How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

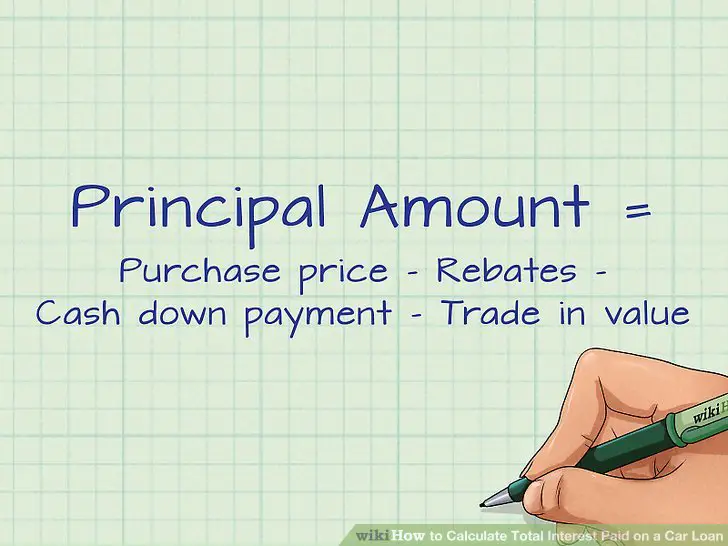

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Apple Carplay And Android Auto Added To The Hyundai Verna S+ And Sx

Hyundai has updated the Verna with wireless features such as the Apple CarPlay and the Android Auto. Recently, the company updated the Creta with several premium features. The Apple CarPlay and the Android Auto will be available on the S+ and SX variants of the Verna. Some of the main features that the Verna is equipped with are wireless charging, sunroof, ventilated front seats, digital instrument cluster, and smartphone connectivity. The Verna is available in both the petrol and diesel variants and comes with a price ranging between Rs.9.19 lakh and Rs.15.25 lakh.

20 May 2021

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Recommended Reading: Registration Cost Texas

How Does The Cash Rate Affect Commercial Interest Rates

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

What Is A Car Loan

A car loan is a type of personal loan taken out to buy a motor vehicle such as a car, ute, 4WD, motorbike or other road vehicle. A car loan can be a helpful form of finance if you need a car and dont have enough savings to buy one, but you can afford to make regular loan repayments.

Your car will typically be used as security for the loan. This means that if you dont repay the loan on time, the lender will be able to repossess your car and sell it to recover the unpaid amount. In some cases, you may be able to take out an unsecured car loan . This type of loan often comes with a higher interest rate and is more common for the purchase of used cars than for new ones.

Also Check: What Credit Bureau Does Car Dealerships Use

Calculation Of Car Loan Emi

The table below provides you the car loan repayment schedule for a loan amount of Rs.5 lakh, EMI of 10,624, tenure of 5 years, interest rate of 10% p.a. and processing fee of 1%.

| Year |

|---|

| Rs.6,37,411 |

In the above example, if you make a prepayment of Rs.50,000 after paying 4 EMIs:

You will Save Rs.32,505 in total loan amount Loan tenure will be reduced by 7 months

Without Pre-payment

Interest: Rs.1,09,906 EMI tenure: 4 years 5 months

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

Is A $500 Because Payment Too Much

A $500 because payment is about average right now. The concept of too much is going to depend on your income and living expenses, your insurance expense, and other budget factors.

Is 700 too much for car payment? According to experts, a car payment is too high if the car payment is more than 30% of your total income. Make sure your car payment does not exceed 15%-20% of your total income. This will ensure you have enough cash in hand to make payments for other loans, utility bills, and household expenses.

Is $2000 a good down payment on a car?

A good rule of thumb for a down payment on a new car loan is 20% of the purchase price. A down payment of 20% or more is a way to avoid being upside down on your car loan .

How much should you put down on a 30000 car? Some lenders don’t require a down payment for a loan, but it’s a good idea to put at least 20 percent down either way, according to Money Under 30.

Read Also: Car Care Credit Locations

Calculate The Total Interest Payment

In order to calculate your interest payments over time, it is necessary to know the total amount of interest due on your loan. Begin by multiplying your loan’s interest rate by the number of years you will be paying the loan off. For example, if you have a 6 percent interest rate on a five-year term, you would multiply 0.06 by 5 to get 0.30. Multiply it by the total amount of money you are borrowing on the loan to get the total amount of interest you will pay over the course of paying off the loan.

If you get a $20,000 loan at 6.0%, you will pay $6,764.51 in interest for the five-year duration, making that a total of $26,764.51. That’s considerably more than you will take out.

