Car Loan Emi Calculator

Today, buying a dream car is almost within your reach irrespective whether you are salaried or self-employed. You dont need to be wealthy enough or save a fair amount of money to buy your first car, unlike a couple of decades ago. You can simply avail a new Car Loan and drive in your dream car sooner.

You can get a pre-approved car loan, depending on your income and credit score, but subject to maximum loan tenure and the loan amount.

Axis Bank offers Car Loans at an attractive rate of interest, low processing fee, a repayment tenure of upto 7 years, and higher loan-to-value ratio to purchase a new car. The Car Loan is offered even to proprietorship firms, partnership firms, companies, trusts and societies.

To make the loan repayment comfortable, you have the EMI facility. So, before you apply for a Car Loan, as a prudent loan planning exercise, make it point to assess how much would be the EMI on your Car Loan.

- Saves time and energy spent on doing manual calculations

- Helps you ascertain how much will be your Car Loan EMI outgo

- Make loan planning easier for you

Remember, the interest rate and your loan tenure are the vital deciding factors for your loan EMI. Higher the interest rate on the loan, higher will be your EMI and vice-versa. Similarly, opting for a longer tenure reduces your EMI and vice versa. So, consider opting for longer loan tenure when you avail a Car Loan so that repayments can become comfortable.

Broadly there are three ways you can apply:

How To Calculate Monthly Loan Payments

The Balance / Julie Bang

The monthly payment formulas calculate how much a loan payment will be and include the loan’s principal and interest.

Learn how to calculate how much you’ll pay on the most common types of loans and how to decide whether you can afford them or not.

Calculate Your Estimated Apr

To estimate your APR on the loan using a spreadsheet, enter the formula below into a cell. This formula assumes that your monthly payment was either calculated in step 1 or otherwise includes fees. If you didnt calculate your monthly payment in step 1 or arent sure whether the monthly payment youre using reflects fees, keep in mind that this formula may not be the best way to calculate your estimated APR.

=RATE*12

Using the monthly payment you calculated , heres what youd enter into the cell for this loan example.

=RATE*12

Entering the formula above would calculate your estimated APR at approximately 5.6%.

You May Like: How To Restore Clear Coat On Car

How Much Interest Do I Pay On A Car Loan

Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest.

Calculation Of Car Loan Emi

The table below provides you the car loan repayment schedule for a loan amount of Rs.5 lakh, EMI of 10,624, tenure of 5 years, interest rate of 10% p.a. and processing fee of 1%.

| Year |

|---|

| Rs.6,37,411 |

In the above example, if you make a prepayment of Rs.50,000 after paying 4 EMIs:

You will Save Rs.32,505 in total loan amount Loan tenure will be reduced by 7 months

Without Pre-payment

Interest: Rs.1,09,906 EMI tenure: 4 years 5 months

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

You May Like: Fastest Production Car In The World 2021

Car Loan Terms You Need Know

Before we get into it, here are a few terms you need to know:

- Interest rate: The cost of taking out a loan. This depends on the prevailing Base Rate, which can go up or down depending on how the economy is doing.

- Down payment: An upfront payment that youll need to make that covers part of the cost of the car. Youll typically need to pay a minimum of 10% or 20% .

- This refers to the proportion of the cars cost that the bank will lend to you.

- Loan period: This is the length of time that youll have to pay off your loan. Banks usually offer a loan period of up to nine years.

- Instalment: The payment you will need to make every month to clear your loan.

- Guarantor: A guarantor is someone who is legally bound to repay the loan if you are unable to.

How Do I Manually Calculate An Auto Loan

Buying a car often requires taking out a loan to finance a portion of the costs. To calculate your monthly payment, you need to know your loan term, the interest rate and the amount you borrowed. The longer your loan, the smaller your monthly payment will be but the larger the total amount of interest you will pay over the life of the loan. Knowing how much you will pay each month will help you figure out if the loan will fit your budget. You will need a scientific calculator to raise a number to a power.

You May Like: Car Rentals With Aarp Discounts

How To Calculate Auto Loan Payments

This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.There are 11 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 422,416 times.

Buying a new or used car, for most people, is not a purchase made by writing a check or handing over cash for the full amount. At least part of the amount is typically financed. If you do finance a car, it’s important that you understand exactly how much you’ll be paying every month, otherwise you could end up going over budget.

