What Is The Average Interest Rate For A Car After Bankruptcy

Your credit score will affect the interest rate you receive on any loan offer. A credit score is a number, usually between about 300 and 850, that represents how well you’ve managed credit in the past. Influencing this are positive factors, such as paying your bills on time, and negative ones such as bankruptcy.

What Is The Difference Between An Auto Loan And A Personal Loan

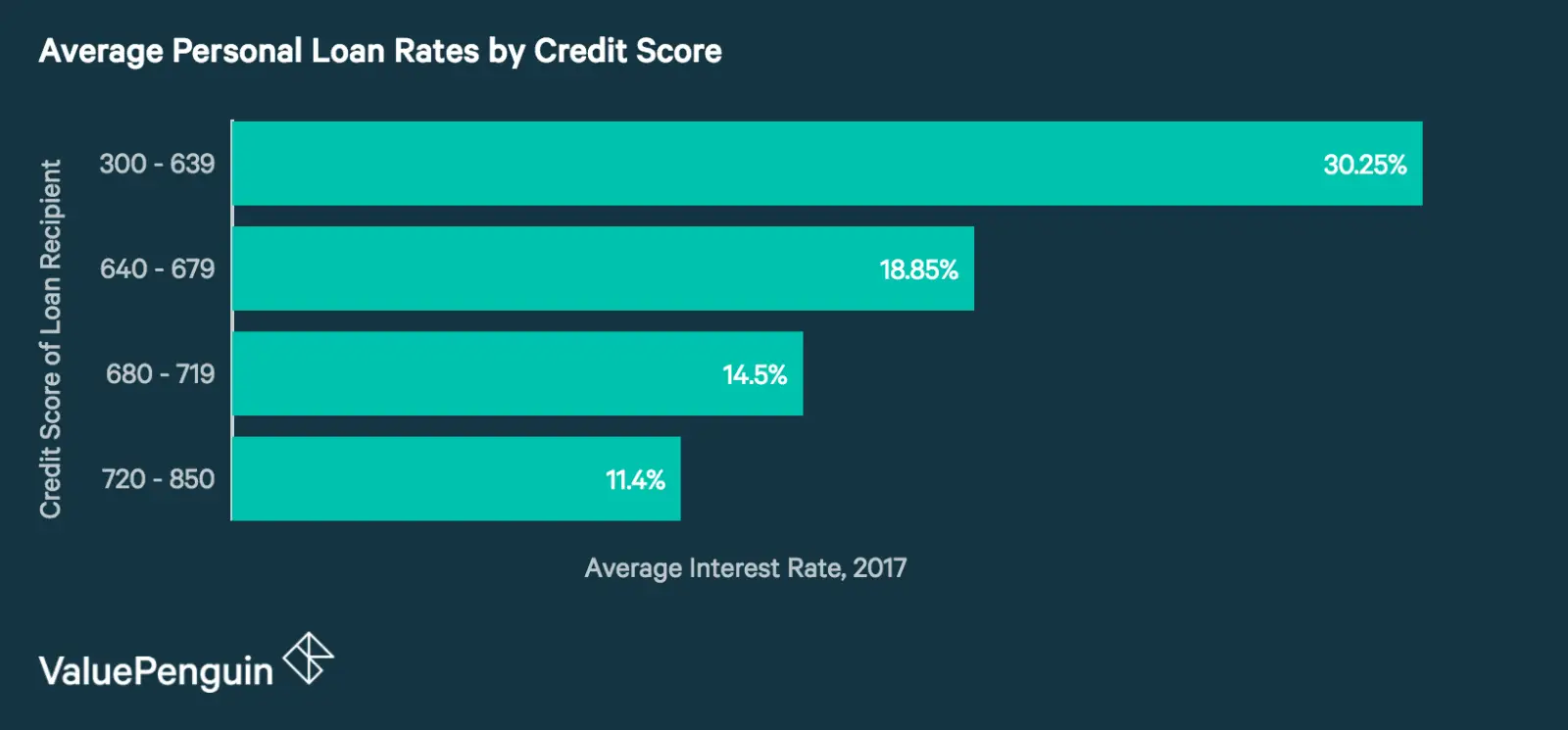

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make monthly payments on the principal of the car with no interest for a set number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Don’t Miss: Who Owns Avis Car Rental

Finding The Best Auto Loan Rates Is About More Than Just A Good Credit Score

When financing a new or used car, you want to find the best auto loan rates possible. The difference between a low and high annual percentage rate can be thousands of dollars by the time you finish paying off your loan.

