Collect Information On Your Loan

First reach out to your lender, and find out the payoff amount on your loan. This might be slightly higher than the current balance printed on your monthly statement because of interest, prepayment penalties or other fees.

As long as you owe money on the car loan, the lender has possession of the title and effectively owns the vehicle, which is used as collateral in the event of default. You must satisfy the payoff amount before the lender will transfer the title to you.

Your lender can also help you understand what steps youâll need to take to pay off your loan and sell your car, no matter how you choose to do so.

Is It Smart To Trade In A Car With Negative Equity

Financially, it can make sense to trade in a car with negative equity if the car is in poor condition and unreliable. You don’t want to put yourself in a position where your vehicle is costing you a lot of money in extensive repairs. Trading in a car with negative equity can be beneficial if you can find a vehicle that is less expensive and fits into your budget.

However, you need to be careful, as you could go into greater debt and more negative equity. If you can hold off on buying a new vehicle, you can reduce your negative equity by making extra payments on the car loan. Delaying a trade-in is often the best option financially, but it only works if you can hold off your trade-in until you’ve saved enough to pay off the loan.

Your negative equity must be paid off sooner or later. If you need a newer car sooner, you may consider paying off the negative equity all at once out of your own pocket. For example, if you currently owe $15,000 on your car and the dealer offers $12,000 for a trade-in, you can make up the $3,000 difference to your lender. Before you do this, check and make sure that there is no prepayment penalty.

Negative Equity On An Auto Loan: All You Need To Know

Negative equity occurs when the value of the vehicle falls below the amount you owe on your current auto loan. For instance, if the remaining payments on your auto loan amount to $20,000 and your vehicles market value is $15,000, you have a negative equity of $5,000. This sticky situation is also referred to as being upside down on your car loan.

Negative equity can also affect youre your ability to sell off your vehicle or trade it in for a new one. Over the course of this blog, well tell you all you need to know about negative equity and how you can get yourself out of this sticky financial situation.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Recommended Reading: What Kind Of Oil Does My Car Use

Calculate The Negative Equity

Your first step should be to determine exactly how far below the surface you are. Its pretty simple to calculate the exact amount of your negative equity. Just subtract the estimated market value of your vehicle from the current amount you owe on the auto loan.

Not sure of your cars actual value? Well, you can always check legitimate online resources such as CARFAX Canada. As theres no single ultimate authority on used car evaluations, checking from multiple resources can help you gain a better idea of what your vehicle is actually worth.

Once you have determined the amount you have in negative equity, youll probably consider refinancing or selling. But before you do either, assess your finances to see if its possible to pay off the amount in full. If its within your means, wed advise you to pay off the amount in full rather than taking on additional debt and placing your other assets in jeopardy.

Research Your Cars Value

Researching the value of your vehicle is another early step in the process of selling a car with an outstanding loan. Its important to know the value of your vehicle so you can decide how much to list it for and so you can negotiate a sale price when you find a potential buyer.

But there’s another reason this is important. If you can’t sell the car for enough money to pay off the entire loan, you’re classified as being “upside down” on your loan. This would mean you’d need to come up with the extra money to pay your loan in full before selling. So if you owed $10,000 and your car would sell for just $9,000, youd have to pay the additional $1,000.

Once you know both your car’s value and the payoff balance of your loan, you can determine if youre likely to be upside down. If it turns out you are, you may either reconsider selling until you’ve paid down more of your car loan or start making a plan to come up with the extra money you’ll need.

You can estimate the value of your vehicle using many different online websites, including Kelley Bluebook, AutoTrader, and Edmunds.com. The value will be affected by the way you sell your car as you can often get more money from a private buyer than a dealer. Most of the websites allow you to get valuations for both options.

Don’t Miss: What Does Certified Car Mean

Consider Selling Your Car To A Private Party

The amount of money you’ll get by trading in your car is generally less than you could get by selling it to a private party. When the dealer takes your car as a trade-in, they’re planning to sell it to someone else. They can’t offer you its full value, because they need to make a profit. They may also have to spend some money sprucing up the car to make it more presentable.

Selling your car by yourself is more work , but it may be worth it if you have the time. A relatively easy way to reach potential buyers is by advertising on one of the major used car websites.

Know What Your Car Is Worth

Next, youâll need to research the current value of your vehicle. With the general supply-chain issues due to the Covid-19 pandemic, the industry is experiencing a scarcity of new carsâwhich means the market is hot for both new and used vehicles.

