Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to provide car loans for fair or poor credit, even if they cant get approval from their bank though they may not get the lowest car loan rates available. Online lenders also tend to be the quickest to approve loans and disburse funds.

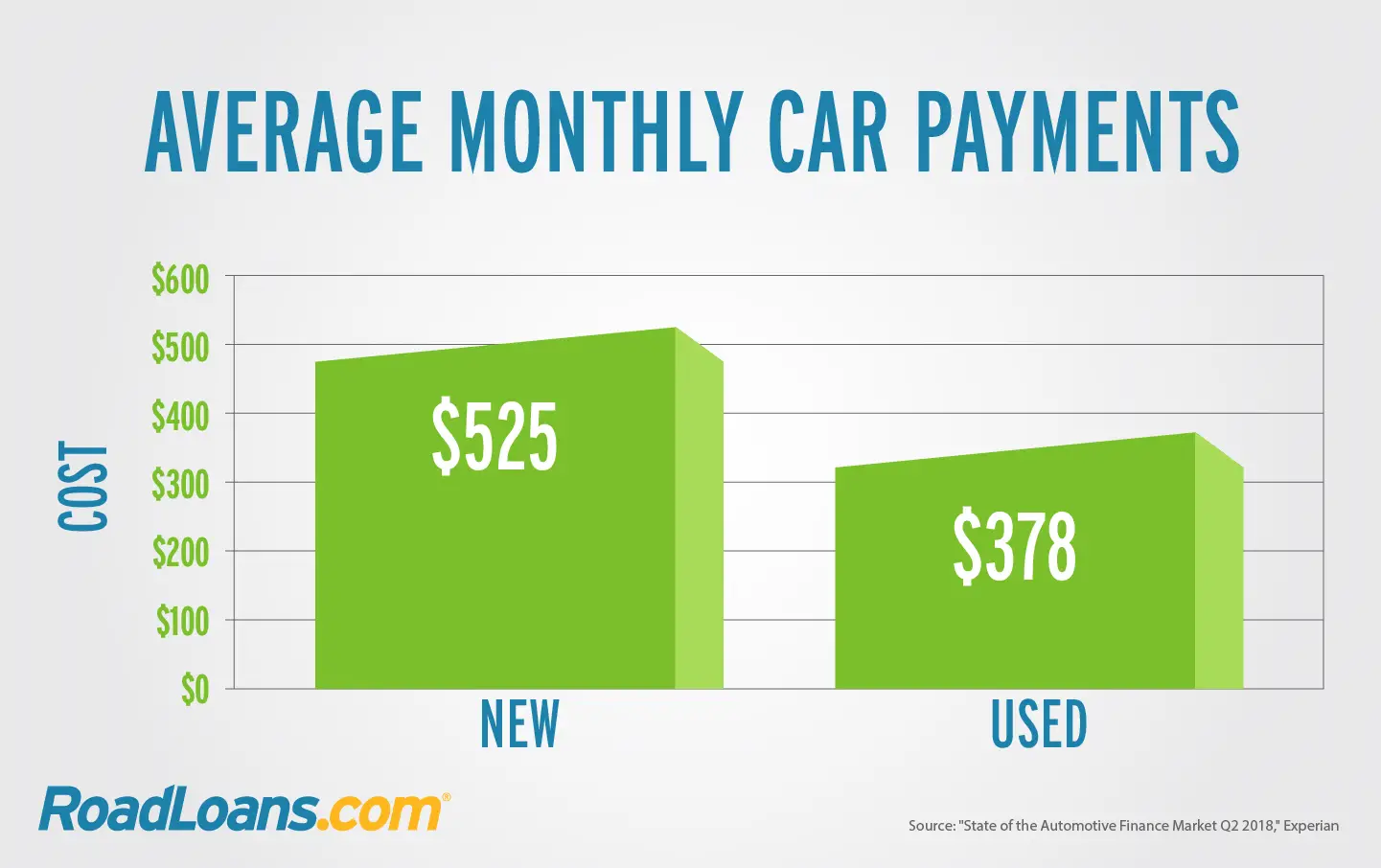

Average Monthly Car Payments

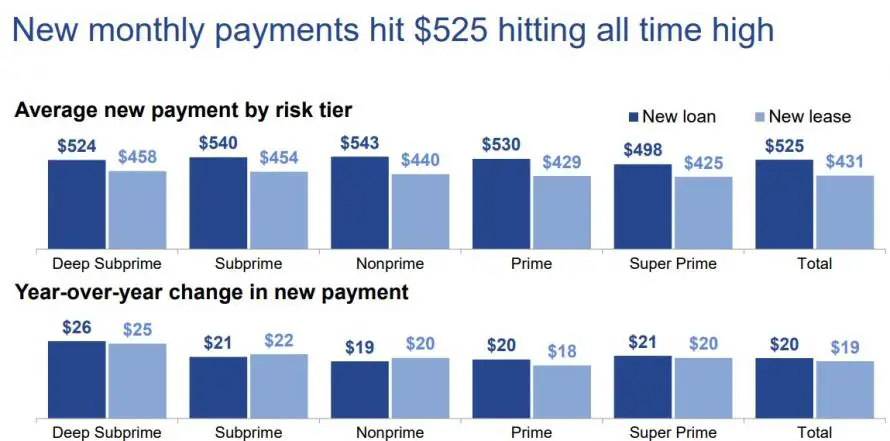

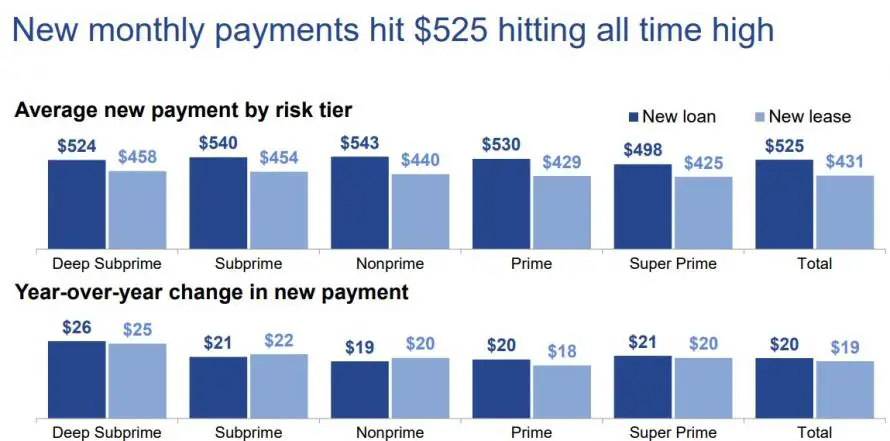

Until the alternative data movement catches up, your credit score serves as your financial DNA and gives lenders an idea of how risky you might be to take on. If you have a strong credit history, you are likely to get offered more competitive rates. And for most, better rates mean lower monthly payments.

Video: Comprehensive and Collision Car Insurance Explained

What Are The Average Auto Loan Terms

With the average auto loan for a new car at $563, buying a used vehicle is not far behind with a median monthly payment of $397. According to Experian, the average interest rate for a new car loan is 4.09% while used transportation has a rate of 8.66%. The average loan length of a car payment is 70 months for new cars and 65 months for used.

The average monthly auto loan payment has climbed about 25% over the last decade. This is all while previous auto loan terms were typically three to five years. This has now been replaced with auto loan payments often lasting six years or more.

Read Also: How To Power Car Amp In Home

The One Monthly Payment Killing Your Wealth

