How To Use A Car Loan To Improve Your Credit Score

Auto loans, when managed responsibly, are likely to have a positive effect on your credit score.

When you have less than stellar credit, you spend a lot of time searching for ways to improve it. After all, a healthy credit score is essential to locking in lower interest rates on future loans and having access to a large variety of credit products.

In your pursuit of bettering your score, you may have come across the idea that taking out a new car loan could help you improve your credit score. If you are considering it, there are some things that you should know before you begin shopping around for the best loan.

2022 Auto Refinance Rates

Can You Be Denied A Loan After Pre

Yes, you can still be denied a loan after pre-approval. Pre-approval for an auto loan is more of an invitation to apply than it is a guarantee that you will be approved once you actually apply. The good news is that a pre-approval suggests that you are likely to be approved for the loan based on your meeting the minimum criteria. However, you still have to apply for the loan, and the lender will have to perform a hard inquiry at which point they may not approve your application.

One of the main reasons why an auto loan may be rejected after pre-approval is because the individuals credit situation has changed. For instance, the individuals credit score may be lower when they apply for the loan then it was when the lender initially received their credit history information. If you are self-reporting credit and income information to get a pre-approval, then any mistakes you make in entering the correct information can also impact denial once you submit the actual loan application and the lender performs the hard inquiry.

To minimize your chances of being rejected for the auto loan after pre-approval, you will want to check your credit score from one or two of the major credit bureaus. If your credit score falls within the range that the lender is looking for, you have a good chance of getting final approval once you have applied. Its important to note that you may also be approved for auto loans that you were not pre-approved or prequalified for.

