Discretionary Sales Surtax In Florida

Some counties in Florida also impose a discretionary surtax on the purchase of a vehicle. Any discretionary sales surtax is applied in addition to the 6% sales tax.

Floridas Hillsborough county has one of the highest total surtax rates at 2.5%. Hillsborough county is one of the most populous counties in Florida. The 2.5% surtax on top of the 6% sales tax makes it the highest tax rate in the state at 8.5%.

As of Jan. 2019, the county imposed a new 1% charter county and regional transportation system surtax, plus a new 0.5% school capital outlay surtax. In effect already was a 0.5% indigent health care surtax plus a 0.5% local government infrastructure surtax.

Get the full list of Florida counties that collect a discretionary surtax and their tax rates from the Florida Department of Revenue.

Determining Tax On Car Purchase

The taxable total of a purchased car is reached in one of two ways. Some states subtract the value of the trade-in from the purchase price, reducing the taxable total. Other states consider the trade-in as a down payment, which doesn’t affect the taxable total of the purchase.

Some states have specific policies for trade-ins depending on the trade-ins value. It is important to review your jurisdiction’s sales tax laws beforehand.

Is It Better To Sell Your Car Or Trade It In

Many states will credit the value of your trade-in when determining the purchase price for sales tax calculations. This can result in a significant discount off the total amount youll pay. These savings are not available if you sell your car to a third party. Use the calculator above to determine which is a better deal.

Get the latest Car Deals as soon as they come out.

Enter your email to be notified when deals are published

Don’t Miss: Can You Lease Through Carvana

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Sales Taxes In Ontario

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax of 13%. The HST is applied to most goods and services, although there are some categories that are exempt or rebated from the HST.

The HST was adopted in Ontario on July 1st, 2010. The HST is made up of two components: an 8% provincial sales tax and a 5% federal sales tax. These replaced the 8% Retail Sales Tax and 5% federal Goods and Services Tax respectively.

Recommended Reading: How Long To Car Seats Last

How Are Car Rebates And Dealer Incentives Taxed In Ohio

Car dealerships in Ohio and across the United States tend to offer incentives or rebates on the original price of vehicles to increase the number of sales. If you get a $4000 rebate on a car with an original price of $12,000, you pay $8000 after the rebate. The state of Ohio taxes car purchases before the application of rebates or incentives given by the dealership. In this instance, you would pay taxes on the vehicle’s full price of $12,000.

S To Determine How Affordable A Vehicle Is In Ohio

You have the option of purchasing your vehicle through a dealership or private party. To make the right calculation, you need to know that the calculation for how much you’ll pay for Ohio’s sales tax on vehicles is based on the sale price of the vehicle, not including accessories and dealership fees.

Follow these steps provided by Cars Direct to help you calculate the right cost of your vehicle:

Also Check: Does Carvana Buy Any Car

How Much Is The Car Sales Tax In Missouri

The current state sales tax on car purchases in Missouri is a flat rate of 4.225%. That means if you purchase a vehicle in Missouri, you will have to pay a minimum of 4.225% state sales tax on the vehicle’s purchase price.

There may be an additional local tax rate as well, which can go as high as 6.125% or as low as 0.5%. However, the average local tax rate is 2.796%, making the average total tax rate in Missouri 7.021%.

We have seen instances that Missouri can only charge a maximum of $725 in taxes, but we could not verify it through Missouri’s DMV site. It might be worth bringing up at the dealership but plan on paying more than the quoted $725 figure in taxes.

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Recommended Reading: How To Remove Scratches From Car Interior

New Hampshire Dealership Fees

Documentation fees in dealerships in New Hampshire can vary. Dealers can only charge $27 on state document fees, but theres no limit to the administrative fees they can charge. The average for New Hampshire doc fees was $304 in 2011, but it rose since then. Some dealerships charge up to $495 in documentation fees.

