Will I Be Using The Car For A Side Hustle

If you want to use your car for a side business like ridesharing, a leased vehicle may not be right for you: Stipulations in leasing contracts usually restrict any kind of business usage. Its best to consult with the leasing company first before you use the car for anything other than routine driving. Of course, if you buy your car, its up to you to decide what youd like to use it for.

Choose The Best Final Lease Terms

Now its time to involve your local dealer again. Call the salesperson who helped you with your test drive and ask if he can beat the quote of your internet/email search winner. If he can beat their quote, you should repeat the process and ask the internet/email winner if they can beat your local dealer. As soon as one of the dealers refuses to improve, you should feel comfortable leasing the car from the other dealer knowing you didnt leave too much on the table.

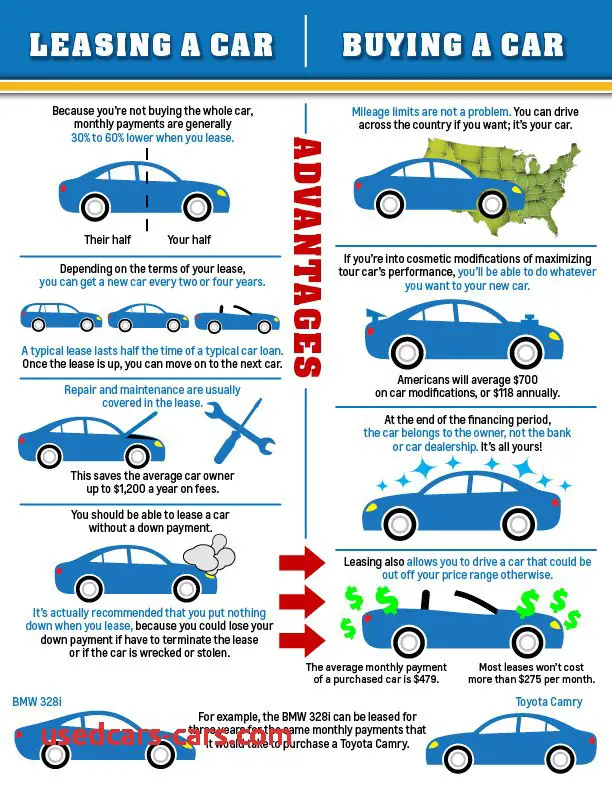

The Differences Of Leasing A Car Vs Buying A Car

You can draw some fairly strong contrasts between leasing and financing. Both have advantages and disadvantages. Short term, a lease will cost less. In the long run, however, two leases will cost more than buying one car. And, at the end of five or six years, the loan will be paid off, and whatever value the car retains will be yours.

Here are some other stark differences.

Leasing

Buying

Don’t Miss: What Is The Fastest Car In Forza Horizon 3

Leasing A Car In Hawaii

Why you can trust Jerry

Hawaii has the highest cost of living in the United States. Leasing a car is a good way to cut these costs, but youâll need to negotiate certain lease terms to maximize savings.

Let Jerry find your price in only 45 seconds

Motor Vehicle Leasing Costs

You can deduct costs you incur to lease a motor vehicle you use to earn income. Include these amounts on:

- line 9281 for business and professional expenses

- line 9819 for farming expenses

- line 9281 for fishing expenses

When you use a passenger vehicle to earn farming or fishing income, there is a limit on the amount of the leasing costs you can deduct. To calculate your eligible leasing costs, fill in “Chart C Eligible leasing cost for passenger vehicles” of your form.

If the lease agreement for your passenger vehicle includes such items as insurance, maintenance, and taxes, include them as part of the lease charges on amount 20 of Chart C.

Recommended Reading: How To Read Club Car Serial Number

Negotiate Your Lease Terms

You may think you can only negotiate when youre buying a vehicle, but thats simply not true. When lease shopping, terms like the mileage, cost of the vehicle and interest rate on the lease can all be negotiated.

This could help you get a lease contract that works better for your needs and budget.

Once youve selected your preferred vehicle and come to an agreement on the terms of your lease, its time to fill out the paperwork. If youre approved, youll receive a contract that formalizes the agreement between you and the leasing company, and it will outline your use of the vehicle and your obligations. This is your lease agreement.

As you review your lease agreement, youll want to note your monthly payment, the amount due at signing, what maintenance youll be responsible for , mileage limits, and any fees due, like the disposition fee and acquisition fee.

You should also confirm if your lease is a closed-end lease or an open-end lease. With a closed-end lease, when you return the car, youre done you generally dont pay any additional amount unless there is excessive mileage or wear on the car, and you can just walk away.

