How Do I Get Affordable Car Insurance

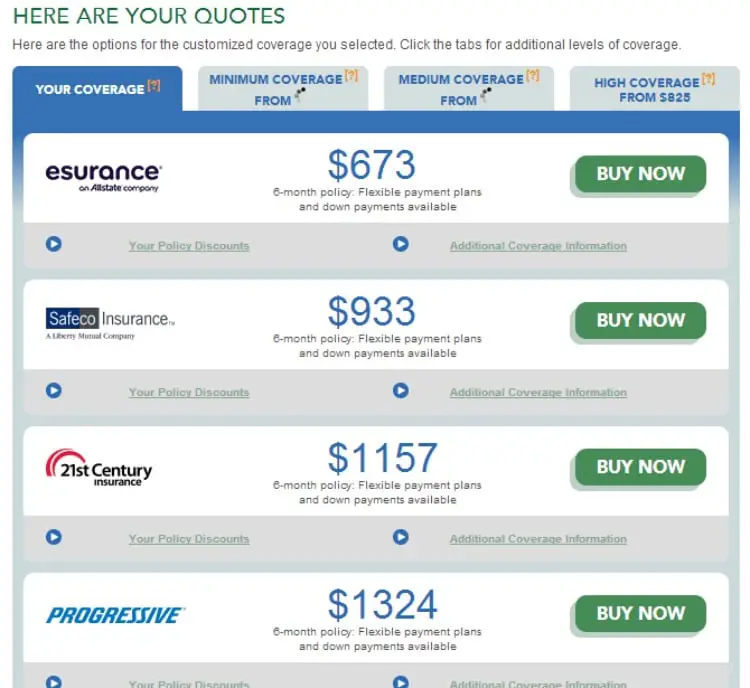

Finding the most affordable car insurance rates for you can be done by getting a car insurance quote and analyzing multiple policies. You should look into as many companies as you can to find the lowest rates.

Insurance Navy shops around from multiple insurance companies to find you the lowest auto insurance rates. Each sets its own rates and offers a variety of discounts.

Finding a car insurance quote that fits nicely into your financial budget and offers good quality coverage is absolutely possible with Insurance Navy.

What’s The Best Credit Card Company

Just as there is no single best credit card for everyone, consumers have widely different opinions about the best credit card issuers. One person could get the runaround from customer service rep and rate a bank zero stars as a result, while another has nothing but positive experiences and gives it five stars across the board. Still, some trends emerge in customer satisfaction surveys.

J.D. Power conducts an annual study of satisfaction among major national and regional credit card issuers. It regularly rates Discover and American Express at the top among mass-market issuers. In the most recent study, USAA and Navy Federal Credit Union had the highest ratings of all, but keep in mind that only people affiliated with the military are eligible for USAA or Navy Federal products.

J.D. Power 2020 Credit Card Satisfaction Study

|

NATIONAL ISSUERS |

How Much Car Insurance Costs By Company

Car insurance rates can cost thousands of dollars more per year at one insurance company compared to another. Our analysis found that the average cost of auto insurance can vary by as much as $222 per month depending on the company.

While many top auto insurance companies use the same factors to set your rate including your location, age, and driving history not every provider evaluates these factors the same way.

In our analysis, USAA has the best car insurance rates among the largest providers. But since USAA is only an option for people in the military, GEICO more often has the most affordable average car insurance rates for most people.

Smaller insurers, like Auto-Owners Insurance, or even local companies, may have cheap rates, too.

|

Company |

|---|

|

$125 |

Monthly costs of car insurance based on different coverage amounts of bodily injury liability coverage. Minimum coverage includes enough insurance to meet the state’s legal requirements, while the “full” and “most” columns are for $50,000 per person/$100,000 per accident and $100,000 per person/$300,000 per accident.

