Examine And Evaluate Quotes

Examine the quotations you receive to make sure they contain the insurance coverage you intend to purchase.

Compare premiums and make sure that reductions in premiums are not due to changes in coverage.

Look at the insurance companies from which you are asking quotations to make sure that you feel they are trustworthy. Keep in mind that you are ultimately responsible for the insurance you purchase.

Start comparing car insurance rates now! Enter your zip code below to get started!

Does More Medical Treatment Get You More Money For Pain And Suffering

Generally speaking, the longer that you treat with a doctor, the higher the full value of pain and suffering. Different injuries have different values for pain and suffering. The amount is usually a range . The higher end of the range is if you have a larger resultant disability. In other words, if you have serious limitations as a result of the injury.

The pain and suffering amount should be fair and just in the light of the evidence.

Compare Car Insurance Rates By Zip Code: Most And Least Expensive By State

Car insurance companies assess many factors when setting rates and location is chief among them. Based on the number, severity or cost of car insurance claims within the area, insurers assign ZIP codes to corresponding risk levels. For instance, insurers take into account the frequency of thefts, collisions and vandalism to gauge the likelihood of such incidents happening to drivers within the ZIP code. This is how insurers calculate the premium base rate in most states California is one exception.

Other pricing factors, such as your driving record, type of car you drive and age are added to the calculation.

Below we compare auto insurance rates by ZIP codes in each state to show the most and least expensive neighborhoods for car insurance.

| $4,357 | $1,062 |

To see the most expensive ZIP code for car insurance in every state, see the table below. Enter a state in the search field to narrow results.

Most expensive ZIP code| $658 |

*Methodology:

CarInsurance.com commissioned Quadrant Information Services to provide a report of average auto insurance rates for a 2019 Honda Accord for nearly every ZIP code in the United States. We calculated rates using data for up to six large carriers .

Also Check: How Does Car Sales Commission Work

Is Insurance Required In Every State

Other than New Hampshire and Virginia, every state in the country requires drivers to maintain a minimum amount of liability coverage to drive legally. Depending on where you live, you may also need to maintain other types of coverage, such as uninsured and underinsured motorist or personal injury protection and medical payments.

It may be tempting to stick with the minimum limits your state requires to save on your premium, but you could be putting yourself at risk. State minimums are notoriously low and could leave you without adequate protection if youre in a serious accident. Most experts recommend maintaining enough coverage to protect your assets.

Related Auto Insurance Stories:

What You Need To Know About Driving Records

After a driving violation, you may be deemed a high-risk driver, and your premium could increase accordingly. The severity of your infraction and how many incidents you have on your driving record will impact how much your car insurance premium increases. For example, the average full coverage premium increases by over $1,400 per year after a DUI conviction but only by $388 annually for a speeding ticket.

Also Check: Zte Mobley Hack

$31k Paid For Pain And Suffering Damages

On July 30, 2018, Shankeva was a passenger in her boyfriends car. They were stopped at a red light in Holly Hill, Florida. In the diagram below, Shankeva was in V3.

Terry was driving vehicle 1. Terry crashed head on into vehicle 2. Vehicle 2 then hit Vehicle 3.

Paramedics arrived at the scene.

You can see them taking Shankeva out of the car.

Below, is a photo showing the damage to the car within which Shankeva was a passenger.

The front of the car was wrecked.

You can see this was a heavy impact accident.

Here is a photo of Shankeva on a stretcher:

An ambulance took her to the hospital.

At the hospital, doctors took x-rays, a CT scan and a MRI of her hip.

The x-ray showed an acetabular fracture. Here is what the acetabulum looks like:

Since she had this fracture, they had her stay at the hospital.

They gave her a room.

While at the hospital, someone took a photo of her:

After she was released from the hospital, she had to use a walker to get around.

Shortly after her accident, Shankeva got a free consultation from me. She did not want to handle her pain and suffering claim without an attorney.

After we spoke, she hired me.

