Auto Loan Payment Calculator Results Explained

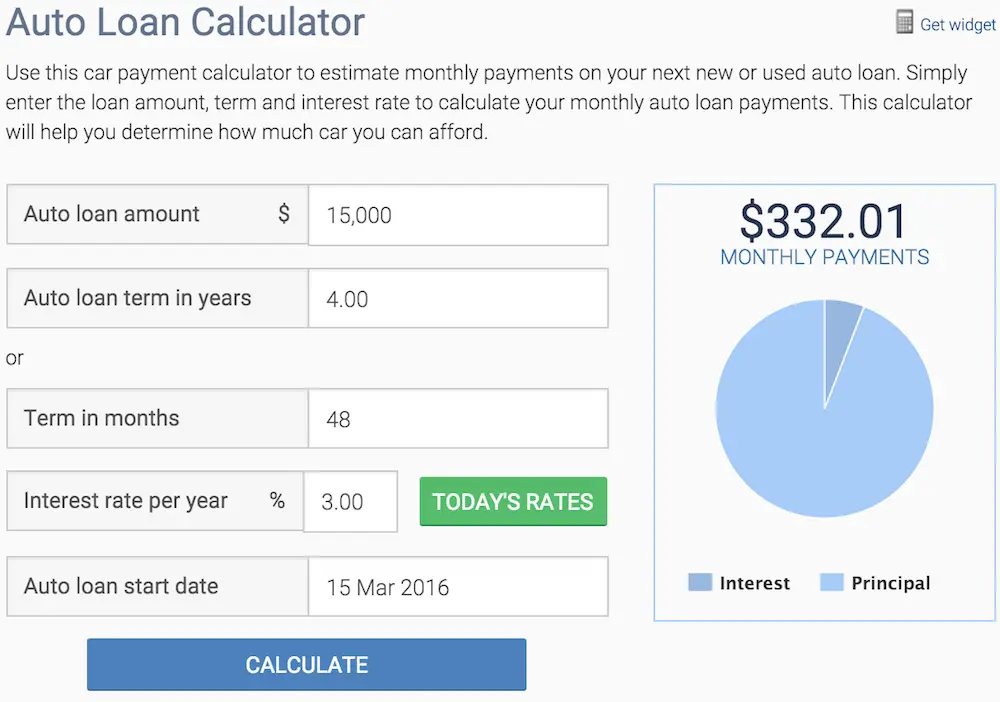

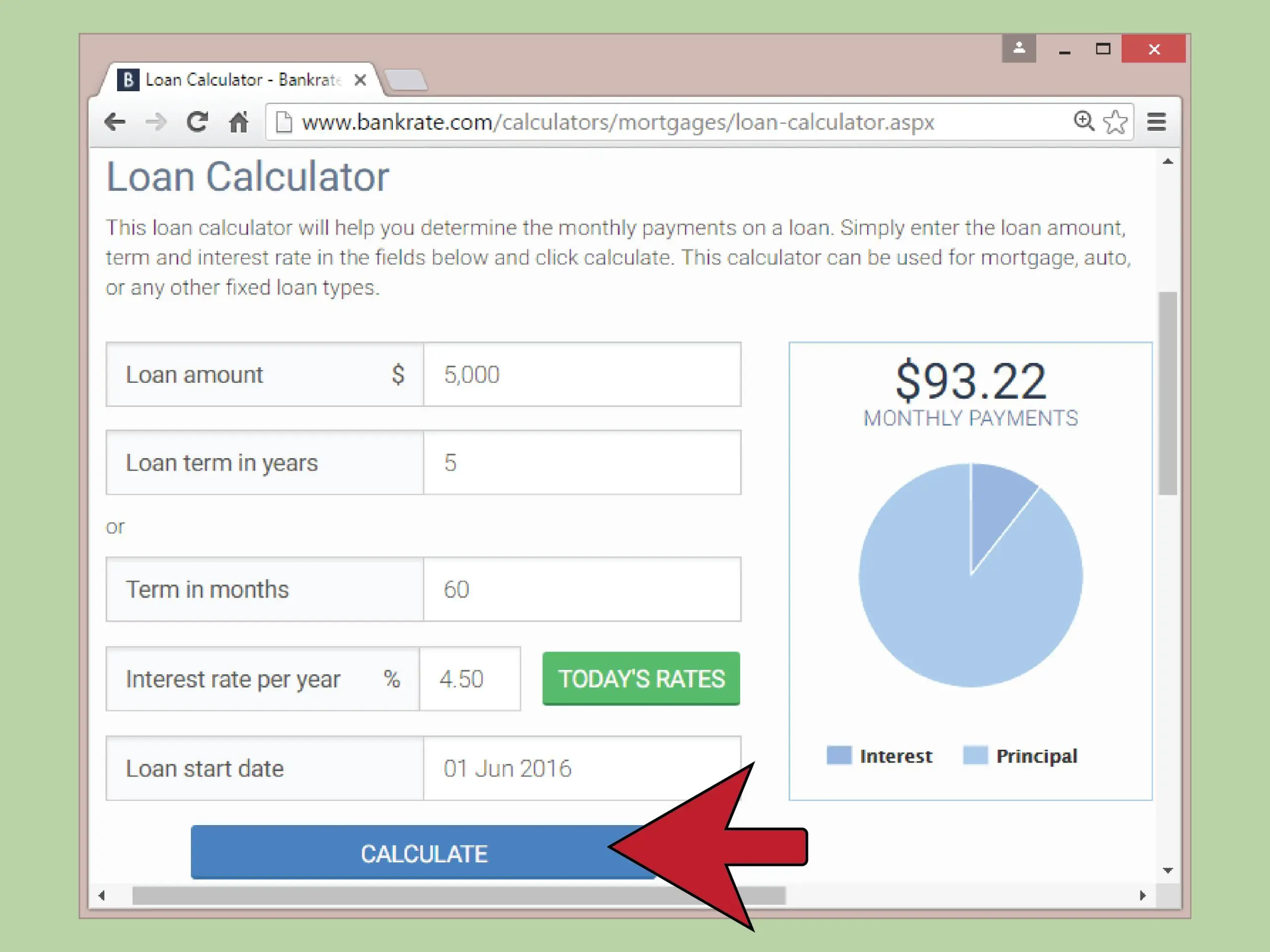

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

My Recommendation For Car Shoppers

Each week, I’ll keep you up-to-date on the latest car deals and news that might affect your purchase. This includes…

- Best Rebates, Incentives, and Lease Deals

- Latest Car Buying Scams and Tricks

- The Best & Worst Time to Buy a Car

- Which Cars You Should Avoid

How To Calculate Car Payment

One of the most common discussions we have with customers deals with matching the right car to a given budget. It can be tough! Weve seen cars that cost less than $10k, one car that cost $138k, and thousands of cars in between. So here are our tips for how to calculate car payment.

To help you better calibrate your car budget and get a better sense for the Shift inventory that matches it, weve created a quick and easy car loan calculator.

You May Like: Who Accepts Carcareone Credit Cards

View Available Inventory Based On Your Budget

Once youve calculated either your max payment or total price, we make it easy to see exactly how many cars in our inventory match your budgeting criteria. This will give you a total price, so remember to factor in tax and extras like warranties or gap insurance.

Youll never need to spend mental energy filtering out cars that arent in your price range again.

How To Get A Lower Car Payment

If it looks like you wont be able to afford the monthly payment for your dream car, dont worry. You can lower your car payment by making a few changes. Check out the following list for tips on how to lower your car payment:

- Pick a cheaper car. One easy way to lower your payment is by reducing the cost of the car, which will lower your loan amount. The lower your loan amount, the less youll have to pay each monthand the less youll pay overall in interest.

- Save for a larger down payment. Your down payment is the money you pay upfront when you purchase the car. If you aren’t in a rush to get a new car, saving for a bigger down payment will reduce your loan amount and could help you lower your monthly payment. Furthermore, reducing the size of your loan with a big down payment may help you lock in other favorable loan terms.