Auto Loan Interest Rates By Credit Score: The Bottom Line

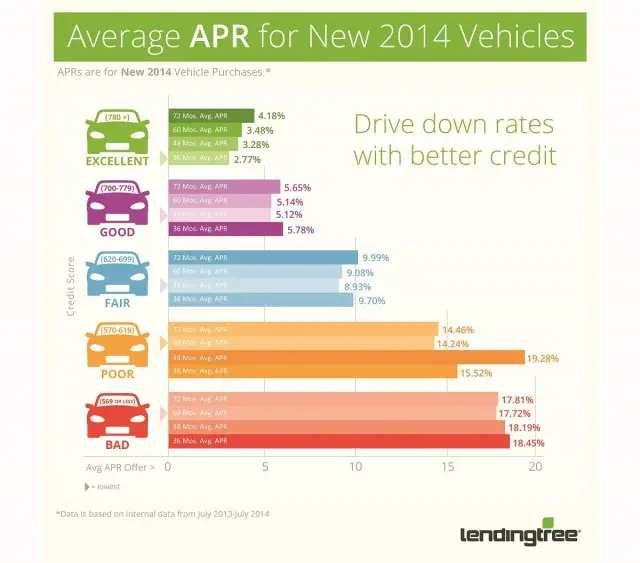

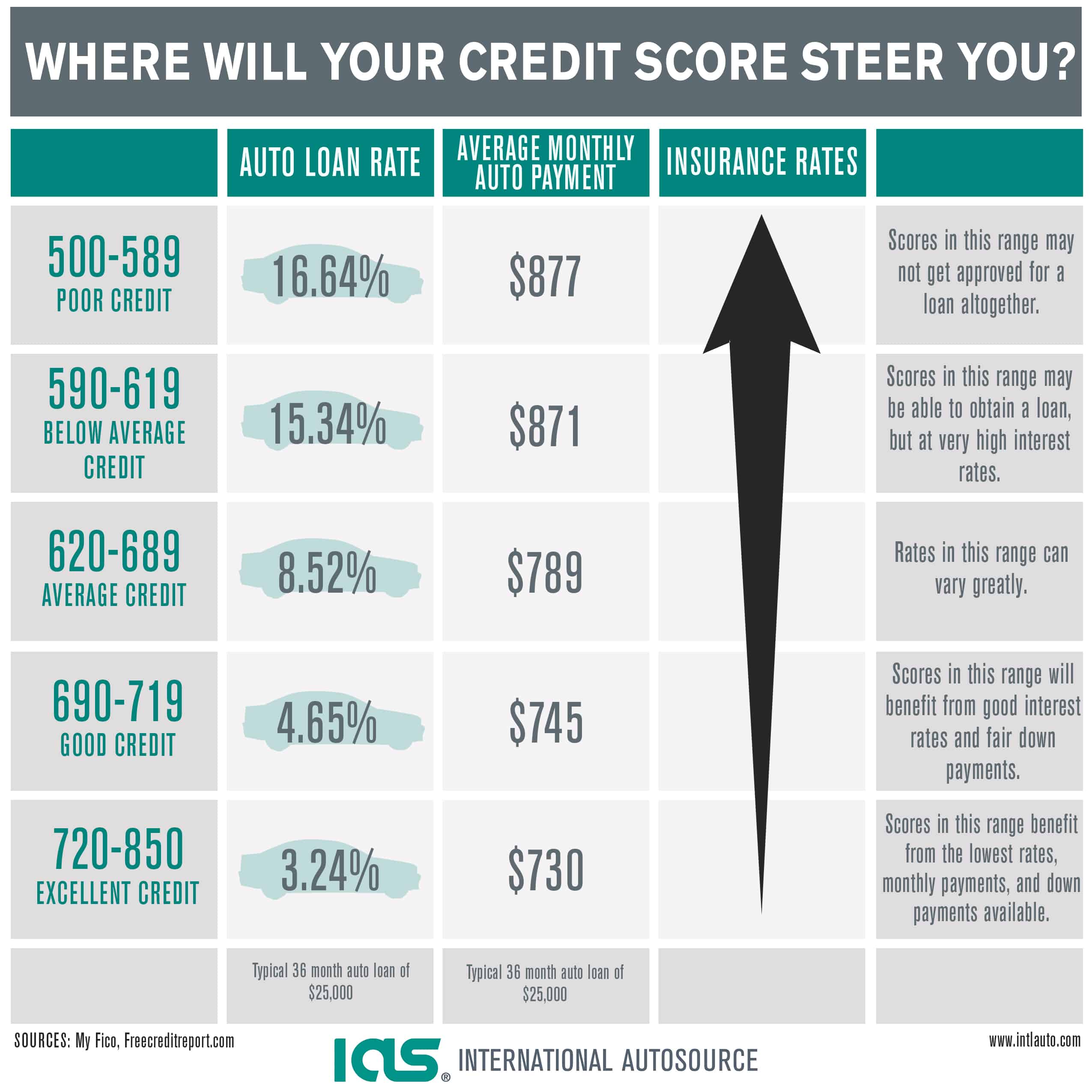

Nearly all lenders set auto loan interest rates by credit score to some extent. While other factors affect the rates available to you, your credit score typically plays the most influential role. Between banks, credit unions, online lenders, loan marketplaces and car dealerships, you have plenty of options for auto loans. Depending on your situation, one may offer you better rates than others.

Recommended Reading: How Much To Lower A Car

Your Credit Score Has Improved

A credit score can go through a lot of changes over a couple of years. If you bought a car with a low score, and it has since improved, you can garner a lower interest rate by refinancing.

Even if it is only a couple of percentage points lower, a minor interest rate adjustment will still save you a lot of money over time. If your credit report is teetering you may want to consider partnering with a . They can help you get back on track and jumpstart the process of rebuilding your credit score by dealing with your creditors and the major credit bureaus for you.

How Much Will An Auto Loan Raise My Credit Score

How much your score will change when you take out a new auto loan is unpredictable. Since everyones credit history is unique to them, the effects of a new loan will be too. In fact, some might not see any change in their credit score whatsoever.

That said, borrowers who are looking to see major changes in their scores should work hard to maintain a positive loan status.

Compare Auto Refinance Rates

Read Also: Where To Buy Car Seat Covers

So Should You Pay Off Your Car Loan Early

Its almost never a good idea to hold onto debt simply for the sake of boosting your credit score by a few points.

There are exceptions to this rule. Lets say youre getting ready to apply for a big loan and your credit score is just above the threshold for good credit . In this precarious position, you may want to wait until after youre approved to rock the boat.

In most situations, though, the sooner you eliminate your debts, the better.

Managing your auto loan can be hard, but its crucial that you make your payments on time if you want a healthy credit score. If youre struggling to make payments, it might be time to make your monthly payments more affordable by refinancing your auto loan.

Lindsay is a recent college graduate living in Fort Collins, CO. She taught herself how to manage her money after a series of bad encounters with student loans, low-paying jobs, and a house from hell. Today, shes working hard to pay off her debts, earn more money, and find her dream job as a wildlife biologist. You can find her work on many financial sites like Magnify Money, Credit Sesame, and Centsai.

Is Financing A Car A Good Idea

Higher credit scores could land you lower rates, and vice versa. Financing a car may be a good idea when: You want to drive a newer car you’d be unable to save up enough cash for in a reasonable amount of time. The interest rate is low, so the extra costs won’t add much to the overall cost of the vehicle.