Read Also: How To Report Suspicious Car In Neighborhood

Get Quotes From Multiple Insurers

Insurance companies use proprietary formulas to calculate rates, so pricing can vary significantly from insurer to insurer. Thats why its essential to shop around before purchasing coverage. Getting quotes from insurers is a simple and straightforward process. You can gather pricing information online over the phone or in-person from an insurer, captive agent, or broker.

How Much Does Car Insurance Cost In My State

Insurance costs vary from state to state. If youre a resident of Florida, youll be paying the highest average rate in the country to fully insure your vehicle, approximately $2,587. Maine residents sit on the other side of that spectrum, averaging a full coverage rate of only $831.2

Why such a large disparity in average costs? There are several factors at play. Prices are affected by various state laws, from regulations on the rates insurance companies can charge3 to policies that affect the cost of medical care. General conditions in a state, such as weather trends or prevalence of insurance fraud, can also influence prices.4 View a comprehensive list of rates by state.

You May Like: Where Is Elon Musk’s Car

How Does Car Insurance Work

A car insurance policy is essentially a contract or commitment between an insurance company and a policyholder.

This contract is enacted once you settle on the affordable coverage you need. The policy a customer agrees on will outline all the terms of coverage and the deductible.

Once you agree on a cheap car insurance policy and types of coverage , you will begin paying your affordable monthly premiums.

Drivers should have an idea of what their auto insurance premiums will be prior to signing with an insurance company. This can be done so by getting free car insurance quotes to determine your annual rates.

A quote for car insurance is offered for free by insurance companies and gives an estimate of how much your auto insurance coverage will cost.

A Car Insurance quote is determined by a number of personal factors, like where you live, car type, marital status, credit score, driving history, and coverage term. More on how premiums are calculated will be explored later.

Paying your monthly premiums will keep your policy active for the set term, usually six or twelve months. Once the term is up, you will have the option of renewing your cheap auto insurance or finding a new insurance company.

Additional Factors That Affect Your Car Insurance Rate

Vehicle. Expensive or luxury vehicles are usually much more costly to insure compared to cheaper models. The parts on these vehicles are pricey to replace and repair, so insurance companies typically charge you a higher premium to protect your car.

Drivers with excellent credit scores will likely receive more affordable rates than those with poor credit. Some insurers use credit scores as a rate factor because they believe there is a correlation between credit scores and the number of claims filed. However, certain states have banned the use of credit scores to calculate insurance premiums.

Gender. Our study shows that young male drivers spend more, on average, for car insurance compared to young women. This is attributed to the fact that young male drivers are more likely to be involved in accidents and receive traffic citations than young women. However, we found that as women get older, they are quoted slightly higher rates than their male counterparts.

Mileage. The more you drive, the higher chance you have of being in an accident. Driving less frequently can also make you eligible for low mileage discounts offered by your insurance company.

Also Check: How To Build A Car From Scratch

How Does The Cost Of Your Car Insurance Compare

Knowing how much you should expect to pay for car insurance can help you find the best deal.

Our car insurance calculator uses data from our most recent car insurance price index. We look at more than 6 million car insurance quotes quarterly to understand how prices have changed.

Try our car insurance price calculator to find out the average car insurance price in your area.

See our handy guide on how to reduce the price of your car insurance for more ways to cut your premium!

Car Insurance Cost Reduction Tips For Teens

- Get your license as early as possible, even if you wont be driving yet

- Maintain an excellent driving record

- Maintain good grades in school

The more time that passes from the day your license was issued, the better for your monthly auto insurance costs. Even if you do not plan to drive alone until you are out of the high risk zone, it is a good idea to get your license as soon as you can to get distance from that just licensed period.

Also Check: How To Check Your Car Battery

How Much Is Gap Insurance: Average Gap Insurance Cost Per Month/year

How much does gap insurance cost? the average gap insurance cost when buying your gap insurance directly from insurers will be a few dollars a month or $20 to $45 per year.

Whatever you do, don’t buy gap insurance at the car dealership, as it will cost you a lot more unjustly.

