Is The Nissan Leaf A Good Car

If gas and hybrid power arent your thing, wed suggest the Nissan Leaf. Unfortunately, theres some caveats to that. If range in EVs is an issue for you, steer clear of any Nissan Leaf before 2018. Thankfully, the issue has since been remedied, and 2018+ Leaf models return a healthy 150-226 miles of range. Obviously, that also means 2018+ models come at a premium. Consumer Reports says to expect pricing from $18,350-$21,150.

Thankfully, youre getting a lot of car for the top end of our budget range. The Nissan Leaf offers hatchback practicality that the other cars on our list just dont. The Leaf is also one of the more reliable EVs out there as well. Ride quality is another huge plus here, a quality shared with the Honda Accord. For those of you who cant charge at home, do be aware the Leaf can take up to six hours to charge depending on the voltage of the charger. While its smaller than the Accord, the Leaf more than makes up for it, meaning the last car on the list has some work cut out for it.

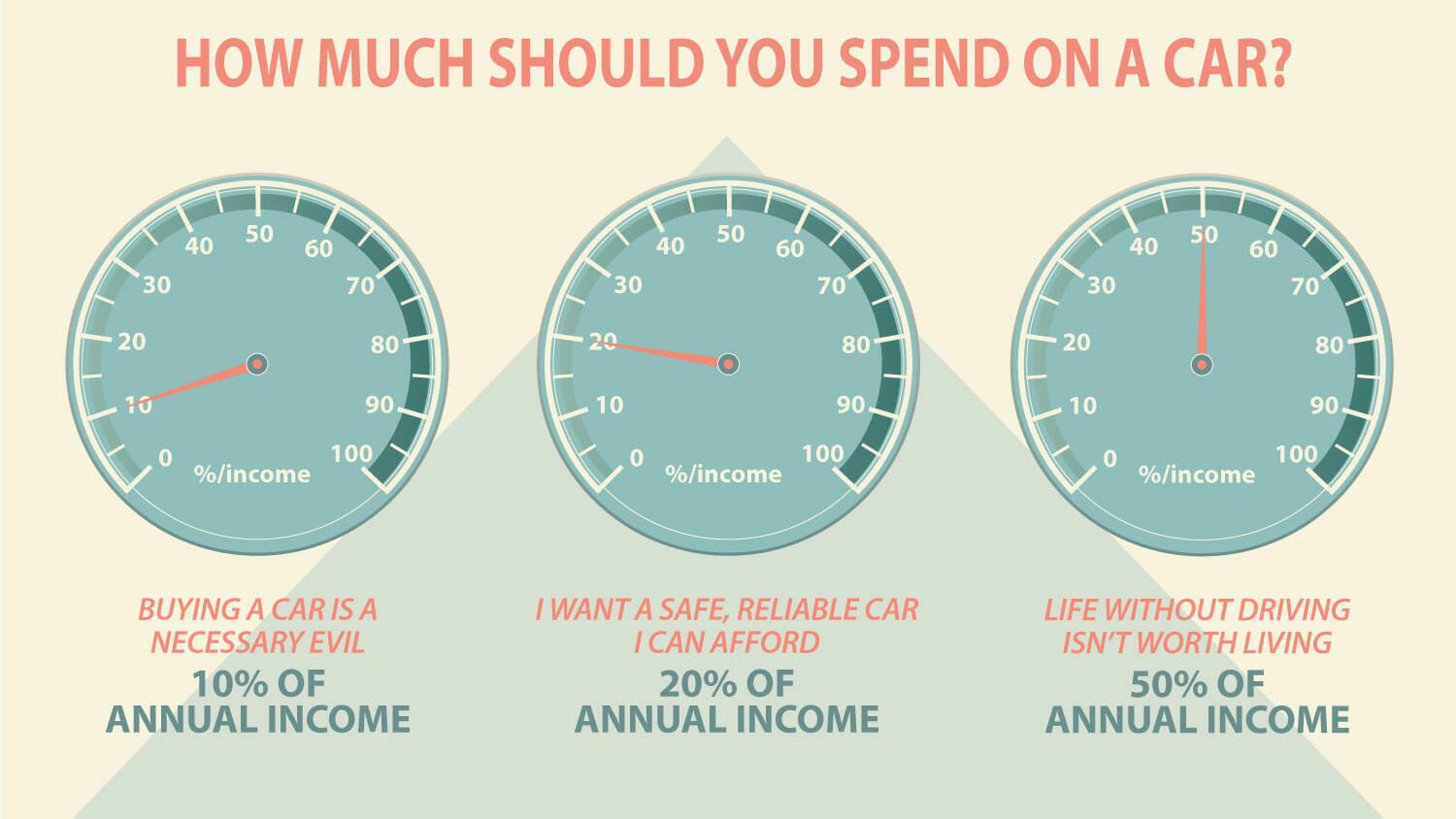

How Much Should You Spend On A Used Car

Financial experts generally agree that you should spendaround 20% of your annual income to get a dependable, newer used car thats within your budget. This strikes the right balance between paying a more affordable price while helping you avoid older vehicles that are more likely to be money pits for repairs.