This article will explain the factors that determine how lenders set APRs and offer tips for finding the lowest auto loan rates. Also read our review of the best auto loan providers to learn about and compare the top lenders in the industry, or visit AutoCreditExpress.com to start comparing rates right away.

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Recommended Reading: How To Remove Hard Water Spots From Car Windows

Auto Loan Interest Rate Factors

The final interest rates presented to you for used cars you’re looking to finance depend on these 8 factors:

Used Car Loan Benefits

- Lower monthly payments: Age and mileage play a role. A pre-owned car will be cheaper than a new version of the same car. This means lower monthly payments for you.

- Shorter loan terms: Consider buying used if you want to pay off a loan faster. Used car loans can bring shorter finance terms.

- Value over time: A major benefit of buying used? The car has already experienced that steep depreciation hit. They’ll retain their value longer.

Read Also: How Much Does A Car Inspection Cost

How Does Canstar Compare Car Loans

Canstar compares car loans using a unique and sophisticated Personal and Car Loans Star Ratings methodology, which looks at both price and features. The ratings represent a shortlist of products, enabling customers to narrow down their search to products that have been assessed and ranked.

Some of the features Canstar considers for car loans are:

- total cost including the interest rate, upfront fees and ongoing fees

- loan purpose

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

Don’t Miss: What Kind Of Car Did Columbo Drive

How Do You Get The Best Interest Rate

If you are looking to get the best interest rate that you can, it is important to do a little planning before you shop. Learn how to qualify for a car loan before heading to the dealership. Check your credit history and note the score. The higher the credit score, the lower your interest rate. Remember to prepare for negotiations as well.