How Does The Car Loan Payoff Calculator Work

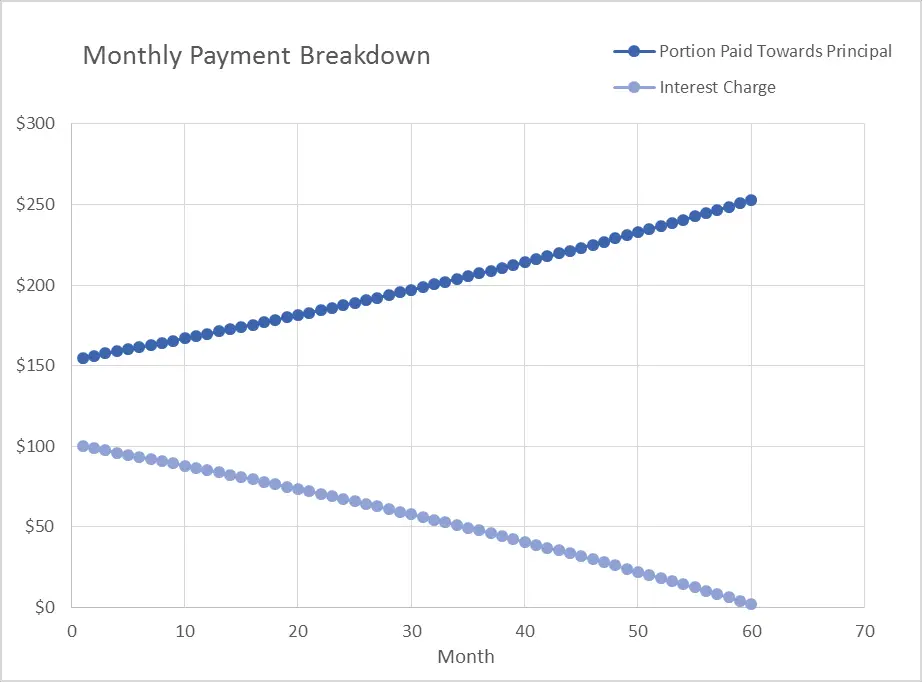

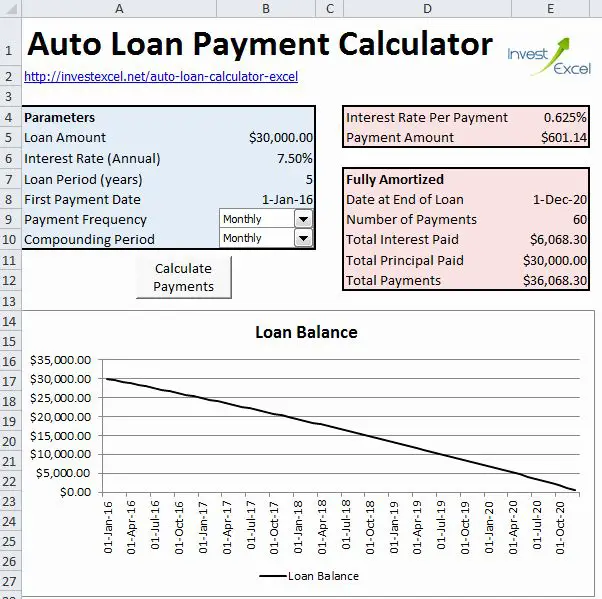

Our calculator helps you work out the costs associated with purchasing a car on credit. Once you have entered the amount, the interest rate and the period of the loan, the calculator will return the total repayment amount, the total interest and the monthly payment figure, as well as full amortization.

