How Do You Calculate Apr Interest On A Car Loan

Iâm trying to pay my car loan off and I noticed my monthly payments are higher than expected. I want to know how to calculate APR interest on a car loan so that I can see if I need to look into refinancing or not.

Answer

divide the total loan and interest amount by the loan term

- Divide the total from your fees and interest by the amount of the loan.

- Take the result and divide it by the number of days in the loan term.

- Now, multiply the resulting number by 365.

- Multiply the result by 100 to get the percentage rate.

Why An Annual Percentage Rate Can Be Misleading

Many lenders feel that requiring APR disclosure is unfair because it makes short-term loans look more expensive than they are, and long-term loans feel cheaper.

Payday loans, for instance, only have a loan term of 14 to 30 days. As such, lenders say, its misleading to convert a fixed fee for a short-term loan into a hypothetical annualized rate.

An example that illustrates this view is the taxi and airplane analogy. A 500-mile flight on an airplane might cost $500, or $2/mile, while a one-mile taxi ride in Los Angeles will cost about $10, or $10/mile. Does this mean that taxis are overpriced? No, most would argue its just a different type of service. To require both of these services to report their costs in the same way would overstate the cost of the taxi ride. Similarly, lenders argue, its unfair to require payday lenders to report an annualized rate.

What Is A Good Interest Rate For Your Car Loan

When you are , you want to avoid overpaying and make sure you get the best interest rate possible for your car loan. Keep your credit score in mind when taking a look at the chart below. Here, you can learn more about the average new and used car loans based on credit scores and the APR, or Annual Percentage Rate, for that average. To take some of the hassles out of shopping for a new car, you can apply for financing in advance from the comfort of home.

Also Check: How To Get Cigarette Burns Out Of Car

How To Calculate Apr

To calculate the APR of a loan, you need to take into consideration the principal amount, the number of years the loan will last and the extra charges that the loan incurs in addition to interest.

To calculate APR, use the following steps:

Calculate the interest rate

Add the administrative fees to the interest amount

Divide by loan amount

Divide by the total number of days in the loan term

Multiply all by 365

Multiply by 100 to convert to a percentage

Here is the annual percentage rate formula:

For example, Frances borrows $2,000 at a 5% interest rate for two years. The closing administrative cost for the loan is $200. To find the APR, first calculate the Interest on this loan using the simple interest formula: A = , where A = total accrued amount, P = principal, R = interest rate and T = time period.

In this case, P = $2000, R = 5% and T = 2 years. Therefore, A = ), or A = $2,200.

Interest accrued = A – P = $2200 – $2000 and interest = $200.

Next, add the interest to the closing cost. Using the APR formula, fees + interest = $200 + $200 = $400.

Finally, divide the loan amount and the number of periods, then multiply by 100 to get a percentage.

The APR on this loan is 10%.

From the APR calculations, you can discover that even though it appears that the interest rate is 5% on this loan, the real annual cost of this loan is 10% when all the charges are included.

Related: 6 Essential Accounting Skills

What Is A Good Apr

You hear a lot of commercials and ads that present buyers with a zero percent financing options, but these are pretty rare and only account for under 10 percent of most loans issued, so don’t start sweating when you see that you’re not getting zero percent.

Your average APR can register anywhere from 3-10%, but obviously you’ll want to aim for the lower numbers. Plus, 3% is a very good annual percentage rate and is your reward for keeping good credit over the years. Anywhere between 4-6% is considered to be a good APR and is usually around the average for people with mid-range credit. Should your credit be less than perfect, you’ll usually pay a higher APR than those with excellent credit, but a car loan is a great step in the right direction for improving your credit.

Related Post: How to Lower APR on a Car Loan

You May Like: How To Make Car Freshies With Aroma Beads

How Do I Calculate Apr On A Car Loan

To calculate the estimated APR on a car loan, weve put together a method using computer spreadsheet software. To go that route, youll need the following information:

- Loan amount The total amount you plan to finance, typically the price of the vehicle, minus any down payment or trade-in

