Best For Checking Accounts: Americas Credit Union

Americas Credit Union was founded in 1954 and originally intended for members who were civilian federal employees at Washington states Fort Lewis. The credit union later opened to military personnel and then civilians. Although membership has expanded, Americas Credit Union continues to offer military benefits to more than 39,000 members.

Eligibility: You can join ACU if you live in the Pacific Northwest, are a member of the Pacific Northwest Consumer Council a member of the armed forces , civilian personnel or someone related to a member of these groups or a member of the Association of the United States Army.

Military benefits: Benefits include free organizational accounts to military unit organizations to open military fund accounts such as the Family Readiness Group. The credit union also offers resources to help military members in financial need through JBLM Financial Resources, and provides relocation and deployment assistance.

Products and services: ACU offers numerous checking accounts with competitive APYs and impressive perks in addition to savings accounts, insurance, mortgages and other loans. The no-fee Affinity Basic checking account pays 2.02% APY on the first $1,000 deposited then 0.1% APY on balances between $1,000.01 $15,000 and 0.25% APY on balances above $15,000 and has no monthly fee or required minimum deposit.

Heres A List Of Credit Cards That Pay For Global Entry Or Tsa Precheck Applications:

Does Navy Federal have good car insurance?

Navy Federal does not offer car insurance directly. Navy Federal is a credit union, not an insurance company, so they cant offer auto insurance themselves. Instead, Navy Federal Credit Union partners with Geico and can facilitate discounts on Geico car insurance for NFCU members.

Navy Federal members might be eligible for discounts with Geico due to their military service. New Geico customers who are also military personnel can save up to 15% on their policy, whether theyre active or retired from service.read full answer

Additionally, Navy Federal members can save on Geico insurance for a stored car while deployed up to 25% off their regular premium. Maintaining some form of insurance coverage, even if your car is in storage, saves you money in the long run, since insurance companies prefer that customers have a long record of uninterrupted coverage with no lapses.

You Can Redeem Rewards For Cash Or Statement Credit

You can have your rewards deposited directly into a qualifying Navy Federal checking or savings account or get a statement credit on your credit card bill. Or, you can redeem rewards for gift cards, merchandise or travel. You can start redeeming rewards as soon as you earn them, and rewards won’t expire as long as your account remains open.

» MORE: NerdWallet’s best cash-back credit cards

Don’t Miss: How To Protect Car From Hail

The Best Military Banks And Credit Unions Of 2021

Between deployments, relocations and other military-specific situations, finding the right bank or credit union for a military lifestyle is incredibly important.

Weve researched banks and credit unions that focus on current and past members of the military, as well as their family members, to determine their unique benefits, ranges of financial products and services, fee structures and customer service. Based on our research, these are the best military banks and credit unions available, and what they offer.

What Is Guaranteed Asset Protection

For many car owners, typical car insurance covers the costs of damaged and stolen cars. However, if what you owe on your auto loan is higher than the total cash value of the car, the difference or GAP is not covered by your insurance plan. GAP helps you cover that difference to give you protection when you need it most.*

*Some exceptions apply. See the full GAP policy below.

How GAP Works

GAP will waive the difference between what the insurance company paid and the loan amount, if the loan amount is higher. For example:

Insurance SettlementHow Auto Deductible Reimbursement Works:

The primary borrower is eligible for coverage. If the loan is joint, the co-borrower is not eligible for the ADR benefit.

All vehicles the primary borrower owns and insures are eligible for coverage.

Only four-wheel, non-commercial passenger vehicles are covered ADR does not cover motorcycles, boats and RVs.

A claim can be filed if the paid claim exceeds the borrowers deductible and has been approved and paid by the borrowers primary auto insurance. Includes comprehensive and collision claims and requires repairs to be made.

If claim is approved, the borrower will be reimbursed for the deductible he/she paid. Refer to program details above for maximum benefit amounts.

Be sure to add GAP coverage when you apply for your PenFed vehicle loan online or call and talk to a representative at 800-247-5626.

