Nerdwallet’s Car Insurance Estimator

The national average car insurance rate is $1,592 per year for “full coverage,” according to NerdWallets 2021 rate analysis. But your rates will differ based on the car you buy, among other factors. Full coverage car insurance isn’t a specific type of policy. Rather, it refers to a combination of coverages. For our rate analysis, full coverage includes liability, comprehensive, collision, uninsured/underinsured motorist protection and any additional state-mandated coverage.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Cheap Car Insurance In Winston

Car insurance in Winston-Salem is generally less expensive than the national average. The cheapest car insurance companies in the city are Nationwide, Erie Insurance, North Carolina Farm Bureau, State Farm and Penn National. Compare car insurance quotes to find the best deal for your needs.

Compare Auto Insurance Policies

You May Like: How To Trade In Car

Other Types Of Auto Insurance Coverage Available In Ontario

Since a car represents a large investment for most drivers, as full as Ontarios mandatory coverage is for basic, on-the-road coverage, motorists usually opt for more protection.

The most common additions to basic coverage include collision and comprehensive coverage. These sections protect the policyholder against damage or loss.

- Collision or Upset coverage: Generally known as collision, this section protects against most incidents occurring to a driven vehicle. This includes collisions with objects and other vehicles as well as overturning also known as upset, from its proper name. Recently, a vehicle parked on Ottawa street fell into a sinkhole that opened at a construction site. Though the driver was not in the vehicle, nor was it being driven, the insurance claim came under collision coverage.

- Comprehensive coverage: Though not quite covering everything else, comprehensive insurance pays for damage and loss resulting from events other than collision or upset. These most frequently include theft, attempted theft, fire, vandalism, floods, lightning, hail, or windstorms. If a car suffers damage from parts falling off an airplane or from a missile impact, yep, those are covered too.

What Does Full Coverage Not Cover

Full coverage car insurance may sound like it covers all situations, but it does not. A full coverage policy generally will not cover:

- Damage you intentionally do

- Personal items stolen from your car

- Items not permanently installed in your car

- Wear and tear to the vehicle

Whats covered by a full coverage policy will also depend on what types of coverage are required in your state.

For instance, if your state requires drivers to carry uninsured motorist coverage, it will be included in your policy no matter what.

Recommended Reading: Does Car Insurance Cover The Car Or The Driver

Cost Of Auto Insurance

How does my auto insurance company decide what it charges me? That’s probably the most asked, least understood question about motor vehicle insurance coverage. Each insurer has thousands of auto insurance rates in every state it does businessrates for each type of car, each driver and every geographical area in the state. Each company also has its own surcharges and discounts available that impact these rates.

Most insurers have three basic goals in mind:

They need to make enough money to cover all their policyholders’ claims and pay their overhead expenses , and if they’re publicly held, still have enough money left over for their shareholders.

They want to balance their risk by charging higher rates to drivers who file more costly claims, more often and lower rates to those drivers who file less expensive claims, less often.

They want to stay competitive with other insurers in the markets they do business.

State Government Regulations

How your insurance rates are set also depends in part on which state you live in, because rates are regulated on a state-by-state basis. The insurer has to follow the regulations of the state you live in. Click on your state below to contact your state insurance department.

Q. Why does it matter what kind of car I drive?

Q. Why do my premiums go up if I get a traffic ticket or I’m involved in an accident?

Q. Why do auto insurance premiums vary depending on what I use my car for?

Q. What is the average cost of auto insurance?

State

How Much Is A Full Coverage Policy Compared To A Liability

The cost of full coverage insurance varies based on your car insurance company. Many factors determine the cost, including where you live, your driving history, the year, make, and model of your car, the coverage limits you select, and your deductible amount .

On average, you can expect to pay 64% more for a full coverage policy than a Liability-only one. A full coverage insurance policy may cost more, but at Liberty Mutual, you can customize your policy so you only pay for what you need.

