Average Car Insurance Costs With Tickets Or Accidents

Your accident and ticket history is another factor insurance companies consider when setting rates and determining if they can insure you.

- A driver with a clean record pays an average of $1,424 per year for car insurance.

- The same driver with a ticket on their record pays an average of $1,836 per year.

- If that driver were at-fault for an accident, he pays an average of $2,237 per year.

There are things that can combat increases or lower the costs to your car insurance after an accident. In some states, attending traffic school can get violation points taken off your record. That, in turn, can impact your premiums. And, depending on the insurer, you may get a break if its your first violation. Its worth discussing your options with your insurance agent.

Car Insurance Premiums With Tickets and Accidents

Scroll for more

How Infractions Affect Your Car Insurance Rate

If you are responsible for a traffic accident or violation, odds are it is going to increase your auto insurance rates. An accident, speeding ticket or a DUI puts you as a high insurance risk in the eyes of providers. Your insurer will charge a higher rate in order to offset this risk.

Fortunately, many infractions do not stay on your record beyond a limited time, depending on what state you live in. In a lot of cases, if you keep your driving record clean for a few years, the infraction will drop off your insurance record. This table shows the average national rates after an accident, DUI or speeding ticket.

Average car insurance rates after an infraction| Infraction | |

|---|---|

| $4,023 | $335 |

| Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

Winsonsin: $1206 Full Coverage

The setting of That 70s Show, Wisconsin, stands at the end of the list of the ten cheapest states for full coverage car insurance. The minimum coverage policy is $354. Severe snow and tornadoes arent a rarity in Wisconsin, and during springtime, rising rivers often cause flooding.

Additionally, the state holds 25th place in terms of population density. All these factors indicate that car insurance prices should be near the US average. Perhaps its the intense competition among insurers that keeps rates in check.

Also Check: How To Add Bluetooth To Car

Car Insurance Rates Methodology

Age16-year-old driverModelIncidentsGender

Car Insurance Rates After A Dui

At-fault accidents and speeding tickets increase your rates, but very few incidents affect your car insurance costs the way a DUI does. DUIs also lead to license suspension, heavy fines, and sometimes jail.

Comparing insurance quotes is essential after getting a DUI, even if you already have a policy. Rates for car insurance after a DUI are always higher, but some companies offer lower rates than others.

Rates for the Top Auto Insurance Companies for Drivers with a DUI

| Insurance Company |

|---|

Although these are average car insurance payments per month, the actual rates youll see depend on your unique circumstances. Youll also pay more in certain states Michigan, Rhode Island, and North Carolina often have some of the most expensive DUI rates in the country.

You May Like: How Much To Change Car Battery

Why Do I Need Car Insurance

While all motorists require Compulsory Third Party to drive on the road, this only covers you for legal liability should you cause bodily injury to others. It doesnt allow for additional coverage such as collision, fire, theft, not at fault accidents and more.

There are several different types of car insurance, from third party property damage to comprehensive coverage policies. Choosing a lower level of cover means you will have a lower premium but might not have the full coverage youre looking for. You can see exactly what is and isnt covered in the product disclosure statement .

Average Car Insurance Cost By Credit Score

| $1,221 |

Note: Premiums are representative only individual premiums will be different

Drivers with bad credit pay an average of 71% more for car insurance than drivers with good credit, according to WalletHubs analysis. Insurance companies consider drivers credit history because it is generally correlated with their likelihood of filing an insurance claim. They do not directly use credit scores when calculating the cost of premiums, but they use the same underlying information: your credit report.

Also Check: How Much Does It Cost To Have Your Car Wrapped

Average Car Insurance Rates By Car Type

| Car type |

|---|

| Nissan Altima 2.5 SV | $2,316 |

Theres a tie for the cheapest vehicle to insure among the 20 top-selling vehicles. The Honda CR-V and Subaru Outback both have an average annual rate of $1,723. Thats $1,405 cheaper than the price of the most expensive vehicle on the list.

