Consider Ppm Or Telematics Insurance

If you dont drive many miles and are a careful driver, you could save some money with pay-per-mile or telematics insurance. PPM programs are offered by Esurance and Metromile. Both companies use devices in your car to track the number of miles you drive annually. In the case of Esurance, if you drive fewer than 10,000 miles, your premiums will be less.

Esurance’s PPM program isn’t available in all states or for hybrid or electric vehicles.

Several major insurance companies go a bit farther and use a telematics device to track your driving behaviors, including jamming on the brakes, speeding, and driving after dark. The discount you receive for being a careful driver is either a percentage or a dollar amount .

What To Do If Your Car Insurance Premiums Increase

In some cases, your car insurance premiums may increase.

Re-evaluate your needs

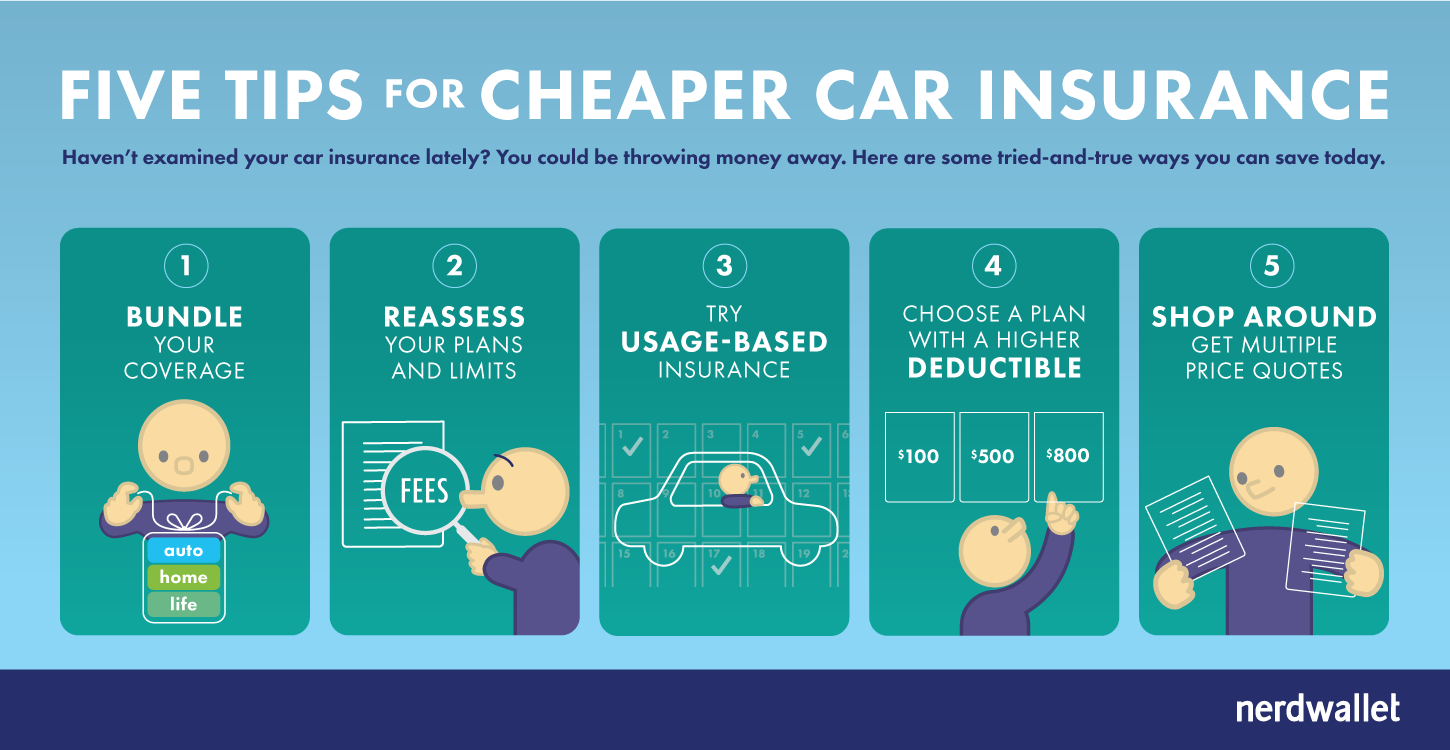

Review your insurance needs with your insurance company. You may want to consider asking about the following options for lowering your car insurance premiums:

- raising your deductible

- dropping collision coverage if your car has a low resale value

- a package deal for insuring your home and car, or more than one car, with the same insurance company

Shop around

Shop around, get quotes and compare prices from different companies and brokers to make sure you’re getting the best deal.

