Best Vehicle Title Loans In Canada

Some individuals who are desperate for fast cash might rush out to their nearest auto title lender to borrow quickly, but that is far from a great option. Instead, borrowing against your vehicle is a way to get fast cash without meeting the strict financial requirements of a non-title loan. In addition, loans against a cars title are typically available within one or two days, and they may be a viable short-term solution if you need money for an emergency.

Loans against a car title are generally easier to get approved because they are secured, making them an excellent option for people with limited credit. Typically, auto title lenders have few requirements for prospective borrowers, such as not checking credit or requiring proof of income.

Reduce Your Interest Rate

One of the best reasons to refinance a car loan is if you have an opportunity to reduce your interest rate. If you previously had no credit or bad credit, it is worth checking into refinancing your car loan after a couple of years to see if you receive better offers. Your credit score may have improved enough to qualify you for a lower interest rate. With a lower interest rate, you will be able to pay off your loan faster or lower your monthly payment while paying it off at the same pace. In either case, you’ll pay less over the life of the loan.

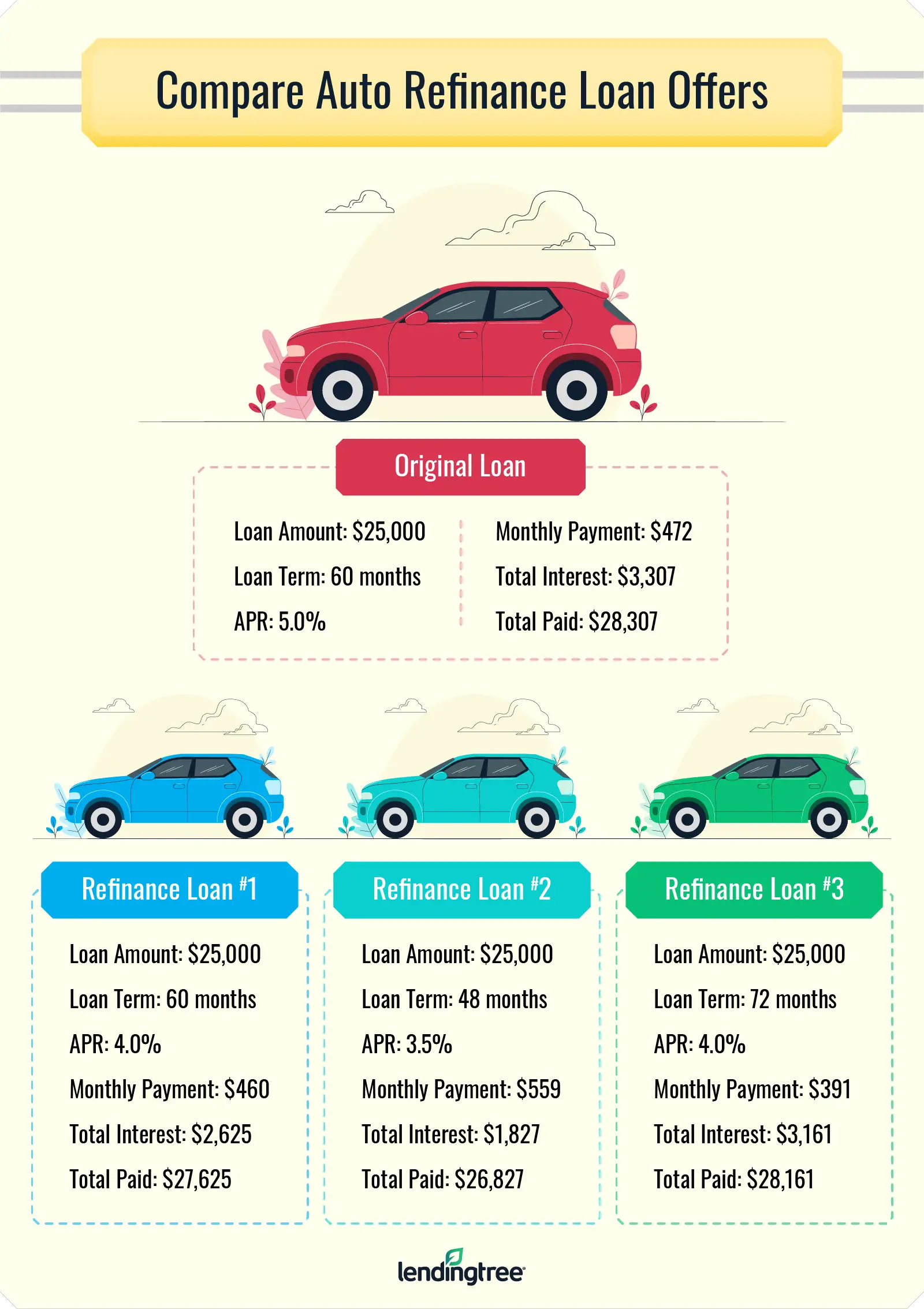

Is Refinancing Worth It

Seeing an example of how refinancing can help you save may put things into perspective.

Let’s say you take out a car loan for $20,000 over 60 months with an interest rate of 8%. That would give you estimated monthly payments of about $406. If you were to pay off your loan on time without missing any payments, you would pay a total of about $24,332. After 12 months, assuming you make all your payments on time, your loan balance would be down to approximately $16,611. Now if you were to refinance at that time and get a loan of $16,611 for the remaining 48 months with a lower interest rate of 5%, you’d end up paying a total of about $18,362 on that loan. When you add that to the amount you already paid on the original loan, your total cost would be about $21,751. That’s $2,581 less than what you would have paid on the original loan.

If you want to experiment with different rates and terms, try our car refinance calculator a quick, easy way to crunch the numbers and see your potential savings.

Don’t Miss: What Is A Town Car

Estimate The Value Of Your Car

The cost of your loan isnt the only factor to consider when thinking about whether to refinance. You will also want to get a sense of what your car is worth. To do this, you can use resources like Kelley Blue Book and Edmunds.

