Insuring A Teen Driver

Once your teen obtains a learners’ permit, they should be added to your car insurance policy. Since their driving will be limited and would only take place with a licensed driver in the car, they will not be rated until they turn 18 years old or receive a valid driver’s license .

When your teen obtains a license, simply log in to add them as a driver on your policy. You can also call us at , ext. 4511, to discuss the best coverage options for your family.

And remember: your teen driver could be eligible for several valuable discounts! Here are a few that we offer for new drivers:

- Good Student

- Driver Training

- Defensive Driving this discount can be obtained for drivers of all ages who complete an approved course.

Why Is Car Insurance So Expensive For An 18

Car insurance for 18-year-old drivers is expensive because insurance companies use your driving history to determine your insurance rates. If you have no driving experience, they automatically default to a presumption that you will file a claim. Insurers also do a fair amount of research into statistical groups, with years of records indicating that teen drivers are more likely to be reckless behind the wheel than drivers in other age groups.

Reconsider Your Auto Insurance Policy After Graduation

Many parents generally opt to retain teens on the familys automobile insurance policy until they graduate from college, assuming they find employment and live away from home. At this point they should be paying for their own housing, food and credit card bills, building up a positive credit rating. Automobile insurers consider an applicants credit score among several other factors in their underwriting. Assuming a clean driving record and a solid credit history, theres a good chance of a competitive premium. By developing a better credit score, most everyone can secure auto insurance at a lower cost, Hartwig says.

Some parents may decide to continue keeping their children on the policy for a period after their graduation. But if the child can afford paying for his or her own auto insurance, this is the time for the family to sit down and talk about it.

You May Like: Carvana Lease

Merrill Burchell Car Insurance Writer

A 17-year-old can get their own car insurance in most states. Most states require a parent to grant legal written permission for anyone under 18 to buy a car or insurance, however. In some states, a 17-year-old must also have a parent listed on the cars title, registration and insurance. A few states set a minimum age for sole ownership of a car but let insurance companies decide whether a parent or guardian must co-sign the insurance policy.

If you are a minor and want to own and insure a vehicle, you should check with your state’s department of motor vehicles to see if your state has a minimum age for car ownership. Also ask about extra measures you may need to take to register and insure a car until you turn 18.

Keep in mind that having your own policy will be expensive. The average cost of an individual policy for a 17-year-old is over $5,500 per yearmore than three times the average amount paid by drivers over 25. Be sure to get multiple quotes, from companies like GEICO and Progressive that offer good rates for young drivers. If you are living at home or attending school, also consider talking with your parents about the pros and cons of being covered on their policy instead. It would be much cheaper.

When does car insurance go down?

Online Aca Insurance Marketplaces And Healthcare

Enroll During Open Enrollment

Anyone can enroll in a healthcare plan on sites like HealthCare.com. Once again, youll have to sign up during the Open Enrollment Period which runs from November 1 December 15 each year in most states. In some places, like California, Colorado and Washington, D.C., enrollment windows have been extended permanently and other states often issue extensions each year.

Enroll Because Your Current Plan Ended

If you lose your current health insurance plan through no fault of your own such as losing your familys or employers sponsored plan, you have a 60-day window to join new ACA insurance.

Buying insurance without price comparing your options can be pretty costly, so its a good idea to see if you qualify for one of the options listed below to save some money.

You May Like: Making Car Freshies

Ask An Insurance Agent

Hartwig further advises including an insurance agent in the conversation. An agent has the risk and insurance expertise to assist with a talk on the different types of insurance coverages that exist in the market and the importance in shopping for insurance, comparing and contrasting the terms, conditions and costs of different policies, he says.

Whether you decide its time for your child to get their own policy or keep them on yours, Nationwide offers reliable auto insurance coverage with plenty of discounts. Get a free quote today.

States With The Highest Car Insurance Cost For A 18

Auto insurance rates are determined at the state level. This means that the same person could see a significant difference in their insurance rates by moving from one state to another. Teens in Michigan, Louisiana and New York will have some of the highest insurance rates in the nation.

