How To File An Insurance Claim If Your Car Is Totaled

If youre involved in an auto accident, regardless of fault, and your car is damaged, immediately notify your agent or insurance company. At Progressive, were available 24/7 to report a claim over the phone or online. Remember, its up to the insurance adjuster to determine whether your car is totaled or if it can be repaired.

What Does Insurance Pay When A Car Is Totaled

How and how much your insurance pays for a totaled car depends on a few factors, including the company and the state you call home.

For example, these are the reimbursement options for a totaled car in Washington State:

- Replace your car with an available and comparable vehicle.

- Offer you a cash settlement based on the actual cash value of comparable cars in your area.

- Offer you a cash settlement based on alternate appraisal methods, like Kelley Blue Book.

Dont Miss: How Do You Make Car Freshies

If My Car Is Totaled Do I Have To Pay Off The Loan

Okay, youve accepted that your car is a total loss. But what if theres still a loan on the vehicle? Are you responsible for paying the balance?

What happens when a car is totaled with a loan is typically your insurance company or the at-fault drivers insurance company will cut a check for your cars actual cash value less any applicable deductibles. Lets suppose you owe $10,000 on your auto loan and your car is valued at $12,000. Your claims adjuster will pay $10,000 to the lender and the remaining $2,000 will be issued to you.

You May Like: Can I Refinance My Car With The Same Lender

How Are You Paid For A Total Loss

The amount you’ll be compensated for a total loss is ACV, the same metric which is used to determine if the car is a total loss. The ACV of the car is determined by its pre-loss market value, less depreciation from when it was new. Ultimately, the ACV of your car will be determined by its wear and tear, and age along with other factors your insurer deems relevant. It is very different from the number you would find on Kelley Blue Book or edmunds.com. Most large insurers have their own method of determining ACV.

Once you agree to the value, the insurer will pay you that amount, if you owned the car. If your car is leased or financed, then the compensation goes back to the leasing or financing company.

If you total a leased or financed car, there is a good chance there is a decent amount left to pay. While the insurance company will pay you for the value of the car, it is very likely the value has depreciated, and does not reflect the value of the car, which you took a lease for. If you drive a leased vehicle, you should consider taking out gap insurance, which would cover you for any remaining balance in a lease.

How Can I Get A New Car After A Total Loss

Before financing a new car after a total loss, check if you owe a balance on your totaled vehicle. While your insurance company may have issued payment to your lender, the amount may not have been enough to cover the full balance, especially if you dont have gap insurance. In those instances, your lender might be able to consolidate what you owe into a new car loan.

Once youve purchased a new car, remember to contact your insurance company with the vehicle information so youre properly covered.

Progressive offers a car shopping service to help with your new vehicle purchase.

Also Check: What Does Certified Used Car Mean

Tips For Settling An Insurance Claim

If you’re in an accident and your car is totaled, the insurance company will pay you your actual cash value . ACV is based on your vehicle’s Kelly Blue Book value at the time of the accident, minus any deductible.

However, you may not be happy with the ACV offered by the insurance company.

If this is the case, there are a few things you can do to try to get a better settlement:

1. Get multiple appraisals: The insurance company will likely give you their appraisal of your car’s worth, but it’s always a good idea to get your own. Bring these appraisals to the insurance adjuster and try to negotiate a higher settlement amount.

2. Document everything: Be sure to take plenty of photos of the damage to your car and keep all repair estimates and receipts. This will help show the insurance company exactly how much it will cost to fix or replace your vehicle.

3. Don’t accept the first offer: Insurance companies are known for lowballing initial settlement offers, so feel free to counter them. Remember, you’re entitled to receive fair compensation for your loss, so don’t be afraid to stand up for yourself.

If your car is totaled in an accident, the insurance company will pay you the actual cash value of your vehicle. The actual cash value is the market value of your car at the time of the accident minus any depreciation.

If you have collision coverage, you can also get a replacement car if yours is totaled.

A Body Shop Is Repairing My Vehicle After An Insured Loss Does My Insurance Company Have To Pay For Original Equipment Manufacturer Parts

If the damage to your car affects how it can be driven safely, the insurance company will pay to repair it with an OEM part. For non-safety parts, unless your claim occurs during the first 20,000 miles on the autos odometer, the insurance company does not have to pay for OEM parts. For autos with more than 20,000 miles, state regulation allows for the replacement of damaged parts with used, reconditioned or after-market parts. You can insist on OEM parts, but you will have to pay the difference in cost.

You May Like: What Do You Need To Get Your Car Inspected

Don’t Miss: How To Sell A Car In Nc

What Happens If You Keep Your Totaled Car

If you keep your car after the actual cash value, sales tax and applicable prorated taxes and fees are added together, the insurer deducts the salvage value from the total amount of the settlement. The insurer must report your totaled auto to the Washington state Department of Licensing .

