Cheap Car Insurance Companies

Its always a good idea to compare car insurance companies. As a reminder, here are our top choices for cheap auto insurance:

For most drivers, we recommend State Farm as the Editors Choice based on its solid financial standings, affordability and strong customer service ratings. To find the cheapest car insurance for your desired level of coverage, get free car insurance quotes when you are shopping for a policy.

Compare Auto Insurance Policies

Below are commonly asked questions about the cheapest car insurance companies, coverage policies, rates and quotes:

Where Can I Get Cheap Car Insurance In Boston For Teen Drivers

Citizens and GEICO are the best sources of cheap car insurance in Boston for teen drivers, based on our data.

Citizens has the cheapest car insurance if youre a teen who wants state-minimum coverage, with an average rate of $123 a month.

GEICO offers affordable rates to these young drivers, too, at an average of $140 a month.

Cheapest car insurance for teens| Company |

|---|

| Progressive | $590 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

Young drivers often pay the highest auto insurance rates because theyre more likely to be involved in an accident than are older and more experienced drivers.

Citizens charges adult drivers with clean records in Boston $37 a month for minimum coverage, for example. It charges teens with clean driving records $123 a month for the same coverage. This is a whopping 232% increase.

What Information Is Needed For A Car Insurance Quote From The General

Receive a car insurance quote from The General by submitting your ZIP Code and some other information about any insurance exclusions, credit history, and liability. Insurance companies check your ZIP Code for the number of accidents in the area. If you live in a place with a high accident rate, usually urban locations, expect to pay more for auto insurance than someone living in a light traffic region. The younger you are, the more you can expect to pay in insurance premiums. The good news is that age-related premiums start coming down around 25, as long as your driving record stays clean.

You dont need to submit any other personal information until you decide to buy the policy. When you decide to buy a car insurance policy, you will have to provide the company with your name, address, drivers license number and vehicle registration. You must include the make, model, and year of your car, and how long youve owned it, along with your annual mileage and driving history. Always tell the truth about any traffic violations youve received, because the insurance company will find out, and it will affect your premiums. Some insurance companies will not accept you if you did not have at least 6 months of prior car insurance coverage, but thats not the case with The General.

Don’t Miss: How To Install Maxi Cosi Car Seat

Is Insurance Expensive In California

Yes, California has the 13th most expensive average quotes for a full coverage policy compared to other states. However, the average cost for a minimum coverage policy is about average, ranking as the 27th most expensive, with an average rate of $604 per year. The average cost of car insurance remained roughly the same compared to the previous year.

Should You Pay Your Auto Insurance In Full

Yes, if you can afford to buy your auto insurance upfront in full it will be cheaper than paying for it in monthly installments.

Its essential to consider your budget and decide which option works best for you. If paying in full will cause you financial difficulties, then paying monthly may be a better option for you.

Read Also: How To Get Rid Of Mouse Urine Smell In Car

Most Affordable For Drivers With An Accident

Drivers with an accident on their record can expect to pay $813 more on average than those with a clean record. MoneyGeek found that the most widely available and cheapest car insurance company for drivers with an accident is State Farm at $1,583 per year. If you have an at-fault accident, State Farm is a good place to start when shopping for cheap insurance

One way to keep rates low in the event of an accident is by purchasing accident forgiveness coverage with your car insurance. This option can help you avoid a rate increase in the event of an accident when you are at fault. State Farm doesn’t offer his coverage, but companies such as Allstate, Nationwide and GEICO do.

Average Annual Rate: $1,538

State Farm offers affordable car insurance policies. At $1,583, State Farms annual premium is 28% lower than the average cost to insure a driver with an accident on their record. The company also offers a variety of discounts to help you save even more.

For instance, State Farm offers one of the best home and auto bundling discounts on the market, with average savings of 25%. You can also get discounts if you insure multiple cars, own a newer vehicle, or install alarms and other approved anti-theft devices.

GEICO isn’t the cheapest option for a driver with an accident on their record, but it still offers some of the most affordable rates available. USAA remains the cheapest option if you’ve been in an at-fault accident and have a military background.

Read More:

Best Cheap Car Insurance For Military Personnel And Veterans

USAA

The United Services Automotive Association is the only insurance provider that offers the cheapest car insurance premiums that consistently beat The General. There’s one condition that needs to be met, however. To apply for a policy through the USAA, you are required to be either a member of the U.S. military, a military service veteran or a near family member of a person who has served.

