How Soon Can You Actually Refinance A Car Loan

If youre interested in refinancing your car loan, you may start looking for new lenders so as soon as youd like.

Believe it or not, you may be able to refinance right after you buy your car. If you are, just make sure its in your best interest to do so. You dont want to go through the refinancing process and later find out that it actually costs you money or takes a toll on your long-term financial plan.

Compare Auto Refinance Rates

The Rules Of Car Loan Refinancing

Access to a car is pretty much a necessity and a freedom that most Americans wouldnt want to do withouteven if car loan payments take a big bite out of their budget. In a 2018 survey conducted by the National Endowment for Financial Education, 15 percent of U.S. adults said they worried about their car loan debt. Whether or not you agree that owning your car is a financial burden, bringing monthly costs down is a good goal to have.

So the big question: When is it a good time to refinance your car loan? How about when you need monthly payments to be more manageable. Thats a good answer. But there are a few other things to consider. But first you should get a good understanding of how refinancing a car works so the route you choose meets your specific goals.

Reasons To Refinance A Car Loan More Than Once

Throughout the life of your auto loan, you may experience different situations when refinancing makes sense leading you to refinance more than once. Here are some examples:

-

To replace a dealers high interest rate. Maybe you financed your car at a dealership and realized the next day that you could qualify for a lower rate. If you have solid credit, you likely can find a lender to refinance your loan to a lower rate right away, or as soon as they can obtain the vehicles title.

-

To take advantage of your improved credit. If your car loan has a high interest rate because of previous credit problems or no credit history, and youve made on-time loan payments for six to 12 months, you might now be able to qualify for an auto refinance loan with a lower rate.

-

Because you need a lower monthly car payment. If your financial situation has worsened for example, you changed jobs and took a cut in pay you might need to refinance to a longer loan term for a lower payment that you can afford.

You May Like: How To Open Car Door

If Your Financial Situation Has Changed Or You Just Want Better Car Loan Terms Refinancing Your Car Loan May Be A Good Move

When you refinance your car, you take on a new loan to pay off the balance on your current car loan. Maybe your credit has improved and you might qualify for a lower interest rate, or your financial situation has gotten better and you want to remove the co-signer from your original loan. Refinancing with a new loan could mean getting better terms and rates that are more in line with your current financial needs and long-term plans.

Read on for tips to help you determine if a refinance is right for you, and to learn how to refinance a car loan.

