Calculate Your Instalment And Interest

If youre curious how the instalment and interest of your fixed-rate car loan is calculated, youll be glad to know that the maths is quite straightforward. First, determine these values:

Then, use the following formulas to determine the total interest, monthly interest and monthly instalment of your car loan:

Your total interest = interest rate/100 x loan amount x loan periodYour monthly interest = total interest / Your monthly instalment = /

For example, you have a car loan amount of RM50,000 and a loan period of five years to be paid at a flat interest rate of 2.5%:

Loan amount = 50,000Your total interest = 2.5/100 x 50,000 x 5 = RM6,250Your monthly interest = 6,250 / = RM104.17Your monthly instalment = / = RM937.50

How To Calculate Effective Interest Rate On A Loan

by Natalia Pratt | Featured article

Effective Interest Rate or EIR is also called Effective Annual Interest Rate, Annual Interest Rate, and subtly, Effective Rate, or Annual Effective Rate.

The actual profit or return that the debt giver receives when the compounding interest and the fees in the case of financial products are taken into consideration is termed as Effective Interest Rate.

Consider a loan taken by you or any credit or investment you have made, like buying a car. After reading this content, you can figure out how to calculate effective interest rate on a loan, car loans, and other such loans.

This blog contains :

- HOW TO CALCULATE INTEREST RATE ON PERSONAL LOAN, CAR, AND HOME

- Steps To Figure Out Loan Interest Rate For Payday Loans

- What Is The Formula Of Calculating Effective Interest Rate On A Loan?

- For What Reason Is EIR Higher Than The Advertised Interest Rate?

- Significance of Effective Annual Rate

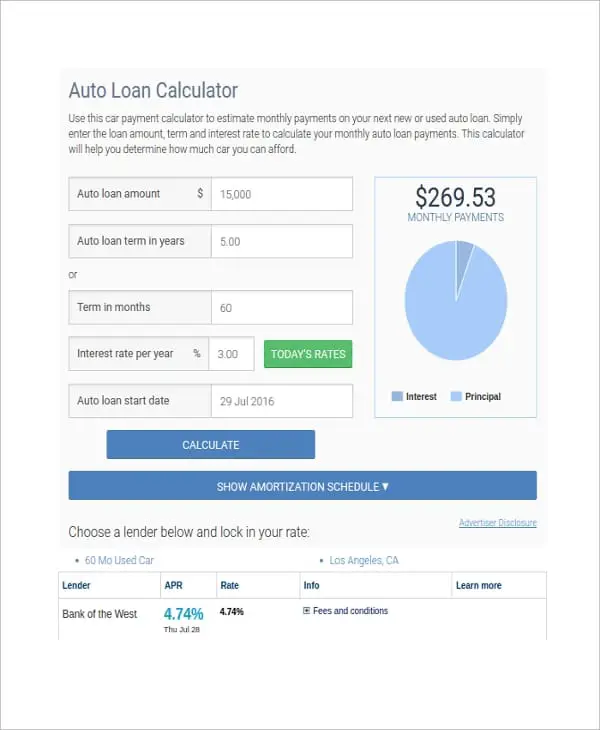

Car Loan Repayment Calculator

Manually calculating your car loan repayments can be long and complicated, and doing it yourself opens up the possibility of human error, which wouldnt be a good thing. Imagine calculating your borrowing power only to be woefully wrong when it comes time to make your repayments! A good lender should be on top of this before approving your application thoughprobably.

Theres no shame in getting an online car loan calculator to do it for you based on your interest rate, loan term, loan amount and payment frequency. In fact, Savings.com.au has one, which you can use on our site.

Also Check: How To Set Up Siriusxm In My Car

How We Chose Our Picks

We examined closed LendingTree auto loans from H1 2022. We wanted to know: 1) which lenders consumers chose most often, and 2) which ones offered the lowest average APR. We also looked at the advertised starting car loan rates of large, national lenders to compare.

To find the best rates for those with military connections, we looked at rates offered by USAA Bank, Navy Federal Credit Union, Pentagon Federal Credit Union and Randolph-Brooks Federal Credit Union, and chose the one with the lowest advertised APR for a traditional new car loan not including any other discounts that may be available, such as breaks for using a car-buying service.

Hyundai To Launch The New Elite I20 In The Beginning Of November

Hyundai is likely to launch the third-generation Elite i20 in the first week of November. The new car has already started arriving at dealerships. Few dealerships have already started bookings for the car for Rs.25,000. The previous model of the car was launched in August 2014. The new car comes with fog lamps, sleep projector headlamps, and a large grille. The interior features of the car include a sunroof, a Bose sound system, a flat-bottom steering, and a 10.25 touchscreen infotainment system. The car is available in both diesel and petrol variants. The car is expected to be priced from Rs.6 lakh and will compete against the likes of the Volkswagen Polo, Honda Jazz, Tata Altroz, Toyota Glanza, and the Maruti Baleno.

