Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

Income Tax Benefits On Car Loans Taken To Purchase Electric Vehicles

If you have taken a car loan to purchase an Electric Vehicle , you can now enjoy a tax rebate of Rs.1.5 lakh on the interest paid. This was announced in the latest Union Budget by Finance Minister Nirmala Sitharaman and is a part of the governments efforts to stimulate the adoption of environment-friendly mobility solutions. If you have purchased an electric vehicle, you will be able to avail a benefit of about Rs.2.5 lakh during the entire term of the loan. The government has also slashed the tax rates on electric vehicles to 5% from the earlier 12%.

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

You May Like: What Year Is My Golf Cart By Serial Number

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

Recommended Reading: Who Takes Carcareone

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

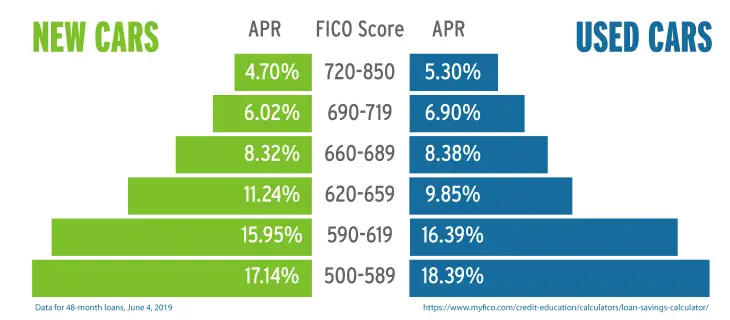

Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

Don’t Miss: How Much Commission Do Car Salesman Make

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Wherever The Road Takes You Were Here To Help

Whether youâre buying your first car, ready to upgrade or looking for a new adventure, we can help you find and finance the vehicle thatâs right for you.

See How Much You Could Afford Today

Business Vehicles

Whatever the size of your business, we have the financing options that will help get your business on the road.

You May Like: Colombos Car

Choosing The Right Car Loan

The following table explains the dos and donts when choosing the right car loan:

| Dos | Donts |

|---|---|

| Compare – BankBazaar.com can help you compare the various car loan options available to you. | Eligibility – Do not apply for a loan amount that exceeds your eligibility, as this will result in the rejection of your loan application. |

| Whats the Interest? Choose a loan that offers you the best interest rate along with the loan amount you need. | Multiple Applications – Do not apply with multiple banks as this will have a negative impact on your credit score. |

| Keep it Simple Choose the car before applying for the loan and make sure the cost of the car fits your budget. | If your application is rejected, dont continue to keep apply at different banks. Chances of rejection will rise. |

| Hidden Fees and Charges – Sometimes what appears as obvious will have a hidden component. Be aware of the hidden fees and charges concerning the car loan. | Relying on the Dealership for loans – The loan that the dealer offers may not have the best interest rate. So, check the other options. |

| Special offers There could be special offers available when you are applying for your loan. Make sure you take advantage of them | Dont pick a car with a high service cost because you already have the EMI and the insurance premiums to pay. |

| Insurance Check the insurance premium for the car as this is a recurring cost. |

In case of bad credit, is a long-term car loan a better option?

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Also Check: What’s The Average Cost Of Carshield