Best Travel Credit Cards Of October 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A travel rewards credit card brings your next trip a little closer every time you use it. Each purchase earns points or miles that you can redeem for travel expenses. If you’re loyal to a specific airline or hotel chain, consider that company’s branded credit cards. Otherwise, check out the general-purpose travel cards on this page, which give you flexible rewards that you can use without the restrictions and blackout dates of branded cards.

Some of our selections for the best travel credit cards can be applied for through NerdWallet, and some cannot. Below, you’ll find application links for the credit cards from our partners that are available through NerdWallet, followed by the full list of our picks.

A travel rewards credit card brings your next trip a little closer every time you use it. Each purchase earns points or miles that you can redeem for travel expenses. If you’re loyal to a specific airline or hotel chain, consider that company’s branded credit cards. Otherwise, check out the general-purpose travel cards on this page, which give you flexible rewards that you can use without the restrictions and blackout dates of branded cards.

Read Also: What Does Leasing A Car Mean

Car Insurance Calculator: Age

If you have a young driver on your insurance policy, you already know the effect it has on your premium. Insurers penalize inexperienced drivers because of the increased risk. Adding a teen driver to your policy will likely cause a rate increase between 44 and 58 percent. On average, the insurance rate for a driver between the ages of 16 and 19 is $2,999, while a 20- to 24-year-old would only pay around $2,040.

Of course, you dont want to put your teen on an individual policy, because that only makes the price jump higher.

Instead, you want to focus on teaching your teen to drive well. Taking a driving course might help to lower the cost of auto insurance coverage, as will having good grades in school. Purchasing a vehicle with anti-theft and driver-assist features can also help to keep premiums low.

For the most part, coverage options are cheaper for drivers between the ages of 30 and 65. After this, seniors will begin to see premiums start to increase because of the heightened risk of accidents.

How To Get A Car Insurance Estimate

Its not difficult to use a car insurance estimator. Most companies provide a simple car insurance estimator tool on their website, so you wont even need to speak with anyone. We recommend getting multiple auto insurance quotes and comparing policies. As you can see, average rates vary significantly from driver to driver. You can save money by merely taking a few minutes to see whats available.

Compare auto insurance rates

Don’t Miss: How To Get New Tags For Car

Customer Reviews About Cheap Car Insurance From Insurance Navy

Look no further for low-cost car insurance! Insurance Navy was our answer! Alejandra was a gem! She was so professional and very patient with all my questions. I was so happy I came here!

Great customer service from Rosie she was able to help get my 2 vehicles insured within minutes and low rates plus offered roadside assistance. Been coming here for a while now, in-person or over the phone, sheâs been a gate help.

I have been coming to this location for many years. The price for full coverage is unbeatable – and the customer service is great.!I highly suggest you ask for Linda, she is so sweet , fast , and informative.

Iâm very pleased with their customer service. Brenda is super attentive and was able to answer all my questions. recommend 100%

I had such a great experience quoting online. I got a response in 1 minute literally 1 minute I was just looking forward to issuing the policy myself but as soon as she mentioned she could find me something more affordable I continued with her and glad I did !!! Thank you Silvia

Thanks to Michelle, very professional. Always takes care of her customers. Got me a really good monthly price on my car insurance! Definitely recommend!!!

I was at State farm before i switched over to Insurance Navy. I didnât believe the hype till I realized how much money i saved for the same great coverage. Linda Kawash was very helpful in making sure i got the best priced quote possible. Thank you!

Individual experiences may vary.

What Are Average Car Insurance Rates

Based on our cost research, the average 35-year-old driver pays $1,732 per year for full coverage car insurance. And while this number may be helpful to keep in mind, it can be hard to gain any valuable information from just this figure. This is because car insurance rates vary widely and are influenced by many factors, including:

- Your credit score

- Your coverage amount

Its not accurate to just use a car insurance estimator and simply assume thats what your car insurance policy will cost. The only way to get an idea of how much car insurance will cost you is to reach out to insurance providers for free quotes.