This condition automatically disqualifies certain people but if you do qualify for USAA’s car insurance policies, we recommend that you do some research. Drivers who move their car insurance policy over to USAA could save up to $707 per year on their car insurance coverage. Surveys and customer feedback also suggest that a whopping 64% of USAA’s customers are “pleased” with USAA’s cheap car insurance premiums. What’s more, customers often refer to USAA as the “most loved financial brand on earth” – high praise indeed for cheap auto insurance online plans!

Read Also: How Can I Get Wifi In My Car

Are Car Insurance Rates Cheaper If You Bundle

Yes, you can get affordable car insurance rates if you bundle. If your family or household has more than one car, you should ask your insurer about car insurance discounts. Or you can use a policy search tool like ours to find the best bundled deals.

Companies that bundle auto insurance usually offer a 5 – 25% discount per policy. This doesnt just apply to auto insurance. For example, bundled home insurance deals can offer huge savings due to the high costs of these premiums.

Cheapest Car Insurance After A Speeding Ticket

Geico has the lowest insurance cost after a speeding ticket , according to a 2022 CarInsurance.com data analysis. Tickets for moving violations affect how much you pay for car insurance, so part of keeping your cost low is maintaining a clean driving record.

Insurance companies check your driving history upon renewal or when you get quotes for a new policy and use that information for rate pricing. Typically, youll pay higher rates if youve had a recent moving violation, such as a speeding ticket.

However, each company assesses risk differently, so even if you have driving infractions on your record, youll save if you compare car insurance companies. Below is a breakdown of average increases for speeding tickets by company.

Average increases for speeding tickets by company| Company |

|---|

Also Check: Where’s The Vin Number On My Car

Cheapest Car Insurance For Teens

Geico is the cheapest car insurance company for teen drivers, among those surveyed in our study of rates for a 17-year-old driver buying their own full coverage policy. However, teenagers cant buy their own policies without having a parent/guardian cosign until theyve reached the age of majority in their state.

Car insurance companies consider teens to be high-risk drivers due to their lack of experience behind the wheel, so car insurance for teens is pricey in general. However, by comparing car insurance rates, you can still save, regardless of your age.

Below youll see which companies have cheap car insurance for teen drivers, based on our rate analysis.

Cheap car insurance for teen drivers| Company |

|---|

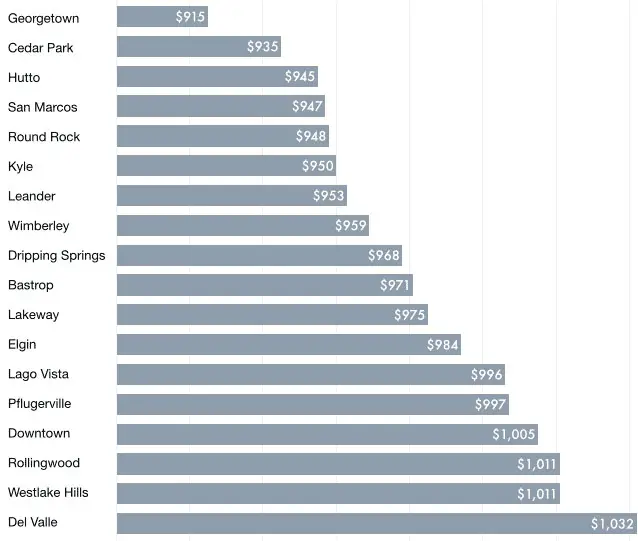

Average Car Insurance Cost In Colorado By City

The average cost of a full coverage policy in Colorado is $2,198 per year, or $183 per month, making it one of the most expensive states in the country for car insurance.

Glendale is the most expensive city for car insurance in Colorado, with full coverage quotes costing an average of $2,595 per year. Fruitvale is the cheapest city, at $1,604 per year.

Location is just one factor affecting auto insurance prices, and although these averages can give you a good idea of how prices may vary, your auto insurance quotes will be different. In general, big cities such as Denver will have more expensive rates because there are more accidents and car thefts.

| City |

|---|

- Young drivers after a ticket: State Farm

- Young drivers after an accident: State Farm

Read Also: How To Test Drive A Used Car

How Does Credit Score Affect Your Texas Car Insurance Premiums

Some states do not allow credit scores to be considered when establishing drivers rates. However, Texas does allow car insurance companies to analyze your credit score to set your auto insurance coverage rates. The worse a drivers credit score is, the more they will be paying for coverage.

