When Do You Pay A Deductible

Youll typically pay your deductible directly to the auto repair shop after they complete the repairs. The insurer will deduct your portion from the total they send to the repair shop. For example, in the scenario above, with a $500 deductible, the insurance company would pay the auto repair shop $500, and youd be expected to pay the other $500.

What Coverage Requires Deductibles

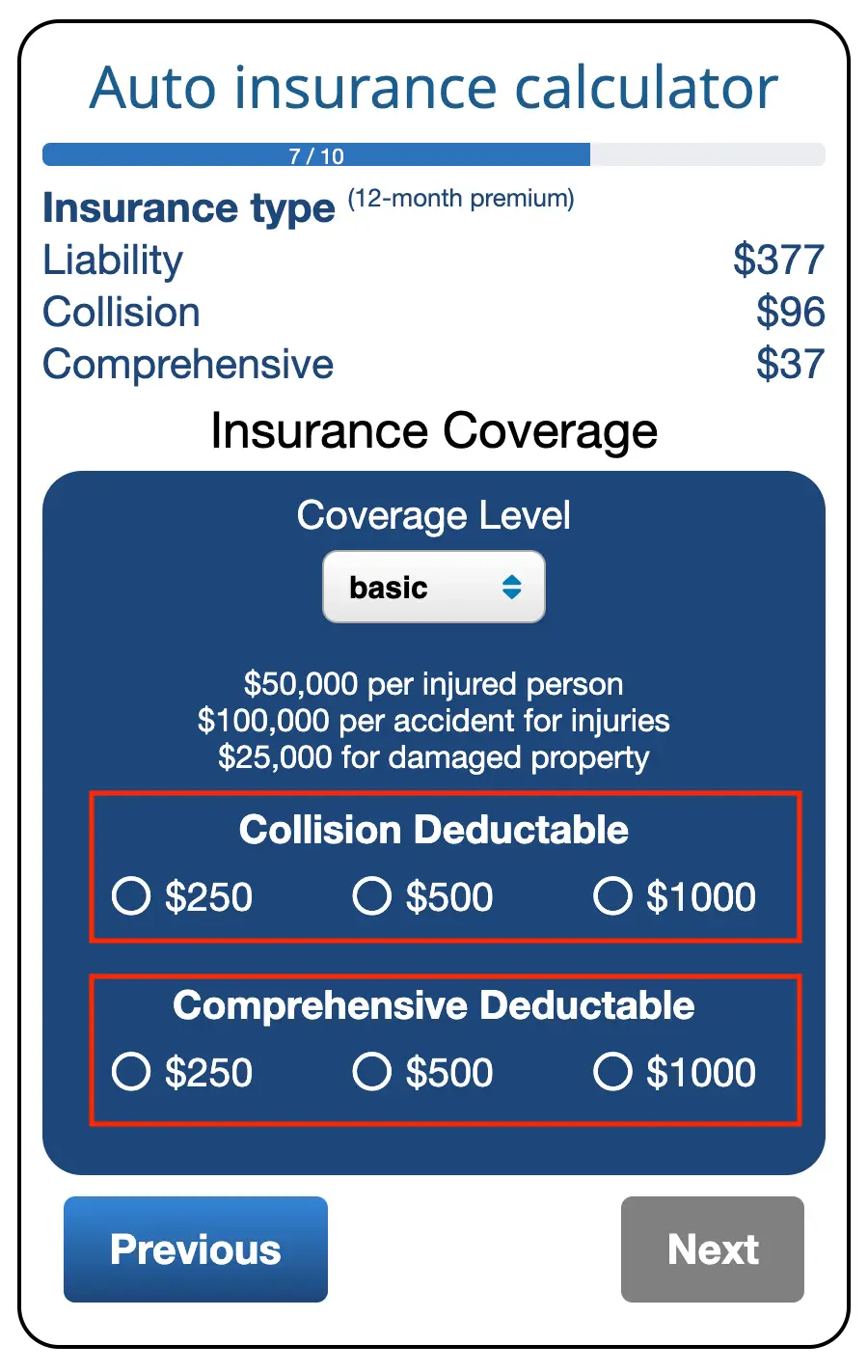

Liability insurance may not require deductibles, but other kinds of car insurance do, according to Esurance. Uninsured motorist coverage may require a deductible, but comprehensive and collision insurance nearly always do. That deductible is typically around $500 to $1,000 and is applied when your vehicle is in an accident and suffers physical damage that needs to be repaired regardless of who’s at fault.