Learn How To Shop For Auto Insurance

Before you get to the dealership and sign on the dotted line, be sure to check in with your American Family Insurance agent. Compare quotes on the various makes and models youre considering as you shop for car insurance. Youll have the information you need to review your budget and verify expenses before you buy. And youll also find real peace of mind knowing that youve got the protection you need when youre out cruising in your new ride.

Also Check: Car Title Transfer Az

State Farm Insurance: 45 Stars

We rate State Farm with 4.5 out of 5.0 stars and find it’s the best option for young people and students. That’s because State Farm offers the best student discount in the industry of up to 25 percent.

State Farm drivers can also take advantage of the Steer Clear® program. It’s an educational app that improves driving skills and can award more discounts. Like Geico, State Farm also has a financial rating of A++.

To learn more, read our full State Farm insurance review.

% Of The Settlement Was For Pain And Suffering

As you can see, 90% of the settlement was for her pain and suffering:

When an insurance company makes a settlement offer, they do not factor in your attorney fees.

The rest of this $100,000 settlement paid for her out of pocket medical bills and health insurance lien.

After my attorneys fees, costs, and paying of Saras medical bills and health insurance liens, she got $56,504 in her pocket for her pain and suffering.

Her pain and suffering multiplier was a little under 10 times her final out of pocket medical bills and health insurance lien.

She was happy with her settlement.

Read Also: Car Care One Credit Card Locations

What To Do If Your Car Insurance Premiums Increase

In some cases, your car insurance premiums may increase.

Re-evaluate your needs

Review your insurance needs with your insurance company. You may want to consider asking about the following options for lowering your car insurance premiums:

- raising your deductible

- dropping collision coverage if your car has a low resale value

- a package deal for insuring your home and car, or more than one car, with the same insurance company

Shop around

Shop around, get quotes and compare prices from different companies and brokers to make sure you’re getting the best deal.

Factors That Determine Your Car Insurance Rates

As the tables above show, car insurance companies employ many different methods to assess your risk as a driverand, as a result, the price of your monthly premiums. Some of the most common factors driving up your monthly auto policy cost include:

- Age: On average, young drivers are less experienced behind the wheel and pay more than older drivers.

- Gender:On average, young men tend to drive more recklessly and therefore pay more than young women.

- Car Type: What car model you drive impacts your insurance rates. A luxury or sports car driver will face higher premiums for their speedy ride with expensive parts.

- Location:For a variety of reasons, certain states have higher average car insurance rates, and urban drivers usually pay more than rural ones.

- In many states, a poor credit score will increase your auto premiums.

- Education: Students are considered lower-risk and are often offered discounts or lowered rates.

- Mileage:If you spend lots of time on the road, youre statistically more likely to get into an accident, so your premiums will be higher.

- Driving Record:Accidents, moving violations, and DUIs will all substantially raise your rates.

You May Like: Car Freshie Beads

Ways To Lower Your Premiums

Having just paid for weeks worth of driving lessons, a driving test and the prospect of maintenance, car tax and fuel on the horizon, expensive car insurance is the final nail in the financial coffin. As such, its important new drivers try to reduce the financial burden of motoring especially as the majority are young drivers without high income or much in the way of savings. Here are eight ways you can lower your premiums.

If A Court Gives You Money For Future Medical Bills Do They Have To Give You Money For Pain And Suffering

No. In Allstate Ins. Co. v. Manasse, 707 So.2d 1110 , Myrda Manasse was injured in an automobile accident with an uninsured driver. She sued Allstate Insurance Company, her uninsured motorist insurer, for compensation.

The jury found that Manasse suffered a permanent injury. They awarded her $10,000 over a forty-year period for future medical expenses, $2,000 for past pain and suffering, and zero for future pain and suffering.

The court said that it was OK that the jury didnt award money for pain and suffering, even though they awarded money for future medical bills.

Also Check: Car Freshie Kit

Insurance Companies Use A Range For Pain And Suffering

Claims adjusters use a range when placing a value on the pain and suffering component in an injury case. For example, an adjuster may say that the pain and suffering of a typical broken wrist in a Florida injury case is between $35,000 and $70,000.