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

How Will Your Credit Score Affect Your Car Loan

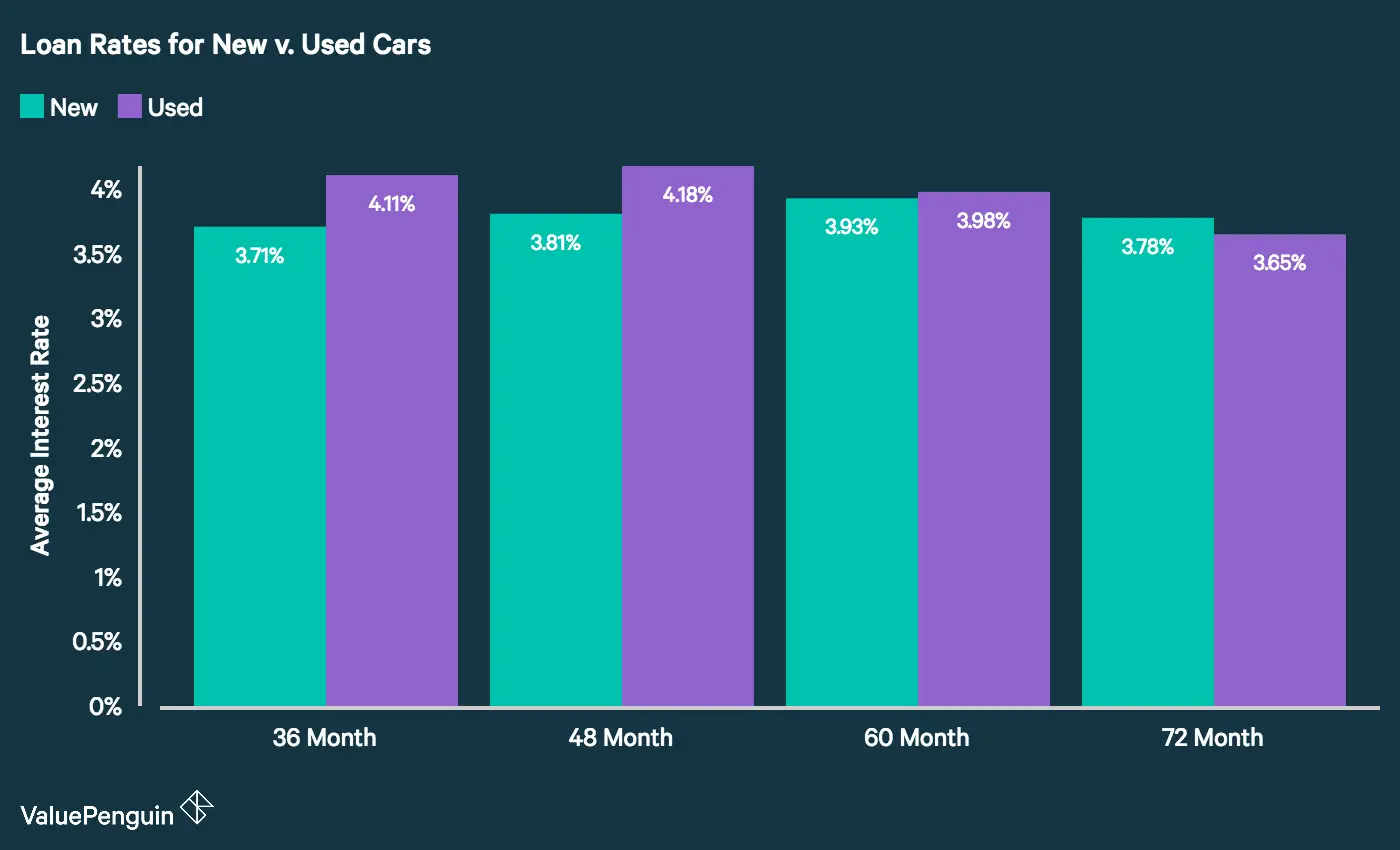

The higher your credit score, the better rate youll receive on an auto loan. Borrowers with good credit can expect to receive an APR around 5.59% or lower for used car loans and 3.69% or lower for new cars. Its possible to get 0% financing from auto manufacturers, but 0% APRs are typically reserved for those with excellent credit and may only be available on certain makes and models.

Recommended Reading: Does Carvana Buy Out Leases

Best Online Auto Loan: Lightstream

LightStream

- 2.49% to 10.99%

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. It’s also strong on customer service, receiving the top score in the J.D. Power 2020 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is the online lending arm of SunTrust Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 2.49%, which includes a 0.5%-point discount for autopay. The maximum APR on an auto loan is 10.99%.

Bank Of America Car Loan Comparison

Compared to other lenders, Bank of America has the lowest initial interest rates for new and used cars purchased at dealerships. This compares the bank with Capital One and Lightstream.

| Bank Of America |

Capital Oneâs auto loan options fall short of the original interest rates available at Bank of America for most buyers with good or better credit standing. However, Capital One can be a good choice for those with poor creditworthiness. Capital One lends to up to 500 people with low FICO creditworthiness. Bank of America does not have a minimum credit rating, so it might be worth applying even if you have low creditworthiness.

Both Lightstream and Bank of America are good choices, but Bank of America has the edge with lower starting interest rates. If youâre already an eligible Bank of America customer, the deal can be even better.

LightStream only works with borrowers with good or better credit ratings and requires a credit rating of 660 or higher. Bank of America does not require a minimum credit rating requirement, so it may be more flexible for some borrowers. Keep in mind, however, that lower creditworthiness often means higher interest rates.

You May Like: Personal Car Lease Tax Deduction

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

You May Like: Title Request Florida

Bank Of America Car Loan Calculator

Before you start the auto loan process, there are a few things you should be familiar with and the Bank of America car loan calculator is a great tool.

You need to know about the current interest rates on a Bank of America car loan, and the Bank of America car loan calculatorwill help you determine how much you can afford and repay.

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Don’t Miss: How To Remove Cigarette Burns From Car

Should I Get A Bank Of America Car Loan

You should definitely consider getting a car loan through Bank of America, especially if you have a very high creditworthiness. The advertised interest rates, which are reserved for those with excellent credit history, are very competitive compared to other major lenders. In general, Bank of Americaâs lending process is simple and has relatively few restrictions.

However, some aspects of Bank of Americaâs financing program may give clients a reason to think. If you want to buy a car from a dealer, you need to make sure that it is in the bankâs network. In addition, Bank of America does not offer discounts on cars.

You can think of other leading lenders who offer incentives to make up for the shortcomings of Bank of America. Light Stream, a division of SunTrust Bank, imposes almost no restrictions on the vehicles it finances, as opposed to the restrictions in the Bank of America dealership. Chase Bank can offer its customers a guaranteed discount on new vehicles sold at participating dealers.

What Should You Consider When Choosing An Auto Loan

In a recent interview with Kathryn J. Morrison, consumer affairs expert and instructor at South Dakota State University, she said “When shopping for an auto loan, one needs to consider more than just the interest rate. Are there any additional fees that you will be charged? Do you need to have a down payment to qualify for this rate? What is the total loan amount, and how much interest will you be paying over the life of the loan?”

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q2 2021, the average credit score was 732 for a new-car loan and 665 for a used car loan, according to a report from Experian.

In Q2 2021, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 2.34% for new cars and 3.66% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 3.48% for new loans and 5.41% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 6.61% for new car loans and 10.49% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Read Also: Request Title Florida