Comprehensive coverage protects you from damage your car incurs when you’re not driving, such as from falling objects, extreme weather, and vandalism. Make sure you keep comprehensive coverage in mind if you drive any of these commonly stolen cars and trucks.

The Complete Guide To How Your Car Insurance Deductible Works

Your car insurance bill can eat up a significant share of your monthly budget. When moneys tight, raising your car insurance deductible may help lower your premium considerably and create extra breathing room for other monthly expenses.

The rate of your deductible directly affects your insurance costs. Raising your deductible amount will lower your premium. By the same token, paying a higher monthly insurance premium does go towards making your deductible lower.

According to a survey by Quadrant Information Services, commissioned by insuranceQuotes, raising your deductible could help you save as much as 28 percent on your premium, depending on where you live.A lower premium may sound appealing, but determining how much of a deductible youre willing to pay for car insurance should be an informed, personal decision.

Backed by market research, the following guide can help you pinpoint the best deductible for car insurance to suit your individual needs and get a better understanding of a car insurance deductibles meaning.

Read Also: Club Car Golf Cart Year

Whats The Cost Of Various Deductible Options

According to McBride, there’s a rule of thumb: When considering deductibles, review any diminishing returns. If the cost of a policy with a $2,500 deductible isn’t much lower than a policy with a $1,000 deductible, the savings may not justify the potential challenge of having to come up with an extra $1,500 after an accident.

You may be able to choose different deductibles for different types of coverage depending on how you assess your own risk or cost concerns. People often choose a lower deductible for comprehensive than collision insurance, McBride said, as comprehensive coverage is generally cheaper than collision.

How Much Will You Save By Raising Your Deductible

The amount you can save by changing your deductible can vary widely.

The survey commissioned by insuranceQuotes, tracked the relationship between car insurance deductibles and premiums, and how much premiums decrease as consumers change their deductibles from $250 to $500, and from $500 to $1,000 or $2,000.

The amount you save by raising your deductible can vary quite a bit depending on what state you live in.

- Raising a deductible from $250 to $500: Bumping up your deductible by just $250 can save you 7 percent, according to the national average.

- Raising a deductible from $500 to $1,000: U.S. consumers, on average, can save 9 percent on their premiums by increasing their deductible from $500 to $1,000.

The biggest savings are in Massachusetts, where consumers can lower their premiums by 17 percent if they make the adjustment.

Other states with sizable savings were South Dakota , Wyoming , Kansas and North Dakota . Consumers in Michigan and Florida saw the smallest savings at 4 percent.

- Raising a deductible from $500 to $2,000: The national average saving on premiums was 15 percent. But the survey found that consumers in South Dakota can save a whopping 28 percent, while consumers in North Carolina saw the smallest savings, only about 6 percent.

Read Also: What Credit Bureau Does Car Dealerships Use

Is A Vanishing Deductible A Good Option

A vanishing deductible is an optional paid addition to your auto policy. Each program works a little differently, but generally, for each year you dont file any claims, the insurer rewards you with a reduction in your deductible. For example, each claim-free year might save you $100 on your collision deductible.

Vanishing deductibles may be a good fit for someone with a good driving history who wants a larger deductible, McBride said. The “vanishing” portion can help bring down the cost if you have to pay your deductible in the event of a claim. These policies tend to be less expensive than low-deductible plans and slightly more expensive than high-deductible plans.

In states with required minimum deductibles, you cant vanish your deductible below that threshold. In New York, as noted above, the collision deductible cant go lower than the state minimum of $100.

How Car Insurance Deductibles Work

Car insurance deductibles work as a prerequisite for filing certain types of claims, ensuring that policyholders dont file frivolous claims by having them pay a portion of the cost up front. Deductible amounts are chosen and agreed upon by the policyholder when purchasing an insurance policy.

Most car insurance companies simply subtract the cost of the deductible from your claim payout. For example, if your mechanic bills $3,000 in repairs and you have a $500 deductible, your insurer will write a check for $2,500 to cover it.

Deductibles work the same for every type of car insurance coverage that uses deductibles. Additionally, car insurance deductibles work very similarly to deductibles for health insurance, homeowners insurance, and business insurance.

| 6% lower than $1,000 deductible |

Note: Rates are for a six-month collision coverage policy, per Progessive.com.