Top 10 Most Expensive States for 18-Year-Old

Scroll for more

Recommended Reading: Columbo Car Auction

Weighing The Long And Short Term Costs Of Adding Your Teenager To Your Policy

When considering whether to put a teen driver on a separate policy parents should weigh short term savings on premium against the implications having a loss could have on their familys finances. Defensive driving courses, good student discounts and establishing safe driving habits that lead to lower rates on renewal are ways to reduce the burden of adding teen drivers and their cars to a parents auto policy. Separate policies could have much larger and longer term financial implications if there was an accident. Discuss your familys needs with a Trusted Choice agent. Trusted Choice agents have the ability to represent multiple insurance companies and can help you find the right match for your needs.

Elliot Whittier Insurance Services, LLC is a local Trusted Choice® agency that represents multiple insurance companies, so it offers you a variety of personal and business coverage choices and can customize an insurance plan to meet your specialized needs. You can visit Elliot Whittier online at www.ElliotWhittier.com, email , or call 800-696-3947 and ask for Christine O’Keefe.

Take Advantage Of Discounts

Most insurance companies offer discounts that can lower your premium, so make sure youre taking advantage of all the discounts you are eligible for. If your car has certain safety features that qualify for a discount, like anti-lock brakes, make sure your insurance company knows. Also ask if there are any unadvertised discounts you can claim. For instance, you might be able to save some money by enrolling in paperless billing.

Also Check: What Rental Car Places Take Debit Cards

How Long Can You Be On Your Parent’s Auto Insurance Policy

You can stay on your parents auto insurance plan indefinitely. There is no age cutoff, as long as you live at the same address. If you have your own car, that vehicle needs its own insurance policy or needs to be listed on your parents policy. The policyholder for any particular vehicle usually needs to be the person named on the title. This doesnt matter if you are 16 and living at home or 26 and on your own.

College students who live at home during the summers or go to school full-time usually remain on their parents insurance policies. Kids are only ever off their parents policies after they leave the nest for good. If you move out or choose to no longer be included on your parents’ car insurance policy, simply notify your insurance company.

If you are a parent, you may be able to exclude a child from your policy , by contacting your auto insurance company and assuring them that the child no longer lives with you. To do so, you might need to prove that your child has their own primary residence depending on their age.

Can Your Teen Get Their Own Insurance

Many parents wonder if they should insure their teenager’s car separately from their own vehicle. Car insurance providers consider teenagers to be high-risk drivers, which means insuring them is going to be expensive. Many parents think getting their teen their own insurance will save them money. They might also believe they won’t be responsible for any accidents or damages their young driver might cause. Unfortunately, having a separate policy for a 17-year-old can leave coverage gaps that end up costing you more in the long run.

Because someone who is 17 is a minor, a parent or guardian must sign the car insurance policy they’re issued. This means parents are going to be responsible for what happens when their teen driver is behind the wheel.

Someone who wants to legally sign a contract, which is what an insurance policy is, must be of legal age to do so. According to CarInsurance.com, a 17-year-old doesn’t meet the legal age requirement to enter into a contractual agreement. This means they can’t do things like consent to medical treatments without a parent or guardian’s consent or sign up for the military until they’re considered an adult in their state.

In fact, if a teen wants to finance and buy a car, their parent or guardian must co-sign the loan. Even if they were to pay cash, their parent is still the legal owner. This is because a minor can’t own property. Only an adult can technically own real estate, a car, or anything else.

Read Also: Repair Cigarette Burn In Car Seat

Liberty Mutual: Best For Teens

After comparing top auto insurance plans for 18-year-olds, Liberty Mutual is the best for teenaged drivers. It is an established brand that has been serving young adults and parents with dependents since 1912, which has earned it a 4.0 out of 5.0 star rating.

Some of the coverage benefits that are useful for young drivers are:

- Accident Forgiveness: This plan will protect your premium against heightened rates after your first at-fault accident, which can be beneficial for newer drivers.

