Will Geico Cancel A Claim If Im At Fault

You cant cancel the other drivers claim if you are found to be at-fault in an accident. Your liability insurance will cover the damages up to your policy limits, and you shouldnt have to pay a deductible. You can, however, choose not to have your insurance company pay out a claim for your personal injuries or vehicle repairs.

How does Geico RV insurance work?

Geico RV insurance includes liability, collision, and comprehensive coverage, similar to Geico car insurance. However, since an RV is really a combination of a vehicle and a home, Geico offers an enhanced coverage policy for property losses and special problems RV owners can face on the road.

Enhanced RV coverage is currently available in all states except Hawaii, Massachusetts, Michigan, and North Carolina.read full answer

How To Cancel Geico Insurance

Why you can trust Jerry

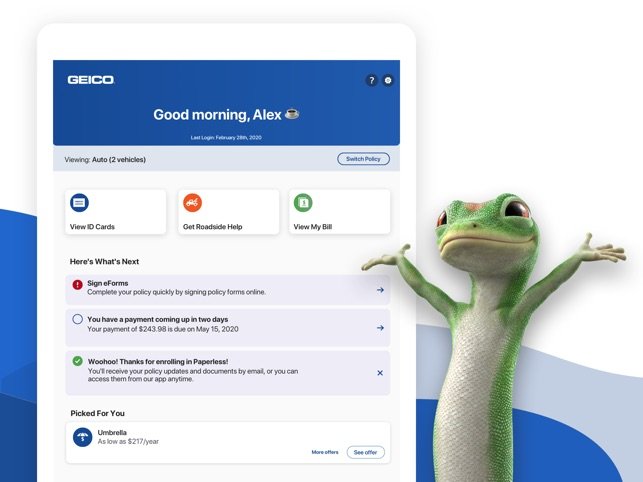

Things change, and you might find that GEICO insurance isnât meeting your needs anymore. If youâre trying to find out how to cancel GEICO insurance, the process is pretty simple.Youâll typically get unused amounts refundedreplacement policycancel your old policy

“I downloaded Jerry to see if it was even possible for me to get cheaper car insurance. Jerry found us car insurance that matches 100% to my old coverage for so much cheaper!” – Satisfied Jerry User

MORE

Be Sure To Have Another Policy Before Cancelling

If you are set on cancelling your GEICO car insurance policy, its important to note that you should set up a policy with another auto insurance provider before cancelling. The recommended course of action is to have a day or two of overlap between the two policies. Even a day without having an auto insurance policy is considered a lapse in coverage and can affect you negatively when searching for car insurance in the future, as well as affecting rates.

Insurance companies determining your premiums will look at multiple factors, including driving record and insurance history. A lapse in coverage can mean that you have been driving uninsured or cant keep up with your payments. As a result, you may be charged a higher rate.

Also Check: 888-601-6302

Geico Auto Insurance Review

As the second-largest auto insurer in the country, Geico offers a wide range of coverage options and extras. Our Geico insurance review also found the companys average rates to be 22% cheaper than the national average for good drivers. In our review of the industrys best car insurance companies, we at the Home Media reviews team rated Geico No. 1 for its strong financial ratings, comprehensive coverage and customer-first practices.

Although Geico scored highly in our study, the best provider for you will depend on your needs. Any time you shop for car insurance, we recommend comparing prices from insurers to get the best deal.

Compare car insurance quotes

Free Auto Insurance Comparison

Secured with SHA-256 Encryption

|

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc… |

Written byLeslie Kasperowicz Farmers CSR for 4 Years |

|

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florid… |

Also Check: How To Stop Car Windows From Fogging Up In Summer

Geico Rental Car Insurance Coverage Limits

The same Geico coverage limits that apply to your personal vehicle will also apply to a rental car. If you only carry liability insurance, Geico will pay for the other drivers injuries and property damage after an at-fault accidentbut not physical damage to the rental. You need a full coverage policy to have damage to the rental car covered by your insurer.

If you have full coverage and you rent a car of similar value to your personal vehicle, you will probably have sufficient coverage. But if your personal vehicle is a 15-year-old Ford and you decide to rent a brand-new Lexus, you should look into extra coverage options.

Inform The Company Of Cancellation

Not only is it good practice to inform your insurer that you plan to cancel, but letting a policy lapse can cost you fines and extra fees. Your policy may auto renew and you will continue to receive insurance bills and, eventually, be marked for nonpayment.

If you dont notify your carrier, it will continue to send bills, and likely follow those up with phone calls or letters. That will eventually stop, but the insurer could mark the account for non-payment, and report this to the credit agencies. You could also face higher car insurance rates in the future.

You May Like: How To Notarize A Title In Az

Reasons For Canceling Your Policy

Most people cancel their policies when they’ve decided to switch to another insurance provider. Often times people will reassess their plans when their circumstances shift like when they remove a driver from their plan, or move to a lower-risk area. There are many factors to consider when the right policy for you.