Using a monthly payment calculator brings is similar in that it simplifies loan calculations. Enter in the amount borrowed, the interest rate and the time period. Using the same example, your monthly payment would be $386.65.

Both types of calculators give an approximate total, whether its interest or a monthly payment. Fees may alter the numbers given but offer a good estimate.

Car Loan Fees And Charges For Top 3 Banks

Given below is a comparison of a few fees and charges levied by three selective banks:

| Name of the bank | Axis Bank | |

|---|---|---|

| Processing fee | 1% of the loan amount. The maximum and minimum amount that can be charged are Rs.5,000 and Rs.10,000, respectively. | Rs.3,500 to Rs.5,500 |

| 3% – 6% depending on amount of time completed* | 5% of the principal outstanding | |

| Loan cancellation | As mentioned by the bank | Rs.2,500 per instance |

| 2% per month |

Note: GST rates will be applicable over and above the rates charges mentioned above.

*HDFC Bank does not allow foreclosure within 6 months from the day the car loan was availed.

Recommended Reading: How Much Do Armored Car Guards Make

What You Need To Know

Before you can calculate your exact payments, you’ll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once you’ve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

How Much I’ll Pay In Loan Interest

If you borrow $20,000 at 5.00% for 5 years, your monthly payment will be $377.42. Your total interest will be $2,645.48 over the term of the loan.

Note: In most cases, your monthly loan payments won’t change over time. With , the proportion of interest paid vs. principal repaid changes each month. As the loan continues to amortize, the amount of monthly interest paid will decrease .

Read Also: Can I Use My Synchrony Car Care Card Anywhere

Calculate Your Instalment And Interest

If youre curious how the instalment and interest of your fixed-rate car loan is calculated, youll be glad to know that the maths is quite straightforward. First, determine these values:

- Loan amount

- Loan period

- Interest rate

Then, use the following formulas to determine the total interest, monthly interest and monthly instalment of your car loan:

Your total interest = interest rate/100 x loan amount x loan periodYour monthly interest = total interest / Your monthly instalment = /

For example, you have a car loan amount of RM50,000 and a loan period of five years to be paid at a flat interest rate of 2.5%:

Loan amount = 50,000Your total interest = 2.5/100 x 50,000 x 5 = RM6,250Your monthly interest = 6,250 / = RM104.17Your monthly instalment = / = RM937.50

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Recommended Reading: How To Remove Scratch From Plastic Car Interior

Calculate Your Car Loan Repayments

Estimate your monthly car loan repayments with our calculator below.

Use our car loan calculator as a general guide on what your car loan repayments will look like.

This calculator will also tell you how much you may pay in total over the life of your loan. To use this calculator, simply enter your estimated vehicle value, loan term, any initial deposit, and the amount of any balloon payment .

Car Loan Calculator Assumptions

The figures provided should be used as an estimate only, should not be relied on as true indication of your car loan repayments, or a quote or indication of pre-qualification for any car loan product. The figures are based upon the information you put into the calculator. We have made a number of assumptions when producing the calculations including:

- Loan term, vehicle purchase price, and loan amount: We assume the loan term, vehicle purchase price, and loan amount are what you enter into the calculator.

- Interest rates: We assume that the rate you enter, is the rate that will apply to your loan for the full loan term.

- Interest and repayments: The displayed total interest payable is the interest for the loan term, calculated on the entered interest rate.

- Payable over 3/4/5 years figure excludes any balloon payment

-

Available for purchasing new and demo vehicles from dealers only

-

$5,000 to $100,000 loan amount

-

Choose between a low fixed or variable rate

When you get a car loan we lend you the money to buy a vehicle.

Variant Of The Bolero Neo Launched By Mahindra In India

The 2021 variant of the Bolero Neo has been launched by Mahindra in India at an ex-showroom price starting from Rs.8.48 lakh. The car is available from the N4 variant to the N10 variant. The N10 variant is available at an ex-showroom price starting from Rs.10 lakh. The car is available with Android Auto and Apple CarPlay. The front of the car comes with a new look. The length, height, and width of the car are 3,995 millimetres, 1,817 millimetres, and 1,795 millimetres, respectively. The car will be powered by a 1.5-litre diesel engine that is BS6 compliant. The N8 variant of the vehicle will be available at an ex-showroom price of Rs.9.48 lakh. The car will compete against the likes of the Tata Nexon and Maruti Suzuki Vitara Brezza.