Read Also: Car Covers To Prevent Hail Damage

General Credit Card Rental Insurance Faq

This section answers general questions about credit cards and rental insurance.

Does My Credit Card Cover Rental Car Insurance?

Many credit cards do. Youll need to check with your specific credit card contract to see if they offer car insurance when you rent a car.

Can You Pay Car Insurance with a Credit Card?

Most car insurance companies and rental car agencies will let you pay with a credit card. You can also usually get rental insurance through your credit card company if you use the card to pay for the rental car.

What Credit Cards Cover Car Rental Insurance?

Most major credit cards will cover rental car insurance. You can get a huge list of which cards cover insurance by reading the specific credit card FAQ section below.

Which Credit Card is Best for Car Rental Insurance?

That depends on a lot of factors. The Chase Sapphire is great if you travel internationally, Whereas the United Mileage Explorer Plus is good if you want rewards. American Express Blue Cash is the best option if you have a longer rental. This is considered by some to be one of the best credit cards for rewards.

Is Rental Car Insurance Covered by Credit Card?

In most cases, yes. There are some restrictions. For example, youll need to pay for your rental car with the credit card you want to pick up the insurance.

How Does Credit Card Rental Car Insurance Work?

What Credit Cards Offer Primary Car Rental Insurance?

Does My Credit Card Insure Rental Car Accidents?

Is Gap Worth It

If youre purchasing a car with little or no money down, or if your car loan has five or more years on it, you could benefit from GAP should anything happen to your car. You may be required to purchase GAP if you have a car lease, but requirements vary and you may not be able to choose where you purchase GAP from.

Read Also: How Much Do You Tip A Car Wash

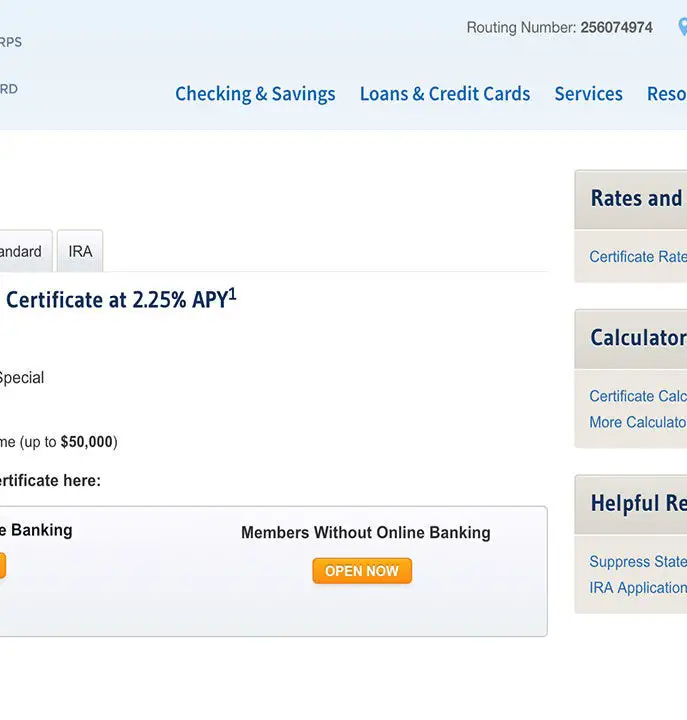

Are Share Certificates Safe

Certificates are generally considered to be one of the safest places to put your savings. If you choose a credit union like Navy Federal that is NCUA-insured, your savings are protected, up to $250,000 per depositor, for each account ownership category, in the event of credit union failure. Navy Federal Credit Union is insured by the NCUA .

Final Word Navy Federal Insurance Review

As a Navy Federal member, you qualify for special discounted car insurance rates with GEICO. GEICO is one of Americas largest and best-known insurance companies. Although GEICO doesnt have a perfect reputation, the company is generally well-regarded for its competitive prices, effective claims satisfaction, and strong customer service.