Reasons Not Refinance Your Car

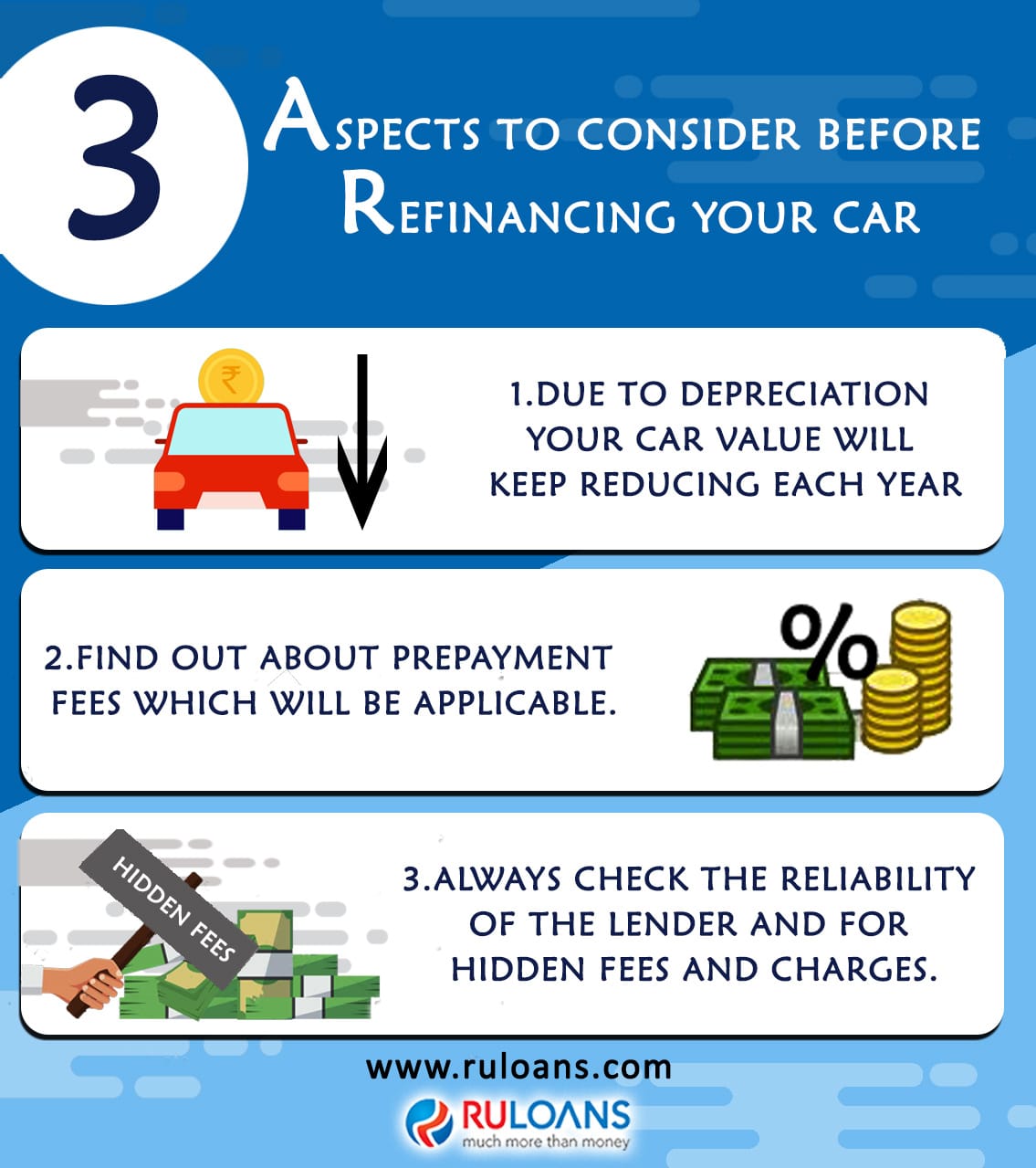

Unfortunately, there are also potential drawbacks to vehicle refinancing:

- You could pay more in interest over the life of the new loan.

- The new lender may charge steep loan origination fees.

- Your current lender could penalize you for paying off the loan early.

Get a quote to refinance your auto loan in minutes with no credit check. See how much you can save with historically Low Rates! Skip Up To 3 Payments. A+ Rating From BBB.

You May Like: How Much To Scrap A Car

Is The Time Right To Refinance Your Car Loan

Interest rates are still hovering near historic lows for mortgages, but did you know that those same super low rates also may make it wise to refinance your car loan?

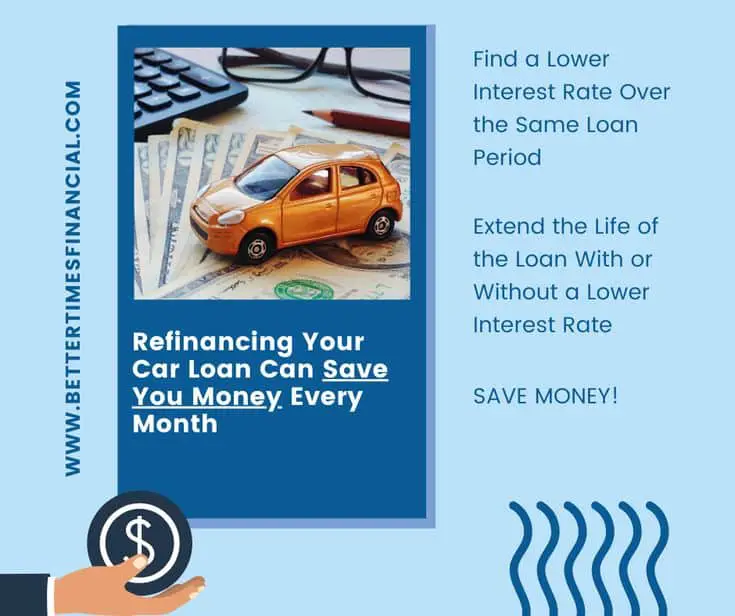

You may have heard of refinancing a mortgage but did you know you can also refinance a car loan? If you decide to refinance, you may save money in a number of ways

- Your current interest rate is high. When you first bought your car, you may not have qualified for the best rate. Or, since you originally took the loan, your credit score may have improved, entitling you to a better, lower rate. In some cases, rates in general may be lower and can be applied to your balance.

- You want to lower your monthly payments. A lower interest rate can reduce your monthly payments without increasing the term of the loan.

- You want to pay your loan off sooner. If you qualify for a lower interest rate, you can continue to make the same monthly payments and pay off the loan faster than you originally planned because more of the monthly payment will be applied to principal.

Sounds great, right? For some people, it’s a beneficial financial choice. One way to decide is to use a calculator tool to estimate your potential savings.