22 October 2020

You May Like: Usaa Student Loans Refinance

Don’t Miss: Does Lowes Make Car Keys

Tips For Reducing Average Car Loan Rates

The best way to reduce the average auto loan rates you find is to improve your credit score. This can be done by paying your bills on time and keeping your credit card balances low. Paying your monthly payments in full can also help. Outstanding debts or collection notices can impact your credit score, so paying these off will improve your credit.

However, building your credit score can take time and the advice above may not be practical for everyone, especially those with a limited income struggling to pay minimum balances each month.

There are a few other things that can reduce your auto loan rates:

- Have someone cosign: Many lenders allow you to have another person cosign a loan. A cosigner with strong credit can reduce your interest rates.

- Buy a new car instead of a used one: While new cars are more expensive, lenders typically offer lower auto loan rates for new car purchases.

- Place a bigger down payment: A bigger down payment can reduce your interest rate as well as the amount of time it takes to pay off your loan.

You might also consider trying to pay your loan in a shorter time frame. While this may not reduce your loan interest rate, it will mean that you pay off your loan sooner and will have to pay less interest. However, be sure to read your loan contract language carefully. Some lenders charge a prepayment penalty an extra fee for paying down your auto loan too early.

Where Can I Get An Auto Loan

Several types of lenders make auto loans, including car dealers, major national banks, community banks, credit unions and online lenders. You may get a particularly good deal from a lender you already have an account with, so check their rates first. Compare auto loan rates across multiple lenders to ensure you get the lowest APR possible.

Read Also: How To Install Graco Car Seat Base

How To Calculate Interest Rate On A Car Loan

If youre adamant about doing the calculations yourself , then calculating the regular interest payments on a car loan is done the same way it is with any loan using the standard amortisation formula:

Interest payment = outstanding balance x

So lets say youve just borrowed $20,000 for a car loan , with a competitive interest rate of 6% p.a. making monthly payments. In this case:

- the outstanding balance is 20,000

- the interest is 0.06

- number of payments is 12

So your interest formula looks like: 20,000 x

Therefore, the interest payment in the first month = $100

BUT as you continue to pay off the loan, your interest payments will shrink, with more of your regular repayment going towards paying off the principal. Allow us to demonstrate.

Over five-years, the $20,000 car loan with a 6% p.a. interest rate could require 60 monthly repayments of around $387.

To work out how much interest youll pay in the second month, you need to calculate how much of the loan is left to repay , which you can do using the formula:

Outstanding balance = principal

= 20,000

= 19,713

In this case, after the first month, your remaining loan amount would be $19,713. Using that number we can now calculate what your interest payment will be in the second month.

Interest payment = 19,713 x

= $98.57

See how this number continues to shrink over the first ten repayments:

| Month | |

|---|---|

| $ 86.82 | $17,064.56 |

Fixed Rate Vs Floating Rate Of Interest

Car loans are offered at fixed as well as floating interest rates. The fixed rate will remain unchanged for the tenure of the loan but the floating rate is subject to change from time to time. The different factors that can affect interest rates include applicable taxes, liquidity, inflation, etc.

- Fixed Rate EMI Calculation

- Floating Rate EMI Calculation

Under the fixed rate EMI calculation, the EMI you have to pay towards the car loan remains unchanged throughout the loan tenure. This is so because the company offered a fixed rate of interest for the whole period.

For example, for a car loan equal to Rs.5 lakh at 10% p.a. interest for a 3-year tenure, the interest payable will be Rs.16,134 per month. This will be the amount payable throughout the tenure of the loan.

Under the floating rate EMI calculation method, the EMI payable differs based on the interest rate applicable at the time. The floating rate of interest changes based on the market lending rate.

Lets say you have taken a car loan equal to Rs.5 lakh for a 3-year tenure. The interest rate for about a year is 10% so the EMI payable, as in the example above is Rs.16,134. After completion of 1 year, you have an outstanding balance of Rs.3,36,409. The car loan interest rate at that time is then changed to 8%. So, for the rest of the tenure, the EMI payable will be Rs.15,215.

Note that the interest rate may increase or decrease within the loan period depending on market fluctuations.

You May Like: Why Does My Car Squeak

How Does Our Auto Loan Payment Calculator Work

With our car loan repayment calculator, car buyers anywhere in Canada can calculate their monthly payments. A car payment estimator will allow the car buyer to see how much they have to put aside every month in order to pay for their car loan. Anyone can use this monthly car payment calculator simply by filling in the details required to get the monthly payment amount.

Can You Negotiate Interest Rates On Cars

Yes, just like the price of the vehicle, the interest rate is negotiable. The first rate for the loan the dealer offers you may not be the lowest rate you qualify for. With dealer-arranged financing, the dealer collects information from you and forwards that information to one or more prospective auto lenders.