Tesla Model Y insurance is the most expensive at $3,128 a year, followed by Tesla Model 3 insurance at $3,053 a year. The Tesla Model Y car insurance costs are 82% more than the Honda CR-V or Subaru Outback. The value of the vehicles and repair costs are a couple of reasons the Tesla models are so expensive to insure.

How Much Is Car Insurance

The average cost of car insurance is $1,771 per year for full coverage, or about $148 per month, according to Bankrates 2022 analysis of average quoted premiums from Quadrant Information Services. Minimum coverage costs an average of $545 per year. But because auto insurance premiums are based on more than a dozen individual rating factors, the actual cost will differ for every driver.

- Full coverage car insurance costs an average of $1,771 per year, while minimum coverage is $545 per year.

- USAA, Geico and Erie offer some of the cheapest full coverage car insurance, but are not all available to all drivers.

- Having a severe infraction like a DUI on your motor vehicle record could increase your car insurance premium by 93% on average.

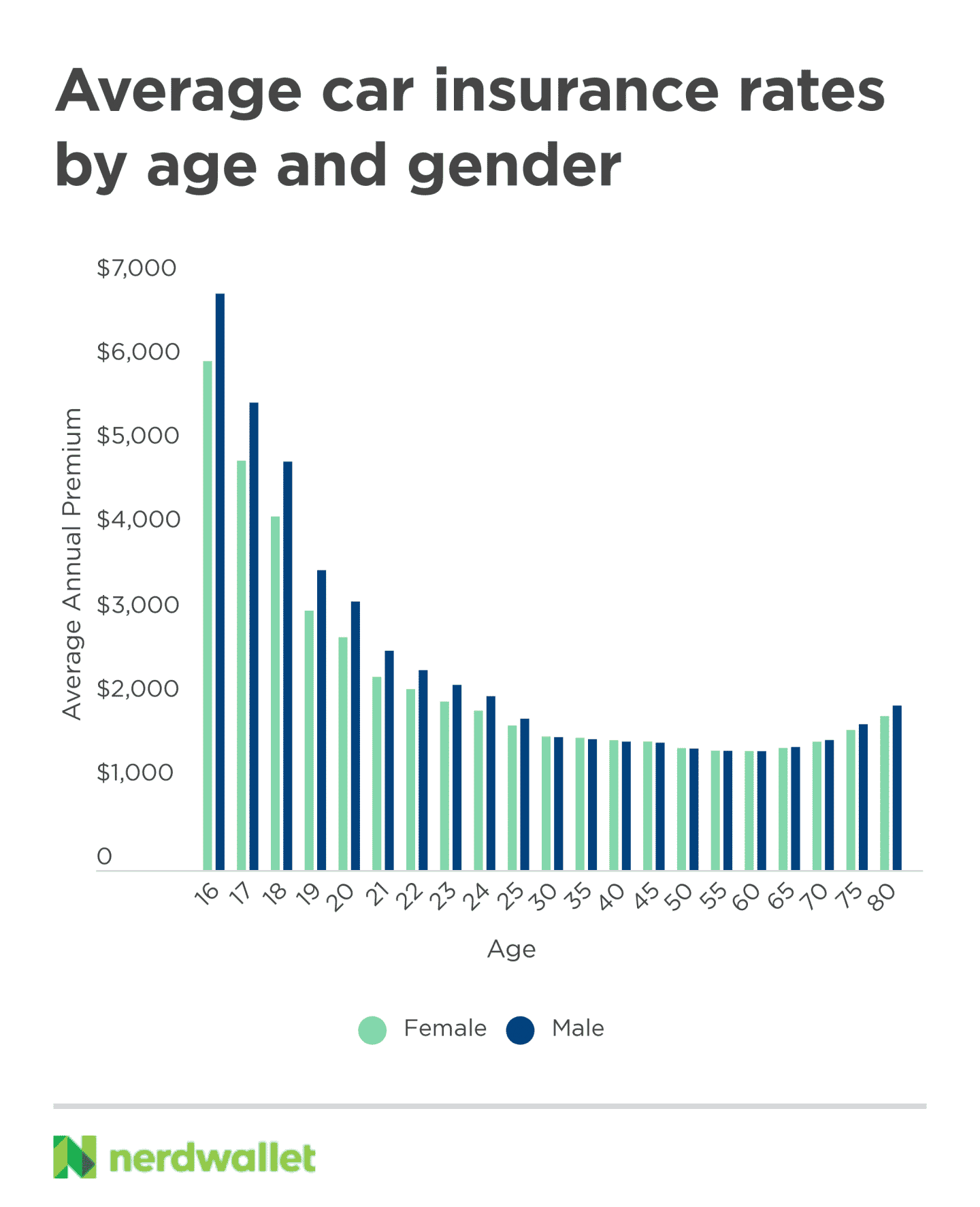

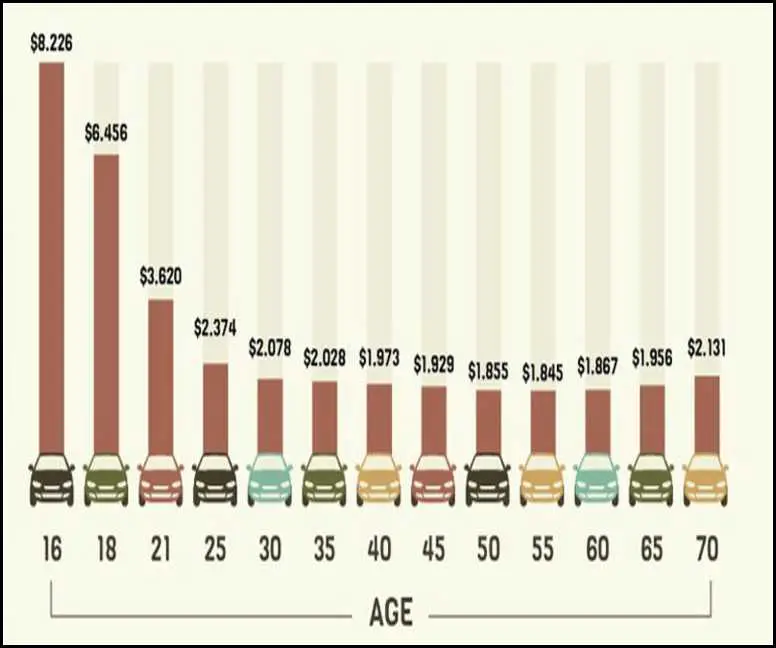

- Teen male drivers may pay $807 more for car insurance on average compared to teen female drivers.

You May Like: How To Activate Siriusxm In Car

How Much Does Car Insurance Cost By Vehicle Type

The type of vehicle you drive has a significant impact on your car insurance premium. The price and availability of parts, cost of labor, statistical likelihood of accidents and the vehicles safety and crash prevention features could all influence how much you pay for coverage. The vehicle makes and models in the table below are well-suited for a variety of lifestyles and budgets.

- High-end vehicles, like luxury or sports cars: The high price tag of these vehicles are often coupled with expensive parts, leading to more costly repairs in the event of a claim, as well as higher speed maximums compared to standard vehicles, increasing the risk of at-fault accidents.

- Vehicle size: Larger vehicles may weigh more and carry more passengers, which could cause more damage in accidents compared to smaller vehicles.

- Common, more affordable vehicles: Though economy cars may be easier on a budget, they may also be more susceptible to vandalism and theft due to having less security measures, raising the likelihood of comprehensive claims.

| Make and model |

|---|

Average Car Insurance Cost In The Us And Influencing Factors

It turns out car insurance is the third biggest expense when owning a vehicle, behind loan payments and gas. We assume that insurance might even be the second-highest expense for folks with electric or hybrid vehicles.