When To Refinance A Car Loan

Its a good idea to refinance your car if the following are true:

- Your credit score has improved and you can get a better interest rate

- You find that your current lender or dealership gave you a bad rate the first time

- You can afford higher payments and want to shorten the loan term to save on total interest charges

- A family member is willing to cosign on the loan for better terms

- You are in a better financial situation and spend less income on debt payments

Also Check: How Fast Did The First Car Go

Have You Taken Out An Auto Loan To Pay For Your Car You May Be Able To Refinance That Loan To Lessen Your Financial Burden

Refinancing acar loan involves taking on a new loan to pay off the balance of your existingcar loan. Most of these loans are secured by a car and paid off in fixedmonthly payments over a predetermined period of time usually a few years.

Peoplegenerally refinance their auto loans to save money, as refinancing could scoreyou a lower interest rate. As a result, it could decrease your monthly paymentsand free up cash for other financial obligations.

Even if youcant find a more favorable rate, you may be able to find another loan with alonger repayment period, which might also result in a lower monthly payment .

Can You Refinance A Car Twice

There are a lot of reasons & benefits to refinancing an auto loan. But did you even know that you could potentially refinance your vehicle a second time? Many financial institutions dont offer this service, but if Call Federal members will experience savings and added financial flexibility from such a solution, then its one were happy to provide.

Lets explore a few reasons why you might consider refinancing your vehicle loan a second time.

Also Check: How Much Will Insurance Pay For My Totaled Car

Shop Around To Find The Best Option

Even if your lender is willing to refinance your loan, shopping around and comparing offers can help you make sure you get the best refinance loan for your needs and budget.

Compare the annual percentage rate, loan term and any fees such as origination fees across offers.

Analyze Your Current Debt

Your first task is to verify the information on your loan payments. Log in to your bank’s online system and access your account information. It should be part of your profile, but if not, pull your old loan documents out of the file cabinet or call customer service for help. You want to determine the interest rate you’re currently paying and how much you still owe.

Recommended Reading: How Much Are Car Speakers

Is Refinancing An Auto Loan Worth It

Theres a lot to consider when it comes to knowing when to refinance your car loan. If you can access a better interest rate and your current loan doesnt have prepayment penalties, refinancing could certainly be worth it. The same is true if you need to lower your monthly bills.

But if you cant afford a negative impact on your credit score or refinancing would cost you more over the life of your loan, you may want to wait for conditions to change.

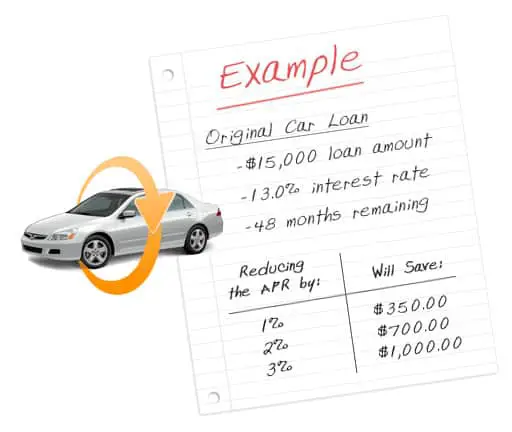

If its time to refinance your car loan or will be soon shop around for the best refinancing rates and lender for you. Some lenders offer free quotes that make it easy to compare. Even a small difference in interest rates can make a big impact on how much you pay over time.

Is It Easy To Refinance A Car Loan In Australia

Refinancing a car loan in Australia is fairly straightforward and involves a similar process to applying for an initial car loan.

Heres how car loan refinancing works:

Recommended Reading: How To Get A Car Unstuck By Yourself

What Are The Requirements To Refinance My Car

You should wait at least six months before refinancing.

While this is not a hard and fast rule, experts generally recommend waiting a minimum of six months to a year before refinancing. This gives your credit score some time to bounce back after opening a new account and gives you some time to make payments on your loan and boost your score that way. But technically speaking, you only need to wait as long as it takes to get the paperwork filed to refinance.

You should not wait until the end of your loan term.

The earlier in your loan term that you refinance, the more beneficial it will be for you. So dont wait until the very end of your loan to apply.

Your car needs to qualify.

Every lender will have different requirements for this, but your car cannot be too old or have too many miles on it. Typically if your car is over 10 years old or has over 100,000 miles on it you will have a harder time securing a refinance.

You need to have enough money left on your loan.

If you only have a small amount of money left on your loan, chances are you will have a hard time securing a refinance. Lenders will simply not think it is worthwhile to take on the hassle of refinance with such little payoff.

Can You Refinance Your Car Loan To Access More Money

You may be able to access more money by refinancing your car loan but it’s worth considering the added costs that may be involved.

Here are some alternatives to accessing more money:

- Activating a credit card means you can pay for individual goods and services with borrowed money, instead of taking out a lump sum. Credit cards typically come with higher interest rates than car loans and personal loans, but may offer more flexibility.