- Loan term The length of your auto loan

- The loans interest rate

- Certain fees, like origination fees

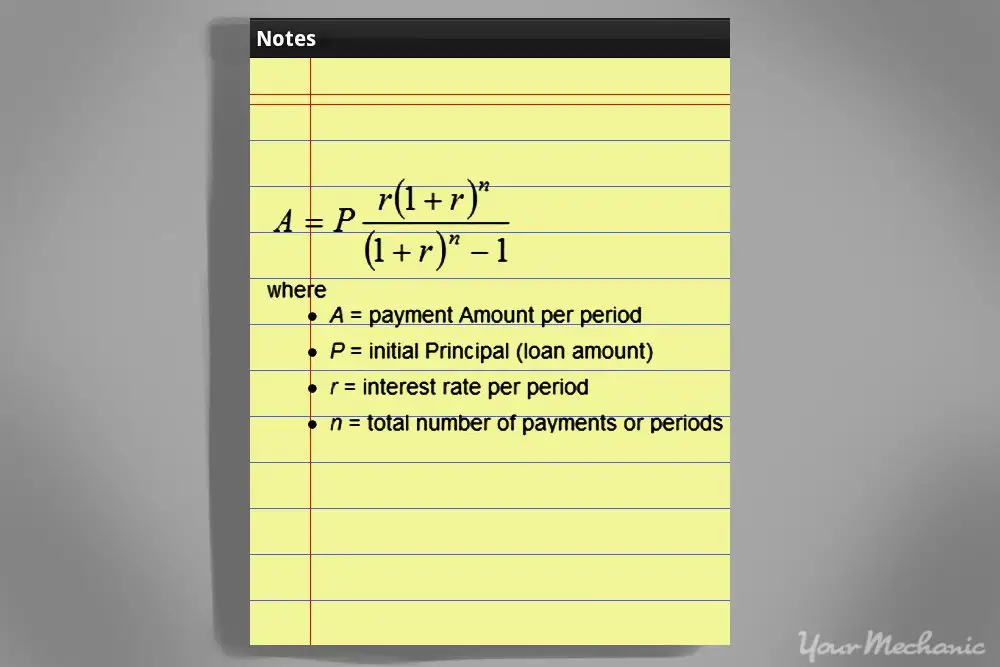

The first step in calculating APR yourself is calculating your estimated monthly payment.

What The Vehicle Loan Really Costs

When it comes to APR vs. interest rate, the APR actually takes into account the total finance charge you pay on your loan, including prepaid finance charges such as loan fees and the interest that accumulates before your first loan payment. When shopping for a loan, make sure youre comparing each lenders APR along with the interest rate.

Also Check: Repair Cigarette Burn In Car Seat

Your Monthly Car Loan Emi: 10624

Monthly amount paid to your Car Loan provider

Your debt repayment schedule in regular instalments over a period of time.

| Year |

|---|

Nowadays, it is much easier to buy your dream car due to the various car loan schemes offered by different lenders. Car loans are offered at attractive interest rates and a repayment tenure of up to 8 years.

Various banks and third-party websites offer a Car Loan EMI Calculator that allows you to calculate the Equated Monthly Instalments that must be paid. The Car Loan EMI calculator offered by BankBazaar is simple to use and is free. Basic details such as the repayment tenure, principal amount, and the rate of interest must be entered to calculate the EMI.

How To Calculate The Apr Of A Term Loan

Calculating the APR of a loan is simple. You need three numbers: the amount borrowed, the total finance charge, and the term length of the loan.

To illustrate, lets calculate the APR on a $1,000 loan with a $400 finance charge and a 90-day term.

Recommended Reading: Repairing Cigarette Burns In Car

Find Out Your Exact Apr

Compare finance options and see your exact monthly payments with no effect on your credit score

This car finance calculator shows you what your monthly repayments are likely to be based on your loan amount. Just select how much you want to borrow and how long you want the agreement to last.

Then well show your likely repayments based on a low, moderate and high .

This should give you a good idea of the finance options available to you. And hopefully therell be fewer surprises when you actually get a finance deal.

Please note, the three APRs shown by our calculator will only be representative examples. To get an exact APR, youll need to get a car finance quote by filling out our application form. Dont worry its only a short one.

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Don’t Miss: Does Autozone Accept Synchrony Car Care

How To Use The Auto Loan Payment Calculator

Heres a guide for the information you will need to input into the auto loan payment calculator.

Car price: In this field, put in the price you think youll pay for the car. To estimate new car prices, you can start with the vehicles sticker price . Subtract any savings from dealer negotiations or manufacturer rebates. Then add the cost of options and the destination fee” charged on new cars.

For used cars, estimating the sale price is a bit trickier. You can start with the sellers asking price, but you may be able to negotiate it lower. To get an idea of a fair price, use online pricing guides or check local online classified ads for comparable cars.