Recommended Reading: Are Car Lease Payments Tax Deductible

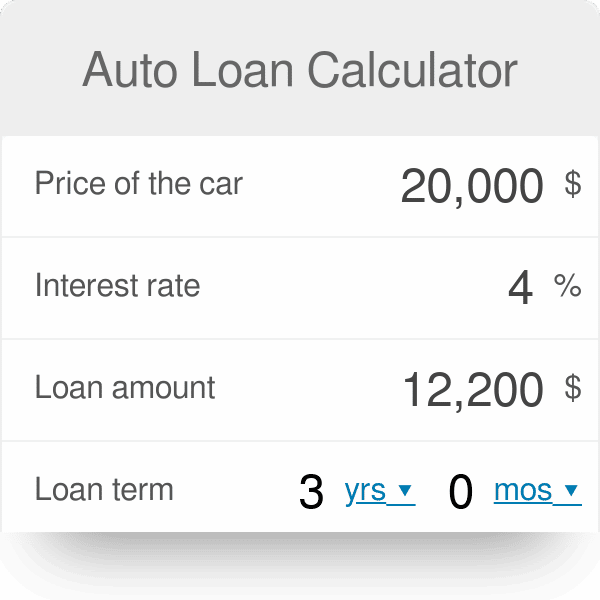

What You Need To Know

Before you can calculate your exact payments, youll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once youve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

Also Check: Can You Refinance An Upside Down Car Loan

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

You May Like: What Is The Weight Limit For Car Seats

Advantages Of Using The Car Loan Emi Calculator

- Break-Up of the Due Amount is Provided: The car loan EMI calculator helps you calculate the processing fees, interest that is paid, the total amount that must be paid, and the principal amount.

- Your Budget can be Planned: Once you know the EMI that must be paid, you can plan your budget accordingly. In case the loan amount that is being availed is large, you may think of opting for a longer tenure. These details can be determined by using the car loan EMI calculator.

- Accuracy: For the details that are being provided on the calculator, the results that are displayed are accurate. Manual calculations may not provide accurate results.

- Saves Time: The main aim of the Car Loan EMI calculator is to save time. Once the relevant details are entered, the results are displayed almost immediately.

- No Limit: There is no limit to the number of times the calculator can be used. Therefore, you use the calculator with different variants. This can help you choose the best lender and the down payment that must be paid.

- Compare: As there is no limit to the number of times that the calculator can be used, you can compare the EMIs for different values.

How Do I Manually Calculate Interest On A Car Loan

You can calculate your interest costs using the formula I = P x R x T, where:

Read Also: How Do You Keep Mice Out Of Your Car

How To Calculate Interest Rate On Car Home Or Personal Loan:

These are loans that are more aptly called amortizing loans.

These are the loans whose mathematical aspects have already been pre-decided and taken into consideration. There is the fixed interest you have to pay continuously, after which the interest and the principal amount are both cleared off.Hence, below youll be taught how to calculate the effective interest rates on a loan.

This is how to calculate the effective interest rate on a car loan:

I = * A

N = Number of repaymentsA = Principle amount creditedLet us consider you are buying a vehicle worth 30,000$ which you have taken for a period of 6 years at a rate of 8.40%, then,

x 30000 = 210$

This is your interest in the first month. Now, since this interest includes the amount borrowed also, the new amount would be:

- New Balance for current month = principle amount .

So now you know how to calculate the interest rate on a car loan. This is how an auto loan interest works.

Calculate Car Loan Interest Payment On Your Own

To start, find the amount, interest rate and the term of your auto loan. The term may be anywhere from 24 months to 84 months but the longer you take, the more interest youll pay. The lender will also factor in your down payment and how much youre borrowing.

Using this information, you can then calculate how much your monthly interest payment will be. Since an auto loan is amortized like student loans and mortgages its a bit more complex than a simple interest calculation. Youll need to first divide your interest rate by the number of payments youre making in a year, likely 12. Then youll take that number and multiply it with the balance of the loan.

To get the monthly interest payment on a $25,000 loan with a 4 percent interest rate with monthly payments, you would take 4 percent expressed as a decimal and divide it by 12, then multiply the result by 25,000. This comes out to an $83 interest payment for your first month. To get the next months interest payment, you would repeat the process with the new loan balance.

Also Check: Can I Take An Abandoned Car

How To Calculate Car Loan Interest After The First Payment

After you start making payments each month, youll pay less toward interest. You can calculate the amount of interest youll pay over time by:

Car Loan Emi Calculator

Calculate how much you may have to pay every month for your car loan with this interactive car loan EMI calculator

The rate mentioned in the calculator is an indicative rate only. The actual rate may vary.Owning your car is an effortless process in todays times. With finances readily available, bring home that dream car for you and your family. At HDFC Bank, we strive to meet your every requirement with utmost convenience and accessibility. We aspire to bring to you, services and facilities to fulfil every want of yours, including that of purchasing your dream car. With our tailor-made Car Loan EMI Calculator, we offer you the provision to identify the exact principal amount, with the interest rate and equated monthly instalments payable over a specific tenure before you intend to apply for your Car Loan.Regardless of whether you are a salaried individual or self-employed, with HDFC Bank, you have the advantage of purchasing a car through our Custom-Fit Car Loans. With the Car EMI Calculator, you only need to input the necessary information whether you intend to buy a new car or a pre-owned car, the sanction loan amount required, tenure of the loan, interest rate and select calculate. The Auto Loan EMI Calculator offers you a detailed view of your yearly principal and interest repayment amounts.

Don’t Miss: What Does Car Title Look Like