The average car payment in US is now $499. That is straight up stupid. That much invested would be over $5M at retirement.

Dave Ramsey

According to a recent State of the Automotive Finance Study from Experian, the average new car payment reached $523 per month last quarter. Worse, the average new car loan is 68 months long! Like my man Dave Ramsey says, its entirely preposterous when you really think about it.

Have you ever imagined what you could do with an extra $499 per month? Lets face it probably not. These days, we blame everything but our car payments for our inability to get ahead.

We blame our employers for not giving us the raises we deserve, or our parents for not educating us enough. We blame health insurance premiums, the price of groceries, the housing market, and even the price of gas. But, do we ever throw shade at our car payments? Heavens no.

Somewhere along the line, weve become socially conditioned to believe a huge car payment is a fact of life. We tell ourselves that everyone has a car payment, and that its normal and okay. And heck, if were going to have a car payment, we might as well get the car we want, right?

This kind of thinking is so widespread its practically an epidemic. The thing is, its also absolutely wrong.and it’s killing our wealth.

The #1 Payment Killing Your Wealth

Tweet This

All across the nation, families are struggling to get ahead. For some, the rising costs of healthcare chip away at their gains. For others, stagnating wages and college bills are a real problem.

Then there are those who claim raising kids makes it impossible to grow wealth.