You can easily find out the present value of your car by visiting a vehicle valuation site like Edmunds, Kelley Blue Book or Cars.com. Youâll need to know the year, make, model, your zip code and overall condition of the vehicle. Vehicles less than three years old hold greater value, but even vehicles up to five years old are in demand.

Also Check: Can I Put Synthetic Oil In My Car

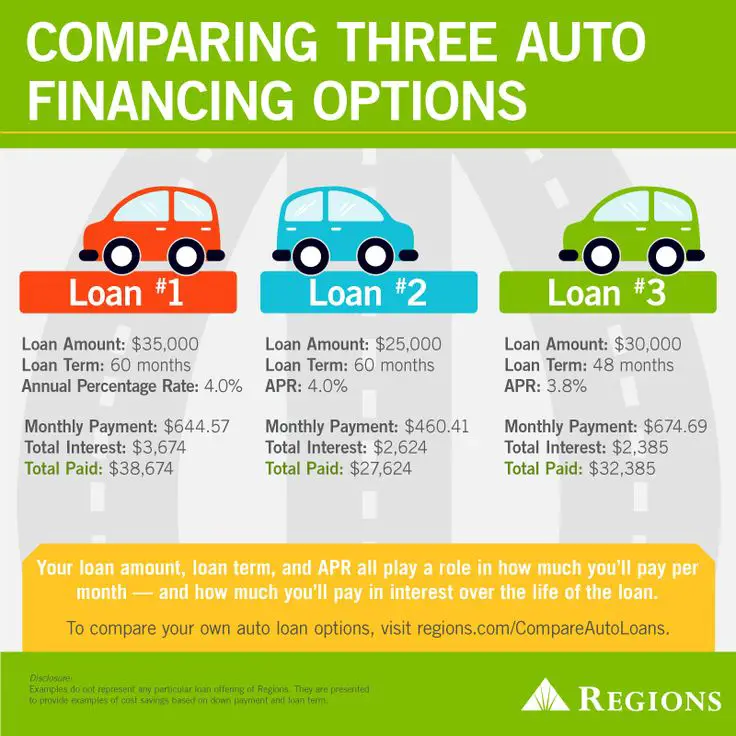

Two: Know The Amortized Payment Formula

The next step is to take the numbers that your potential lender or lenders have provided you and do some math. Because an auto loan is an amortized loan , you will need to use a specific formula:

A = P

A = the monthly payment.

r = the interest rate per month, which equals the annual interest rate divided by 12.

n = the total number of months.

Use Cash Windfalls Responsibly

Every now and then, we benefit from unexpected financial fortune. A spot bonus for going the extra mile at work. A generous cash gift from a relative for a birthday present. An unexpected tax return. While you cant necessarily predict our next monetary windfall, you can be prepared to use it responsibly.

If you have negative equity in your car and you happen to receive a little extra cash, consider using it to pay down your loan.

Don’t Miss: How To Get Paid For Advertising On Your Car

Are There Any Risks Linked With Trading In My Car With A Loan

There are some risks associated with trading a car with a loan. Considering the risks can help you decide if trading in your car is the right decision right now:

- Taking out another car loan could stretch your budget.

- Getting into more debt could put you into negative equity. The Federal Trade Commission explains negative equity in this article.

How To Trade In Your Car When You Owe Money On It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Yes, you can trade in a car with a loan. But proceed with caution and make sure you not the dealer control the transaction.

If youre trading in a car you still owe money on, youre looking at one of these two situations:

-

You have positive equity. If your car is worth more than the amount you owe on your loan, youre in good shape. This difference is called positive equity and its like having money that you can apply toward the purchase of a new car.

-

You have negative equity. If your car is worth less than what you still owe, you have a negative equity car also known as being upside-down or underwater on your car loan. When trading in a car with negative equity, youll have to pay the difference between the loan balance and the trade-in value. You can pay it with cash, another loan or and this isn’t recommended rolling what you owe into a new car loan.

Well show you how to handle each of these situations. But first, a little background.

Read Also: How Much Should I Spend On A Used Car

Find Out How Much You Still Owe On Your Current Loan

One thing you should always do when youre considering trading in a car you havent yet paid off is find out for sure exactly how much you still owe on the loan. You need to know this in order to see how the trade-in offer at a dealership compares to what you still owe. In an ideal scenario, what you still owe would be less than the trade-in offers you receive, but it also might not work out that way, which is a common situation well deal with a bit further on in this article. Finding out how much you still owe on a vehicle is easy to do you just have to call up your lender and ask. However, the figure youre looking for isnt necessarily as simple as the remaining outstanding balance on your loan, which is something you could easily look up online or from your last loan statement. The reason for this is because the interest charges on your loan keep accruing on a daily basis, so what you want to get is a 10-day pay-off amount, which lets you know exactly how much you still owe that includes all the interest that will accrue for the next 10 days. After those 10 days, youd want to get a new pay-off amount since it keeps changing.