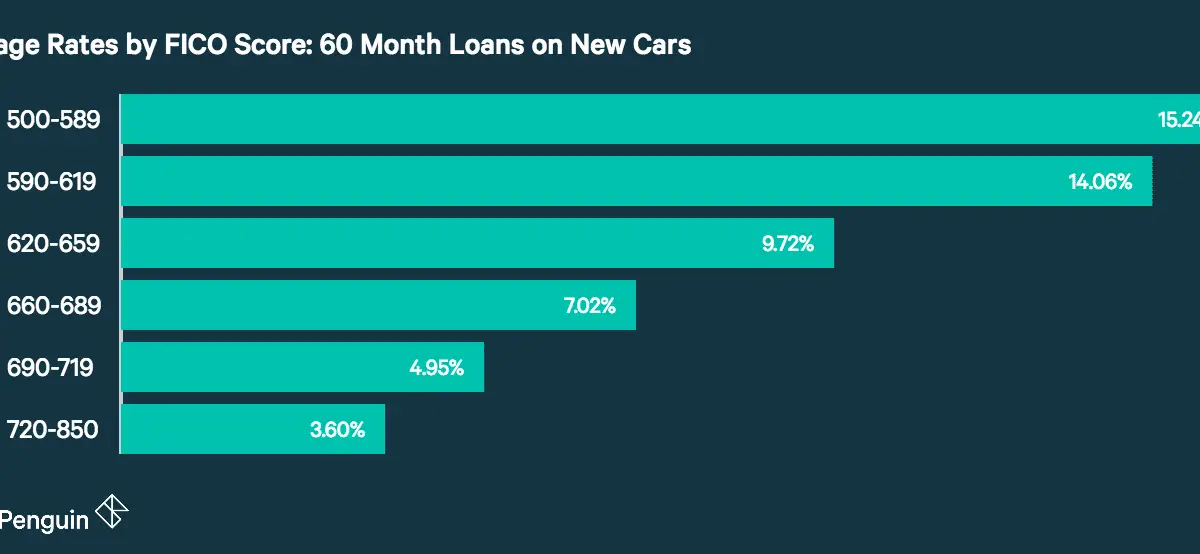

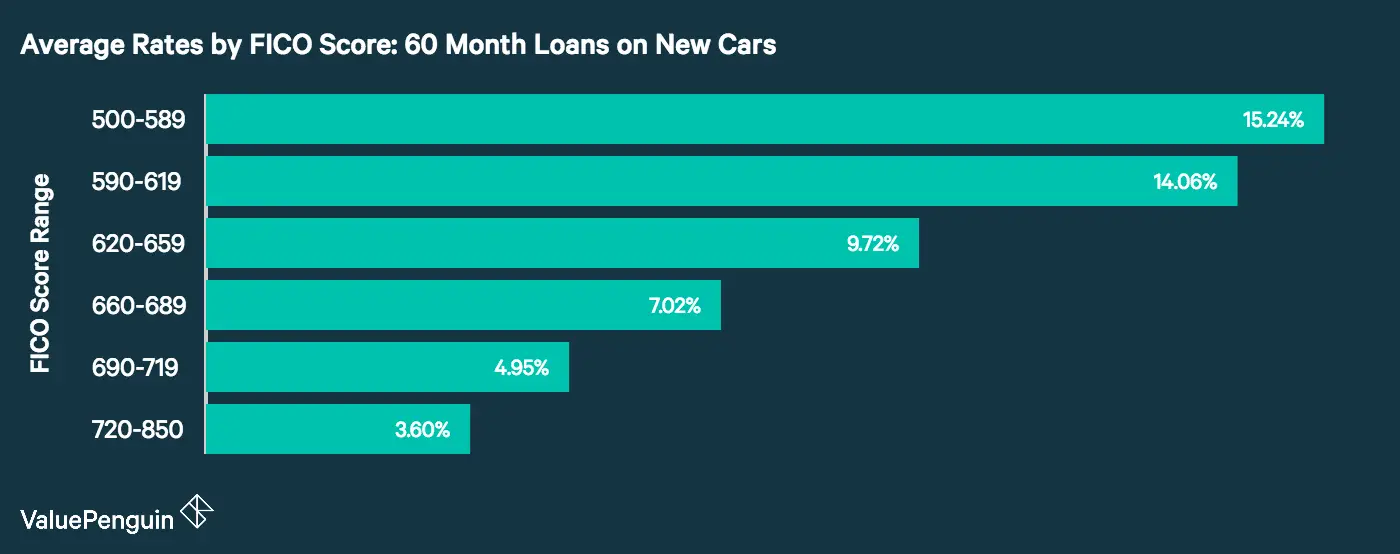

So what is a good car loan rate? According to the chart, this can range between 3.17% and 13.76% based on credit score.

If you are offered a higher interest rate than you were anticipating, you can try to negotiate a better offer. When you receive the offer, look at all of the details, dont just focus on the payment amount.

How To Apply For An Auto Loan

You can apply for an auto loan online, at a financial institution, or at the dealership when purchasing a car. Some lenders allow you to browse the inventory of participating dealerships after your loan is preapproved. Because most loan applications require vehicle information, you may need to have a particular car in mind before applying.

When you apply for a car loan, be sure to have the following information handy, as it may be required to prequalify and will certainly be required before you submit your formal loan application:

- Personal details such as name, address, and age

- Social security number

- Gross annual income information

- Vehicle information such as age, mileage, and vehicle identification number

While not required during prequalification, before you can secure your loan, you may need additional documentation such as your driver’s license, pay stubs, and personal references.

If you plan to have someone cosign your loan, that person will also need to supply the information and documents mentioned above.

To start comparing the best auto loan rates from multiple lenders, visit AutoCreditExpress.com.

Recommended Reading: What Kind Of Car Did Columbo Drive

‘shadow Edition’ Of Bmw 3 Series Gran Turismo Launched

On Thursday, BMW Group India announced the launch of the BMW 3 Series Gran Turismo Shadow Edition. The car which will be available in colour options – Alpine White, Melbourne Red Metallic, Black Sapphire Metallic and Estoril Blue Metallic has been priced at Rs.42.50 lakh. The 3 Series Gran Turismo Shadow Edition which will be will be powered by a petrol engine will be available in limited numbers.

The car which is being produced at the BMW Chennai plant will be laced with black kidney grilles, LED headlamps and taillights, 18-inch alloy wheels etc. BMW claims that engine churns out 255PS of power and 350 Nm of torque. The car which can accelerate to 0 100 kmph in 6.1 seconds as per the company will have six airbags, ABS with brake assist, Cornering Brake Control , electronic vehicle immobiliser, dynamic stability control which includes dynamic traction control, side-impact protection etc.

24 August 2020

Bmw Launches The X3 M Suv In India

German automaker BMW has recently launched the BMW X3 M SUV in India. The price tag that the car comes with is Rs.99.90 lakh .

This is the first time that the automaker has brought a high performance M version of the SUV in the country. The company claims that the BWM X3 M comes with the most powerful straight-six engine ever which has been put under the hood of a BMW M series car. The car comes with a host of features and safety fitments such as adaptive LED headlamps, rain sensing wipers, parking assistant, powered tail gate, head-up display, tyre pressure monitor, vehicle immobiliser, ABS with brake assist, EBD, and so on. The engine powering the car is a Twin Power Turbo, 3.0-litre, inline six cylinder engine that churns out 480 hp of max power and 600 Nm of peak torque. It is capable of clocking 0 to 100 kmph in 4.2 seconds and can hit a top speed of 250 kmph.