Your credit score is determined based on a number of things, like how many loans you have and if you pay your bills on time. A credit score establishes how financially responsible a driver is, and car insurance companies believe the lower your credit score is, the more likely drivers are to file multiple claims.

For this reason and many others, they will set your car insurance coverage rate higher. Luckily, you can work towards bettering your credit score by paying off loans and staying on top of your bills. It takes some time but will help you in the long run.

Enter your ZIP code below to view quotes for the cheapest Auto Insurance Rates.

If You Think That Cheap Car Insurance Rate Is Too Good To Be True It Probably Is

Its our business to make sure that you, your car, and your livelihood are covered in the event of an accident. Without quality car insurance coverage, you could face unexpected financial hardship.

And we get it, youre looking for the best price you can get , but cheap doesnt just mean low cost, it usually means low quality as well.

Moral of the story: The cheapest insurance usually comes at a high price if youre in an accident, so make sure you choose a good, reputable car insurance company that takes care of you as well as your wallet.

Check out how you can customize your insurance so you only pay for what you need.

Recommended Reading: Where To Sell My Car

Factors Allowed In Bellingham Car Insurance Rates

Factors considered by insurance companies to determine your rates include:

Remember, a single life event could cut down premiums drastically. For example, switching to an older make and model vehicle can cut your premiums by 20%, thanks to the cheaper cost of parts and labor. Less driving can also have an impact, as will raising your deductible.

If you doubt a recent life change will impact your policy, it doesnt hurt to call your auto insurance carrier to confirm.

Cheapest Car Insurance For Safe And Low

If you drive less than average or are generally a safe driver, a usage-based or pay-per-mile auto insurance company such as Metromile may be the cheapest insurance for you.

Metromile was one of the first companies in the U.S. to determine car insurance quotes largely based on mileage. How much driving is too much when shopping with Metromile? Generally, for Metromile to be a good deal, you should drive fewer than 10,000 miles per year.

Usage-based insurance is often cheaper than standard car insurance because your rates are largely based on how often and how well you drive. It’s a good option for people who are generally safe drivers but can’t find cheap rates elsewhere because they’re young, have poor credit, live in a congested city or have other risk factors that raise their insurance rates.

That means Metromile could offer cheap car insurance for people who are retired or work from home, students who live on campus and young drivers with a clean driving record.

The biggest downside to Metromile is that it’s only available in eight states: Arizona, California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia and Washington. If you don’t live in one of those states, consider other telematics programs that offer discounts for less driving or safer driving, like Nationwide, Liberty Mutual or State Farm.

Read Also: How To Find Out If Your Car Was Repossessed

Improve Your Credit For Better Car Insurance Rates In Texas

Your credit score will be considered by your insurance provider when purchasing coverage in Texas. The lower it is, the more expensive your rates will be. To try to reduce them, you should work towards raising your credit score.

Your credit score can improve by staying on top of your bills and paying off loans. The higher your credit score is, the more financially responsible you are perceived to be.

Insurers like drivers who are stable in this fashion because they think someone with a good credit score will get into fewer accidents and subsequently make fewer claims. It can take a while to improve your credit score, but it will be worth it in the long run.

Most Affordable For Drivers With A Dui

If you have a DUI on your record, MoneyGeek found that Progressive is the cheapest option. On average across the country, it charged our sample driver $2,132 per year, which is hundreds of dollars cheaper than most providers.

A DUI can increase your rates by hundreds or even thousands of dollars per year. A company that raises your premium less than its competitors could save you a lot of money. To find the cheapest car insurance with a DUI, we recommend comparing quotes from at least three providers to find the cheapest rate.

Average Annual Rate: $2,132

On average, MoneyGeek found that Progressive offers the most affordable rates for drivers with a DUI.

Though the company doesn’t offer some of the most common discounts on the market, like savings for anti-theft systems or defensive driving courses, it still has plenty of opportunities to save. For example, if you pay your policy in full online and opt for paperless and automatic billing, you can receive money off your annual premium. Progressive also provides discounts for bundling home and auto insurance or owning a home, meaning that homeowners have extra opportunities to save.

MoneyGeek’s analysis of rates gathered across the country found that for drivers with a DUI, Progressive was almost $100 cheaper than State Farm and almost $300 cheaper than Farmers. Some insurers, such as Allstate, GEICO and Travelers, charged a sample driver an additional $1,300 to $1,600 per year after they committed a DUI.