If you have questions about what happens next with your totaled car, contact the:

Coverage To Use For A Totaled Car

| Cause of Totaled Car |

|---|

| Comprehensive |

Other coverage options that can help you if your car is totaled are gap insurance and new car replacement. Gap insurance will help to cover any remaining balance owed toward a leased or financed car that gets totaled. New car replacement will replace a totaled vehicle with a comparable new vehicle.

Read Also: How To Open Car Hood Without Lever

What Happens To My Car If Its Totaled

Usually, the insurance company will take ownership of your vehicle by transferring the title to their name. After that, theyll likely sell it to a salvage buyer. If you decide to keep your car, the salvage value will be deducted from your settlement total. Some states have specific guidelines relating to owner-retained total losses, so be sure to check with your claims adjuster to fully understand what this entails.

What Criteria Do Insurance Companies Use To Decide If A Motorcycle Should Receive A Total Loss Or Be Repaired

Insurance companies consider several factors when determining whether to declare a motorcycle a total loss or to proceed with repairs. Each insurance company has its own specific set of criteria, but the most common ones include:

1. Cost: The first factor that an insurance company will consider when deciding if a motorcycle should be declared a total loss is the overall cost of repairs in relation to the available coverage and value of the bike. The more expensive it is to repair, relative to these figures, the more likely it is for an insurer to decide that a total loss declaration would be most beneficial for both parties involved.

2. Age: The age of the bike being insured can often play an important role in such decisions as well particularly in cases involving older motorcycles and antique models. If parts are hard-to-find or prohibitively expensive , declaring it as a total loss may be seen as being more cost effective than attempting potentially costly repairs which may not add much value or longevity back into the vehicle itself.

Learn More: Will a locksmith damage my car?

Recommended Reading: How To Check If Car Battery Is Under Warranty

Talk To A Car Accident Lawyer

You might be able to handle your own insurance claim. But if you have questions about your rights and options, talk to a car accident lawyer. A lawyer can answer your questions, negotiate with insurers, and represent you in court if necessary. Its worth the expense of hiring a lawyer when you dont feel the insurer is offering a fair settlement for your totaled car.

Learn more about how an attorney can help with your car accident claim. You can also connect with a lawyer directly from this page for free.

Option : Donate The Car

Donating a totaled vehicle to a nonprofit organization is another option. There are a number of charities that accept vehicle donations, including cars that have been totaled, to support their operations.

An added benefit of donating a totaled vehicle to charity is that you may be able to claim it as a tax deduction. If the nonprofit you donate your vehicle to sells it for less than $500, you can deduct the lesser of $500 or the fair market value of the car on the date that you donated it. If your donated vehicle is sold for more than $500, you can claim the amount for which it was sold.

To support your tax deduction, be sure to get a receipt showing the date of your donation and the name of the nonprofit organization.

Some car dealers will take a totaled vehicle as a trade-in.

Read Also: How To Replace A Car Key

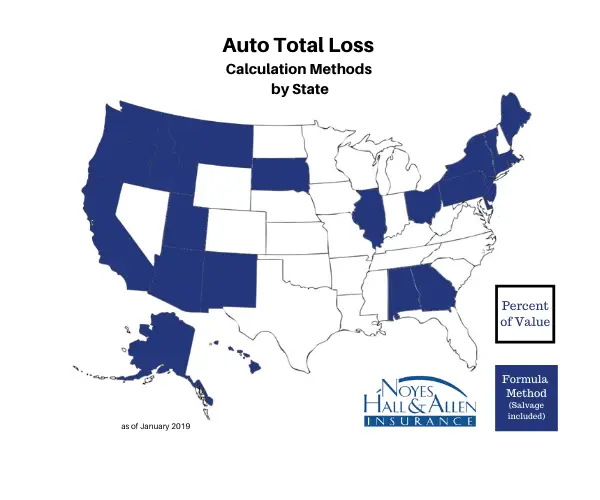

What Are The Methods For Calculating A Total Loss

Depending on the state in which you live, your insurance carrier will use one of two methods for determining a total loss.

Some states bind insurance companies to one or the other.

What Is the Fair Market Value of a Car?

A cars fair market value is its book value at any specific time. For our purposes here, that specific time is right before the event, like a flood, a crash, or a tornado. With the FMV method, the state sets a percentage of the FMV as the threshold for declaring a car totaled. In our Alabama example above, the states set percentage is 75%. Some states like Oklahoma use a lower percentage , while others like Colorado have a higher percentage .

Whatever the percentage, the insurance carrier will total your car if estimated repairs exceed that percentage of the fair market value.

What Is the Total Loss Formula?

In states without that percentage threshold, insurance carriers base totaling a car on a total loss formula . Here, the number at which they will total a car is the FMV minus the cars salvage value, or the amount the insurance company can get for your car at a junk or salvage yard.