- Roadside Assistance: Liberty Mutual will cover towing, flat-tire changes, dead battery service, lockout service, and fuel delivery service when your teen’s car is disabled.

It’s usage-based program, RightTrack®, is another popular way to save money on teen car insurance and rewards safe driving choices. The discount is based upon total miles driven, nighttime driving, braking, and acceleration.

If you’re interested, we recommend reading our review of Liberty Mutual in full and contacting an agent to get matched with the best quotes in your area.

Car Insurance Rates By Insurance Carrier For 18

Every insurance provider charges a slightly different rate for insurance. Based on our sample quotes, Erie, USAA and Geico offer the lowest rates for 18-year-old drivers. In comparison, The Hanover, Farmers and MetLife had the most expensive premiums.

For most 18-year-old drivers, we recommend checking out Erie and Geico. Erie offers a discount for drivers who are under 21, and accident forgiveness is included in every policy. Geico offers a good student discount based on GPA, along with a long list of other savings. Slightly higher in average premiums, Travelers also offers some great discounts for young adults, including a good student discount, student away at school discount and driving training discount.

If your spouse or parent is affiliated with the military, we also suggest looking into USAA. Not only does USAA typically offer competitive rates, but they also have amazing customer service, a driver training discount and a good student discount. USAA insurance is also available to ROTC students and officer candidates in a commissioning program.

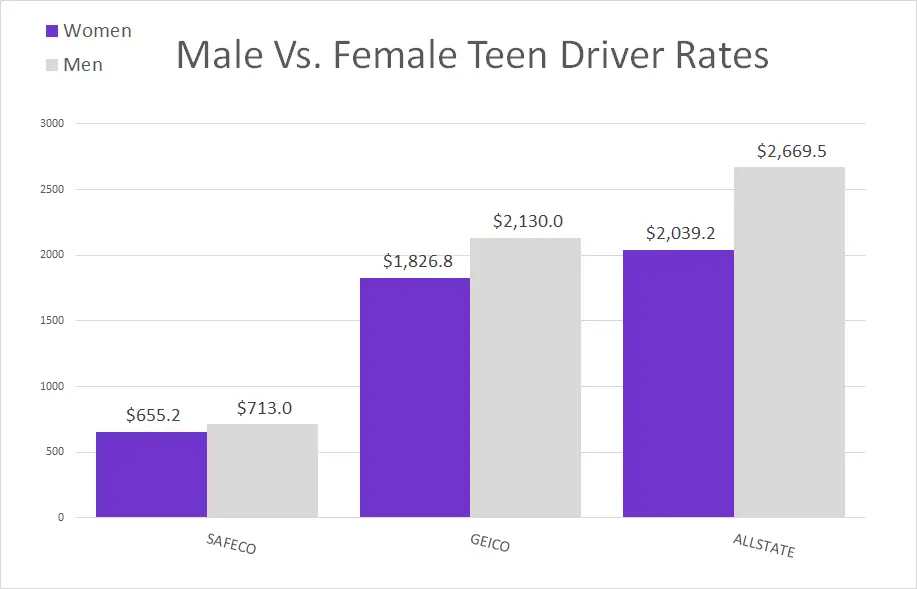

The chart below compares the average car insurance premiums for male and female 18-year-olds based on provider.

| Company |

|---|

| $2,413 |

Read Also: 300 Amp Alternator Car Audio

Cheapest Auto Insurance Companies For 18

Geico is the cheapest insurer in three out of nine states, according to our analysis.

| State | |

|---|---|

| Fred Loya | $3,163 |

We did not include USAA in these recommendations, as its policies only serve current or former military members and their families. If USAA were included, it would offer the cheapest auto insurance for 20-year-olds in Illinois, Michigan, New York and Texas.

Teens Cannot Sign A Contract

In order to legally sign an insurance policy or other contract, a person must be of the “age of majority” and a 17-year does not usually meet that requirement. This is the age when a child legally becomes an adult in the eyes of the state. Once a person reaches the age of majority they can consent to medical treatment, sign a contract and join the military if they wish.