You May Like: How To Remove Hard Water Spots From Car Windows

The First Hard Inquiry And Rate Shopping

When you first start car shopping and give your information to a lender, or fill out an application for a loan, a hard inquiry hits your credit. It isnt always a heavy hit, and not all hard inquiries are the same, but you can generally expect a five- to eight-point drop in your credit score.

Good news, though, because if you continue car shopping and apply with different lenders or dealerships, your credit score is only affected as if one hard inquiry was made as long as you stay within a 14- to 45-day time frame.

Having multiple inquiries in a short time is often referred to as rate shopping. Essentially, this means you can go to multiple dealers within two weeks, and only have one hard inquiry reflected on your credit score.

As a result, you shouldnt be afraid to shop, double-check your credit score, ask questions, and search for the best deal available.

What Credit Score Is Needed To Get A Car Loan

There isnt a specific credit score that will guarantee approval for a car loan, but it tends to be the case that the higher your credit score, the more desirable you may be as a customer to lenders.

So, while a car loan has the potential to both positively and negatively affect your credit score, doing your due diligence and managing your credit responsibly can give you the tools you need to protect it as best you can.

Did you find this helpful? Why not share this article?

This article was reviewed by Personal Finance Editor before it was published as part of RateCity’s Fact Check process.

Georgia Brown

Personal Finance Editor

Georgia Brown is a Personal Finance Editor and journalist for RateCity, covering the scope of finance in Australia over loans, credit, mortgage and housing, superannuation, and sustainable finance, to name a few. Before venturing into personal finance, she worked as a reporter for Smart Property Investment, Real Estate Business, and REA’s realestate.com.au, and these days her work can be seen across numerous publications, including Lifehacker and RateCity.

Also Check: What Recalls Are On My Car

Can You Refinance An Auto Loan With Bad Credit

If your credit scores have dropped significantly since you took out your original car loan, it may be difficult to find refinancing that saves you money because lenders typically charge higher interest rates to applicants with lower credit scores. If your refinancing goal is lower monthly payments, however, you may be able to find an auto lender that specializes in borrowers with less-than-ideal credit. You may qualify for a new loan with a longer repayment period thatll cost more over time than the original loan did, but the extra expense could be worth it if it means you can pay todays bills more easily.

If youre at risk of missing a payment on your original car loan and having difficulty finding refinancing options, reach out to your lender as quickly as possible to explain the situation. While they are not obligated to do so, some lenders will work with you and may even modify your original loan terms to give you lower paymentsin exchange for a higher interest rate and potential fees.

Ones Credit History Counts

A personal auto loan approval is dependent upon ones credit score but many consumers do not think about what financing a car will do to credit score. The factors considered when calculating credit scores include how much money one owes, payment history, the length of time one has had credit and the types of financing one has had in the past. A first time car loan applicant may have higher auto loan rates if the person is young, does not have a long credit history, or has had a history of making late payments on previous debts. It is the responsibility of the person who received financing for a car to make sure their rating is impacted positively by making all of the necessary payments on time.

A car loan also affects ones credit score positively if he/she has a young credit history or a desire to remedy a bad credit rating. At the same time, a credit score can be affected negatively if one neglects to make the assigned payments on time. After so many missed payments, a car can be repossessed, which can ruin a credit score.

It may seem like a no-brainer, but in some cases, your lender may have restrictions on how they report your auto loan. This may be especially true if you are landing from a small dealer or other informal lender who may handle financing themselves. Make sure that your auto loan will go to the books to help you build credit.

Read Also: How To Buy Your Leased Car

How Much Will My Credit Score Drop If I Apply For A Car Loan

Shopping for the best deal on a vehicle loan is smart, right? After all, for many of us, a loan to buy a car or truck will be one of our largest loans. Most of us rely on financing when purchasing a vehicle, according to data from Experian Automotive and the average loan amount for a new vehicle is $28,381 the highest on record and an increase of almost $1,000 from a year ago. In fact, the average monthly payment is now up to $482. Shaving even a percentage point off the interest rate on a car loan can mean decent savings.

But there is a hidden danger lurking in those applications for auto loans, as a number of our readers have discovered:

A single credit inquiry generally has little impact on your credit scores. One inquiry might drop your score 2 to 7 points or so. And multiple inquiries created as a result of shopping for an auto loan are not supposed to hurt your credit scores significantly if you limit your shopping to a short window of time. VantageScore counts all inquiries within a 14-day rolling window as one. FICO scores contain a similar buffer except the window varies sometimes it is 14 days and sometimes it is 45 days depending on the FICO score model that is used.