There is no exact standard for measuring pain and suffering. However, accident attorneys and adjusters have a good idea of the full value pain and suffering. They know these values by looking at their own past Florida jury verdicts and settlements.

Policy Limits And Deductibles

Car insurance always has a policy limit , which is the maximum amount the insurance company will pay for each type of coverage.

If you set low policy limits, your premium will be lower too. Just dont aim too lowyou dont want to face legal or medical costs totaling hundreds of thousands of dollars when your policy only covers half of that.

Your deductible is the amount you pay before the insurance company starts chipping in. If your policys deductible is low , then your premium will be high. Thats because youre asking the insurance company to cover more costs for you.

But if you choose a high deductible, youll pay lower premiums because youre lowering the insurance companys risk of losing money. Its totally a you-scratch-their-back, theyll-scratch-yours situation.

Also Check: Commision Rate For Car Salesman

I Settled Her Case For $120k Because Proving Fault Was Hard

Take a look at their email to me:

Proving liability was tough in her case. Her accident happened during the day, and we didnt have good photos of the hazard.

Thus, I settled her case for a big discount of the full value of her case.

In May 2020, I settled her case for $120,000.

I estimate that about 72% of the settlement was for pain and suffering.

The pain and suffering multiplier was about 3.5 times the final out of pocket medical bills.

This would have been a tough case to evaluate with a pain and suffering calculator.

Why?

Because most pain and suffering calculators do not factor in your percentage of fault.

If her fall would have occurred at night, she would have gotten more money. This is because she may not have been able to see the warning tape that she tripped on.

Take a look at the settlement check:

Since Tiffany did not have health insurance or Medicaid, she owed the hospital a lot of money. However, they greatly reduced her bill. Thus, most of Tiffanys settlement was for pain and suffering damages.

Tiffany was happy that she did not handle her pain and suffering claim without a lawyer.

You can watch a video about Tiffanys pain and suffering claim here:

Amount & Type Of Coverage

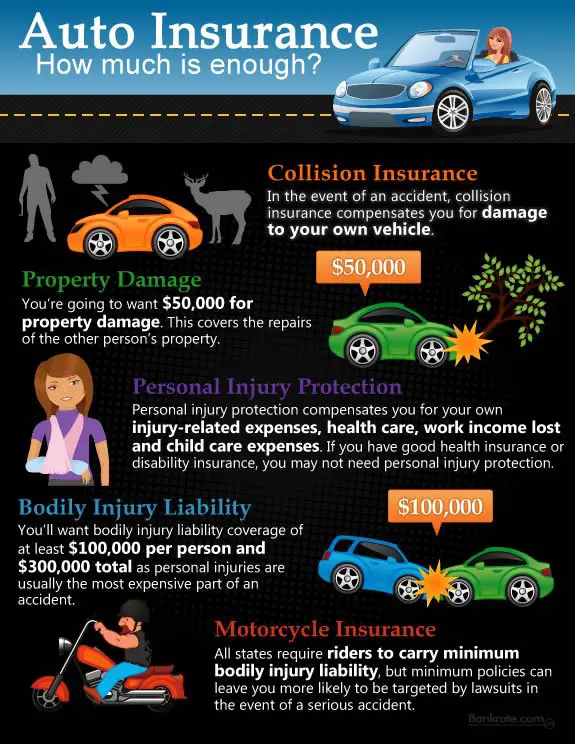

Most states require drivers to purchase a minimum amount of coverage. State minimum car insurance requirements vary by location and could include:

- Bodily Injury Liability: This coverage protects you financially if a driver listed on your policy is responsible for an accident that injures another person . Bodily Injury Liability will help cover the costs of their medical expenses and pay for your legal services, if necessary.

- Property Damage Liability: If you causes an accident that damages another persons property, Property Damage Liability will kick in. This coverage typically covers damages to the other drivers car, but it can also include damage to things like a fence, mailbox, home, or storefront.