The age of majority varies by state but in all states, it is at least 18. There are a couple of states where it is even higher, Alabama and Nebraska put their age of majority at 19.

What all of this means is that in most states, a teen cannot buy or insure a car completely on their own. A minor typically cannot own property in most states so his or her parents would technically own that property until the child becomes an adult.

In most states, a parent will have to co-sign on a loan for a car as well as any other financial paperwork the dealership requires. Basically, while a juvenile can technically buy a car, the parent will be the legal owner.

Read Also: Car Rental Companies With Aarp Discount

Average Cost Of Car Insurance For Teenagers By Age

|

$1,812 |

Teenagers are more expensive to insure than older, more mature drivers because theyre more likely to be involved in an accident, which makes them high-risk. In fact, teen drivers are nearly three times as likely to be involved in a fatal car accident as drivers over the age of 20, according to the CDC. Teenage boys are even more expensive to insure than teenage girls, paying an average of 10% more for coverage.

How Much It Costs To Insure A 16

Determining the cost of car insurance for any one person is extremely tough to do. Several variables impact your rate, including:

- What insurance carrier you hold

- What state you live in

- Whether you qualify for discounts

- Whether or not the teen has their own vehicle

The fastest way to get the numbers you need to properly budget for a 16-year-old driver would be to .

Most states require every driver on the road to have car insurance, and the penalties and fees for not doing so will vary. A teenager can be covered by their parents or guardians’ policy, or they can purchase your own. In most cases, though, it is more cost effective for a teenager to be on their household’s insurance policy.

Read Also: What Stores Accept Carcareone Card

How To Lower The Cost Of Teenage Car Insurance

Even though car insurance is typically expensive for teenagers, there are still ways to lower the cost of covering a young driver. One of the best ways to reduce the cost of teen car insurance is to add them to an existing policy rather than have them purchase their own policy. Adding a teen to a policy raises rates by an average of $1,461 per year, but its still cheaper than the cost of a separate policy. Also, look for discounts that are specifically for young drivers, like good-student and student-away-at-school discounts.

If your teen does need to purchase their own policy, they should compare quotes from at least three different insurers in order to find the best deal. The cheapest car insurance companies for teens are Travelers, USAA, and Progressive, according to WalletHubs analysis.

Lower The Coverage Amount

When thinking about what car to choose for a teen driver, an older, more affordable vehicle can help you save money on your car insurance. If you can afford to replace the car out of pocket, a liability-only car insurance policy can be an excellent way to save money on your insurance. MoneyGeek analyzed dozens of car insurance companies across hundreds of cities and all 50 states to find the cheapest liability-only car insurance companies.

If you buy a new vehicle with a loan, the lender may require that you carry comprehensive and collision coverage. In contrast, a vehicle that costs several thousand dollars to replace in the event of an accident may need to carry full coverage even if you arent dealing with a lender. Choosing a cheap, older model can let you use liability-only coverage to keep insurance costs low.

You May Like: How Much Do Car Washes Make A Year

Tips For Parents Of New Drivers

Parents have the biggest influence on their children when they’re learning to drive. Help your new teen driver develop safe habits by:

- Allowing lots of time for practice driving

- Exposing them to different types of terrain and adverse weather conditions when practice driving

- Evaluating their skills to determine when they are ready to drive on their own

Be sure to read all of our tips for parents of teen drivers!

Is Car Insurance Cheaper If You Own The Car

The answer here is probably not. As a young driver, you are in the highest risk group for car insurance, especially if you are still a teen. Young drivers cause the most accidents of any age group, so insurers need to charge more for their policies to ensure theyll have enough to pay out on claims.

Chances are if you are a young driver, your premium costs will be high whether you own the car or not. The rate that an insurer will charge your parents, unless they are bad drivers, will probably be lower than what youd pay for a policy, even if youre listed as a driver on their policy.

Also Check: Carcareone Card Locations