16 Juy 2021

Don’t Miss: How To Remove Car Door Panels

The Hyundai Genesis S80 Spotted In Mumbai

The Hyundai Genesis S80 has been spotted testing in Mumbai. The sedan will compete with the likes of the BMW 5 Series and the Mercedes-Benz E-Class. The car made its debut in the global markets in March 2020. However, there is still no confirmation that the car will launch in India. The Genesis line-up was launched in the international markets in 2015. Currently, there are two SUVs and three sedans under the Genesis brand. The car comes with a 4-door coupe design. Some of the main interior features of the car include a 12.3-inch digital instrument cluster, a two-spoke steering wheel, and a 14-inch infotainment unit.

19 February 2021

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Don’t Miss: How To Clean Plastic Car Door Panels

How Is Emi Determined

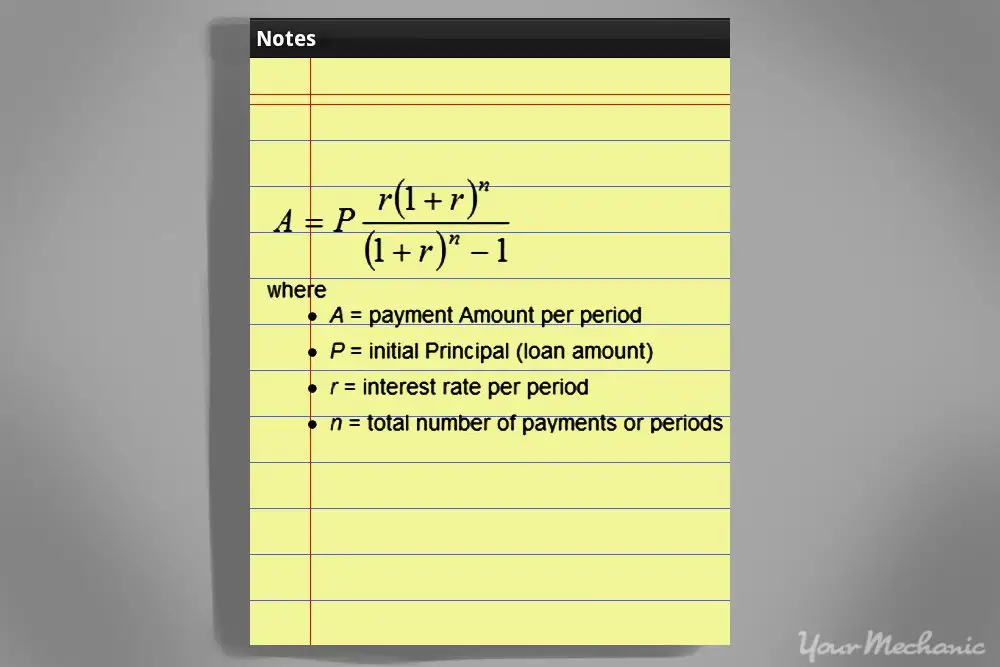

The EMI for any type of loan is essentially calculated using a formula. The formula is as follows:

E = P x R x ^n /

where E stands for the EMI you owe,

P stands for the principal amount,

R stands for the interest rate applicable to your car loan,

and n stands for the tenure of the car loan .

How Does Car Loan Emi Calculators Work

- P stands for the Principal Amount. It is the original loan amount given to you by the bank on which the interest will be calculated.

- R stands for the Rate of Interest set by the bank.

- N is the number of years given for the repayment of the loan. As you must pay the EMIs each month, the duration is calculated in the number of months.

Also Check: Replace Title Florida

Fixed Rate Vs Floating Rate Of Interest

Car loans are offered at fixed as well as floating interest rates. The fixed rate will remain unchanged for the tenure of the loan but the floating rate is subject to change from time to time. The different factors that can affect interest rates include applicable taxes, liquidity, inflation, etc.

- Fixed Rate EMI Calculation

- Floating Rate EMI Calculation

Under the fixed rate EMI calculation, the EMI you have to pay towards the car loan remains unchanged throughout the loan tenure. This is so because the company offered a fixed rate of interest for the whole period.

For example, for a car loan equal to Rs.5 lakh at 10% p.a. interest for a 3-year tenure, the interest payable will be Rs.16,134 per month. This will be the amount payable throughout the tenure of the loan.

Under the floating rate EMI calculation method, the EMI payable differs based on the interest rate applicable at the time. The floating rate of interest changes based on the market lending rate.

Lets say you have taken a car loan equal to Rs.5 lakh for a 3-year tenure. The interest rate for about a year is 10% so the EMI payable, as in the example above is Rs.16,134. After completion of 1 year, you have an outstanding balance of Rs.3,36,409. The car loan interest rate at that time is then changed to 8%. So, for the rest of the tenure, the EMI payable will be Rs.15,215.

Note that the interest rate may increase or decrease within the loan period depending on market fluctuations.