If your car is newer with low mileage and a sizable balance that will still take years to pay off, refinancing could save you money and prevent you from going upside-down on your loan. If its worth less than what you owe, you may be out of luck. And if your vehicle is almost paid off, it makes less sense to refinance since interest currently makes up a small portion of your remaining payments.

The bottom line: Knowing the value of your car can help you determine whether lenders will be willing to refinance. If your vehicle isnt worth much, refinancing could cost you more money than youd save.

Pay Off Your Old Loan And Start Making New Monthly Payments

Depending on your lender, much of the transition from your old loan to your new one can be taken care of by the lender. For example, your new lender might pay off your old loan. But be sure to reach out to your previous lender to get confirmation that its been paid in full before you stop making payments on that loan.

Once your original loan is paid off, you can focus on making on-time payments on your new loan each month, which may help boost your credit.

Recommended Reading: Where To Buy Car Mats

Does Refinancing A Car Hurt Your Credit

Like with any loan, it’s important to know the potential effects on credit scores. Does refinancing a car hurt your credit or will it raise your score?

Ultimately, reducing debt that you can’t afford is a good thing. So, in the long run, refinancing can help to increase your credit score. If you do refinance, be sure to make your payments on time because that contributes to 35% of your .

But as is common with taking out a loan, refinancing does require a hard credit inquiry. That means your credit score will temporarily drop up to five points when you submit an application with your lender.

If you shop around and submit multiple applications with various lenders, your credit score can drop. But, the impact to your credit score should be the same as if you only submitted one application, assuming you submit all your applications within a 14 to 45 day window.

Now that you understand the pros and cons of refinancing a car loan, let’s dig into the right time of when to refinance.

Factors To Consider Before Refinancing

Lender requirements, additional fees and your finances should all be considered before you refinance your vehicle.

- Requirements for refinancing: Every bank or lender has its own criteria to determine if you are eligible for refinancing. Be sure that you are not upside-down on your loan and are current on payments.

- Prepayment penalties: A prepayment penalty is the fee that you must pay if you pay off your loan early. Not all lenders charge this, but it could affect your overall savings.

- Time remaining on the loan: If you are near the end of your current loan, it may make more sense to finish paying it off instead of sinking time and money into refinancing.

- Your financial state: Your debt-to-income ratio is one of the many factors considered by lenders. The more debt you are able to pay off before applying for a new loan, the better terms you receive will be.