3 November 2020

Read Also: How Much To Get Car Detailed

Are Average Car Interest Rates Really Around 7% Or Is That High

This Site Might Help You. RE: Are average car interest rates really around 7% or is that high? Everytime I go to bankrate.com the lowest inerest rate I see is like 6.95% for new cars and 7.2% for new cars. I have never financed a car before, but remebering what I hear from others, I was thinking it should be more around the 3-4% range.

Average Interest Rate For Bad Credit Car Loans

Car loan interest rates are primarily based on your credit score. Generally speaking, the higher your credit score is, the lower the interest rate you can qualify for. The opposite goes for borrowers with lower credit scores.

A credit score isnt the only factor that influences your interest rate, however. The national prime rate, the lender youre working with, the vehicle you’re financing, how long of a loan term you choose, and more can also impact what’s available to you.

According to Experian’s State of the Automotive Finance Market report from the second quarter of 2021, the average bad credit auto loan interest rates on used vehicles are:

|

10.49% |

Recommended Reading: How Much Does A Car Salesman Make Per Car

What Is A Good Interest Rate For Your Car Loan

When you are shopping for a vehicle, you want to avoid overpaying and make sure you get the best interest rate possible for your car loan. Keep your credit score in mind when taking a look at the chart below. Here, you can learn more about the average new and used car loans based on credit scores and the APR, or Annual Percentage Rate, for that average. To take some of the hassles out of shopping for a new car, you can apply for financing in advance from the comfort of home.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

Read Also: How To Make Car Freshies

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

If Youre In The Market For A Car Theres A Good Chance Youll Have To Finance Your Purchase With An Auto Loan

That means youll probably also be doing some math around the kind of monthly payment you can afford. Overall, Americans are paying more to drive their cars these days, whether the vehicle is leased or purchased.

The average monthly car payment was $568 for a new vehicle and $397 for used vehicles in the U.S. during the second quarter of 2020, according to Experian data. The average lease payment was $467 a month in the same period.

Lets take a look at the trends of average car payments and loan length, and review tips for nailing down a car payment that fits your budget.

Recommended Reading: How To Remove Scuff Marks From Car Door Panels

Average Student Loan Interest Rate

Federal student loan interest rate depend on the type of loans you’re eligible for. Most students use federal loans to finance their education, but there is also the option to instead use private lenders also, some who borrow under a government program may later switch to private lenders to refinance or consolidate their loan. Each federal student loan has a universal fixed interest rate set by Congress every year. Credit score is not a factor for federal student loans, in contrast to most other loan types. Instead, the rate you’ll pay varies by the type of loan you’re getting, your income range and whether you are an undergrad or going to graduate school.

| Loan Type |

|---|

*Parent of Undergraduates

Car Loan Interest Rates For January 2021

Interest rate by loan term. The interest rate you get can also depend on your cars loan term, though not always. In fact, the average interest rate on both a 48- and 60-month car loan from a commercial bank in the third quarter of 2019 was 5.27%, according to the Federal Reserve. While some lenders may charge lower rates for a longer term, others like credit unions offer higher rates on

Don’t Miss: How To Remove Hail Dents

The Average Interest Rates For Car Loans With Bad Credit

Experian, one of the country’s three main credit bureaus, issues quarterly reports that study data surrounding the auto loan market. Their State of the Automotive Finance Market report from the fourth quarter of 2020 found that the average interest rates for both new and used auto loans look like this:

| Average New Car Loan Interest Rate | Average Used Car Loan Interest Rate | |

| Super prime | ||

| 14.20% | 20.30% |

As you can see, your credit score has a major influence on the interest rate you can qualify for. Auto lenders base interest rates on several factors, including the length of the loan, the vehicle’s age and mileage, and the state you live in but your credit score is by far the most important factor.

Your interest rate ultimately determines your monthly payment and the total cost of financing. So, unfortunately, a bad credit score means you end up paying more in the long run.

What Are Typical Car Lease Interest Rates

You’re stoked. You’ve found a promotional offer on a car lease offering interest rates way lower than what you might have otherwise paid. As a starting point in your car-lease quest, you looked for the going national average interest rates offered to people with credit scores similar to yours. These typical rates helped you get a leg-up on spotting a bargain.

Tips

-

Your car lease interest rate will be directly affected by a number of factors, including your current credit score. With that in mind, there is no set interest rate for all individuals choosing to lease their automobile.

Recommended Reading: How Much Does A Car Salesman Make Per Car