You May Like: Do Puppies Get Car Sick

How To Shop Around For Full Coverage Insurance

The goal of shopping around is to find equivalent insurance protection for a lower price. When comparing policies with different insurers, you should make sure that you:

- Select consistent liability limits. If you shop with an insurer and select $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident and $25,000 in property damage liability per accident, you should select the same with comparison insurers.

- Choose the same deductible for comprehensive and collision insurance. Increasing your deductible lowers the cost of your policy and vice versa.

- Set the same coverage limits for all other coverages, such as uninsured/underinsured motorist coverage, personal injury protection and more. Additional protections cost more money.

If you follow these steps, you’ll find that different insurers will offer the same coverage for varying prices. The best and cheapest car insurance company for your neighbor may not be the same as the best one for you.

Buy Only The Coverage You Want

You cant drive legally without the state-required coverage. But if you own your car outright without a loan or lease, and your car is already on its last leg, you may want to consider foregoing comprehensive and collision coverage.

The maximum amount your comprehensive coverage will pay you is the market value of the car which decreases with each passing year minus your deductible. If this amount is more than your premium, then it will be useful. If not, you would be better off saving the money you would have otherwise spent on the premium for repairs.

We suggest using the Kelley Blue Book or Edmunds.com car value pricing tools to determine how much your car is worth and decide if what you pay for your comprehensive coverage is actually worth it.

Recommended Reading: How Many Miles Can A Car Last

Car Insurance Rates Based On Coverage Level

The cost of car insurance can vary significantly depending on your chosen coverage level. Drivers who only purchase liability insurance can expect to pay much lower premiums than those who opt for more comprehensive coverage.

However, the cheapest insurance option is not always the best. In an accident, drivers with only basic coverage may face more out-of-pocket expenses. On the other hand, a driver who has invested in a full coverage insurance policy can rest assured knowing that he or she will be covered.

Listed below is the average cost of car insurance for three coverage levels:

- State minimum liability requirements vary by state, and many states have super low limits. But a typical amount is $25,000 for medical bills from injuries in an accident you cause, up to $50,000 per accident, with $25,000 for any property damage you cause .

- Liability limits of $50,000 for injuries you cause in an accident, up to $100,000 per accident, with $50,000 to pay for property damage .

- Full coverage with comprehensive and collision, which cover damage to your car, carrying a $500 deductible, $100,000 for injuries you cause in an accident, up to $300,000 per accident, with $100,000 for property damage .

| Coverage Type |

|---|

What Does Car Insurance Cover

Here is what the main types of car insurance cover:

- Liability insurance. Required in most states and is the base of an auto insurance policy. Pays for property damage and injuries you accidentally cause to others. It also pays for legal fees, judgments, settlements and your defense if youre sued due to an auto accident.

- Collision insurance. This optional coverage pays to repair or replace your car if youre in an accident, regardless of fault, or if you hit an object, for instance a pole or a fence.

- Comprehensive insurance. Also optional, this covers theft and also pays to repair or replace your car if damaged by animal strikes, hail, falling objects, fire, flooding or vandalism.

- Uninsured motorist coverage. Required in some states and optional in others. Uninsured motorist insurance pays you and your passengers medical expenses if youre injured in a car accident caused by a driver without liability car insurance.

- Personal injury protection or medical payments. Required in some states. Regardless of fault, personal injury protection and medical payments help pay for medical bills if youre injured in an auto accident. PIP also covers lost wages and replacement services.

Related: What does car insurance cover?

Also Check: Can I Put Synthetic Oil In My Car

How Much Is Full Coverage Insurance

The average full coverage car insurance cost is $1,682 per year, or about $140 per month, according to the data pulled from Quadrant Information Services. Thats based on coverage of 100/300/100, which means $100,000 per person and $300,000 per incident for injuries, and $100,000 per incident for property damage. The average cost for state minimum liability coverage is $526 per year, according to 2022 data.