Recommended Reading: Can I Use My Synchrony Car Care Card Anywhere

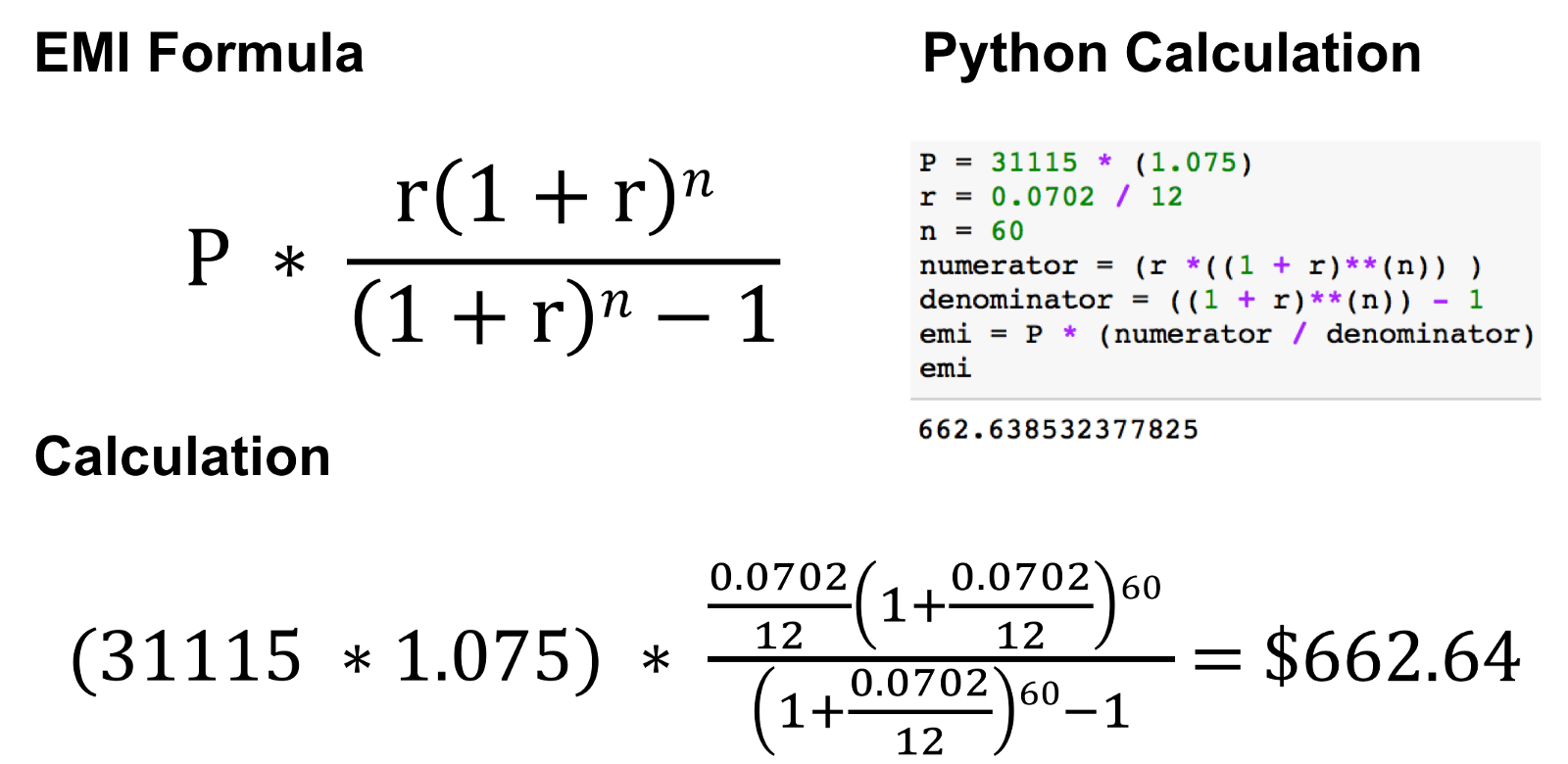

What Is My Loan Payment Formula

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

Tips To Calculating Monthly Payments

- Play around with your calculator or spreadsheet program like Microsoft Excel with different interest rates, loan term in months, and amount of loan to find out what monthly payments you can afford.

- Remember, if using a calculator, that the numbers shown in this example are rounded up.

- If you’re still having problems calculating a monthly car payment, ask your accountant or bank manager to help you.

- Interest rates vary from day to day, so call your bank first and find out what the current interest rates are and add one to two points to that rate. By adding one or two points, you’ll get an interest rate that you will most likely be offered by a bank, dealership or credit union.

- Use our Car Buying Strategies to help you get the best deal when car shopping.