As you can see, increasing the deductible lowers the premium. But notice how little you would be saving by jumping from a $1,000 to $2,000 deductiblejust 6%. The extra $5 each month in your pocket is almost certainly not worth paying an extra $1,000 out of pocket after an accident.

Moral of the storymake sure youre considering value in addition to cost.

Learn more about how deductibles affect car insurance.

Don’t Miss: Fastest Cars In The World 2021

Should I Choose A Low Or High Deductible Amount

Keep in mind that a lower deductible for car insurance normally will result in a higher premium, because youre assuming less of the cost for a claim. And a higher deductible typically will lead to a lower premium, because youre assuming more of the cost if you make a claim.

If you have a car loan, your lender may require a certain deductible amount, so be sure to check before selecting an amount.

Otherwise, there isnt a right or wrong deductible amount, it really comes down to what youre comfortable doing. Generally, if you would rather pay more for car repairs than for insurance, a high deductible might be worthwhile. Consider the following:

- A high deductible might make sense if it doesnt make you feel nervous that you will have to pay more to fix your car if you file a claim.

- You might opt for a high deductible if you have the money already saved to pay the difference between your repair bill and claim payout.

- If you dont live in an area prone to hail, flooding or animal collisions or have a long commute or drive in an urban area, you may be less likely to file a claim, which means a high deductible might not be a bad choice.

When You File A Comprehensive Claim

Comprehensive car insurance covers your vehicle if youre involved in an incident that does not include another driver. Examples of comprehensive claims you may make include theft, break-ins, fires or damage from falling trees. If you have coverage from a comprehensive insurance company and need to file a claim, you will pay your comprehensive coverage deductible.

Also Check: Kill Carpet Beetles In Car

How Do Auto Insurance Deductibles Work

If youve got auto insurance or are shopping around for some you may have heard the term deductible. When you build a car insurance policy, youll have to decide how much of a deductible you want, most often either $500 or $1,000. So what exactly is a car insurance deductible? And how much should yours be? Well help you understand your deductible and whats best for your auto insurance to help protect what matters most.

Is It Better Financially To Have A Low Deductible And A Higher Premium

That depends. Someone with a low deductible/higher premium ratio can go through a 10-year period without filing an insurance claim. The person will end up having paid more money over that time in total premium than someone else with a higher deductible. Alternatively, a person can end up filing several insurance claims in just a few years.

Read Also: How To Keep Animals Out Of Your Car Engine

Average Car Insurance Deductible

The average car insurance deductible is $500, which, if a claim is filed, will generally be less than whatever the cost of repairs are for a serious accident. If the cost of repairs is less than your deductible, you should not file a claim. Your insurance company wont pay for any repairs below the deductible, and filing a claim can cause your insurance premium to rise.

For example, if you get into an accident that damages only your windshield, it may cost around $400 to fully replace it. With a $500 deductible, youd pay the entire cost yourself, rather than your insurance paying for it, and you wouldnt file a claim. But if you get into a covered accident that damages the structure of your car, causing it to need extensive repairs, this could cost upwards of $3500 to fix. With a $500 deductible, you would only pay $500 towards the repairs, while your insurance company would pay the rest.

Accidents May Be Rare But Choosing The Right Car Insurance Deductible Is Still Important

Lets say you just got in a wreck and your car needs $4,000 in repairs, but your insurance will only cover $3,000. If you’re confused, understanding your car insurance deductible might be the answer. In this article, well explain what a car insurance deductible really is, when you need to pay it, and whether you should choose a high or low one.

Whenever you shop for car insurance, we recommend getting quotes from multiple providers so you can compare coverage, rates, and deductibles. In addition to the insurance company you choose, factors such as your age, vehicle make and model, and driving history can affect your premium, so whats best for your neighbor might not be best for you.

Use our tool below to start comparing personalized car insurance quotes or call for an easier process.

Also Check: Who Accepts Synchrony

Uninsured/underinsured Motorist Property Damage

If you are involved in an accident with an uninsured driver or one without enough coverage to pay for your cars damage, or in the case of a hit-and-run, you may be able to file a claim under your uninsured/underinsured motorist property damage coverage. This coverage is not available in every state, but it may have a state-mandated deductible amount in those where it is. In the cases where a deductible applies, it is generally low, between $100 to $300.

The Likelihood Of A Claim

The more likely it is someone will make a claim, the lower they should set their deductible. If someone has a new driver on their policy or lives in an area where accidents are especially common, they’d be better off paying higher premiums for more protection.