If you plan on still owning a car, but you’ve cancelled your insurance, you need to obtain a new policy ASAP. Otherwise, you can be considered lapsed, which could put you at risk for fines from your state.

Final Word Geico Cancellation Fee

Most car insurance companies in most states do not charge cancellation fees. In most cases, you can cancel your auto insurance policy with any company without issue.

GEICO, like most of its competitors, does not charge any termination fees or cancellation fees. Call GEICO to cancel, then check if youre getting a pro-rata or short rate policy cancellation.

Help protect yourself on the roadwith Insurance Panda

Recommended Reading: Repair Clearcoat

How Do I Cancel My Car Insurance With Geico

My car insurance provider is GEICO but I just sold my car. How do I cancel my car insurance with them?

Answer

no cancellation fee

- Your name

- Your GEICO policy number

- The date of cancelation

beforeYou may need to surrender your license plates before you cancel your insurance.

Geico Rental Reimbursement Coverage

In addition to standard rental car insurance, Geico offers rental reimbursement coverage as an optional policy add-on. It helps pay for the cost of a rental car while your personal vehicle is being repaired for a covered claim. This coverage costs between $2 and $15 per month, on average, but youll need to call customer service to get a personalized quote and add rental reimbursement coverage to your policy.

How do GEICO glass claims work?

GEICO glass and windshield claims are subject to a $0-$1,500 deductible, depending on how the glass damage occurs, where it is on the car, and whether or not the policyholder has comprehensive coverage. If your glass or windshield is damaged in an accident that is not your fault, it should be covered by the at-fault drivers liability insurance. If it is damaged in a collision caused by you, whether with another vehicle or an object such as a fence or a tree, it can be covered by GEICO collision insurance. This is optional coverage that you can get when you purchase your auto policy.read full answer

To make a claim for glass damage not caused by a collision, you need to have GEICOs comprehensive coverage. This is also a choice you make when you buy your policy. In general, GEICOs comprehensive insurance covers glass damage caused by:

- Fire

- Earthquakes

- Civil disturbances

Also Check: Arizona Car Title Transfer Gift

Know Your Geico Policy Details

Pull out the declarations page of your Geico policy and make note of your current coverage levels. Unless youre relocating out of the country or getting rid of your car once and for all, youll need to replace your coverages. To ensure you are comparing your options apples to apples, make sure you get quotes for the same coverage levels you have with Geico.

You should also take note of your coverage effective dates and billing status. To avoid any chance of being charged a short rate, youll want to cancel the Geico policy on the day that coverage expires. In that case, you wouldnt owe additional premiums, nor would you be entitled to a refund.

Can You Cancel A Claim

Yes, insurance providers will allow you to cancel a claim once you filed it. There are several reasons why drivers might want to cancel a claim, and one of the most common is not wanting to pay the deductible. To cancel your insurance claim, simply talk to a representative of your insurance provider.

Recommended Reading: Where To Install Car Seat

Recommended Reading: Program Car Computer

What Should I Consider Before Canceling My Policy With Geico

- Does your state require proof of new insurance?It is illegal to drive without car insurance, so make sure there is no lapse in your coverage by having new car insurance in place before canceling your current policy.

- When is the best time to cancel or switch providers?Life changes like getting married, buying a house or having a baby might be good times to shop around for a new policy. Experts also recommend shopping around for a new policy once a year.

- How much time do I need to switch policies?If youre cancelling by phone, cancellation is usually effective immediately. But if you are mailing in a written request, give yourself enough time for Geico to receive and process your letter.

Whats The Best Way To Cancel Geico Insurance

Can a family member or friend cancel my insurance for me?

No. Because car insurance is a legal contract that you sign when you apply, only you can cancel your policy. An exception is a person whos designated as your power of attorney this person can cancel your policy, but Geico will require proof of POA.

Recommended Reading: Get Removed From Dnr List Enterprise

Homeowners Insurance From Geico

Geico offers homeowners insurance policies through partner agencies. Coverage is available in all 50 states and typically includes property damage coverage, personal property coverage and limited jewelry coverage. Some policies may also include personal liability and medical bills coverage. Homeowners who already have Geico auto insurance can save on their homeowners insurance policies.

You can find out more about Geico homeowners insurance coverage in our review of the best homeowners insurance companies.

Consider Suspending Your Policy Instead Of Cancelling

Perhaps you are satisfied with your current policy and do not want to cancel it, but there are other reasons you no longer need an active policy or the same level of coverage. What can you do if you are not planning to drive your vehicle for 30 days or more, are traveling for an extended period of time, have a suspended license or need to repair your car?