No matter where you go, youll hear stories of hardship many of which are out of our control.

But, what if I told you some financial pain in this country is self-inflicted? What if I told you one financial decision in particular has been absolutely catastrophic for people at every income?

What if I suggested one simple change that could turn your finances upside down ?

If youre still reading this post, you asked for it.

Brace yourself you might not like what youre about to hear.

Also Check: Does Aaa Ship Cars

Buying New Versus Used Vehicles

Buying new has its advantages, such as the fact that it has never been previously owned. It has that new car smell and everything about it is brand new. The engine is clean and the interior has no stains, burns or defects. However, the individual who purchases new pays a much higher price than if they had purchased the same make and model used.

Though purchasing a used car means that there may be imperfections left behind from the previous owner, the cost of ownership is typically lower. The advantages of purchasing used include:

There are several advantages for purchasing used instead of new. However, purchasing used does have a few disadvantages, too. For example, the vehicle typically will no longer be under any type of warranty & third party warranty services can be quite expensive. It may also have significant wear and tear on the engine and other vital drive train parts, especially if it has been used as a fleet vehicle or owned by an individual who traveled a great deal, such as a sales professional. When purchasing used, if you want to avoid expensive repair fees it is typically best to purchase something that is only two or three years old with low mileage. On average, cars clock about 12,000 miles per year. If a three year old vehicle which has over 100,000 miles on the engine is probably not a good bet.

How to Make Sure to Buy a Quality Used Car

How to Prevent Buying a Lemon

Tip #: Get Your Financial House In Order First

If the foundation of your financial house is not in order, getting into a high car payment or lease should be the last thing you consider, says financial advisor Jamie Pomeroy. Have 6-9 months living expenses saved up as an emergency fund? Are you free of consumer debt? Are you maxing out your Roth IRA or contributing to your employers 401 at least up to their matching point? If not, avoid that high car payment at all costs, he says.

Read Also: Cigarette Burn In Car Seat

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

If Youre In The Market For A Car Theres A Good Chance Youll Have To Finance Your Purchase With An Auto Loan

That means youll probably also be doing some math around the kind of monthly payment you can afford. Overall, Americans are paying more to drive their cars these days, whether the vehicle is leased or purchased.

The average monthly car payment was $644 for a new vehicle and $488 for used vehicles in the U.S. during the fourth quarter of 2021, according toExperian data. The average lease payment was $531 a month in the same period.

Lets take a look at the trends of average car payments and loan length, and review tips for nailing down a car payment that fits your budget.

Recommended Reading: Car Rentals With Aarp Discounts

Average Monthly Car Payments: Loans Terms & Rates

Thinking about buying a car and wondering how much it will cost? What is the average car payment and what factors will impact yours? Well cover all the details here, and also provide a few money-saving and affordability tips.

Weve chosen to highlight data for used car purchases because Americans boughtand financedmeaningfully more used cars than new cars in 2016. To be exact, the sales figure was 38.5 million used cars vs. 17.5 million new cars.

How Is A Car Payment Determined

There are several factors that will determine your payment on an auto loan. Here’s what goes into the calculation:

Let’s say you qualify for a $30,000 loan on a new car with a 3.74% interest rate over 60 months. Your monthly payment would be $549, and you’d pay $2,939 in interest over the life of the loan. If you were to extend your repayment term to 72 months, the monthly payment would drop to $466, but the total interest paid would jump to $3,538.

Now let’s say you manage to reduce the interest rate to 3.24% by putting down $5,000 but keep the term at 60 months. Your new loan amount would be $25,000, your monthly payment would be $452, and you’d pay $2,113 in total interest charges.

Read Also: Fixing Burn Holes In Car Upholstery

How Much Is The Average Car Interest Rate

The average annual percentage rate for auto loans in 2019 was 8.06%. On a yearly basis, this proportion varied from 5.66% for customers with excellent credit to 21.54% for customers with bad credit.

Key Statistics:

- In the United States, baby boomers are the demographic most likely to acquire a new vehicle.

- Despite the fact that only 9.28 percent of America’s credit is devoted to automobile loans, 85% of new non-commercial vehicles are purchased in the United States.

- According to the Federal Reserve Bank of New York, it appears that approximately 7 million Americans are at least 90 days late in paying their automobile loans.

- The silent generation, which has 8.3 percent of the market share, and Gen Z purchasers, who have 2.8 percent of the market share, are the populations that account for the lowest number of new vehicle yearly registrations.