- Shop around for a lower interest rate. When you take out an auto loan, youll be assigned an interest rate that represents the cost to borrow money to pay for your car. Interest is paid as part of your monthly payment, and the lender determines your rate based on your creditworthiness and other factors. If you can lock in a lower interest rate, your monthly payment should be lower as a result. Rates vary by lender, and an improved credit score could help you land a lower one.

If you don’t know your credit score, you can get a free copy of your credit report and FICO® Score from Experian to get an updated view of where your credit stands.

Don’t Miss: Getting Hail Dents Out Of Car

Tips To Calculating Monthly Payments

- Play around with your calculator or spreadsheet program like Microsoft Excel with different interest rates, loan term in months, and amount of loan to find out what monthly payments you can afford.

- Remember, if using a calculator, that the numbers shown in this example are rounded up.

- If you’re still having problems calculating a monthly car payment, ask your accountant or bank manager to help you.

- Interest rates vary from day to day, so call your bank first and find out what the current interest rates are and add one to two points to that rate. By adding one or two points, you’ll get an interest rate that you will most likely be offered by a bank, dealership or credit union.

- Use our Car Buying Strategies to help you get the best deal when car shopping.

- If a dealership’s finance department comes up with a different monthly payment than what you are calculating, ask if there are hidden fees in the purchase price.

It’s easy to calculate a monthly car payment on your calculator or with a mathematical spreadsheet software program. You can find easy ways to calculate online, but learning how to calculate on your own can be gold if you’re stuck at the dealership without access to the Internet.