Featured Topics

Why Paying Off Loans Early Can Hurt Your Credit Score

To start, lets cover why taking out an auto loan is good for your credit by looking at the five pillars of a FICO® Score. Keep in mind that I dont work for FICO so this is only speculation, driven by experience and basic logic:

- 35% Payments history If you havent missed a car payment, youve built up credit here.

- 30% Amounts owed If your auto loan hasnt hyperextended your credit, your loan helped build credit in this category, too.

- 15% Length of credit history If youre paying off your auto loan now, you probably took it out years ago, which means you have years at least of credit history.

- 10% Credit mix If this was your only auto loan, you almost certainly improved your credit mix.

- 10% New credit You lose points here if you opened too many lines of credit in a short span of time, so it probably wasnt solely impacted by the status of your auto loan.

Now, when you pay off your auto loan, youre ending one of your lines of credit. In terms of how this impacts your FICO® Score, its a bit like removing a good test score from your end-of-semester average. Biologically speaking, its like removing a source of nutrition from healthy credit.

Again, FICOs exact math is a trade secret, but we can speculate with reasonable confidence by looking at all five elements. How would ending a line of credit prematurely hurt you?

In short, paying off an auto loan early can hurt your FICO® Score because youre potentially:

You May Like: Does Paying Off Car Loan Help Credit

Does Refinancing A Car Loan Hurt Your Credit Score

When you apply for refinancing, you will most likely need to submit another credit application. This can affect your credit score, especially if youre submitting multiple applications as mentioned above. However, if you manage your new loan effectively, refinancing shouldnt hurt your credit score.

Does Car Finance Affect Mortgage Application

Yes, car finance can affect your mortgage. Car finance is technically a debt, so this is something banks and mortgage lenders will look at when assessing your application.

Mortgage lenders will look at your income vs outgoings, including your debt repayments. Theyâll also look at your debt-to-income ratio, which shows what percentage of your salary goes on paying off your current debts.

If youâre paying a large amount for a car loan each month, this may make mortgage lenders reduce the amount theyâre willing to offer you.

You can reduce the impact your car finance will have on your mortgage by paying off your car loan before applying – paying it off could improve your chances of being approved for the mortgage amount you require.

Now you know how car finance impacts your credit score, you can make an informed decision about whether the timing is right for you.

If you are ready to get started, explore our different car finance. If credit rating is a concern for you, learn more about your bad credit car finance options with Zuto.

Read Also: Where Can You Get Your Car Inspected

What Credit Score Do I Need For A Car Loan

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A better credit score can increase your chances of approval for loans and credit cards and can also get you better interest rates and other terms. With some types of loans, like mortgages and credit cards, you simply cannot get approved if your credit score is below a certain amount.

Auto loans are a different story. There isnt a set FICO® Score floor for auto lending, and a good percentage of auto loans made in the U.S. are to borrowers with ultra-low credit scores.

With that in mind, heres a rundown of how to check and interpret your own , what it means to you as a potential auto loan borrower, and a few money-saving tips that you should use in the auto-buying process, regardless of your credit score.

Can I Still Get An Auto Loan With Bad Credit

Yes, credit is a major factor in getting an auto loan, but you should also keep in mind that most dealers really want to sell you a car. They’re often willing to work with you in order to do so. Nerdwallet points out that, “…at the end of 2017, the average credit score for a new-car loan was 713, and 656 for a used-car loan, according to an Experian report. But nearly 20% of car loans go to borrowers with credit scores below 600, according to Experian. Almost 4% go to those with scores below 500.”

While you’ll likely be able to get a vehicle loan with less-than-stellar credit, it might have a pretty significant impact on the maximum loan amount, the loan term, or the annual percentage rate that you receive. So the worse your credit is, the higher the rate, the longer the monthly payment schedule might be, and the less money you might be able to borrow towards your new vehicle.

You May Like: Is Geico Good Car Insurance

Refinancing May Be Worth It

Fortunately, refinancing a car loan is easy and straightforward. As long as youre okay with a small, short-term hit to your credit score, this strategy can improve your finances. It may save you money on interest and/or lower your monthly payments.

Unless youre not in a situation where it makes sense, dont allow a temporary credit drop to keep you from refinancing and putting hundreds or even thousands of extra dollars in your pocket. It can be an effective way to improve your financial situation.

Ready to refinance your car loan?