To obtain a Navy Federal car insurance quote through GEICO, complete the application here:

Help protect yourself on the roadwith Insurance Panda

Don’t Miss: How To Burn Mp3 Cd For Car

You Can Choose Between A Visa Or Mastercard Version

In most cases, when you apply for a credit card, you’re choosing the issuing bank and a specific card offered by that bank but the payment network typically isn’t a choice.

The Navy Federal Credit Union® cashRewards Credit Card is a little different, as it lets you pick either a Visa or a Mastercard version during the application process.

Best Military Banks And Credit Unions Of August 2021

| Best for | |

|---|---|

|

|

|

|

|

|

| Savings accounts |

|

|

|

|

Established by 25 Army officers in 1922, USAA Federal Savings Bank has a long history of serving members of the military. What started as a company offering auto insurance to officers has since evolved to a bank with a variety of products and services for military members ranging from insurance to bank accounts and mortgages. Many of the products are specifically designed to help customers who are on active duty. USAA has more than 13 million members.

Eligibility: Banking with USAA requires USAA membership. You can qualify for membership if you are current or former military , a spouse or child of current or former military or a precommissioned officer.

Products and services: USAA offers its Classic Checking account with no monthly fees and 0.01% APY on balances of $1,000 or more. This checking account includes access to 60,000 in-network ATMs and refunds up to $15 per month to cover ATM fees from other banks.

Read Also: How To Make Car Freshies

The Quote Process With Navy Federal

When reaching out to Navy Federal to get an auto insurance quote, you will be redirected to Geico. You have the option to get an online quote, get a quote over the phone, visit a nearby location to talk about your options. Though this is a more lengthy process, speaking with a representative often gives you a better understanding of your options.

When you reach out for a quote, be sure to have some information on hand for a smoother process:

- Information on your driving record

- Mileage on your car

- Details about your vehicle

- The type of coverage youre interested in

For an easy process, use this quick tool to get matched with the best providers in your state. Or, for an even easier process, call our team at .

Refinancing With Navy Federal Credit Union

Homeowners with existing mortgages can refinance into a new loan, and Navy Federal offers the following options:

- Rate-and-term refinance, in which youll take out a new mortgage with a new interest rate, a different loan term, or both.

- Cash-out refinance, which allows you to get a mortgage for more than you currently owe and use the extra cash for whatever you need.

- VA Interest Rate Reduction Refinance Loan , which allows VA loan borrowers to lower their interest rate or switch from an adjustable rate to a fixed rate.

Recommended Reading: How Much Does A Car Salesman Make Per Car

Is There A Gap In Your Coverage

Your auto insurance may not be protecting you completely. Navy Federals Guaranteed Asset Protection helps you fill in the gap. Learn more about the benefits of GAP and enroll today.

This article is intended to provide general information and shouldn’t be considered legal, tax or financial advice. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation.

Most Hunted Geico And Navy Federal Discount

Take benefits of the current geico and navy federal discount at Promocodeads before it expires! If you are lucky enough to locate the precise code, the degree of discounts can be as high as 50% OFF. We will try our best to supply customers with safe, checked, and validated coupon codes, as well as the most recent discounts and offers on the market. View more

You May Like: How To Take Out Hail Dents

Unlock Discounts To One Of The Top

In this guide, well explore if Navy Federal auto insurance is the best bet for your wallet and your peace of mind. We will discuss Navy Federal reviews, coverage options, and cost.

Whenever you shop for car insurance, we recommend getting quotes from multiple providers so you can compare coverage and rates. In addition to the insurance company you choose, factors such as your age, vehicle make and model, and driving history can affect your premium, so whats best for your neighbor might not be best for you.

Use our quote comparison tool above to get started. Or, for an easier process, call our team at to get free, personalized quotes seven days a week.