Depending on the circumstances, your insurance company may allow you to suspend your policy one of several flexible options to help your policy fit your needs. In order to find out if you can suspend your car insurance policy, call a GEICO agent to discuss your options.

Also Check: Carcareone Credit Card

Why Did Geico Cancel My Policy

As an established company in the auto insurance industry, GEICO cant just cancel someones policy for no good reason, lest it risk a lawsuit. If GEICO has canceled your auto insurance policy, then you likely did something to void the contract. Some of the reasons GEICO might void a policy include:

- You stopped paying your rates

- Your only vehicle was totaled

- You filed too many claims in a short period

In any of the above instances, the insurer would still attempt to contact you in several ways before ending your coverage. If you suddenly find you dont have auto insurance coverage, you can reach out to the insurance company and ask why your policy was canceled.

Canceling Your Geico Insurance Step By Step

Since you are legally required to carry auto insurance in most U.S. states, you dont want to part ways with Geico on a whim. Also, if you still own your vehicle, Geico will probably require you to show proof of alternate coverage before you can cancel your policy. So, its best to be organized about the switch. Thatll streamline the process for you. Heres how to proceed.

Recommended Reading: Geico Cancel Policy Refund

You Won’t Be Driving Temporarily Because

- You’ve sold your vehicle, it was totaled, or it’s inoperable.

If you’re going to be without a vehicle for 30 days or less, your GEICO policy could cover you while driving a rental. You’ll get to keep your tenure, discounts, and benefits through to your next car. Otherwise, Non-Owner Insurance can provide you with coverage for damage to another car when you borrow or rent a vehicle.

- You are putting your car in storage for more than 30 days.

We offer reduced rate insurance for stored vehicles in case of theft or other damage. Call us at to learn more.

Faq: Cancelled Car Insurance

Is it hard to get car insurance after being cancelled?

If your auto insurance was cancelled because of too many traffic violations or an infraction like a DUI, youll have to pay more for new insurance. You might not be able to find any from standard or high-risk insurers. If thats the case, you can turn to your states assigned risk pool for insurance. No matter your situation, you can get insurance you just might have to pay more for it.

Any insurance agent in your state can connect you to an assigned risk pool policy. In some states, you might need to show that youve been turned down by three companies before you can access it.

Why is my car insurance cancelled?

Your insurance could have been cancelled for non-payment, for too many traffic violations, for a license suspension, or for misrepresenting yourself on a quote.

Why would an insurance company drop you?

Insurance companies can drop customers for external reasons by sending a notice of non-renewal. Non-renewals might not have anything to do with the customers themselves. On the other hand, an insurance company may cancel policies for things like non-payment and increased claims.

You May Like: How To Add Oil To Car

You May Like: Does Aaa Ship Cars

How Long Before Geico Cancels Insurance

There should be no delay in the cancellation of your Geico car insurance. As soon as Geico receives your request to cancel your policy, they should be able to cancel the policy immediately. The only reason that would delay the cancellation of your Geico auto insurance would be if you do not include all the required information. Be sure to reference the list above of what they need to cancel your policy.

Weigh Options Before Cancelling

While you dont need to tell the insurance company why you are cancelling, its always a good idea, especially if the reason is cost or dissatisfaction. Auto insurance is very competitive and companies want to retain as many customers as possible. Expect the company to try and keep your business by offering discounts or other incentives. To get a better sense of whether another insurer might be a better bet, try comparing Geico auto insurance reviews with other companies reviews.

Recommended Reading: How Car Salesmen Get Paid

Do I Need To Have A New Policy In Place Before Canceling My Policy With Geico

No, Geico doesnt require you to prove that youve picked up a new policy before canceling coverage with them.

Keep in mind that driving without at least the minimum auto insurance is illegal. Make sure that you understand your states requirements for car insurance. Some require that you carry insurance on a vehicle until you turn in your license plate, and Geico will likely notify your state directly of the cancellation date of your insurance.

You Located A Cheaper Rate Elsewhere

There are a variety of discounts available that may result in a less expensive auto insurance premium. As soon as youve made sure youre getting the optimum discounts with GEICO, make certain youre comparing it to the same plan from an additional firm– one that has the same insurance coverage, deductibles, and benefits that you have now.

We hope that the above information will prove to be a lot more useful than our expectations.

You May Like Also

Also Check: Carvana Buy Out Lease

How Do I Cancel My Policy

You can change or drop certain aspects of your coverage online. But to fully cancel your auto policy, you need to call in or cancel by mail.

What info do I need to cancel?

Have this info ready when you call or include it in your cancellation letter.

- Your full name and address

- Your Geico insurance policy number

- The date your policy is to end

How To Cancel Progressive Insurance

Progressive says you will be refunded the money you paid in advance for coverage you wont use. Unfortunately, they dont give details about how they pro-rate refunds or whether they charge any cancellation fees.

Don’t Miss: Cost To Have A Car Painted