Lets say your vehicles fair market value is $15,000. The insurance company approaches a salvage yard to see what it would pay for your wrecked car. Lets say the salvage value comes to $4,000. Subtracting $4,000 from $15,000, leaves $11,000. In this example, if the estimated repairs exceed $11,000, the insurance company would total your car.

Total Loss Car Insurance Settlements And Sales Tax By State

States vary concerning what they cover regarding sales tax. Here are 10 examples from MWL Attorneys at Law:

There are also states that don’t have any statutes on the matter, including Idaho, Michigan, Montana, New Hampshire, New Mexico, North Carolina, North Dakota, Wisconsin, and Wyoming. Some of these states don’t have sales tax. Most auto insurance policies limit an insurer’s liability to the car’s ACV or the cost to repair or replace it. So, if you’re in a state without a statute, you may not get help with sales tax.

Talk to the insurance adjuster about your state’s situation if your insurer totals your car.

Also Check: How To Fix Scratches On Car Window

When Do I Get My New Vehicle After A Car Insurance Claim

When your vehicle has been declared a total loss, your insurance company will pay your claim settlement amount directly to you. This is also the case if your car is financed, but the finance company is also named on the cheque . If you lease your vehicle, the leasing company will receive the co-payable cheque directly, and they will give you the difference if the settlement is more than you currently owe.

Youre responsible for finding and purchasing a new vehicle yourself. The price you pay for the replacement vehicle, whether its more or less than your settlement, is up to you as well. Keep in mind that current supply chain disruption issues may affect the cost and timing of getting a new vehicle. If you decide to purchase a used car instead, consider the factors that may affect your car insurance. Some vehicle modifications, for example, may not be eligible for coverage. Talk to your broker before you make your purchase to find out if there are insurance implications.

Can You Keep Your Car If It’s Totaled

If an insurer totals a vehicle, many states require the car’s title to be changed to a “salvage title.” That means you’re not able to register for plates until you make repairs to fix the damage. If the repairs are completed, you can apply for a new title.

Often, a damaged car is auctioned off. The auto insurance company keeps the sales’ going. However, if you want to keep the car and your state allows it, the insurance company will request bids from salvage buyers to set a fair market value. They will then deduct that amount for your settlement.

This varies by state. So, if you decide you want to keep the car and perform the needed repairs, you’ll want to talk to your insurance adjuster to see whether it’s worth it.

A word of warning: your insurer may not sell you comprehensive and collision coverage on the rebuilt car. Why? Because an insurer might not know how to estimate value in the previously totaled car. You’ll want to keep that in mind if you’re thinking about keeping your totaled vehicle.

Don’t Miss: How To Get Out From Under A Car Loan

When Is A Car Totaled

An insurance company will “total” a car when the cost to repair it is about the same or more than what the car was worth immediately before the damage occurred. An insurer might also declare a car to be a total loss if it cannot be repaired safely or repaired at all.

Sometimes, state law dictates the amount of damage necessary to total a car, and this threshold can be as low as 50% of its value.

Learn more about when an insurance company totals a car.

My Car’s Airbags Deployed Is It A Total Loss

If your vehicle’s airbags deploy in a car accident, that doesnt necessarily mean your car is a total loss. Your insurers will assess the situation and determine if the cost of replacing the airbags and repairing your vehicle would exceed its actual cash value. If the cost of repairs is less than the value of your car, your vehicle will likely not be declared a total loss.

Don’t Miss: What Year Car For Uber

Final Thoughts: Car Insurance Doesn’t Always Pay Off Your Totaled Car

Unfortunately, even if you have gap insurance to cover the rest of your loan amount, you won’t get money to put toward a replacement car.

To have money from your insurance claim to put down on a replacement car, you would need to owe less than your loan amount. In that case, you would receive the money remaining after the lender was paid off. Or if you owned the car outright, all of the money would come to you to put toward a new car.

But your insurance company isn’t obligated to buy you another car, just to pay you the pre-accident value of your old one.

Consider a gap policy essential if you can’t put a hefty down payment toward the new car.

And don’t forget to shop around. When you look for a replacement vehicle, compare car insurance quotes with multiple auto insurance providers to find who will offer you the best rates. You could save hundreds, or more, by shopping around and finding the insurer that doesn’t rate as severely for an accident on your record.

Filing A Claim At Progressive

and a claims representative will walk you through the claim process. You can also file a claim by logging into your policy or using the Progressive app.

If youre not a Progressive customer, you can track an existing claim online.

Looking for more information about auto insurance? Our car insurance resource center has you covered.

Related articles

Dont Miss: Rattling Sound In Car When Driving

Also Check: How Much Is Tax On A Car

Start Shopping For A New Car

Once you know how much money you are going to receive from your insurance company, you can start looking for a new car. In several states, including California and Florida, insurers are required to pay for the sales tax on your new vehicle as a part of the final settlement. Just keep in mind that you usually have to request reimbursement within 30 days of purchasing the new car.

Also, remember that different cars can come with different insurance rates, so always shop around and compare quotes before making a decision.