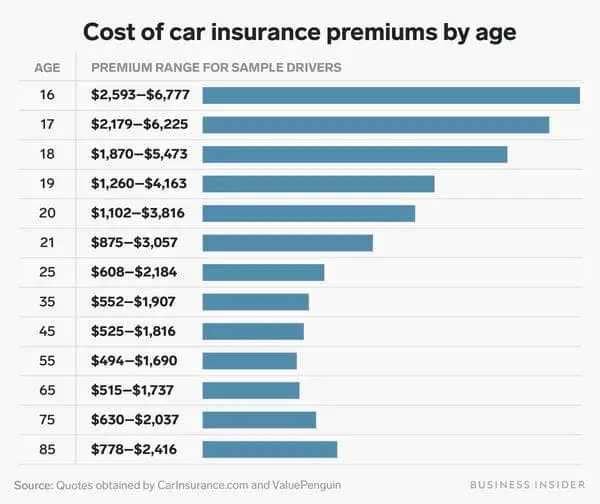

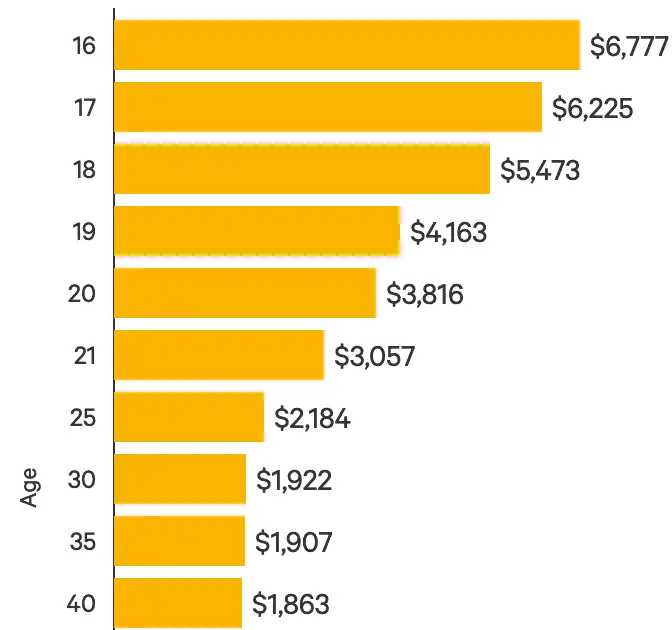

Car insurance rates are very specific to the person who owns the car: Your age, driving record, credit history and location count, as well as the kind of car you are driving. Rates also vary by hundreds or even thousands of dollars from company to company. That’s why we always suggest, as your first step to saving money, that you compare quotes.

Here’s a state-by-state comparison of the average yearly cost of the following coverage levels:

- State-mandated minimum liability.

- Full coverage with liability of $100,000 per person, $300,000 per accident, and $100,000 for property damage, and a $500 deductible for comprehensive and collision.

Cheapest Car Insurance Winston

Age and marital status can significantly affect your car insurance premium. Married drivers tend to pay less for car insurance coverage than single drivers. Older drivers often pay less for coverage than younger drivers. Teen drivers also have less experience behind the wheel and tend to get into more accidents.

The table below shows average rates for 24-year-old single drivers and 35-year-old married drivers in Winston-Salem.

| Car Insurance Company |

|---|

| $4,249 |

Read Also: How Often To Change Car Air Filter

Aaa Insurance Agents Are Here To Answer Your Questions

While there may not be a set definition of full coverage insurance, AAA offers a range of insurance options to fit your needs. Consider your options and speak with a AAA insurance agent for answers that can help you select the best insurance at the most affordable price. They can also inform you of any applicable discounts that you may be eligible for.

AAA insurance can help you protect all your most important belongings. Find all the AAA insurance discounts you could qualify for.