Is There A Sales Tax On Used Cars

Yes, theres a sales tax involved in buying used cars. In fact, theres a sales tax involved when buying a car or leasing a car. This goes to the state and its Department of Motor Vehicle. If youre purchasing a car in California, the sales tax will be collected by the California DMV. The sales tax is billed on the receipt you receive from the previous buyer. Then the seller pays the tax to the government.

It is mandatory that the seller provide this bill of sale to the DMV. This is irrespective of whether you buy the car from a dealer or directly from the seller. It should show the sale price, and the DMV representatives will deduct the taxes from the total amount accordingly.

To curb misuse in the form of mutually lowering of price on paper to save money, certain states require the sale price to be linked to the blue book value for the car.

Also Check: Equus Reliability

How To Calculate Missouri Sales Tax On A Car

You can calculate the Missouri sales tax on a car by multiplying the vehicle’s purchase price by the Missouri state sales tax rate of 4.225%. Be sure to subtract any trade-ins or rebates and incentives before multiplying the tax rate.

As an example:

- Let’s say you purchase a new vehicle for $50,000

- Your trade-in vehicle is worth $7,500 and you get a $2,500 rebate

- That puts the cost of the vehicle at $40,000

- Now multiply $40,000 by 4.225%

- This gives you a states sales of $1,690

The example above does not account for the additional local tax rate.

How Is Sales Tax Calculated For A New Car Purchase With A Trade In

Related

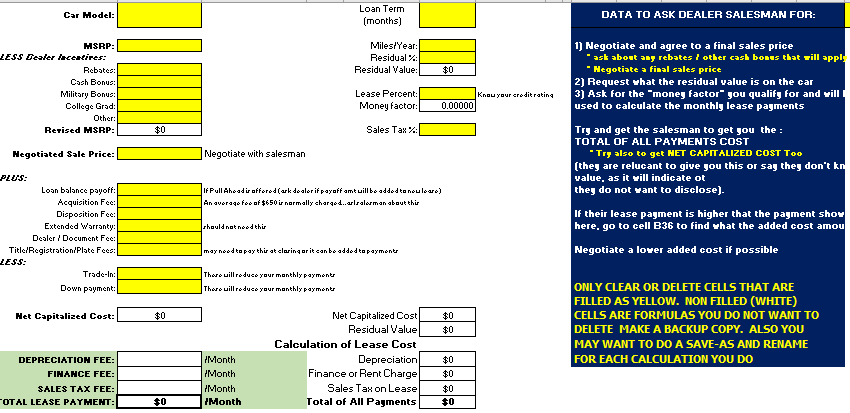

When you are looking to buy a new car, a high-ranking stressor on the long list of things to consider is the cost. When budgeting what you can afford, be sure you don’t overlook the sales tax that is added to the total cost. It may be helpful to calculate the sales tax on a car’s total price beforehand, especially when purchasing with a trade-in that may affect the taxable amount.

Tip

To calculate sales tax on a car when you have a trade-in, you first need to determine the sales tax rate in your home state. Then, you need to know the local rules about whether a trade-in counts toward a down payment or lowers your purchase price.

Also Check: How To Remove Scuff Marks On Car

Is There A Way To Avoid Paying Sales Tax On Cars In New York

Unfortunately, there is no way around having to pay sales taxes on vehicles for New York residents. In fact, the state’s Department of Motor Vehicles has anticipated people buying cars in other states in an attempt to save money and has prevented them from being able to skirt paying taxes once back in New York. Plus, if you purchase a car in another state that doesn’t meet the emission standards of New York, you will be required to pay even more for modifications to the vehicle.

With this information, you should be well informed when making a vehicle purchase in New York State.

Buying A Car In Florida

In Florida, vehicle sales tax is owed on the purchase of any car, motorcycle, truck, trailer or RV. Be sure to consider all other costs before buying a car.

Below is a list of common expenses to plan ahead for.

- Title fee: Your cars title is the document proving that you are the legal owner of your vehicle. This paper may be given to you during a car buying exchange, or you may receive one from the dealer when you buy your car. The title fee in Florida typically costs $75.75.