Most Affordable For Drivers With An Accident

Compared to the average driver, drivers with an accident on their record can expect to pay an average of $813 more than those without an accident on their record.

Unlike with tickets, MoneyGeek found that State Farm is the cheapest widely available insurance company. If you have an at-fault accident, it’s a good place to start when shopping for cheap insurance.

One way to keep rates low in the event of an accident is by purchasing accident forgiveness coverage with your car insurance. This option can help you avoid a rate increase in the event of an accident when you are at fault. Companies such as Allstate, Nationwide and Geico offer this option.

State Farm offers affordable car insurance policies. At $1,583, State Farms annual premium is 28.1% lower than the average cost to insure a driver with an accident on their record.

Although GEICO isn’t the cheapest option for this type of driver, it still offers some of the most affordable rates available. And USAA remains the cheapest option if you’ve been in an at-fault accident and have a military background.

The Cheapest Car Insurance Companies for Drivers With an Accident

Scroll for more

- $3,114

Also Check: How To Make Your Own Car Freshies

How Long Can You Stay On Your Parents Insurance

Theres no age limit for staying on your parents insurance. The only requirements are that you live in the same household as them and have their names on the title of your car. As long as you meet those two qualifications, you can stay on their insurance indefinitely.

Can you put insurance on a car that is not in your name? No. The policyholder, in most cases, needs to be the one who has title to the car. Talk to your parents once youve got your drivers license to figure out how youll handle insurance costs.

Check Out Local And Regional Companies

Large car insurance companies spend billions on advertising every year, but smaller insurers may be able to provide the cheapest premiums in some cases. So, when youre shopping around, make sure to compare quotes from companies of all sizes. You can use WalletHubs cheap car insurance guide as a starting point. Just click on your state to compare the cheapest insurers.

Car insurance premiums are based on drivers individual risk factors as well as the coverage types and limits they choose. Check out WalletHub’s full guide on the factors that affect car insurance rates for more information.

Should you keep full coverage on a paid off car?

No, you do not need full coverage on a paid off car. Full coverage car insurance is only necessary when a car is not paid off yet and the lender requires full coverage, as there isnt a legal requirement to carry full coverage anywhere in the United States. Insured drivers always have the option to add full coverage to their paid off car if they want to, though, and it can be a good idea.read full answer

For example, you should have full coverage on a paid off car if you want to make sure your insurance will pay for the car to be repaired or replaced, especially if the unexpected expense would be a financial hardship. Without the collision and comprehensive insurance thats usually part of full coverage, youll have to pay for damage to your vehicle yourself in the event of an accident, theft or other incident.

You May Like: Repair Burn Holes In Car Seat

Why You Shouldnt Try To Weasel Out Of The Required Coverage

If youre looking to save money on auto insurance, you might be tempted to try some sort of strategy, like adding collision and comprehensive coverage to your basic auto insurance policy in order to satisfy the lender, but then drop it later to save money.

Bad idea!

Whenever you finance a car, the lender becomes an official lien-holder on the vehicle. That basically makes them a joint owner of the car. As such, they will require that they are listed as the loss payee or as an additional insured on your auto insurance policy. In fact, your auto insurance provider will specifically ask if there is a lien-holder on your car.

Once that is established by the insurance company, it will also be recorded on the title to your vehicle with the state Department of Motor Vehicles . That record will be available to your lender, and the DMV may alert the lender about changes in your coverage.

Should the lender find out about the deleted extra coverages shortly after purchasing the vehicle, but before the loan has been paid in full, they can accelerate the payoff of your loan.

Since you will have violated the terms of the loan, they will be legally entitled to repossess your vehicle, and sell it in satisfaction of the loan. And if the proceeds from the sale are insufficient to fully satisfy the loan, they can take legal action against you personally, forcing you to make good on any shortfall.

Adding An Older Named Driver To Your First Car Insurance Policy

Instead of parents adding a child to their insurance, the opposite could result in reducing the cost of insurance for new drivers.

If a new driver adds a parent to their first car insurance policy, the price of the policy could come down. That’s because the insurance provider will see an older and more experienced driver sharing the vehicle, and using it for some of the time, and may offer a cheaper price.

Again however, its important that the older driver does use or intend to use the car to avoid invalidating the insurance at a later date.