With an open-end lease, you and the lessor agree at the start of the lease what you think the car will be worth at the end of the lease . Then, when the lease ends, you have to pay any difference between its residual value and its realized, or market, value.

Costs Less To Get Nice Options

With the money youre saving with cheaper monthly payments, tax deductions and lower down payments, you can spend a bit more on yourself, getting a nicer car in the process. Whether you get upgrades to your vehicle or a bigger or better car altogether is up to you, but thanks to the low cost of leasing, you can finally get the car you want.

You May Like: Clear Coat Repair Diy

Can I Finance The Purchase Of My Car When The Lease Ends

Paying with cash is the cheapest option since you wont pay interest charges. But if you finance the purchase, proceed as if you were starting a car hunt from scratch. Get preapproved for a loan at a bank or credit union before visiting the dealer so you have a comparison for the dealers financing offer, said Ryan Felton, a Consumer Reports writer who recently investigated variations in interest rates charged to borrowers with similar credit profiles. Your best bet is to shop around, he said. And keep an eye on the total cost, he said, not just the monthly payment.

Youll Never Get Bored

New cars are coming out every year with more options, better fuel efficiency, more stylish looks and newer technology. You dont want to miss out on all that, do you? Leasing is a great way to always have the keys to a newer car in your possession, and youll never fall out of love with your new ride. Plus it helps with keeping up with the Joneses. Those guys are fast!

You May Like: Fastest Car In The World 2021

Questions To Ask Before You Lease

Before you decide to lease a car, consider your priorities:

- Are you looking for a new or a used car? The monthly payments for a new car will likely be less if you choose to lease.

- How many miles do you drive per year? If you drive a lot, leasing may get expensive.

- Can you take care of the cars interior and exterior? If you return the car in poor condition, you may incur additional charges.

What Does It Mean To Lease A Car

Leasing a car is fundamentally different from purchasing one, and each option comes with its own set of benefits and drawbacks. When you lease a car, you’re signing an agreement to rent the car for a specified term . You do not own the car and at the end of the term you’ll need to return the car to the dealer. This is different than buying, where you’ll own the car yourself.

Many people elect to lease a car to secure lower monthly payments, pay less cash out-of-pocket, and gain peace of mind afforded by the manufacturer warranty and maintenance coverage. Leasing is also attractive to those who prefer to drive the newest body style or enjoy the latest technology. A lessee is not bound to their leased vehicle indefinitely, nor do they have to worry about selling it when they are ready to get into a new model.

However, because leasing a car is not the same as buying a car, the payments made toward your vehicle each month do not translate to ownership of the car at the end of the lease period. The only way you’ll get to keep the car is if your agreement comes with a purchase option and you choose to buy the vehicle by exercising the purchase option.

Further, leasing a car comes with certain requirements car ownership does not impose. Staying at or below the mileage limit outlined in your lease agreement is one such limitation. If you exceed the allowable mileage, you may be charged excess mileage penalties at the end of the lease term.

Read Also: Carvana Sell Leased Car

What’s The Difference Between Leasing And Buying A Car

A car lease is a contract in which one party permits another party to drive a vehicle for a specified period of time in exchange for periodic payments, usually monthly installments. Unless your contract has the option to purchase the car at the end of the contract period, you must turn it back over to the lessor.

The difference between leasing a car and financing a car is that with financing, you are purchasing the vehicle. You will still make monthly payments, but at the end of the term, you’ll own the car.

| Leasing |

|---|

| Post-warranty repair costs |

More Leasing Terms To Know:

The leasing process will be easier if you have a basic understanding of what these terms mean:

- Lessor: The leasing company providing the lease.

- Lessee: The person leasing the vehicle .

- Residual value: The projected value of the car at the end of the lease.

- Sale price or capitalized cost: The amount of money youll pay to lease the car.

- MSRP: The Manufacturers Suggested Retail Price for the vehicle.

Read Also: How Much Is License And Registration In California

How To Lease A Car

If youre ready to lease a car, follow these steps:

At the end of the lease, youll have a few options. You can either turn in your car to the dealer, purchase the car or lease a new car.

Reasons Leasing Works Now

Not everyone is a candidate for leasing. But here are five factors that could tip the decision toward leasing rather than buying your next vehicle.

1. Leasing offers a shorter commitment. No one knows what will happen over the next few years, Weintraub says. People are worried about job security and their finances so the commitment of a car purchase isnt as appealing. Instead, consumers are leaning toward leasing because there are affordable two- and three-year leasing agreements available. Also, points out Scot Hall of the lease-trading site Swapalease, leases are more flexible since the contract can easily be transferred to another person without a severe financial penalty.