Don’t Miss: How Do I Register My Car In Nc

When It Makes Sense To Refinance

- Your credit has improved. You might be eligible for a better rate if your credit score has improved significantly since you initially took out the loan. If your credit score is still less than stellar, however, you can refinance using a co-signer with a strong credit history to potentially receive a better rate.

- You want a lower monthly payment. If youâre struggling to keep up with debt payments, and need some extra room in your budget, refinancing to get a lower payment can be a good option. Just keep in mind that if you choose a longer term to get that lower payment, it will cause you to pay more in interest over the length of the loan.

- Interest rates are lower. Another reason to refinance would be if you have a high interest rate on your current car loan and interest rates are now lower.

Where Is The Best Place To Refinance A Car

The best auto refinancing companies for your personal needs will depend on your specific situation. We recommend RateGenius for its vast network of lenders though, as with any auto refinance company, good credit will get you favorable rates and excellent credit will attract even better rates. However, if you’re working with a low credit score, a company like Auto Credit Express or Autopay, both of which specifically state they work with borrowers with bad credit, may be a better fit.

You will need to look at each auto refinance company’s criteria to find the best loan options for you. Nobody is obligated to accept the first auto refinance offer they receive. Especially if you have good credit, there’s always a different lender out there to consider.

Read Also: What Headlight Bulb Fits My Car

The Best Reason To Refinance: Pay Less Interest

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. That lower rate means you pay less for your car after taking all of your borrowing costs into account. Because the interest rate is also part of your monthly payment calculation, your required payment should also decrease. As a result, managing your monthly cash flow becomes an easier task.

When you can replace your existing loan at a lower rate, its best to refinance as early as possible. Most auto loans are amortizing loans, which means you pay a fixed monthly payment with interest costs built into the payment.

Over time, you pay down your debt, but you pay most of your interest costs at the beginning of the loanso get that rate down sooner than later to start cutting costs. An amortization calculator can show you exactly how much you can save by refinancing.

A Different Lender Offers Better Terms

Financial institutions occasionally offer incentives for new customers to refinance their auto loans. This could mean that your interest rate might go down, your monthly payment amounts might be reduced, or the length of your loan term might shorten.

Restructuring your loan with a different lender can provide different avenues for you to save and get a better deal on the books. Each lenders criteria will vary but in general, they will look at items such as:

You May Like: How To Remove Duct Tape Residue From Car

The Guide You Need To Refinance Your Home Car Or Other Loans In Singapore

Whats the meaning of refinancing? It is to finance something, typically a home or car or big-ticket items, with another new loan, usually at lower interest rates in order for an individual to save money in the long run throughout the loan tenure. Refinancing could therefore be a great option and opportunity for borrowers who want to save thousands of dollars. With interest rates climbing amidst the global economic situation, it may be a good time now to switch over to a new loan for its better terms and rates.

How Can Refinancing Save Money

Does saving hundreds of dollars pique your interest? Refinancing to a lower interest rate can save you cash over time however, thats only if you dont extend the term of your loan. If you receive a better interest rate but you decide to go with a longer term, it may reduce the amount of your monthly payment but it can end up costing you more in total.

Heres an example. Lets say you have a five-year, $20,000 auto financing package that charges an 8% interest rate. Each month, your car payment is around $406. Refinance to a 4% interest rate and your monthly payment will drop to $368 saving you almost $2,300 over the course of the term.

You might also be able to reduce your monthly bill by refinancing to extend the length of your term . If cash flow is running a little tight and your current car payment has become a stressor on your budget, this could be a good option to explore.

Take that same $20,000 financing with an 8% interest rate above. If your term is 36 months, you owe about $627 each month. Refinance and increase your term to 48 months and your monthly payment will drop by more than $100, to around $488.

Just keep in mind: a longer term may end up costing you more in total. So, if you take this route, you might want to increase your monthly payments later on if youre financially able, to pay off your principle balance sooner and reduce the amount of interest youll have to pay over the life of your loan.

Also Check: When To Buy A Used Car

What Refinancing Is And How It Works

Refinancing allows you to replace your current loan with a new one. This new loan will hold better rates and terms and thus save you money each month. Your existing loan will be replaced with one from a new lender, but it is always wise to calculate potential savings if you stayed with your current bank or lender.

The choice to refinance does not come without risk. By extending the lifetime of your loan you are more likely to become upside-down on your vehicle loan. To avoid this, stay away from long repayment terms which can feel enticing when refinancing.