- Personal Injury Protection: Also referred to as PIP coverage or no-fault insurance, this coverage helps you and your passengers pay for expenses resulting from an accident, regardless of who is at fault. PIP coverage varies by state, so be sure to check the requirements with your insurance agent.

- Uninsured Motorist Coverage: Unfortunately, many people on the road are driving uninsured. Thankfully, theres Uninsured Motorist Coverage! If youre in an accident caused by an uninsured driver, or if the driver cant be identified due to a hit-and-run, this coverage helps pay for your expenses.

You May Like: How To Remove Scuff Marks From Car Interior

What Additional Factors Affect My Car Insurance Rate

There are even more factors that can affect your car insurance rates besides location, coverage levels, age, gender, car type, driving history, and credit score. The cost of car insurance can also be influenced by:

-

The company you choose: Even if you live in a state where rates are higher than average, some companies offer more competitive rates than others, which is why itâs important to shop around.

-

Discounts: Some of the most common car insurance discounts include savings for bundling policies, completing a driving safety course, and paying your annual policy in full.

-

Insurance history: You may pay more for car insurance if you’ve had past coverage with a high-risk provider or if you have a lapse in coverage on your record. If you have a history of consistent coverage and on-time payments, on the other hand, you could see lower rates.

-

Your annual mileage: If you use your car often, your auto insurance will cost more than for someone who drives infrequently.

-

Your job and education: In some states it’s illegal for insurers to use your occupation and education to set rates. However, in many places you could pay more for car insurance if you’re unemployed or if you didn’t graduate from college.

Examples Of The Auto Insurance Coverage Under An Umbrella Policy:

Pile-ups

The primary auto insurance policy can only do so much in a multiple vehicle collision. “Most people do not realize that if they get into an accident and hit multiple cars or injure multiple people, there is a cap on the primary auto policy. That is why is recommended to have an umbrella policy that sits over and above these limits,” said Clement.

Loss of income

If an accident takes a neurosurgeon out of commission for six months, you may be at risk for their loss of income. According to the 2012 MGMA Physician Compensation Report, a surgeon makes on average $775,968 a year. For those six months they spent recuperating, their foregone salary totaled $387,984. The foregone salary alone would have cleared out your maximum policy with approximately $88,000 out of pocket, assuming you had the highest level of protection from Geico and without factoring in the cost of medical care. In this case, an umbrella policy could protect you from paying the additional damages, particularly if you are a high net worth individual.

Recommended Reading: Walmart Car Key Copy Price

Pay Attention On The Road

To put it another way, drive safely. This should go without saying, but in this day and age of increased in-car distractions, its worth repeating. The more alert you are, the fewer accidents or moving offenses you will encounterevents that will raise your insurance costs. Depending on your driving record, Travelers offers safe driver discounts ranging from 10% to 23%.4

For those who arent aware, a motorist is usually given points for moving offenses, and having more points can result in higher insurance prices .

Reasons Car Insurance Rates Vary

Vehicle insurance rates can differ one car to the next and even between drivers. Most car insurance companies will have their insurance agents collect information about your car when developing a quote. Theyll also ask you about your preferred coverage limits, which can adjust the cost of your car insurance policy.

Agents will look at state-mandated coverage requirements to be sure youre getting the protection you need to drive legally. Heres an in-depth look at some of the individual factors that can influence your rates.

Age. Your age can influence the average cost of car insurance. Rates usually go down for drivers after they turn 25, but young drivers can get lower rates by enrolling in our Teen Safe Driving program, which tracks driving performance.

The KnowYourDrive app is able to produce a trip summary that scores young drivers performance. Parents love it because it can also help them keep an eye on their childrens whereabouts.

If you get married or divorced, its best to connect with your American Family Insurance agent as soon as possible to let them know of the change. Usually, this will mean youll be changing your policy, whether youre including your new spouse or removing your ex.

You may be able to save money on car insurance with a good credit rating. Insurance brokers and agents will review your FICO credit score, which can impact your final price.

Read Also: How Many Square Feet Is A 2.5 Car Garage