Interest rate: There are several ways you can determine the interest rate to enter. At the top of the calculator, you can select your credit score on the drop down to see average car loan rates. You can also check online lenders for rates. If you get pre-qualified or preapproved for a loan, simply enter the rate you are offered.

Trade-in and down payment: Enter the total amount of cash youre putting toward the new car, or the trade-in value of your existing vehicle, if any. You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost . You can also get cash purchase offers from your local CarMax, or online from services such as Vroom or Carvana, as a baseline.

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

You May Like: How To Get Hail Dents Out Of Cars

What Is A Balloon Payment

A balloon payment is a large, lump-sum payment made at the end of a long-term loan. It is commonly used in car finance loans as a way of reducing monthly repayment figures. Be aware that once you reach the end of your loan period, the balloon amount becomes payable. You can learn more about balloon payments in our article, What is a balloon payment?.

If you have any problems using this car loan payoff calculator then please contact me.

Recommended Reading: Adding Bluetooth To A Car

How You Can Use Spreadsheets To Help Calculate Apr

Calculating the APR on loans like a mortgage is a bit more complex because of all the variables, like costs, financing charges, interest and term length. Using a spreadsheet to calculate APR can help you with the calculations.

Use the or make your own Microsoft Excel APR spreadsheet:

Test your formula for a $100,000 loan at 8 percent interest for 15 years with closing fees of $1000:

Also Check: Removing Scratches From Car Interior

Definition And Examples Of Apr

The annual percentage rate of a loan is the total amount of interest you pay each year. This is calculated before compounding interest is taken into account. APR represented as a percentage of the loan balance.

When you borrow money, any interest you pay raises the cost of the things you buy with that money. Credit cards are a form of borrowing, as are loans and lines of credit.

Knowing a card or loans APR helps you compare offers. It also shows you the true cost of what you are buying.

For example, if a credit card has an APR of 10%, you might pay roughly $100 annually per $1,000 borrowed. All other things being equal, the loan or credit card with the lowest APR is typically the least expensive.

What You Need To Know

Before you can calculate your exact payments, you’ll need to collect some information about your car and finances. The Consumer Financial Protection Bureau has a handy worksheet you can use to gather this information. Just fill in your details next to the example scenario.

First, figure out the overall value of the car and registration. This figure includes the sticker price of your car, along with any taxes, titling fees, warranties, and prior car loan amounts being rolled over into your new car loan. Once you’ve calculated this cost, you can subtract your down payment, along with any applicable rebates and the trade-in value of your previous vehicle.

Next, take a close look at the terms of the loan. To determine the car payment amount, you will need to know the length of the loan and the interest rate you will pay. The period of vehicle loans is generally stated in months, even if it lasts for years.

The CFPB has documented a steady rise in the length of car loans. Term lengths of six years or more made up just 26% of car loans issued in 2009. By 2017, these long-term loans made up 42% of car loans.

Don’t Miss: Cost To Get Car Painted

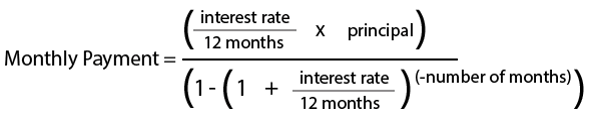

Calculating Your Estimated Apr

For the estimated APR, you will require the following formula entered into a cell in your spreadsheet.

=RATE *12

Note that to calculate the estimated APR, you have to have already calculated the monthly payments and have the complete breakdown of all additional fees. The negative figure from the monthly estimated payments formula should be entered as-is.

How Are Auto Loans Calculated

Calculating the cost of an auto loan involves following a mathematical formula. It might not be as simple as 1+2=3, but the concept is the same!

If you take the factors listed in the previous section and plug them into the right spot in the equation, you will get your monthly auto loan rate. There are auto loan calculators that can give you an idea of this amount, but understanding the how behind the calculations is essential as well.

First, its important to note that an auto loan is an amortizing loan. This means that you pay back the amount of your loan plus interest. Your payments are the same each month and include the principal balance plus interest. Each payment you make will be the same however, as you make more payments, you will pay more towards the principal and less toward interest.

Again, you can choose to use a calculator or rely on your lender to calculate your auto loan payment, but its good to understanding the mechanics behind how and why auto loans are calculated the way they are.

Also Check: How To Remove Hail Dents From Car

Don’t Miss: Keep Squirrels Away From Car