You May Like: Automatic Transmission Grinding Noise When Accelerating

Your Policy And Deductibles

When you are choosing your car insurance deductible and coverages, the specifics play a role in your monthly payment.

- Generally, choosing a higher deductible means a lower monthly payment.

- Choosing a lower deductible means a higher monthly payment.

Any additional coverage you add typically gives you added insurance protection, depending on the claim, but will also add to your monthly cost.

One way to lower insurance costs is to review your policy with your insurance agent and eliminate any coverage you may not need, such as comprehensive coverage on an older vehicle, rental reimbursement or emergency roadside service.

How Much Does Car Insurance Cost

Car insurance costs are different for every driver, depending on the state they live in, their choice of insurance company and the type of coverage they have. But when trying to save money on car insurance, it helps to know what the typical driver pays.

On average, the typical person spent $1,190 on car insurance in 2018, based on the latest figures available from the National Association of Insurance Commissioners . According to the NAIC data, car insurance premiums rose 30% between 2014 and 2018, despite the number of insured vehicles only rising by 7%.

Data from AAA put the average cost of car insurance for new vehicles in 2020 slightly higher, at $1,202 annually. The numbers are fairly close together, suggesting that as you budget for a new car purchase you may need to include $100 or so per month for auto insurance.

Also Check: Car Salesman Hours Per Week

Choose A Sedan Over A Sports Car

Vehicle type is an essential factor when it comes to car insurance costs. For example, something like a Camry a four-door sedan that earned the top-safety pick from the Insurance Institute for Highway Safety will be a cheaper option to insure than a muscle car that focuses on performance, like a Mustang.

Sports cars and expensive luxury cars, in general, will be more expensive, too.

Find Savings For Younger Drivers

As new drivers on the road, teen drivers inherently come with a higher risk than more experienced drivers. That higher risk is reflected in more expensive car insurance rates. To keep rates down, parents should add teen drivers to their existing family policy. In addition, shop around for good student discounts for teens with specific grade-point averages as well as college student discounts attending school a minimum distance away from home.

Read Also: Places That Accept Car Care One Credit Card

Does Your Car Insurance Go Down After Your Car Is Paid Off

It might, but only if you change your coverage selections. Financing a vehicle doesnt directly impact your car insurance premiums, but your lender likely requires you to carry full coverage, which can increase the price you pay. Once you pay off your loan, you could remove full coverage and have a liability-only policy, which would likely reduce your premium. However, you might want to talk to your agent first. Full coverage can be a good idea even if you own your car outright.

How Do I Add A Driver To My Auto Insurance In Ontario

It is rather straightforward to add a driver to your auto insurance. You will follow similar steps as if you were doing a quote. You should contact your insurer. Provide them with the driverâs information and licence number. They will ask you some questions about their driving history.

You do not need to add an occasional driver if they are only using your vehicle one time. For example, lending your car to a neighbour or a relative who is visiting on vacation. You are required to add licenced drivers who reside in your home and use your vehicle occasionally.

You May Like: Colombo Car

How Much Does Car Insurance Cost By Credit Score

Statistically, drivers with poor credit file more claims and have higher claim severity than drivers with good credit, according to the Triple-I. This means that, in general, the better your credit rating, the lower your premium. Your insurance credit tier is determined by each car insurance provider and is based on various factors it probably wont exactly match the scores from Experian, TransUnion or Equifax as it is a , not a credit score. The table below showcases how credit can affect your annual full coverage car insurance premium.

California, Hawaii, Massachusetts, Michigan and the state of Washington do not allow credit to be factored in when setting auto insurance rates.

| Average cost of full coverage car insurance by credit score |

|---|

| Poor |

*16-year-old rate reflects the premium increase for adding the teen driver to their parents auto policy.

Decide Whether You Need Comprehensive And Collision Coverage

In nearly every state, drivers are required to have a minimum amount of liability insurance, which covers you for any damage you do to another driver’s car and for any injury to that driver. Consumer Reports advises drivers to go beyond these state minimums and purchase liability insurance that covers $100,000 per person, $300,000 per incident, and $100,000 for property damage.

However, you may be able to save money on your insurance by canceling your comprehensive and collision coverage. Collision coverage is for damage to your own car if you have an accident involving another vehicle or an object, such as a telephone pole. Comprehensive coverage protects you from a non-collision-related loss, such as theft, vandalism, or damage caused by bad weather, a falling object, or an animal.