- Registration fees: these expenses will vary based on the type and size of the vehicle. Registration is$225 for the initial fee but depending on what kind of vehicle you drive and how large it is, it could be higher.

- License plates and tags: The sunshine state is proud to support organizations, causes, and military drivers, so they offer a variety of options when it comes to picking out your plates. Florida also has 120 specialty license plates. If you want to Protect Our Reefs or Fish Florida! or support one of the states colleges or universities, there is a special fee tacked on.

When looking to pay these fees, contact your local Florida Department of Motor Vehicles to pay them directly. To learn more, research the overall cost to own and auto insurance on the new car as well.

You May Like: What Stores Accept Carcareone Card

States With Tax & Tag Charts Only

The following states provideTAX CHARTS& INFORMATION to help you determine sales and/or registration taxes:

Generally, these lists/charts will be organized and broken down by:

- Vehicle model years and weight classes.

- Sales tax percentages.

- Titling procedures.

- Duration of the registration.

If you need help interpreting your state’s chart or have questions about which category your vehicle will fall under,please contact your state’s DMV, MVD, MVA, DOR, SOS, or county clerk’s office directly.

Florida Ev Rebates & Incentives

In addition to federal EV incentives, Florida also offers some state incentives. Two examples are the Jacksonville Plug-In Electric Vehicle Rebate. With this rebate, you can receive a $500 credit for vehicles with a battery of fewer than 15 kilowatt-hours or $1,000 for a PHEV with a larger battery capacity.

The Orlando Utilities Commission also offers a credit for new and pre-owned PEV models. This rebate must be claimed within six months of the green vehicle lease or purchase.

Read more about the EV incentives Florida offers here.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Read Also: Can You Trade In A Lease To Carvana

How Much Does Ohio Collect For Its State Sales Tax

If you own a company, then you can write off taxes you owe on your vehicles. However, check the tax code for limits on passengers and how long you’ve used it for business. What you file on your taxes can affect the deduction you receive or how much you can write off.

According to the Sales Tax Handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of Ohio. You need to pay taxes to the county after you purchase your vehicle and those rates can lead to an additional 2 percent payment at the time of purchase. Ohio’s state sales tax rate can change depending on the type of purchase you make, as listed by Sales Tax States.

The lowest rate you can pay on your sales tax is 5.8 percent in Blacklick, while the highest is Berea at 8 percent. Other tax rates you can pay include 6.5 percent, 6.75 percent, 7 percent, 7.25 percent, and 7.5 percent. If you combine these tax rates, the average is 7.059 percent. Ohio’s Department of Revenue requires dealerships to earn a vendor license so the state can earn tax revenue from vehicle purchases, as stated by Avalara.

Dealerships charge a documentary service fee after the purchase of all vehicles. The Greater Cleveland Automobile Dealers’ Association says that this amount cannot exceed $250 or 10 percent of the price listed on the sales contract.

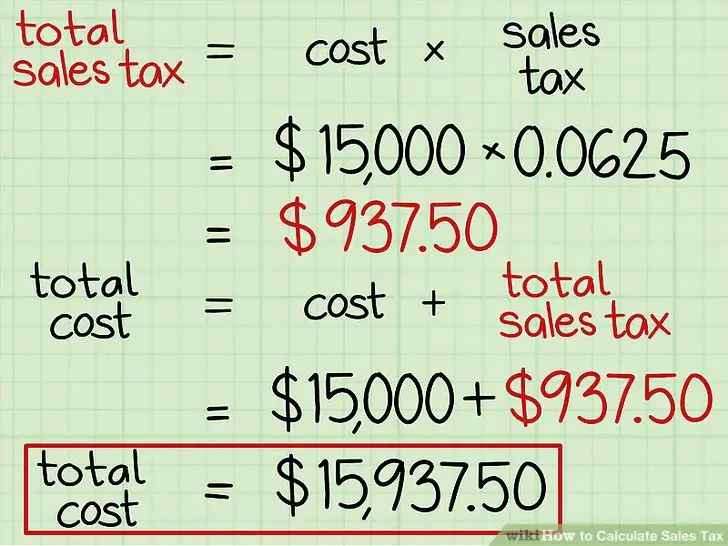

Formula For Sales Tax

Wondering what’s the formula for sales tax? The two ways that sales tax is calculated on a car with a trade-in are the trade-in reduces the taxable total or the trade-in is considered a down payment. If you are in a state where the trade-in is considered a down payment, the sales tax is calculated by multiplying the rate by the purchased car price.