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

You May Like: Can You Add Someone To Your Car Loan

Ways To Negotiate Sales Prices And Online Alternatives To Haggling

Many Americans do not like to haggle for a better deal. However, haggling is commonplace in some cultures. If a buyer will haggle over the price of a new or used vehicle, they stand a chance of obtaining a better purchase price for the vehicle. Haggling simply means that the purchaser makes a counter-offer to the dealer or seller once they have presented the purchaser with a selling price. Haggling is simple negotiation. Dealers in particular have some bargaining leeway when it comes to the purchase price of their new and used vehicles. When shopping, the purchaser has nothing to lose. They should attempt to negotiate a lower selling price. Even a $500 break is often equivalent to a monthly payment. Buyers should always attempt to gert a better price than the asking price of the seller.

For those who are uncomfortable with the prospect of haggling for a better price, some websites offer services that allow users to comparison shop for the same make and model of vehicle. Sites such as CarsDirect and TrueCar allow users to search for a specific make and model in their geographical area. The search results provide the asking prices of various sellers and dealers. The site user may then contact the seller or dealer and even offer a lower price, if the so choose.

How Much Should My Car Payment Be

There are many different tools to help you get a better idea of what you’ll be paying toward your vehicle every month. The Chase Auto Payment Calculator is one such tool that can simplify this process for you. However, to get a more thorough understanding of what goes into these calculations, consider the following factors that can influence your monthly car payments.

Read Also: How Much Does It Cost To Register A Vehicle In Texas

The Components Of A Car Payment

When you make car payments on an auto loan over months and years, you’re not just paying for the price of the car. Each monthly payment consists of different pieces that go toward specific obligations contained in your loan.

The most sizable chunk of your payment goes toward the actual amount you borrow, also known as the principal. You can think of the principal, like when you borrow money from a friend and pay them back the exact amount.

But lenders need to make money when they provide loans, so you’re responsible for additional interest and fees. The interest rate on a car loan is a percentage of the principal charged over the term length. And you may be obligated to pay additional fees to the lender, further increasing your monthly payment.

Interest and lender fees combine to form your auto loan’s annual percentage rate or APR.

Each month, your car payment is a combination of these fees added to the principal.

Whether you’re in the market for a pickup truck or an electric car, Shift makes financing easy. Shift works with a network of trusted lenders, securing you the best deal on financing. And Shift has best-in-industry service contracts, so you know your vehicle is good to go, mile after mile.

Comparing Types Of Car Loans

There are two primary types of auto loans: direct loans and dealer financing. A direct loan is a traditional loan through a bank or financial institution, while dealer financing is a loan obtained through the dealership sometimes referred to as “buy here pay here” . A direct loan is much more common, and a dealer may typically sell the loan they make to you to bank or credit union which will then service your account. While this means that the two options are very similar once you begin paying your loan, dealerships may be able to offer special manufacturer-sponsored incentives or other offers that a bank would not.

Also Check: What Credit Bureau Does Car Dealerships Use

Average Auto Loan Interest Rates: Facts & Figures

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

Average Monthly Car Payment: Find Out Where You Stand Based On Your Income

Knowing how much the average monthly car payment serves as a good indicator of whether or not youre paying too much. The average monthly car payment varies based on several factors. The total amount youll owe will depend on the cars sale price, your down payment, loan agreement, and your credit and income. This article will help gauge how much you should expect to pay, and also provide answers to the following questions:

-

Does the condition of a vehicle affect the car payment?

-

How long is the average car loan?

-

How do car payments vary by income?

Also Check: How To Remove Scratches From Black Plastic Car Interior

Average Monthly Car Payment In Summary

Though your average car payment is a significant financial aspect of your vehicle purchase, it doesn’t tell the whole story. Even if you owe what seems like a workable sum each month for your car payment, other factors like the term of your loan and the interest rate paint a clearer financial picture.

When it comes time to purchase your next vehicle and take out a car loan, the total cost after financing is the most important figure.

And if low monthly payments appeal to you, remember that they cost you more money in total when paired with longer-term loans.

Shopping for a used car and want to take a test drive? If you live in one of Shift’s many service areas, a concierge will drive your vehicle to you for no charge, letting you get a feel for its driving performance and interior.

Legal notes

All prices are based on vehicle availability and pricing as of

Historical Auto Loan Rates

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

You May Like: Auto Sales Commission Structure