No Garage

Next Steps: Identify Cars Within Your Budget

Establishing an auto budget is an important first step in the car-buying process. Once youve landed on a number youre comfortable with, you can move on to identifying makes and models within your price range before heading to the dealership.

Check out our guides to buying a new car or used car for tips on finding a car and financing that fits your needs.

Find The True Cost Of Car Ownership

This car cost calculator figures the true cost of ownership for …show more instructions

This calculator makes it easy to compare car costs on totally different deals from new to used by factoring in all the relevant expenses .

To calculate costs for a single car click on the Single Car Calculation radio button, fill in the left-hand column with the vehicle cost data and then click the Calculate Car Cost button.

To compare two cars click on the Double Car Calculation radio button, fill in both columns data and then click the Calculate Car Cost button. If both vehicles have similar data, you can fill in the first column with the Single Car Calculation radio button selected, and then click on the Copy Car #1 Entries to Car #2 button to fill in the right-hand column . Then just change any cells that are different before calculating.

Cars are one of your top 5 expenses and can significantly impact your wealth plan so it pays to be prudent. I teach how to have free cars for life in this wealth strategy course.

You May Like: Car Rental Discounts Through Aarp

Are Kelley Blue Book Values Accurate

The question Whats the Blue Book Value? has been part of buying and selling a car for over 90 years. And simply put, no one has more experience with vehicle values and pricing than Kelley Blue Book. Weve been the go-to source for both consumers and the automotive industry since 1926. We leverage massive amounts of data, including actual transactions – then adjust for local market conditions and seasonal trends. Our values reflect both wholesale and retail transactions to provide a 360 degree view of the market. We update our pricing at least weekly to reflect the market and give dealers and consumers the most up-to-date pricing.

Car Affordability: How Much To Spend On A Car Based On Salary

Car affordability calculation is one of those necessary preparatory work that must be done before a new car purchase. Generally when we buy a car, we do not care about affordability calculation. But this is a mistake.

Car is a financial liability, but it is also a very convenient way of transportation. Moreover for many, owning a car is a huge psychological booster. Hence, people tend to overspend on their car purchase.

How to control this overspending urge? By first performing ones car affordability calculation, and then buying a car in accordance with it. Ive also provided a simple calculator which can ease ones affordability calculation.

People who are car fans, and also remain aware of their spending habits will like my calculator. Take it as a fun calculator. When I use this calculator for myself, Ive seen that its car-value predictions generally matches my actual affordability.

Recommended Reading: How Much Money Does A Car Salesman Make

Think Car Maintenance & Calculate Car Affordability

In India, people spend about 1.5% of their annual income on car maintenance . Also, on an average, annual insurance premium is about 2.25% of depreciated value of the car.

This parameter also works as an affordability check. How? We will see here…

Suppose one want to buy a Audi Q3. It’s cost is Rs.40 lakhs. On an average, annual maintenance cost of Audi Q3 will be around Rs.95,000. Annual insurance premium of the car will be about Rs.85,000. Hence we can say the total maintenance/up-keep cost of the car is Rs.1,80,000 per year. You can use the calculator to find the values.

Suppose, salary is Rs.2,50,000* each month. How much this person will spend on annual maintenance, compared to his annual salary, had he bought Audi Q3 ? Let’s do the maths:

= Rs.1,80,000/30,00,000 = 6%

This ratio proves that, the person will overspend by buying a Audi. So which is the right car for him? To find this, lets do a back calculation for this person:

- Annual Cash in hand: Rs.30 Lakhs

- Preferred Car Up-keep Cost : Rs.1,35,000 .

- Car Value : Rs.28,00,000 .

What does it mean? A person who earns around Rs.2.5 lakhs per month, shall buy a car that costs not more than Rs.28 lakhs.

Car Bumper Repair Versus Car Bumper Replacement

So, whats the big difference between getting your car bumper repaired and getting your car bumper replaced? Usually, its the cost of the procedure. Here are the key differences.

Car Bumper Repair

If your vehicle has small scratches, dents, or other cosmetic issues after a minor collision. Usually, this type of damage occurs after hitting a parked car or hitting another car at a low speed. Bumper repair is typically cheaper than bumper replacement because it doesnt require ridding the car of an entire part. Bumper repair can cost anywhere from around 100.00 to 1,000.00.

Car Bumper Replacement

If you have large dents, scratches, or if your bumper is in some way falling off the frame of the car, youll need to get a car bumper replacement. Major damage like cracks, missing chunks, and deformity, often will be fixed with a full bumper replacement. Bumper replacement generally costs more than bumper repair, running anywhere up to 2,000 dollars.

You May Like: How To Fix Clear Coat Damage

And If You Really Love Cars

To all you personal finance blog regulars out there, this probably sounds good so far. If this is your first time here , you might be thinking, These people are so cheap! Thats crazy. Theres no way I can get a car I want for that money!

To you, I would say: Ask yourself why youre saying that. Is it because youre a car guy and you value your car most out of all your possessions? Or is it because youve simply been conditioned by our culture, advertising, and car salespeople to think that you should buy a brand new car and that theres nothing wrong with spending a years worth of paychecks on a car?

If its the formerthat you love carscool. Theres nothing wrong with intentional spending on the things you value most. By intentional spending, I mean spending moneymaybe more than other people would think is sensibleon things that interest you.

So if you value your car, I dont see anything wrong with spending more than we recommend for most people, perhaps up to 50% of your income on a car. Chances areas a car personyoull care for the car more, enjoy it more, and get more money for it when you sell it than the average car owner. Again, you just have to remember that because the car will be a large expense, youll have to be extra vigilant about other expenses.

The Compromise: 20% Of Annual Income

For me, if Im going to buy a new car I want something thats as safe and reliable as possible for my needs. Especially with a young family and two busy working parents, reliability is keysending the car to the shop all the time would be a hassle. The last two vehicles Ive bought have been between two and three years old with around 20,000 miles on them. The newness of the cars was good for their reliability, but the fact that they were used took thousands off the price of buying new.

How much car you can afford? is a different question than How much you should spend on a new car?

A loan officer will look at your income and credit report and say: You can afford $650 a month. You could finance a new Porsche for $650 a month if they stretch the loan out long enough, but you certainly shouldnt spend that much on a car.

If you take pride in your frugality, 1015% of your income sounds about right. If you value the reliability a newer, more expensive car brings, then 2025% is a good benchmark. This gets you $5,000 to $7,500 on a $25,000 salary. Still not a lot, but youll have more options. At a salary of $50,000, you can spend $10,000 to $15,000 which should be plenty for a basic used sedan under 100,000 miles.

Use Edmunds to get dealers to fight for your business! Pick your car and see the best price before you leave home.

Also Check: How Much Does A Car Salesman Make On A Sale