But if the chances of a covered incident are unlikely, a driver may be better off keeping their premiums low. Some people could save around $220 annually on comprehensive and collision coverage by switching from a policy with a $50 deductible to one with a $250 deductible. By putting the premium savings into a bank account, a person could have enough money in around a year to cover the added deductible amount. They could then continue benefiting from the premium savings. As long as a driver doesn’t get into an accident in less than a year, they’d be better off.

Also Check: How To Make Car Freshies Last Longer

When It Doesnt Make Sense To File A Claim

Also worth noting is that if your deductible exceeds the amount of repairs needed for your car, it doesnt make financial sense to file a claim. Lets say the repair bill for your car is $800 but your collision deductible is $1,000. In this case, youd be stuck with the entire repair bill because the repair costs are lower than the deductible amount. Theres no reason to file a claim in a case like this.

Also, even if your repair bill is higher than your deductible, you may want to consider whether a relatively low payout amount is worth a potential insurance rate hike at renewal time. For instance, if you have a $1,000 deductible, and you file a $1,600 claim, you would get $600 to fix your vehicle. But if its a collision claim, your insurance company might increase your rates. That means it could cost more for coverage over the long-term, even though you got $600 to fix your car.

What Is A Car Insurance Deductible And How Does It Work

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A car insurance deductible is the amount a policyholder is responsible for paying when making a claim with their car insurer after a covered incident. This has to occur before insurance pays the costs of damages. For example, if a car incurs $5,000 worth of damage in a covered accident and the driver has a $1,000 deductible, they would pay $1,000 of the repair costs and the insurer would pay $4,000.

Key takeaways:

- A car insurance deductible is the amount a motorist is responsible for paying when they make an insurance claim

- People can choose their deductible when they buy insurance coverage

- The higher the deductible, the lower the auto insurance premiums — and vice versa

Read Also: How To Get A Car Title In Florida

Find Cheap Auto Insurance Quotes In Your Area

Changing the deductibles on your policy impacts what you pay in premiums, and is one of the ways that drivers can manage the auto insurance rates and risks they’re comfortable paying. The amount of the deductibles is inversely proportional to the premium, so increasing your deductibles will lower your rates and vice versa. In our analysis, we’ll show how varying deductibles can save drivers money on their auto insurance premiums, and provide some pointers on thinking about deductible and premium trade-offs.

Should I Use My Insurance Deductible Or Just Pay For The Damage Myself

There are situations where you may be better off paying for damage to the car yourself rather than filing a claim. Here is an example :

If you get into an accident and have $550 worth of damage to your vehicle and your deductible is $500, is it worth filing to have your insurance provider pay the additional $50?

Remember, when you file regardless of how much you are responsible for paying it. Since filing could increase your payments upon renewal, you are better off paying for the damage yourself.

Also Check: How Much Do Armored Car Guards Make

How To Choose A Car Insurance Deductible

To choose a car insurance deductible, youll need to determine how much you are willing to pay out of pocket in the event of an accident and how likely you are to have to file a claim. Youll also want to figure out how much a higher deductible may save you in premiums and compare that to how much youd save in an accident with a lower deductible. The most common deductible amount is $500, but companies usually offer deductibles ranging from $100 to over $2,000.

What Is The Average Auto Insurance Deductible

In provinces with private coverage, the average auto insurance deductible is $500 on both collision and comprehensive coverage policies, according to Mitchell. The deductible on a public auto insurance plan may be similar, though specific conditions will apply. In Manitoba, for example, the default deductible is $750 but there are options to reduce or waive it for a fee.

Auto insurance deductibles vary widely based on your province, the type of coverage and even your driving history. Depending on the insurer and the premium you want to pay, they can range from $250 to $2,000, so youll want to speak to your provider about what they can offer you.

You May Like: Making Car Freshies With Aroma Beads

When Do You Pay A Deductible For Car Insurance

You pay your car insurance deductible if you file a claim with your insurance company under a coverage that includes a deductible. This most often applies to damages to your own car, but it can sometimes apply to personal injury protection or underinsured motorist coverage.

After filing a claim, your insurance provider will write you a check for how much the repairs would cost, minus your deductible. For example, if your car has $2,000 in damages and you have a $500 deductible, your insurer will pay you $1,500.

| Coverage | |

|---|---|

| Personal injury protection | Sometimes |