Frugal spenders can find a decent used car at 10 to 15% of their annual income, but they should be prepared for possible breakdowns and frequent repairs.

If you want a luxury car and your finances can handle the expense, 35% of your annual income should be the maximum of what you spend.

If you need a dependable used car to get you to where you need to go, check out NIADA certified used cars.

Sell Or Trade In Your Current Car

When you’re ready to purchase your new or used car, you have to decide if you want to sell your old car yourself or use it for its trade-in value at the dealership where you purchase your new vehicle. Naturally, there are advantages and disadvantages to both.

As a rule of thumb, you get more cash if you sell your old car yourself. Of course, the downside is that you need to decide on a price and deal with prospective buyers. Websites like Kelley Blue Book and Edmunds.com can help you determine a realistic price for your old car. These websites require information such as mileage, condition, make, model and year.

Once you decide on a price, you need to take a photograph of the car and choose a couple of ways to post it for potential buyers, such as Facebook, Craigslist, Carfax, and Autolist, among others. You need to list the car for slightly higher than the bottom price you are willing to take for your old one because many Americans enjoy offering less than the listed price.

When you trade-in your old car at the dealership, where you’re buying your new one, you save yourself a lot of time and hassle. However, you should still consult KBB or Edmunds before getting a price to ensure that you are not being shorted more than you’re comfortable with. Dealerships make money from your trade-in, so trading in your car can give you a little leverage to get better pricing or a package of amenities you need for less.

Also Check: What Credit Bureau Do Car Dealerships Use

How Much Should I Spend On A Car If I Make $100000

So, theoretically, if your salary is $50,000 you could afford a car payment of $430 or less. With a $100,000 salary, you could afford a mortgage payment of no more than $2,500. For those with a salary near $30,000 your home, car, and debt combine should be no more than $1,250 per month.

How much car can I afford on 50k salary? Rather than looking at monthly transportation costs, Dave recommends buying cars that cost no more than 50% of your annual income. So if you make $50,000 a year, you should not spend more than $25,000 for a car.

What is too high of a car payment?

According to experts, a car payment is too high if the car payment is more than 30% of your total income. Remember, the car payment isnt your only car expense! Make sure to consider fuel and maintenance expenses. Make sure your car payment does not exceed 15%-20% of your total income.

How much should you put down on a $12000 car? A typical down payment is usually between 10% and 20% of the total price. On a $12,000 car loan, that would be between $1,200 and $2,400. When it comes to the down payment, the more you put down, the better off you will be in the long run because this reduces the amount you will pay for the car in the end.

Calculate The Car Loan Amount You Can Afford

Now that youve calculated your affordable monthly car payment amount, you can start to get a sense of how much you can borrow. This will depend on several other factors, including:

-

Your credit score, which will in part determine your annual percentage rate, or APR, on the loan.

-

Your loan term: how many months you have to pay off the loan.

-

Whether you buy new or used. New car loans tend to have lower APRs.

With a monthly payment, an estimated APR and loan term, the car affordability calculator works backward to determine the total loan amount you can afford.

Also Check: Columbo Car Model

The Frugal Rule: 10% Of Income

For many people, I think that will be between 1015% of your income. So if you earn $25,000 a year, thats going to be a high-mileage used car for $2,500$3,000. If you earn $80,000, thats a used car for around $10,000 or $12,000. .

So heres the thing: Im not that frugal. I know thats weird coming from a personal finance blogger, but Ive always been honest about the fact that Im more of a natural-born spender than saver. Ive checked myself in a lot of ways and become better at making frugal decisions, but I dont have that driving passion for spending as little as I can at every turn .

I also value cars: I enjoy driving and taking care of vehicles, so Im willing to spend a bit morewithout going crazyon my vehicles.