Read Also: What Car Loan Can I Afford Calculator

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: How To Tint Car Windows

How To Calculate The Best Time To Trade In Your Car:

Imagine that you had a car that costs $30,000. During the next 3 years, the value is reduced to $15,000. If you take the difference between the original price and the current price, youre left with a depreciation amount of $15,000.

$30,000 $15,000 = $15,000

If you divide the depreciation amount by the number of months you have owned the car, you will find that you paid $416 per month in depreciation to own the vehicle.

$15,000 / 36 = $416

However, if you continue to own the vehicle for another 3 years, you may see the value of the vehicle will drop from $15,000 to $13,000. That means that for the next 3 years, you will only have paid $55 in depreciation every month.

$15,000 $13,000 = $2,000

$2,000 / 36 = $55

Ultimately, if you keep the car for 3 years, you lose $416 per month in value depreciation. But if you keep the car for 6 years, you only lose $236 per month.

$15,000 + $2,000 = $17,000

$17,000 / 72 = $236

This math shows that it makes more financial sense to keep the car longer. Keep in mind that losing money due to depreciation is not a complete loss. While it is money out of your pocket, you will also have use of a well-running car, a value that is harder to quantify but should still be a factor.

Cars typically lose value faster in the first 2 years of ownership. Once youve weathered that stretch, the value will drop much more slowly.

How To Trade In A Financed Car: Everything You Need To Know

If you still owe money on your car but you’re eager to buy a new one, trading in your vehicle might be a good option. However, it doesn’t mean you’re off the hook for your current loan.

Before trading in a financed car, there are a few things you should do, like find out how much equity you have in the vehicle and calculate much car you can afford. Here’s how you can trade in a financed car, and several things to consider along the way.

Read Also: How Does Trading In Your Car Work

Selling With Negative Equity

The process for selling a car when youre underwater or upside-down is more complicated. You will not only have to pay the lender all the proceeds from the sale, but then youll have to pay more money to cover the negative equity amount. There are several options for selling the car and paying the loan debt in full when youre dealing with negative equity.

TIP: If you need another car loan, check your credit score and get preapproved for an auto loan before you go to the dealership so the dealer wont try to inflate your APR.

Pay It Off Before You Sell

If none of these options seem attractive to you, you also have another choice keep the car and wait to sell it until you’ve paid off the remaining loan balance. While this may not be the ideal solution if you’re eager to buy a new vehicle and owe a lot of money on your current loan, it can have some significant advantages.

If you take this approach, you won’t have to worry about any prepayment penalties that might apply if you pay off your loan early. You also won’t need to worry about the complexity of a title transfer. Since you’ll wait until you own the car free and clear, you’ll be able to transfer the clean title to the new owner when you find a buyer.

If you’ve paid off your car loan in full before buying a new vehicle, you may also be able to use the proceeds from your sale to buy your new car without a loan. It can really pay off to save for a car instead of borrowing because you’ll eliminate your monthly payment and won’t owe interest on the vehicle.

You’ll also have more flexibility to negotiate car prices with buyers since you won’t have a loan to pay off.

Read Also: What Happens To Electric Car Batteries

Cons Of Trading In A Car

There is one major downside to trading in your car, though: You probably wont make as much money as you would if you sold the vehicle yourself. The car dealership wants to make a profit by reselling your used car to another driver, so youll miss out on that extra chunk of money.

Trading your car in might also limit your options when it comes to buying your next car. If youre planning to use the value of your old vehicle as the down payment on a new one, youll have to purchase your next car from a dealer willing to buy the old one.

Donât Miss: Does Va Loan Work For Manufactured Homes

What Is Negative Equity On A Car

When the amount you owe on your auto loan is greater than the vehicle’s value, you have a negative equity car loan. Many people refer to it as being upside down on your car loan. Cars decrease in value the minute you drive them off the car lot. A new car can possibly lose 20% of its value in the first year. With the rapid depreciation, it is easy to owe more than your car is worth if you used financing.

Negative equity often happens if you don’t put enough money down. It also occurs if you put a lot of wear and tear on your car. The car’s condition can deteriorate and reduce the value. Long-term car loans that are six or seven years often lead to negative equity. The more time it takes to pay off your car, the more likely you are at risk for negative equity.

Don’t Miss: What Is The Right Car For Me