What Do You Need To Approve My Car Financing Application

Simply go to our website and fill out the application form. we will then brainstorm the best solution for your needs and contact you to complete the application. The process is very simple and straightforward, with an additional required step to follow if your credit score is bad. Alternatively, you are welcome to call us or leave your phone number and we will walk through the steps over the phone. Overall, your application should typically be approved within a day.

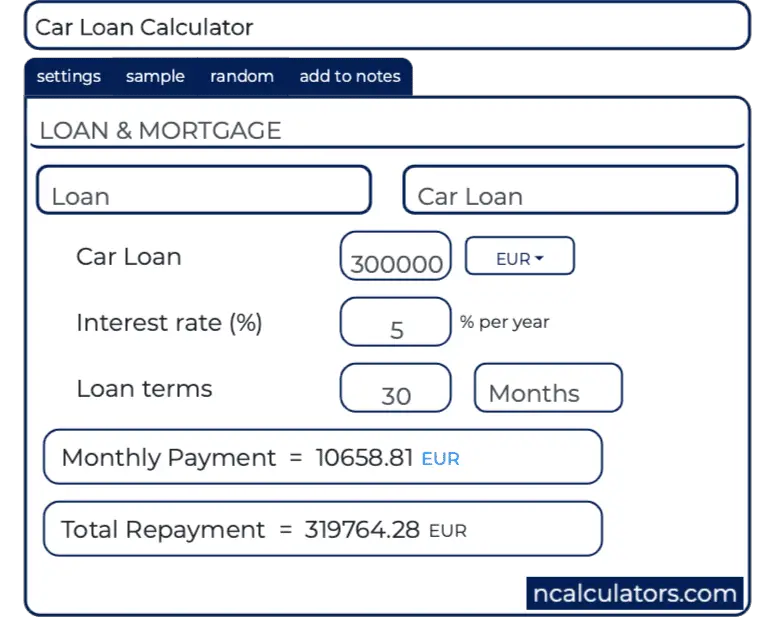

How Can I Calculate My Car Payment

Our loan calculator shows how much a loan will cost you each month and how much interest you will pay overall. It can be helpful to use the calculator to try out different scenarios to find a loan that fits your monthly budgetand the amount of total interest you’re willing to pay.

The best way to get a lower auto loan interest rate is to improve your credit score. If you have a low credit score, consider holding off on a car purchase until you can improve your score.

To calculate your monthly car loan payment by hand, divide the total loan and interest amount by the loan term . For example, the total interest on a $30,000, 60-month loan at 4% would be $3,150. So, your monthly payment would be $552.50 .

If you took a three-month payment freeze on a loan due to a COVID-19-related financial hardship, your subsequent repayments could be slightly higher to compensate.

The longer you take to repay a loan, the more interest you’ll pay overalland you’ll likely have a higher interest rate, as well. Make a down payment, if possible, and aim for the shortest loan term possible with a monthly payment you can still afford. And keep in mind that a car comes with expenses beyond the loan payment. Be sure you’ll have money left over to pay for car insurance, gas, parking, maintenance, and the like.

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 365,673 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

You May Like: When To Move Out Of Infant Car Seat

Calculate Car Loan Interest Payment On Your Own

To start, find the amount, interest rate and the term of your auto loan. The term may be anywhere from 24 months to 84 months but the longer you take, the more interest youll pay. The lender will also factor in your down payment and how much youre borrowing.

Using this information, you can then calculate how much your monthly interest payment will be. Since an auto loan is amortized like student loans and mortgages its a bit more complex than a simple interest calculation. Youll need to first divide your interest rate by the number of payments youre making in a year, likely 12. Then youll take that number and multiply it with the balance of the loan.

To get the monthly interest payment on a $25,000 loan with a 4 percent interest rate with monthly payments, you would take 4 percent expressed as a decimal and divide it by 12, then multiply the result by 25,000. This comes out to an $83 interest payment for your first month. To get the next months interest payment, you would repeat the process with the new loan balance.

Calculating Auto Loan Payments

Don’t Miss: How To Jumpstart Your Car

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount. You can use an auto loan calculator to get an estimate of your amortization schedule.

How Can I Make My Saving Strategy Work

To ensure that you keep making the regular monthly transfers required to achieve your savings goal without accidentally missing a payment, consider setting up an automatic monthly payment from your deposit account into your savings or investment account. You can then rest easy that everything is taken care of so that you’re sipping drinks on your beach or taking possession of your car or house keys just when you expect to, without having to save any longer to achieve your goal.

If you would like some more tips on ways to increase your savings by making changes in your lifestyle, you could try reading about Financial Independence, Retire Early . There’s also a very comprehensive article on Jim Wang’s Wallet Hacks website featuring 105 Easy Ways to Save Money.

Finally, we’ve written our own article with some saving tips for young people. Do take a look!

If you have any problems using our calculator tool, please contact us.

Finance Features

Read Also: Where Do I Find The Paint Code For My Car

Divide Total Interest By Time

Once you have the total amount of interest you will pay off over the life of the loan, divide this number by the number of years you will be paying on the loan to determine the yearly interest payments. You can then divide this number by twelve to determine the amount of your monthly payment that will be applied to interest. An auto loan calculator available on the Internet can aid in this process, which can help you customize your payment options to fit your budget and financial schedule.