- If a dealership’s finance department comes up with a different monthly payment than what you are calculating, ask if there are hidden fees in the purchase price.

It’s easy to calculate a monthly car payment on your calculator or with a mathematical spreadsheet software program. You can find easy ways to calculate online, but learning how to calculate on your own can be gold if you’re stuck at the dealership without access to the Internet.

Also Check: How Much Money Can A Car Salesman Make

Where To Buy Car Key Battery

Category: Cars 1. Batteries For Key Fobs Best Buy Best Buy customers often prefer the following products when searching for Batteries For Key Fobs. · Energizer 377 Batteries , Silver Oxide Button Cell Best Buy customers often prefer the following products when searching for Car Remote Batteries. ·

How To Calculate Using The Auto Loan Payment Calculator

One needs to follow the below steps in order to calculate the monthly installment amounts of auto loans.

First, we shall enter the principal amount:

Also Check: Do Car Dealerships Look At Equifax Or Transunion

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

How To Calculate Car Loan Emi Amount

Groww follows a standardised formula:

E= P. R. ^n/

The various components of the formula are as follows

| P | |

| The total tenure in months | |

| E | Total EMI payable each month |

As an example, if you borrow Rs 10 Lakh from a financial institution , with the rate of interest 10% , for a total tenure of 7 years , using the formula, your EMI comes to Rs 16,602. The sum payable at the end of the tenure is Rs. 16,602 x 84 or Rs. 13,94,568. Of this, your interest amount payable is Rs 3,94,568.

You can choose from a range of fixed and floating interest rates from our website.

Read Also: The Fastest Car In The World 2021

Auto Loan Calculator Carscom

Estimate your monthly payments with Cars.coms car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

Aug 11, 2021 Use the car loan calculator to see the monthly car payment, total interest and overall loan cost based on different interest rates and loan

What If The Math Still Doesn’t Add Up

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

You May Like: Fixing Burn Holes In Car Upholstery

Car Loan Calculator Jd Power

What finance/car loan interest rate do you qualify for? 3.95% is based on average credit score. 5. Loan Term

Use Carvanas auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments.What is the usual loan term for an auto loan?How do you calculate monthly car payments?

Use our new and used auto loan payment calculator to estimate your monthly payments, finance rates, payment schedule and more with U.S. Bank.

Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for

Heres an example of an annual amortization schedule. Car Price: $20,000. Interest Rate: 4.5%. Loan Term: 60 months. Down Payment: $2,000. Sales Tax: 6%. Titles

Jul 26, 2021 If youve ever applied for a car loan, a mortgage or a credit card, youve probably seen the term annual percentage rate .

Lets calculate a monthly budget that works for you. Vehicle budget APR. Estimated based on your credit rating. How financing works at CarMax.

With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though its there for convenience for anyone who Loan Term: monthsYour State: Select AlabamaAlaskaArizona

Nov 8, 2018 Before choosing your next new vehicle, learn more about calculating your interest rate, how to calculate payments, and more with this guide

How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Don’t Miss: How To Get My Car Title In Florida

Calculate Your Instalment And Interest

If youre curious how the instalment and interest of your fixed-rate car loan is calculated, youll be glad to know that the maths is quite straightforward. First, determine these values:

- Loan amount

- Loan period

- Interest rate

Then, use the following formulas to determine the total interest, monthly interest and monthly instalment of your car loan:

Your total interest = interest rate/100 x loan amount x loan periodYour monthly interest = total interest / Your monthly instalment = /

For example, you have a car loan amount of RM50,000 and a loan period of five years to be paid at a flat interest rate of 2.5%:

Loan amount = 50,000Your total interest = 2.5/100 x 50,000 x 5 = RM6,250Your monthly interest = 6,250 / = RM104.17Your monthly instalment = / = RM937.50

Use A Car Loan Payment Calculator

Skip the hassle of math formulas and get straight to the answer you’re looking for by plugging the necessary information into a loan calculator. A calculator makes it easy to input different combinations of numbers, allowing you to instantly compare the costs of loans.

Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. These variables help you plan ways to reduce your debt. Technically, you can use car loan payment calculators on any of your loans. As long as you know your loan factors, the calculator will work.

Also Check: Can You Lease A Car Through Carvana