It is also important to consider that lenders do hold specific requirements when it comes to refinancing. Many banks and lenders will look for a clean vehicle title, history of payments and the value and age of the vehicle.

Our Top Picks For Best Auto Refinance Companies

- Auto Credit Express – Best for Low Credit Score

- AutoPay – Runner-up for Best for Low Credit

- PenFed Credit Union – Best for Add-Ons

- MyAutoLoan.com – Best for Fair Credit

- Caribou – Runner-up for Best for Fair Credit

- Lightstream – Best for Older Cars

Why we chose it: RateGenius has the biggest lender network compared to any other auto refinance specialist in our top picks.

- No limit on existing loan balance

- Prequalify with a soft credit inquiry

- Loan Terms

- 24 to 96 months

The auto refinance specialist RateGenius is the flagship brand of The Savings Group, which includes auto finance companies Autopay and Tresl. Its 200-lender marketplace includes credit unions, national banks, regional banks and non-depository financial institutions. The abundance and variety of options makes finding the best rate for your particular auto refinance situation easier.

RateGenius is best for a prime borrower, meaning someone with a credit score ranging from 640 to 740. However, co-applicants are allowed, which could help boost your chances of being offered the lowest rates.

You can pre-qualify with only a soft credit pull, but you will see a hard credit check once you formally apply with a lender. Approvals are generally granted within 48 hours of submitting all the required information. RateGenius handles the work of paying off your previous lender, too.

- Quote request form takes less than five minutes

- Serves a wide range of credit scores

- Minimum amount owed for refinancing is $8,000

Don’t Miss: How To Stop Rust On Your Car

Important Legal Disclosures And Information

Refinancing at a longer repayment term may lower your car payment, but may also increase the total interest paid over the life of the loan. Refinancing at a shorter repayment term may increase your car payment, but may lower the total interest paid over the life of the loan. Contact us to discuss the option that best meets your needs.

Automated payment must be set up at loan closing from a PNC checking account to qualify for the 0.25% discount. If automated payment is discontinued at any time, you may no longer receive an automated payment discount and your rate will increase 0.25%

Certain restrictions and conditions apply.

May exclude weekends and holidays.

*Check Auto Loan Rates: APRs that will display include a 0.25% discount for automated payment from a PNC checking account. The lowest rates are available to well-qualified applicants. Your actual APR will be based upon multiple factors. Refer to Important Disclosures” under Get Rates for more details.

Bank deposit products and services provided by PNC Bank, National Association. Member FDIC

Should You Repay Your Car Loan Early

Paying off your car loan early will not only save you on interest charges, but it also eliminates your car payments altogether. If your financial situation has vastly improved recently, or youve received an inheritance, tax refund, or simply have a second income stream, consider paying your car loan off early.

However, be sure to check the fine print in your car loan agreement. Some lenders include a clause in the contract which requires you to pay an early repayment penalty fee if the loan is broken early. If such a fee exists, make sure to find out how much this fee is, as the cost may be more than how much youd pay in interest over the life of the loan.

You May Like: Can You Park Your Car At The Airport

Pros And Cons Of Refinancing A Car Loan

Now that you know the potential savings, let’s hit the brakes and look at the advantages and disadvantages of refinancing your car loan.

| Pros of Refinancing | |

|---|---|

| You have the opportunity to lower your interest rate and monthly payment | Your refinanced loan could have a higher interest rate than your original loan |

| Lowering your monthly payments could increase your cash flow | Some lenders may issue a prepayment penalty for paying off your original loan early |

| You could save money on interest if you shorten your loan term | You could pay more over time if you extend your loan term |

Those are some of the basic pros and cons of refinancing a car loan. But one area that could be a pro or a con is your credit score.

How Does Refinancing A Car Work

When you refinance your car loan, youâll take out a new loan with different terms that replaces your original loan. Then youâll begin making monthly payments on the new loan.

You can choose to refinance with your existing lender or pick a new lender after shopping around to compare fees, rates and special offers.

The lender you choose will appraise your vehicle, run a credit check, verify your income and ask for proof of car insurance. You may need to provide recent pay stubs or W-2s for the last two years to assure the lender that you can make the monthly payments.

Read Also: How To Start A Car With A Dead Battery