Approximately $1,630 annually, or 136 per month, thats the average insurance cost in the United States as of 2022. The numbers represent a drop from $2,646 annually or $211 per month in 2021.

The available data was based on the costs for all age and risk groups. Still, the cost depends on:

Don’t Miss: How To Get Rid Of Old Car Smell

How Auto Insurance Prices Vary By Driver Profile And History

- Younger drivers pay more. New drivers are more expensive than a driver with 16 or more years of driving experience.

- When you’re married, auto insurance costs more.

- Drivers with a previous accident on their records pay more. After an accident, premiums jump 30%, according to Insurance.com and Insure.com reporting, based on data from Quadrant Information Services.

- Drivers with a DUI on their record pay more. With a DUI on your record, insurance will cost 63% more, according to Insurance.com and Insure.com reporting.

- Drivers with poor credit scores pay more. Consumer Reports compiled rate pricing information from car insurance companies in every state, and found that . In Michigan, a driver with poor credit will pay about $2,470 more each year than someone with excellent credit and $444 more in Ohio, $1,512 more in Texas, and $251 more in North Carolina. Three states don’t allow credit scores to be factored into car insurance prices.

- Drivers who live in more urban areas pay more. Car insurance is cheaper in zip codes that are more rural, and the same is true at the state level. Insure.com data shows that Iowa, Idaho, Wisconsin, and Maine have the cheapest car insurance of all states, and that’s because they’re more rural states.

Why Is Car Insurance So Expensive In The Uk

There are a number of reasons why car insurance is so expensive in the UK, but its primarily due to the high cost of claims and the fact that many claims are fraudulent. ABI figures show that a total of 55,000 fraudulent car insurance claims worth £602 million were uncovered by insurers in 2020.

Referral fees can also push up prices for motorists. This is where personal details are sold by car insurance firms to personal injury lawyers after an accident, leading to a rise in compensation claims.

Additionally, there are more than 1 million uninsured motorists on the UKs roads. This increases the cost for all insured drivers as the insurance industry has to cover the cost of injury and damage to others following an accident.

You May Like: Does My Car Insurance Cover Other Drivers

A Single Policy For All Cars

Alternatively, you can have a single policy for all the cars, which will usually offer the same level of cover for each driver and each vehicle.

While the policy will start and renew for all cars on the same date, don’t get too hung up on timing.

If you want to move to a multi-car policy but currently have policies on vehicles that are up for renewal at different times, most insurers will make that easy for you. They just add each new car on to your policy as the previous insurer expires in year one, you’ll pay a premium that reflects the fact that at least one car wasn’t insured for the whole year.

This newsletter delivers free money-related content, along with other information aboutWhich? Groupproducts and services. Unsubscribe whenever you want. Your data will be processed in accordance with ourPrivacy policy

Why Has My Car Insurance Gone Up For No Apparent Reason

Finder insurance expert Danny Butler answers

This can be one of the most frustrating realities to get to grips with. Why on earth does your car insurance rise when you havent claimed, had an accident or made any changes?

As a general rule, safe driving and stability are rewarded. And, at least in the first few years of buying car insurance, accumulating claim-free years will boost your no-claims bonus a discount on your headline premiums. So, all else being equal, you would reasonably expect premiums to go down over time.

But most insurers cap their no-claims discount at a certain level. There will come a point when the level of discount will stop growing. And, even if this isnt the case, there may be factors that drive your premium up more than the discount brings it down. One of these is age. As we highlighted above, drivers in their 70s and 80s become more likely to make a claim. So, sadly, you may find that your premiums start to rise after you turn 70.

Plus, sometimes, external factors play a part. For example, if the cost of replacement car parts increases, or the government puts up the cost of insurance premium tax , car insurers are likely to pass these costs on to their customers.

Read Also: What Is Gap Insurance For A Car

Does Paying Your Car Loan Off Affect Your Rates

While your rates arent affected by your ownership status on your car, youll probably be able to lower your coverage. Lenders usually require you to carry full coverage, but you can drop to minimum insurance once you pay off your loan.

