Overview Of Comprehensive Vs Collision Insurance

- Comprehensive insurance covers damage to your car caused by something other than a collision, such as a fire, natural disaster, falling object or vandalism.

- Collision insurance covers repairs to your own car when you hit another vehicle, an object like a tree or fence, or a road hazard like a guardrail.

- Neither comprehensive nor collision insurance covers damage to someone elses vehicle.

- The cost of comprehensive and collision insurance is determined largely by the value of your car.

What Does 50/100/50 Or 100/300/100 Mean

Your liability coverage is a group of three numbers. These numbers represent, in thousands of dollars, the amount of coverage the policy provides. A 50/100/50 policy offers coverage in the amounts of $50,000/$100,000/$50,000.

The first number represents your bodily injury liability coverage per person, meaning each person in the other vehicle is covered for up to $50,000 for medical bills. The second number is the total your insurance will pay for bodily injury liability claims for the entire accident. The third number is the total amount your insurance company will pay for property damage in an accident.

For example, imagine that your liability coverage is 50/100/50, and you rear-end another car on the highway with three passengers inside. Two of them sustain minor injuries, each requiring $1,000 in medical care, but the third is severely injured and requires $80,000 worth of treatment. You caused $62,000 in property damage.

Your insurance payout would be:

- $1,000 for the first person.

- $1,000 for the second person.

- $50,000 for the third person.

- $50,000 for property damage.

Even with $100,000 worth of bodily injury coverage available, the $50,000 per person cap leaves you with $30,000 of medical liability and $12,000 of property liability out-of-pocket.

What Does Full Coverage Typically Include

Full coverage is generally used to describe having multiple insurance types that provide a wide variety of coverage options. Typically, this includes a minimum of liability, comprehensive and collision coverage. Even the best auto insurance companies have no standard definition of full coverage insurance, but it could include a combination of insurance types with some options being incremental to full coverage:

Don’t Miss: How Much Does A Car Salesman Make Per Car

Do You Really Need Comprehensive Car Insurance

Approximately 77 percent of insured drivers have comprehensive coverage, according to the III. To help you decide whether to get this coverage or not, here are some questions you should ask yourself.

- Are you still paying for the vehicle? If your car is financed, you may be required to get comprehensive insurance, along with collision coverage and liability insurance.

- How old is your car? You wont need comprehensive coverage if your vehicle is worth less than your insurance deductible combined with annual coverage. Carriers wont pay out more than your vehicle is worth. If you forgo this insurance, however, make sure to set money aside for the cost of repairs or even a new car.

- Where do you live? This insurance covers vandalism and theft, which tend to be common in urban areas. The risk of natural disasters is another reason to get this coverage. Floods can easily cause serious damage to your car or even total it if you live in an area prone to flooding.

- Where do you park your vehicle? Your car may be more at risk if you tend to park it on the street instead of in a garage.

Enter your zip code in this tool or give our team a call at to get your free car insurance quote:

When Should You Opt For Rental Car Insurance

Sometimes its worth it to buy rental car insurance. This depends on if you:

Its up to you to do your research before renting a car.

Knowing how much your auto policy covers for a rental car will prevent you from signing on for coverage from the rental car company that you dont need. Itll save you money from paying for the same coverage twice.

Looking for car insurance? The Cover app compares rates from over 30 different providers to find you a competitive rate.

Cover will get you an auto quote in as little as five minutes. All you have to do is answer a few short questions.

Read Also: What Year Is My Club Car Golf Cart

What Is Liability Coverage

Liability insurance is required by most states and covers the cost of damage and injuries to others you cause in an accident.

In other words, liability insurance does not cover damage to your own car or injury to yourself only damage to others for which you’re legally liable. Liability coverage is split into two different components: bodily injury liability and property damage liability.

Bodily injury coverage will cover the cost of the other person’s injuries if you are at fault for the accident, up to the policy’s limits. Policy limits normally show two figures:

- The maximum amount paid per person injured in an accident

- The maximum amount paid for the entire accident

Typically, the total amount is double the per-person limit. For example, a policy might limit coverage to $15,000 per person injured and $30,000 for all injured people.

Property damage liability coverage pays for damage to other vehicles or property when you are at fault. The policy limit for this type of coverage is listed as a single-dollar amount, which represents the maximum payout per accident. However, this does not cover damage to your own vehicle.

If you live in a state that does not require car insurance, like New Hampshire or Virginia, you’re still financially responsible for injuries and property damage resulting from an accident. So, we recommend you buy some sort of coverage.

Are Comprehensive Insurance Policies Expensive

You might assume comprehensive car insurance costs more than third party or third party, fire and theft, but thats not always the case. Sometimes comprehensive insurance is the cheapest option.

Our data shows that 50% of people who use Compare the Market could achieve a quote of £536** for a comprehensive annual policy. But for third-party car insurance, 50% could achieve a quote of £1,387***.

Its hard to say exactly how much youll pay as insurance providers look at various factors, such as how old you are and where you live. Your premium price will also depend on your cars make and model, what insurance group your cars in, how much its worth and how many miles a year you drive.