In a state where the trade-in reduces the taxable total, the calculation is as follows:

– = x = Sales tax

Example:

Assume a car purchased in Illinois costs $20,000 and the trade-in is valued at $7,000. The sales tax on a vehicle in Illinois is 6.25 percent.

$20,000 – $7,000 = $13,000 x 6.25 percent = $812.50

You pay $812.50 in sales tax.

Read Also: How To Tell Year Of Club Car

What Are Other Taxes And Fees Applicable To California Car Purchases

If you’re purchasing a vehicle in California, the car dealership should give you full disclosure of the fees you’ll pay before you agree to the purchase. Everquote shares the fees you’ll pay to California’s DMV:

- A title fee is $21 when you purchase a vehicle in California.

- A registration fee can range from $15 to $500 after you purchase a vehicle in California, but you need to pay the fee within 30 days of purchasing the vehicle.

- A plate transfer fee costs $65 following the purchase of your vehicle in California.

- A smog transfer fee costs $8 if the car you purchased is less than four years old.

How To Calculate Colorado Car Tax

If you’re a resident of Colorado and have recently purchased a vehicle, you’re liable to pay Colorado cartax, ownership tax and other fees. Sales tax differs across every state in the US and it’s thus beneficial to research your state’s DMV website to obtain updated information. You could also use a Colorado car tax calculator available online, to get an estimate of the amount you will have to pay. In order to get an accurate figure, bear in mind these guidelines.

Calculating Colorado State Auto Sales Tax:

- The sales tax is calculated as a certain percentage of the net purchase price of a vehicle. The fees that have to be paid along with the taxes are calculated according to the vehicle’s date of purchase, year, weight and taxable component.

- Although the taxes charged vary according to location, the taxes include Colorado state tax, RTD tax and city tax. To cite an example, the total sales tax charged for residents of Denver amounts to 7.72 percent.

- To find out your auto sales tax, take the sales price of your vehicle and calculate 7.72 percent of this price. This is the estimated amount that you will have to pay. For a more accurate figure, visit a branch office in person and keep your title papers handy.

- Apart from this, you’re also responsible for paying ownership tax. To find out how much you have to pay, visit the Denver.gov website. This site is also a good source of information on vehicle registrations, licenses and emission tests.

Related Articles

Read Also: How To Remove Hail Dents From Car Hood

Key Organizations For General Rules And Due Dates

DOR Contact

9 a.m.4 p.m., Monday through Friday

Online

The amount taxed on casual sales is based on the higher of:

- The actual amount paid for the vehicle, or

- The clean trade-in value of the vehicle adjusted by either the high mileage adjustment or the low mileage adjustment

The Registry of Motor Vehicles properly adjusts for mileage at the time of registration. Value adjustments based on the mechanical or structural condition of the motor vehicle are not considered under current sales/use tax law. For example, if the car engine or doors need replacing, the vehicle’s book value will not be adjusted.

If you believe that you have paid sales or use tax on an incorrect book value, visit Request a motor vehicle sales or use tax abatement.

Salvage vehicles

An exception to the above rule is a salvage vehicle. A salvage vehicle is any vehicle that an insurance company:

- Has deemed to be a total loss due to fire, theft, collision, flood, or similar event, and

- Has issued a title stamped or labeled “salvage” by the RMV

If the RMV has titled a motor vehicle titled to the seller as a “salvage vehicle,” the sales/use tax is based on on the actual amount the buyer paid.