Consumer Reports recommends canceling C& C coverage if the annual premiums for it amount to 10% or more of your cars book value.

Recommended Reading: Removing Scratches From Car Interior

Should I Lease Or Buy A Car

When you purchase a vehicle with an auto loan, you keep the vehicle after paying it off. You can also drive as many miles as you like without restriction. While the monthly payment for a lease is often less than the payment for a loan, you will pay less overall for a vehicle when you continue to drive it after the loan expires. However, you’ll also take the impact of the vehicle’s depreciating value as well as the full cost of vehicle maintenance and upkeep after your car is out of warranty.

Instead of making loan payments to a finance company, leasing involves a monthly payment for use of a vehicle long-term. Since lease payments don’t have interest, they usually cost less than auto loan payments. However, unlike with an auto loan, you don’t own the car and have to turn it in at the end of your lease.

Many drivers would rather lease than purchase a vehicle so they can trade up for the latest model every few years. You also avoid the cost of depreciation, a significant loss for car owners with loans who may end up owing more than the vehicle is worth.

Leasing also comes with certain drawbacks. For example, Policy Genius notes that you’ll be making monthly payments the entire time you drive the car, while you can eventually pay off your auto loan and own the vehicle outright. It’s also important to review your leasing contract carefully since most companies restrict your mileage and have other conditions you must follow.

How To Get Cheaper Car Insurance For Your Teenage Driver

If your teen has started driving, youve probably made a few jokes about how everybody in your neighborhood should take cover. Ah, yes, making fun of teenage drivers and their abilities behind the wheel. Its hilarious.

Until you get your new car insurance rates.

As youve probably heard, add a teenage driver to your policy and the average car insurance premium can go way up. As much as 80 percent, according to InsuranceQuotes.com.

Drivers aged 16 or 17 are nine times more likely to cause an accident than a 45-year-old driver. Thats why car insurance companies charge them three to four times more than they would typically charge people from safer categories, said Tony Arevalo, an insurance agent with Carsurance.net.

Still, there are some ways to hold down insurance costs when you have a teenage driver in the family.

Don’t Miss: Who Accepts Carcareone Card

Monitor Your Teen Driver To Ensure A Clean Driving Record

As with drivers of any age, ensuring your young driver keeps a clean driving record is a great way to keep car insurance costs down. Conversely, accidents and tickets will dramatically increase car insurance costs for your 16-year-old. Its especially important to monitor your teen driver while they are in that 1617 age range when crashes tend to be statistically more likely.

Improve Your Credit Score

Good credit can also influence your insurance rates, and about 95% of auto insurance companies use your insurance credit score when setting your premiums in states where it is legal to do. Your insurance credit score is a special type of credit score that is designed to quantify your risk to an insurer.

Nationwide uses the following aspects of your insurance credit score when determining premiums:

- Your payment history, including late payments and failure to pay

- The length of your credit history

- The types of credit in your history

Read Also: Remove Scuff Marks From Car Interior

Before You Buy A Car Compare Insurance Costs

Before you buy a new or used car, check into insurance costs. Car insurance premiums are based in part on the cars price, the cost to repair it, its overall safety record and the likelihood of theft. Many insurers offer discounts for features that reduce the risk of injuries or theft. To help you decide what car to buy, you can get information from the Insurance Institute for Highway Safety .

Cheapest Car Insurance For Drivers With Bad Credit

One of the personalized factors car insurance companies consider when determining your car insurance rates is your credit score. In general, those with higher credit scores file fewer claims than those with lower credit scores. In MoneyGeeks study, the average premium for drivers with poor credit is $2,670, while the average premium for average drivers with good credit is $1,424.

Drivers can still find cheap insurance with poor credit by shopping around, with USAA and GEICO among the cheapest on average.

For most drivers, GEICO is the cheapest car insurance company if you have bad credit. The average annual premium of $1,681 is nearly $1,000 less than the average annual premium for the category.

USAA is also an affordable option, but it is only available to military families.

According to the National Association of Insurance Commissioners , car insurance companies may offer higher rates to drivers with lower credit scores to compensate for the elevated risk that you’ll make more claims.

The Cheapest Car Insurance Companies for Drivers With Poor Credit

Scroll for more

- MetLife$4,248

California, Massachusetts and Hawaii prohibit car insurance companies from using credit scores to evaluate drivers, so drivers in these states will not have to worry about how their score affects their insurance rates.

Don’t Miss: How To Remove Car Door Panels