2. Leasing requires little upfront money. During the recent lockdowns, many people burned through their savings and had little cash left for a down payment for buying a car. But lease contracts can be initiated with little or no money down. Of course, a no-money-down monthly lease payment is higher, but some people still prefer it, Weintraub says. If monthly payments are still too high, its best to consider leasing a lower-priced car to stay in your budget.

3. Low interest rates mean more affordable payments. Current lending rates are at a nearly seven-year low, according to auto site Edmunds, with many no-interest loans available. Weintraub says this substantially reduces the cost of monthly payments.

-

Monthly payment.

Also Check: How To Keep Squirrels Away From Cars

What Is A Leasing Mileage Cap

Even when you finance a car, the higher the mileage when you sell it or trade it in, the less its worth. The difference with leasing, the lessor factors in a specific number of miles when estimating depreciation. Over the course of a lease, the allowable mileage or mileage cap might average out to 10,000, 12,000, or 15,000 miles per year. Exceeding the mileage cap reduces the cars value at the end of the lease. This is why a leasing company will charge you a predetermined penalty for each mile over the cap. Be sure you know the per-mile penalty before signing the lease.

Leasing Vs Buying A New Car

Comparing the two major finance choices

The choice between buying and leasing a car is often a tough call. On the one hand, buying involves higher monthly costs, but you own an assetyour vehiclein the end. On the other hand, a lease has lower monthly payments and lets you drive a vehicle that may be more expensive than you could afford to buy, but you get into a cycle in which you never stop paying for the vehicle. With more people choosing a lease over a loan than they did just a few years ago, the boom in leasing isnt stopping anytime soon.

Buying a vehicle with a conventional car loan is pretty straightforward. You borrow money from a bank, credit union, or other lending institution and make monthly payments for some number of years. A chunk of each payment is put toward paying interest on the loan and the rest is used to pay down the principal. The higher the interest rate, the higher the payment. As you repay the principal, you build equity untilby the end of the loanthe car is all yours. You can keep the car as long as you like and treat it as nicelyor poorlyas you want to. The only penalties for modification or abuse could be repair bills and a lower resale value down the road.

With more people than ever working from home, the mileage restrictions on a lease may not be a factor for a lot of shoppers. Quite the opposite: Many might find they dont use the miles they have paid for.

Recommended Reading: How To Remove Scuff Marks From Car Interior

Leasing Vs Buying A Car In Canada

Leasing is essentially a long-term lease and works very differently than owning a car or paying off auto loans. When you sign a car rental agreement, you agree with the dealership that you will drive and service that car for the period specified in the rental agreement. Then, the dealer makes the payment for renting the vehicle, usually for 2-4 years.

Generally, a lease is cheaper than a car loan because you pay for the cars depreciation. With leasing, you are essentially paying for a long-term rental and paying for the cars depreciation, resulting in returning the vehicle to the dealer. At the end of a fixed-term contract, a lease option is usually to buy the car. In contrast, leasing means you only pay for the car when you own it.

However, with leasing, you are limited in how much you can use the vehicle how much you can drive it, and you always have a monthly payment for the car. Owning a car is expensive whether youre buying new or used, and leasing is one way many people cut their monthly vehicle operating costs. Renting a used car can be a cost-effective move if you only plan to drive for a few years and want to get a low monthly rate.

Finally, the great thing about leasing is that you dont have to worry about the long-term maintenance of the car. Your only concern is paying any lease termination fees, including unusual wear and tear on the car or extra mileage.

How Much Will I Drive It

If you lease a car, there will be strict limits to how much you can driveusually 15,000 miles per year. If you exceed that amount, youll have to pay penalties, plus hefty per-mile overage charges on top of that. If you normally put lots of miles on your vehicle, or think that you might, buying a car is probably the way to go you can drive it as much or as little as you want.

Read Also: How Do I Identify My Club Car Golf Cart

Consider Selling The Vehicle To Another Person

One of the very creative tricks that many customers implement is selling the leased car to another person without buying it themselves. In other words, you don’t necessarily have to pay for the vehicle and buy it under your name and then sell it to another person. Instead, you can simply sell it immediately to the other person and make some profit out of it.

What To Do At The End Of Your Lease

This is perhaps the biggest question most people have – what happens at the end of a lease?

You can choose to:

-

Purchase the carYou can purchase the vehicle outright or take out a loan to finance the purchase of the vehicle for its remaining value.

-

Return the carSimply give the car back. After an inspection, you’ll be charged for any excess wear and tear, excess miles and a disposition fee.

-

Extend the leaseIf you want to hold onto the car but don’t want to buy it, you can extend the lease for a limited period of time.

-

Re-leaseYou can re-lease your current vehicle with a used car-lease, which is typically less expensive than a new car lease.

Don’t Miss: How To Keep Squirrels Out Of Your Car