But always compare the price of comprehensive cover with third party and third party, fire and theft because you could well find it costs less.

**50% of people could achieve a quote of £535.64 per year for their fully comprehensive car insurance based on Compare the Market data in May 2021.

***50% of people could achieve a quote of £1,386.56 per year for their third party car insurance based on Compare the Market data in May 2021.

You May Like: How To Burn Mp3 Cd For Car

What Is Full Coverage Car Insurance

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Advantages And Disadvantages Of Comprehensive Insurance

Comprehensive auto insurance protects you financially from theft, natural accidents, and weather-related damage. This insurance means you won’t end up paying out of pocket if a tree falls on your car or a thief takes off with it in the night.

There are downsides. If you are in an accident, comprehensive insurance won’t pay for the damage. And comprehensive insurance may be expensive if you are purchasing it along with collision insurance. If your vehicle is older and paid off, you could save money by not purchasing comprehensive coverage, especially if theft and weather-related events are not concerns where you live.

-

Comprehensive coverage protects you against theft, weather-related events, and other major things beyond your control.

-

Comprehensive coverage often covers “unforeseen events” like break-ins or broken windshield wipers due to hail.

-

If you own a new car and live in a high-crime area, comprehensive insurance will cover the damages caused by any break-ins or thefts.

-

Comprehensive insurance doesn’t damage caused by a collision.

-

It may not be necessary to have for an older car with high mileage.

-

Comprehensive insurance doesn’t cover anything personal stolen from your car.

-

It doesn’t cover damage due to pot holes.

Recommended Reading: Equus Bass Cost

Why Choose Comprehensive Coverage

Consider the risks of not having this coverage. Are the savings enough to cover the cost of repairing or replacing the vehicle?

- Is your car a high-value vehicle?

- Do you live in an area prone to weather-related disasters?

- Is there a high rate of car theft where you live?

- How much can you afford to pay, or are willing to pay, out of your own pocket if you are involved in a loss that isnt covered by collision insurance?

To help you figure out if you should purchase comprehensive coverage, you should estimate the approximate value of your vehicle through an online resource like Kelley Blue Book. Let a State Farm agent help you determine the value of your vehicle along with how much extra you’d pay to add comprehensive coverage.

Do I Need Full Coverage Car Insurance

Full coverage is a preference unless required by a lender. Although full coverage costs more than liability-only insurance, it does offer financial protection in more situations. Because full coverage usually covers physical damage incurred by the insured vehicle while its parked, its commonly chosen for vehicles in storage or not being driven for any length of time.

Don’t Miss: How To Clean Dirty Leather Car Seats

Whats The Difference Between Full Coverage And Liability

The difference between full coverage and liability-only insurance is the extent of insurance coverage provided. Liability-only insurance usually covers property damage or medical expenses caused to others as a result of an at-fault accident.

Conversely, full coverage typically includes liability coverage and extends to cover the insured drivers own injuries and vehicle in an accident. It also usually covers property damage or medical expenses, regardless of fault. In most states, liability insurance is required, however, full coverage is optional.

For the most protection for a vehicle, full coverage policies are a top choice. Generally, a car with this type of policy will be protected against the widest range of potential incidents and occurrences, whether the car is on the road or parked in a garage.

Explore MAPFRE Insurances wide range of car insurance value programs and customize a Massachusetts policy that fits your needs. If youre located in another state, the Agent Locator can help you find an independent agent closest to you.

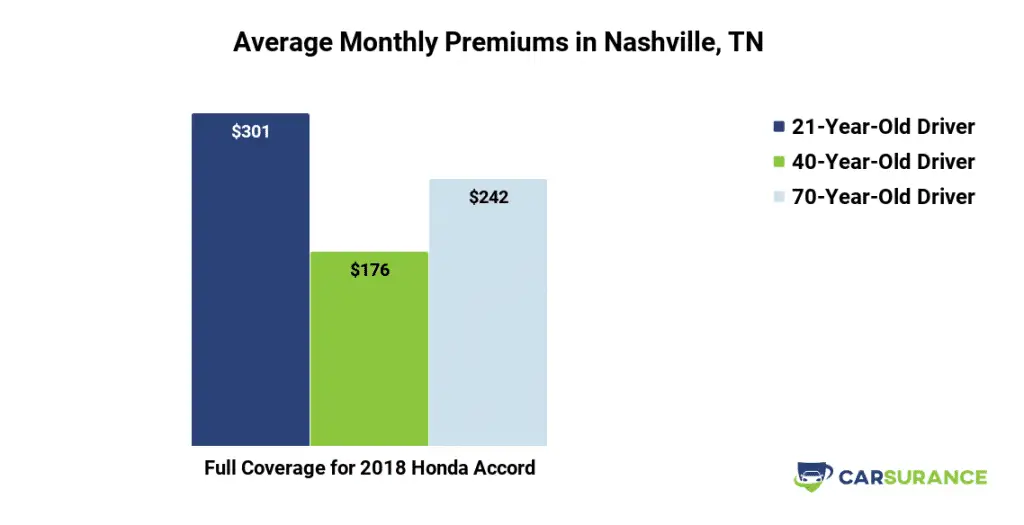

How Much Is Full Coverage Insurance

Insurance providers dont offer full coverage, but you can still build a dependable auto insurance package that protects you in the event of many incidents on and off the road. Naturally, the more coverages you select, the higher your monthly bill. However, there are still plenty of variables that affect your insurance costs, including:

- Your age

Don’t Miss: How Much Does A Car Salesman Make Per Car

When Repairing A Car Would Not Have A Big Impact On Your Finances

Maybe you have an emergency fund that you could use to fix your vehicle. If you’re willing to spend your savings on car repairs, then it’s safe to drop collision insurance. However, people often prefer their emergency fund to be a safety net for when they leave their job, face health issues, or need home repairs. It all depends on what you’re comfortable with personally and how much you have saved.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Cost Of Vehicle Registration In Texas

Why Compare Comprehensive Car Insurance With Compare The Market

50% of customers could save up to £267****

2021 comparethe.com. All rights reserved. comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution . Energy and Digital products are not regulated by the FCA.

*To obtain a reward, a qualifying product must be taken out. 1 membership per year.Rewards T& Cs apply. Meerkat Meals: App only. Participating outlets. Restrictions, limitations & T& Cs apply.

- Pizza Delivery: 50% off Pizzas, 7 days a week. £30 min spend. Excl. N.I.

- Dine out 2 for 1: Selected food, cheapest free. A la carte only. Sun-Thurs. Max 6 people. Kids meals and drinks excl.

- Dine out 25% off total bill: Days available vary by outlet. Min & Max group sizes apply.

- Delivery & Collection: Specific offer, delivery fees & radius vary by outlet. Card only.

Meerkat Movies: Participating cinemas. Tues or Weds. 2 standard tickets only, cheapest free.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

How Car Insurance Covers Theft

Comprehensive coverage won’t cover theft of your personal belongings, like your phone, laptop, or other valuables. Those items should be listed on your homeowner’s or renter’s insurance policy, even if you often leave them in your car.

Normal liability car insurance won’t cover theft because it protects the other driver from bodily injury and property damage resulting from an accident you cause.

A collision deductible waiver helps drivers save money on their deductible after an accident with an uninsured driver. Collision damage waivers typically apply only to accidents where an identified driver without insurance is completely at fault. A notable exception is California, where collision deductible waivers can be used in hit-and-run accidents.

Recommended Reading: How Much Does A Car Salesman Make Per Car

Flood Damage To Your Car And Steps To Take

The amount of flood damage will depend on how much water enters your car and where. But even the smallest amount can cause problems. So its best to get it thoroughly checked after a flooding incident.

Floodwater can cause cosmetic issues such as rust, foggy lights, and a moldy interior. But it can also result in extensive damage to the electrical and mechanical systems, including:

- Engine seizure

- Warped brakes

- Airbag failure

In the event of car flooding, the first thing you should do is record the highest level of water exposure and then dry the vehicle as much as possible. If you suspect the engine was underwater, do not start the vehicle. You may cause more damage this way.

Contact your insurance company as soon as possible to report the flood damage and make arrangements to have your car completely evaluated by a certified technician. Ask the insurance company if they have a preferred body shop.

A technician will inspect all the vehicles components for water damage. And they might flush and replace the internal fluids.

Can I Drive Any Car If I Have Fully Comprehensive Cover

Its a common misconception that comprehensive car insurance covers you for driving other peoples cars. Driving Other Cars cover used to be reasonably common on comprehensive policies and it meant you could legally drive someone elses car with their permission but you could still be liable for any damage.

Its much rarer these days and often only applies in emergency situations. Its rare for a driver under 25 to get DOC cover. Check your policy wording carefully as your comprehensive cover may reduce to third party cover in someone elses car.

If you want to drive someone elses car, or you want someone else to drive your car and you want to make sure youre covered, you should look adding a named driver.

Recommended Reading: How Much Do Car Salesman Make Per Sale

Should I Add Optional Coverages

Even if your lender doesn’t require any coverage, a new vehicle is an important investment and should be protected as such. Comprehensive and collision will pay for damages to your vehicle due to accidents and incidents that are both in and out of your control.

If your vehicle’s value is extremely minimal , it may not make sense to carry physical damage coverage. Should you decide to select liability coverage only, make sure you’ll be able to purchase a new vehicle out of your own pocket in the event it’s totaled and uninsured.

Extra coverage like roadside assistance or rental car reimbursement is typically inexpensive and can be purchased at your discretion as well.

Rates Of Comprehensive Coverage By State

MoneyGeek calculated the percent of vehicles covered by comprehensive insurance in every state. We also broke down the number of cars that werent covered with this type of insurance.

To find the number of registered drivers in each state, we utilized data from the Federal Highway Administration.

| State |

|---|

Read Also: How Do I Get My Car Title In Florida