Before you take out a loan for a new or used car, you should calculate the auto loan interest that youll end up paying on the loan. Auto loan terms can be hard to understand sometimes, if not misleading.

How To Use The Cleartax Car Loan Calculator

- Use the slider and select the loan amount.

- You then select the loan tenure in months.

- Move the slider and select the interest rate.

- The calculator would show you the EMI payable, total interest and the total payable amount.

- Recalculate your EMI anytime by changing the input sliders.

- EMI will be calculated instantly when you move the sliders.

You May Like: How To Dye Leather Car Seats

Calculate Your Instalment And Interest

If youre curious how the instalment and interest of your fixed-rate car loan is calculated, youll be glad to know that the maths is quite straightforward. First, determine these values:

- Loan amount

- Loan period

- Interest rate

Then, use the following formulas to determine the total interest, monthly interest and monthly instalment of your car loan:

Your total interest = interest rate/100 x loan amount x loan periodYour monthly interest = total interest / Your monthly instalment = /

For example, you have a car loan amount of RM50,000 and a loan period of five years to be paid at a flat interest rate of 2.5%:

Loan amount = 50,000Your total interest = 2.5/100 x 50,000 x 5 = RM6,250Your monthly interest = 6,250 / = RM104.17Your monthly instalment = / = RM937.50

How To Understand The Interest Rate And Other Terms On A Car Loan

Car loans can be confusing, with all of the different terms and interest rates. But understanding how loans work is important if you’re going to finance a vehicle.

Here’s a quick guide to help you understand the interest rate and other terms on a car loan:

Don’t Miss: How To Sell Your Car Online

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

How To Apply For A Car Loan

Here’s what you need to do: First, research different lenders and compare rates. This will help you get the best deal possible. Next, gather all the documents you’ll need, including your driver’s license, proof of income, and proof of insurance.

Then, fill out the application and submit it to the lender. Be sure to read all the fine print carefully before signing anything. You will then need to wait to see if your loan is approved. Applying for a car loan can be easy and hassle-free – as long as you know what to do.

Don’t Miss: How To Switch Car Insurance Companies

How Does Car Loan Emi Calculators Work

- P stands for the Principal Amount. It is the original loan amount given to you by the bank on which the interest will be calculated.

- R stands for the Rate of Interest set by the bank.

- N is the number of years given for the repayment of the loan. As you must pay the EMIs each month, the duration is calculated in the number of months.

Why An Auto Loan Calculator Is Important

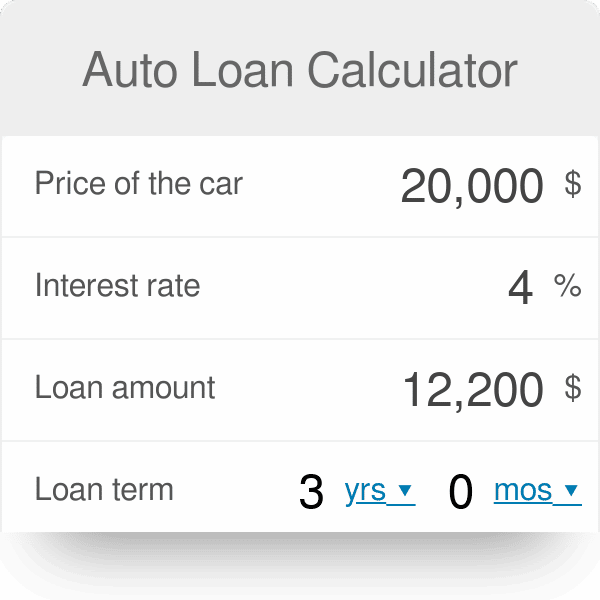

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Don’t Miss: What Does Insurance Cover If Your Car Is Stolen

How To Calculate Auto Loan Interest

Paying for a car using a loan means receiving a lump sum of money from the lender, and then paying it back, with interest added, over a set period of time. The monthly amount you pay back depends on several factors: the amount borrowed, the number of installments and the interest rate.

Typically, car loans are calculated using simple interest, meaning the interest is charged only on the amount owed on a loan. This way it saves money to the borrower, as opposed to compound interest. Amortization is used when paying car loans, that is more interest is paid at the beginning of the term than toward the end.

Here is an example of a monthly payment calculation for a loan of $20,000, paid over a period of 48 months with an interest rate of 8%. If you calculate it using our car finance calculator you can see the monthly payment would be $488.

Alternatively, you can calculate it yourself using the below formula. The result for this calculation or any other combination of loan, interest rate, principal and number of the month will be identical if you calculate it manually or if you use our car loan calculator below.

How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

You May Like: How Hot Does A Car Engine Get

Use A Car Loan Payment Calculator

Skip the hassle of math formulas and get straight to the answer you’re looking for by plugging the necessary information into a loan calculator. A calculator makes it easy to input different combinations of numbers, allowing you to instantly compare the costs of loans.

Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. These variables help you plan ways to reduce your debt. Technically, you can use car loan payment calculators on any of your loans. As long as you know your loan factors, the calculator will work.

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the following:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Recommended Reading: How To Check Water In Car