Read More:

You May Like: How To Get Cosigner Off Car Title

Affordable Car Insurance Really Is That Simple

With GEICO, you don’t have to compromise quality for a low-cost car insurance policy. We work hard to make sure “cheap” only describes your car insurance rates and not the quality of service or your experience as a policyholder. Find out why drivers are switching to GEICO and get a free auto insurance quote today.

Best Car Insurance Companies In Colorado

State Farm is our top recommendation for the best insurance company in Colorado, owing to a strong combination of affordable quotes, customer service and coverage options. We also took into account the result of J.D. Power’s Auto Insurance Claims Satisfaction Survey.

Geico is the next-best option, and it offers a convenient user experience for buying car insurance and updating your policy online. Nationwide is also a good choice if you want a range of ways to customize coverages, including pay-per-mile insurance.

| Company |

|---|

| $25,000 per person and $50,000 per accident | |

| Property damage liability | $15,000 per accident |

In addition to the required coverages, Colorado residents also have the option to purchase uninsured/underinsured motorist, medical payments, comprehensive and collision coverage.

Don’t Miss: How Long Should Car Tires Last

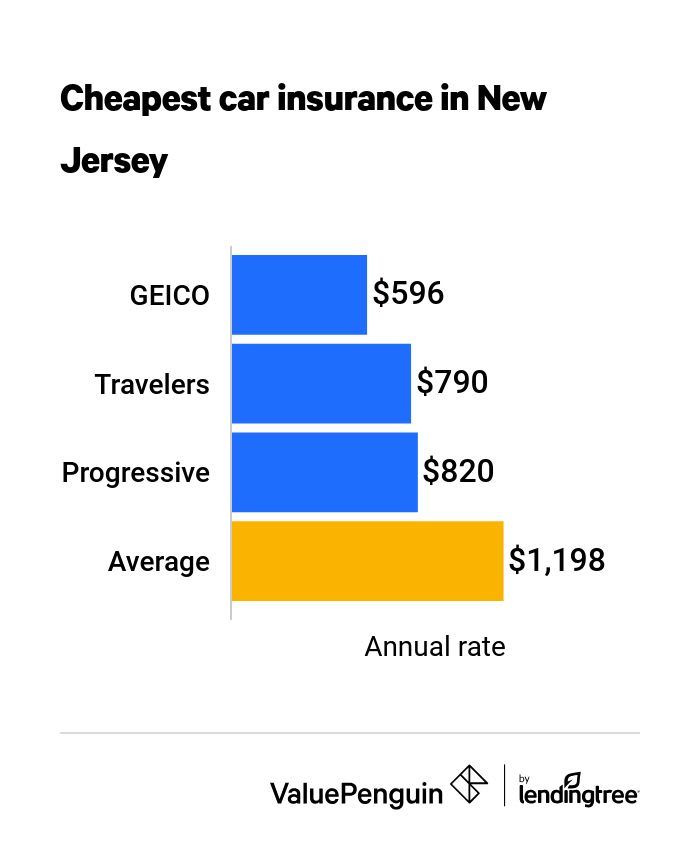

The Cheapest Car Insurance Company Overall: Geico

Geico is the cheapest major auto insurance company in the nation, according to NerdWallets most recent analysis of minimum coverage rates. Geicos average annual rate was $354, or about $29 per month. The company also earned a 4.5-star rating from NerdWallet, and you can read our Geico auto insurance review to learn why.

California Car Insurance Faqs

What is the cheapest car insurance in the state of California?

Progressive is the cheapest car insurance in the state of California. However, State Farm, Geico, Travelers, and Esurance also offer some of the cheapest car insurance rates in the state.

What is the average car insurance cost per month in California?

The average car insurance cost per month in California is $152 per month or $1,822 per year. However, keep in mind that premiums vary by carrier and that factors like your driving record, age, and location might have an impact on your rates.

Do new automobiles require full coverage car insurance in California?

Yes, normally you will need full coverage on a vehicle for which you are still paying a lien holder for the loan you have out on it.

What is considered good car insurance coverage In California?

Good car insurance coverage for most drivers in California is 100/300/100, which is $100,000 per person, $300,000 per accident in bodily injury liability, and $100,000 per accident in property damage liability.

SIMPLY INSURANCE MAKES IT EASY TO SAVE!

Also Check: How To Buff Out Scratches On Your Car