Do you pay car insurance monthly or yearly?

You have several options for paying your car insurance. You can choose to pay monthly, or you can pay for your entire policy at once. Usually, companies sell six months of car insurance at once, and you might earn a discount for choosing one lump payment.

Average Insurance Rates For Popular Cars

While looking at the average price of car insurance for specific vehicle types is an excellent place to start, you can also compare rates by specific makes and models.

Some of the most expensive cars to insure in the U.S. are luxury cars like the Tesla Model S and BMW 330i. Other popular cars that cost less and have solid safety ratings have more affordable insurance, such as car insurance for a Honda Civic or car insurance for a Ford F-150.

You May Like: Who Has The Best Car Rental Deals

How To Reduce Car Insurance Costs

Whether you buy a bare-bones minimum liability car insurance policy or a robust full coverage auto insurance policy there are ways to save.

- Shop around with multiple companies. The hands-down best way to save money on car insurance is to shop around. Knowing the average cost of car insurance gives you an idea of what you can expect to pay. But comparison shoppingwith at least three auto insurance companiesshows you how much you can save and can identify the company that offers you the best rates.

- Ask for discounts. Car insurance discounts can be a way to trim your costs. Some price breaks are relatively easy to getfor example, for going paperless. Ask what car insurance discounts youre eligible for when buying a policy.

- Raise your deductible. A deductible is the amount your car insurance company will deduct from an insurance claim check. If you choose a higher deductible, youll pay less for your policy because the car insurance company is responsible for paying a little less on claims. Collision and comprehensive coverage each come with a deductible.

- Try out a usage-based car insurance policy. Most car insurance companies offer usage-based car insurance, which could result in substantial savings if youre a really good driver. With a usage-based insurance policy, you allow your car insurance company to monitor your driving habits, such as your braking, acceleration and miles driven.

Hawaii: $1128 Full Coverage

When we compare auto insurance prices between states, we can see that Hawaii takes fifth place on the list of states with the cheapest full coverage car insurance. Furthermore, its minimum coverage is $365.

Like most states, Hawaii also maintains minimum car insurance laws, and you must carry car insurance coverage if you reside in the Aloha State.

Don’t Miss: How To Draw A Cool Car

Why Do Car Insurance Rates Change

Looking at average car insurance rates by age and state makes you wonder, what else affects rates? The answer is that auto insurance rates can change for many reasons.

The most common cause of a rate increase is filing a claim. An at-fault accident can raise your rate as much as 50 percent over the next three years. If you were convicted of a DUI or perpetrated a hit-and-run, your rates will go up even more.

However, you dont have to be in an accident to experience rising rates. Overall, car insurance tends to get more expensive as time goes on.

Cars with smart technology and advanced safety features cost more to repair, and an influx of these vehicles can drive up local rates. Also, if your state has a spell of natural disasters, rates will increase to cover the increase in comprehensive auto claims.

Since premiums can be expensive, you might assume that car insurance companies are just getting rich off of what they charge drivers. However, auto insurance losses and expenses actually exceeded written premiums in the industry from 2008 to 2015.

Average Car Insurance Cost By Category

- Minimum Coverage: $60 per month

- Full Coverage: $166 per month

- Drivers with a Violation: $75 per month

- Young Drivers: $201 per month

- Senior Drivers: $61 per month

The cost of the average car insurance policy can be a good indication of how much a driver should expect to pay for coverage.

| $1,434 |

Note: Premiums are representative only individual premiums will be different

Drivers almost always pay more for auto insurance after a moving violation. The exact amount that your rates will go up depends mostly on your state and the specific infraction, but in some states your premium can rise to more than double the rate that a safe driver would pay.

You can check your driving record to see how many infractions and points you have on your license, and if you practice good habits behind the wheel, your rates will eventually go back down. It usually takes 3-5 years to improve your driving record for insurance purposes after a moving violation.

You May Like: How To Clean Car Headlights With Baking Soda