- Personal loan: A personal loan allows you to access extra cash for you to use as you wish – whether thats to consolidate a debt, go on a holiday or improve your home. When considering a personal loan, make sure you meet the eligibility criteria and understand the terms before you apply.

- No Interest Loans Scheme : This scheme offers people on low incomes access to credit for essential goods and services.

- Financial counselling: Financial counsellors are able to provide advice and support when it comes to bills and debt. Chatting to a counsellor could help you manage your savings and pay off your debts quicker.

Read Also: How To Get Car Oil Out Of Clothes

What You Need To Refinance

To refinance an existing loan, you need the following :

Compare Rates And Fees

Rates and terms may vary widely, so its important to compare lenders when looking to refinance. And, know that your credit score factors into the rate youre quoted. Generally speaking, the higher your credit score, the better rate youll be offered.

When looking to refinance, also consider origination fees for your new loan and prepayment penalties on your previous loan, so you can understand the total cost of refinancing.

If you have questions about your loan quote, visit a local U.S. Bank branch or by phone .

Also Check: How To Get Your First Car

Youve Taken Other Loans Out Recently

For the same reason you want to avoid refinancing for at least six months after getting your car loan, youll want to wait to refinance if youve recently taken out any other loans. Whether its a home mortgage, personal loan, or new credit card, any new loan will cause a dip in your credit score.

Even shopping for loans can hurt your credit if a hard inquiry is required. That dip, however, is temporary. If youve recently taken out a new loan, waiting for your score to recover can help you get the best auto loan rate to refinance your car.

Your Credit Rating Improved

Buying a vehicle on credit will improve your rating. As long as you make on-time monthly payments, that is. Even after just 12 months, your reliable track record could result in a nice spike on your credit report.

Armed with an improved rating, you may be able to qualify for a significantly lower interest rate. There are a few other ways you can boost your overall score, including:

- Pay off outstanding debt.

- Use no more than 30% of your available credit.

Also Check: What Type Of Oil Does My Car Use

Rule Of Thumb Of When To Refinance A Car Loan

The bottom line is that, while there is nothing to stop you from trying to refinance at any time, it is generally better to wait at least a short period of time.

At IFS, we use the following rules of thumb to guide customers on when to refinance their auto loans:

- Wait at least 60-90 days from getting your original loan to refinance. It typically takes this long for the title on your vehicle to transfer properly, a process that will need to be completed before any lender will consider your application. Refinancing this early typically only works out for those with great credit.

- Consider refinancing after six months. If you have fair to great credit, you will begin to have refinancing options after this length of time.

- If you are a first-time car loan borrower, wait at least a year to refinance your loan. A first-time borrower typically needs to build up a good car loan payment history before refinancing.

Before you jump in, it might be a good idea to think about what you hope to get out of refinancing. We did a full write-up detailing three reasons you might want to refinance. Additionally, read our guide covering what refinancing might do for you.

Check Your Credit Reports And Credit Scores

Before you apply for a refinance loan, check your credit. Review your credit reports for any incorrect information and dispute those errors. Inaccuracies could hurt your credit scores, which could affect your ability to qualify for a new loan.

Checking your credit and knowing your credit scores can also help set your expectations before you start shopping for a loan. For example, if a previous bankruptcy is still on your credit reports, youll want to shop lenders that consider applicants with previous bankruptcies in their credit history. You can check your Equifax® and TransUnion® or request one free report per year from each credit reporting agency on annualcreditreport.com.

Read Also: How To Pair Android Phone To Car

How Soon Can I Refinance After Buying A Car

Is there such thing as refinancing a car loan too early?

Unless you pay for your new car in cash, youll likely take out a car loan. When you do so, know that you dont have to commit to your initial loan forever. There may come a point where you want to refinance your auto loan to accommodate your new needs or priorities. But how soon can you move forward with a refinance after you buy a car?

2022 Auto Refinance Rates

Between 60 And 90 Days

One thing to remember is that the earlier you refinance, the more you can save money. Because it can take the previous owner and motor vehicle department months to transfer the title, you may have to wait up to 90 days to refinance your loan.

This waiting period is the ideal time to prequalify for your new loan, so you can leisurely compare rates and offers.

Also Check: How To Clean Car Interior Roof

Where To Refinance Your Car

Before moving forward with vehicle refinancing, you want to shop around to ensure you get the best deal. Use an online lender matching platform like Auto Approve to simplify the process.

It lets you view potential offers from banks and credit unions in its extensive network of lenders to gauge if refinancing your car is a smart financial move. Heres how Auto Approve works:

- Step 2: Compare loan offers to find the best fit.

- Step 3: Work with the Auto Approve team to finalize the vehicle refinance transaction.

Take the first step today towards securing a more affordable loan payment or lower interest rate. Complete the online form to explore your options in minutes.