Navy Federal Credit Union: Loan Types And Products

Navy Federal Credit Unions loans are geared toward service members, veterans, and certain government employees. In fact, Navy Federal originated more than $11.6 billion in Department of Veterans Affairs mortgages in 2020 alone, making it the sixth-largest lender by volume for this type of mortgage. But it also offers other types of home loans, including:

- Military Choice loans

- Homebuyers Choice loans

Navy doesnt offer Federal Housing Administration mortgages , U.S. Department of Agriculture mortgages , renovations loans, reverse mortgages, and other niche products.

One of Navy Federals specialized loans is the Homebuyers Choice program, which is geared toward first-time homebuyers. The loan requires no down payment or private mortgage insurance, and borrowers may be able to wrap the funding fee into the mortgage or get it waived in exchange for a higher interest rate.

Another product, the Military Choice program, offers special pricing on mortgage interest rates and no down payment for active-duty and veteran borrowers. The standard 1% loan origination fee and 1.75% funding fee can be rolled into the loan or waived in exchange for a higher interest rate.

If you choose to get an adjustable-rate mortgage , you can choose from terms of 5/5 and 3/5. With an ARM, your interest rate stays fixed for a certain number of years in this case, five or three years then, it may go up or down for the rest of the loan term.

Don’t Miss: How To Make Car Freshies

Our Methodology: How We Review Life Insurance Carriers

In order to provide you with the most accurate and complete life insurance carrier reviews, we implement a comprehensive methodology. This includes looking at a carriers product availability, plans, personalization options, and pricing. We also consider factors such as consumer satisfaction, third-party ratings, and trusted industry scores.

Does Navy Federal Credit Union Require Full

I’m financing a new car through Navy Federal Credit Union. The loan officer told me I need to have full coverage, which is far more expensive than the liability I had on my old car. Is it normal for lenders to ask for full coverage on an auto loan?

Did this answer help you?

Read Also: Transferring A Title In Arizona

Does Carmax Require Full Coverage Insurance

Looking for does carmax require full coverage insurance? Get direct access to does carmax require full coverage insurance through official links provided below.

Follow these easy steps:

- Step 1. Go to does carmax require full coverage insurance page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access does carmax require full coverage insurance please leave a message below .

was full coverage a requirement on behalf of carmax? since the car is still carmax’s, you have to abide by their rules. *yes, i know you’re paying for it, but they’re financing YOU, which means it legally is THEIR car. most dealerships require full coverage on their cars. look at the disclosure you signed when buying that car.

I purchased a car from Carmax back in April and yes, you will need full coverage to purchase a car. At the very least I am 100% certain they will not let you leave the lot with the vehicle without proof of insurance. I believe this will be the standard across most reputable dealerships.

Navy Federal Auto Insurance Discounts

GEICO is one of Americas most affordable car insurance companies, and GEICO offers a range of auto insurance discounts to drop prices even further. Some of the discounts available through Navy Federal and GEICO include:

Bundling Discounts: You can buy virtually any type of insurance policy through Navy Federal and GEICO, and bundling multiple policies together can save 20 to 30%. If you bundle homeowners insurance, car insurance, RV insurance, motorcycle insurance, and other insurance products under one policy, you can qualify for bundling discounts through GEICO and Navy Federal.

Vehicle Equipment Discounts: GEICO and Navy Federal offer discounts for vehicle safety features like airbags, anti-lock brakes, anti-theft systems, daytime running lights, and more.

Good Driver Discounts: As a good driver with a clean record, you qualify for savings of up to 30%. To qualify, you need 3 to 7 years of clean driving history with no speeding tickets, at-fault accidents, or citations.

Affiliation Discounts: Just for being a member of Navy Federal, you qualify for discounted rates on GEICO auto insurance.

Drivers Education Discounts: Obtain a drivers education discount with Navy Federal and GEICO by taking an approved driver training course.

Multi-Vehicle Discount: If you need to insure multiple vehicles with Navy Federal and GEICO, then you could save money across all vehicles by insuring them under a single policy.

Read Also: How To Buff Out Scratches On Your Car