Well take a deep dive into each of the factors that influence auto insurance rates below.

Read Also: How To Clean Car Mats

Is Auto Insurance Required

Texas law requires drivers to show proof they can pay for the accidents they cause. Most drivers do this by buying auto liability insurance. Liability insurance pays to repair or replace the other drivers car, or other damaged property, and pays other peoples medical expenses when youre at fault in an accident.

If you still owe money on your car, your lender will require you to have collision and comprehensive coverage.

How Much Is Car Insurance

The average cost of car insurance is $137 per month for a full-coverage policy. This means car insurance costs $1,652 per year on average.

But thats what an average driver pays for insurance what youll actually pay is based on your own personal details, like your age, driving history, and ZIP code.

We calculated how much car insurance costs using rates from across the U.S. Our analysis takes into account all of the factors that can affect your policy, so you can understand how much auto insurance really costs and compare car insurance rates based on your needs.

Our team of data and insurance experts at Policygenius found the cost of car insurance for different types of drivers by analyzing hundreds of thousands of rates from every ZIP code and every state .

Our rates for most people used the sample profile of a 30-year-old driver of a 2017 Toyota Camry with a clean driving record. This sample policy included coverage limits of:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured/underinsured motorist: $50,000 per person, $100,000 per accident

- Comprehensive: $500 deductible

- Collision: $500 deductible

In addition to finding the costs for most people using this information, we also determined how much car insurance costs for other drivers based on which states they live in whether they have an accident, DUI, or other violation on their record their gender age and coverage limits.

Read Also: Why Is Car Insurance Important

Nerdwallet’s Car Insurance Estimator

The national average car insurance rate is $1,592 per year for “full coverage,” according to NerdWallets 2021 rate analysis. But your rates will differ based on the car you buy, among other factors. Full coverage car insurance isn’t a specific type of policy. Rather, it refers to a combination of coverages. For our rate analysis, full coverage includes liability, comprehensive, collision, uninsured/underinsured motorist protection and any additional state-mandated coverage.

Average Car Insurance Rates By State Per Year

Car insurance cost varies depending on the state you are a resident of as well. Below is a table that displays a state by state rates for minimum coverage, full coverage and a general average auto insurance rate by state.

Minimum liability coverage only pays for damages that you incur on others and their properties, so your car is not covered by the minimum policy in accidents where you are at fault.

Full coverage includes collision insurance and comprehensive insurance, which means damages to your car caused by accidents, natural disasters, fire, damage done by animals, and theft.

The total average auto insurance rate shows the overall average car insurance rates by state annually.

It is important to note that among all the states, Michigan has the highest average price of car insurance, with a minimum coverage cost of $1,855 and an average full coverage cost of $3,150. Michigans average minimum coverage costs even more than the average full coverage costs of the 16th highest insurance rate, Texas, which is $1,823.

| State |

|---|

| $1,700 |

Recommended Reading: How To Clean Rubber Car Mats

Long Island City Insurance Faqs

What factors affect car insurance quotes in Long Island City?

The factors that car insurance companies take into account when calculating your monthly cost include things you can’t control like your gender and age, but also factors like your vehicle’s year, make and model, plus your driving record, credit score, marital status, and address.

Why is the cost of car insurance in Long Island City different from other neighboring cities?

Car insurance companies take local factors into consideration when determining how much to charge for coverage. Things like parking situations, crime rates, and local laws — which can vary from city to city — can significantly affect your rate.

Which car insurance company will offer me the cheapest rate in Long Island City?

There isn’t one company that will offer the cheapest rate to everybody. What companies will charge you are based on many different factors that vary from person to person, such as your driving record, what kind of car you drive, how many drivers will be on your policy, and a number of other factors. Because of this, it’s a good idea to use sites like Compare.com to compare multiple quotes at once. That way, you can be confident you’re getting the best price.

Do I need to change my insurance if I move to Long Island City?

Do I need to wait for my policy to expire to switch to a different car insurance company?