This information is a helpful overview of automobile policy coverage. Coverage may vary by state or product and this is not a comprehensive description of all coverages, exclusions, definitions or provisions that may apply. The information provided is not intended to and does not substitute for or supersede the actual language of an issued policy contract, endorsement or declarations. For specific terms, definitions, coverages and exclusions that apply to your particular insurance policy coverage for a specified loss or peril, please read your policy contract, declaration pages and endorsements. Where this information differs from an actual policy contract, endorsement or declarations, the terms for the policy, declarations and endorsement that make up your issued policy will prevail.

How To Get Cheap Full Coverage Insurance

In the short term, there are two ways to get cheaper full coverage car insurance: shop around and reduce coverages.

Shop around to see if different insurance companies give you different full coverage rates, with the potential to get the same coverage for a lower price.

Reduce coverage you don’t need to lower your rates. You’ll get less protection from the insurer, but the trade-off may be worth it, depending on your personal situation.

Recommended Reading: How To Charge A Dead Car Battery

What Are The Different Types Of Insurance Under Full Coverage

Generally, full coverage car insurance consists of liability, comprehensive and collision, although you can add other optional car insurance coverages in order to build your perfect auto insurance package. And, once you meet the minimum state-required car insurance, you can typically decide exactly how much coverage you want to purchase. Lets take a closer look at these three basic types of full coverage car insurance.

How Much Does Full Coverage Insurance Cost

The average cost of a full coverage auto policy in the United States costs $1,771 per year. Because of the additional protections that full coverage adds, it is typically much more expensive than minimum coverage car insurance, which is $545 per year on average. However, full coverage provides a greater degree of protection to your finances because it covers damage to both the other party and to your own vehicle. This means that, although your premium might be more expensive, your financial health is better protected with full coverage.

If you are looking for cheap full coverage insurance, there are several factors that you should be aware of. The company you choose, the state you live in, your driving history, the type of vehicle you drive, and the coverage limits and deductibles you choose will all impact how much you pay.

Learn more:Cheapest car insurance companies

Read Also: How Do You Know If Your Car Battery Is Dead

Why Some Cars Cost More To Insure

Certain cars cost more to insure than others because carriers use crash and theft statistics to help set rates for each model separately. So if the car you choose tends to be stolen or crashed more, chances are youll pay more for insurance. For example, the reason sports cars cost more to cover is because theyre more likely to be driven fast and crashed hard by their owners.

Here are some specific vehicle characteristics that affect auto insurance costs:

-

Retail price. Generally, the pricier the car, the more expensive it will be to insure. If you buy comprehensive and collision coverage, the insurance company will be on the hook to pay out the cars market value if the vehicle is stolen or wrecked beyond repair.

-

Cost of parts. High-end models often use parts made from carbon fiber and other specialized materials that are expensive to repair. This drives up the cost of damage claims.

-

Safety. Over time, cars that do a good job of protecting drivers and their passengers bring down insurance costs. Fewer injuries mean fewer claims for medical payments and personal injury protection.

» MORE:Ranking the cheapest cars to insure

How Much More Is Full Coverage Compared To Liability Car Insurance

Forbes Advisors analysis found full coverage costs 200% more than a liability-only car insurance policy, on average. The average cost for full coverage is $1,853 a year, and the average cost of a bare-bones liability policy is $618 a year.

Car insurance policies that only have state-minimum car insurance requirements are cheaper but woefully short on coverage. For instance, California only requires $15,000 per person and $30,000 per accident for bodily injury liability and $5,000 for property damage per accident. You could cause an accident that easily exceeds those limitsleaving you personally responsible for the remainder. Also, with liability-only coverage, you have zero coverage for damage to your own car.

If youre not sure you can afford full coverage, compare car insurance quotes to find out. You may be pleasantly surprised that you can add on collision and comprehensive coverageto make a full coverage policyfor a price within your budget.

You May Like: What To Do When A Car Dealer Lied To You