College Savings Plans: What You Need To Know About 529 Withdrawal Rules

Whether youre saving for your child to go to college or planning the next chapter of your career, you have several options to choose from when it comes to paying for school. The good news is that youre thinking about your options ahead of time, which should help you make the most of your money as you prepare to further your education. 529 plans can be confusing but learning about these programs will help you save money over time as you finance your education, regardless of where you decide to go to school.

You May Like: How To Fix Burn Hole In Leather Car Seat

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand:

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

You May Like: Pa Car Inspection Grace Period

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

How Much Will My Car Payment Be

Monthly payments on car loans are based on multiple factors, so it can be difficult to estimate what youll pay each month until you know the price of the car you want to buy and your specific loan terms. However, by entering some basic information into the auto loan calculator above, you can get a pretty good idea of what might end up paying.

Recommended Reading: How To Remove Duct Tape Residue From Car Window

Can I Get A Loan With A Credit Score Of 600

Auto Loan Calculator: Estimate Your Car Payment

Shopping around for the right auto loan can help you find the best terms but before you start applying, you need to use an auto loan calculator to understand how much your car payment will be and what interest youll pay over the life of your loan.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

More calculators:Refinance car loan calculator& boat loan calculator

You May Like: How Do I Transfer An Electronic Title In Florida

How Does Interest Work On A Car Loan

Interest on a car loan generally accrues every day based on the principal balance or amount you borrow. As you make loan payments, part of your payment amount goes toward principal and part of it goes toward paying accrued interest.

The higher your interest rate, obviously, the more total interest youll pay but the length of your loan also affects your car loan payment. If you choose a loan with a longer repayment term, youll have lower monthly payments because of the longer repayment timeline. If you opt for a loan with a shorter term, your monthly payments will be higher, but youll pay less interest over the life of your loan.

Say, for example, you borrow $20,000 using a loan with a 5% interest rate and 48-month loan term. In that scenario, your monthly payments will be around $461. But if you take 60 months to repay your loan with the same interest rate, your monthly payment will be just $377 at the same interest rate for the same vehicle.

The Formula For Calculating Car Interest Costs

I = P X R X T

- I = total interest cost

- P = loan principal. This is the amount you borrow before interest.

- R = APR. This is the interest rate you will pay on the loan. This number should be expressed in decimal form.

- T = loan term. This is the length of your loan. Make sure that this number is expressed in the same terms as your interest rate. If your APR is annualized and your loan term is expressed in months, divide your loan term by 12 to translate it into annual terms.

Also Check: How To Get A Replacement Title In Florida

Refinancing Your Home: How To Refinance A Mortgage

Refinancing your mortgage is a great way to reduce debt and take control of your finances. There are many reasons to swap out your current home mortgage for a new repayment plan. It all depends on what youre looking to achieve with your new home loan. Use this guide to learn more about the refinancing process to see if this is the right option for you.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

You May Like: How Much Do Car Salesman Make Per Sale

You Set Your Target Payment We Help You Find A Car

Our payment calculator lets you search our inventory for vehicles that match your budget. You tell us what you want to spend and our payment calculator finds the most affordable car for you, helping you save time and money.

Finance disclosures

The Estimated Monthly Payment amount calculated is based on the variables entered, the price of the vehicle you entered, the term you select, the down payment you enter, the Annual Percentage Rate you select, and any net trade-in amount. The payment estimate displayed does not include taxes, title, license and/or registration fees. Payment amount is for illustrative purposes only. Actual prices may vary by Dealer. Payment amounts may be different due to various factors such as fees, specials, rebates, term, down payment, APR, net trade-in, and applicable tax rate. Actual APR is based on available finance programs and the creditworthiness of the customer. Not all customers will qualify for credit or for the lowest rate. Please contact an authorized dealer for actual rates, program details and actual terms.

Finance disclosures

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

Also Check: Zte Mobley Hack

Ways To Negotiate Sales Prices And Online Alternatives To Haggling

Many Americans do not like to haggle for a better deal. However, haggling is commonplace in some cultures. If a buyer will haggle over the price of a new or used vehicle, they stand a chance of obtaining a better purchase price for the vehicle. Haggling simply means that the purchaser makes a counter-offer to the dealer or seller once they have presented the purchaser with a selling price. Haggling is simple negotiation. Dealers in particular have some bargaining leeway when it comes to the purchase price of their new and used vehicles. When shopping, the purchaser has nothing to lose. They should attempt to negotiate a lower selling price. Even a $500 break is often equivalent to a monthly payment. Buyers should always attempt to gert a better price than the asking price of the seller.

For those who are uncomfortable with the prospect of haggling for a better price, some websites offer services that allow users to comparison shop for the same make and model of vehicle. Sites such as CarsDirect and TrueCar allow users to search for a specific make and model in their geographical area. The search results provide the asking prices of various sellers and dealers. The site user may then contact the seller or dealer and even offer a lower price, if the so choose.