How Much Cash Do I Need To Spend On My Next Car

Want a cheap-to-run city car that should cost barely anything to run? Well under £6,000 gets you a comfortable, practical, and reliable three-year-old Hyundai i10. Need a spacious, easy-to-drive, and economical family car for the lowest cost? Barely £7,000 buys you a four-year-old Vauxhall Astra.

Have to have tonnes of space for a combination of children, pushchairs, luggage, and shopping in a fuel-efficient, comfortable and safe package? Well under £10,000 gets you the keys to a four-year-old Skoda Octavia Estate. And if you really want an upmarket SUV, you can get a relatively low mileage 2015 Volkswagen Tiguan for less than £12,000.

This means that theres no need to blow the budget and spend £15,000, £20,000, or even £30,000 if you cant afford it. If you do want something more interesting and can justify spending the cash, there are tonnes of exciting ways to spend your money.

Also Check: Is Nissan An American Company

More Than Just Sticker Price

We shouldnt forget that newer models often have advantages over their older counterparts. For instance, in 2012, electronic stability control was mandated for all cars, and side curtain airbags became standard in most vehicles. Backup cameras were available on many 2012 models. Other advanced active safety features became more widely available in the 2012 model year, so its a good place to start if safety is your primary concern in purchasing a used car.

Newer vehicles often have better mileage, too, which can save you money in the long run. And you often find more gadgets and better stylistic choices in newer model years.

And If You Really Love Cars

To all you personal finance blog regulars out there, this probably sounds good so far. If this is your first time here , you might be thinking, These people are so cheap! Thats crazy. Theres no way I can get a car I want for that money!

To you, I would say: Ask yourself why youre saying that. Is it because youre a car guy and you value your car most out of all your possessions? Or is it because youve simply been conditioned by our culture, advertising, and car salespeople to think that you should buy a brand new car and that theres nothing wrong with spending a years worth of paychecks on a car?

If its the formerthat you love carscool. Theres nothing wrong with intentional spending on the things you value most. By intentional spending, I mean spending moneymaybe more than other people would think is sensibleon things that interest you.

So if you value your car, I dont see anything wrong with spending more than we recommend for most people, perhaps up to 50% of your income on a car. Chances areas a car personyoull care for the car more, enjoy it more, and get more money for it when you sell it than the average car owner. Again, you just have to remember that because the car will be a large expense, youll have to be extra vigilant about other expenses.

Also Check: Repairing Cigarette Burns In Car Upholstery

Budgeting For Your Purchase

Create a budget to determine how much money your new vehicle will cost you each month without a bank loan and then subtract that from how much you can afford each month on a car. Your monthly car payment should be less than this amount.

A loan calculator can help determine how much of a down payment to come up with to make your auto loan more affordable each month. Among the factors this type of car affordability calculator considers includes the interest rate, down payment, price of the car, and the number of months on the loan, to determine the final monthly payment. It helps you establish a price range for yourself before you go car shopping.

Car Finance: Should I Go For Pcp Finance Or Hire Purchase

Should you prefer the pay monthly option, consider whether its important to you to own the car or if you simply want the lowest monthly payments and are happy to put down another deposit after several years, followed by a series of payments to get into another car.

If ownership is important to you, then look into Hire Purchase you get relatively affordable monthly instalments and own the car outright once youve made all the payments. As youre paying off the debt faster than with PCP finance, youll pay less interest overall, too.

If you simply want the lowest monthly payments, however, choose PCP finance youll have smaller monthly bills and can hand the car back when the contract ends, put down another deposit and get a new one.

As you dont own the car with PCP – unless you make the large optional final payment – youll want to put some money aside during the contract for your next finance deposit, though. Otherwise, you may find your monthly payments ramping up when it comes time to trade up, as the less you put down on a deposit next time around, the higher the instalments will be.

Don’t Miss: Hail Protector Pool Noodle Car Cover

Ask For An Extended Warranty

For new cars extended warranties are usually a bad deal, but in some cases they might help protect the investment on a used car. It may be possible to purchase an extended warranty when you buy an used car. Because the original warranty has already expired on most previously owned vehicles, this option is available for the consumer who wants to make sure their purchase is covered. It is important to realize that the warranty is not automatically included in the sticker. In fact, the consumer should ask the dealer specifically about purchasing an extended warranty. More often than not, an extended warranty can be added into the total cost and may even be included in the financing.

Some lemon laws provide a baseline level of protection, but when negotiating price on a used car sometimes you can get a warranty included at a discounted price.

How Can I Find The Most Efficient And Reliable Car

You have plenty of good options for efficient and reliable used cars. In general, you should look for vehicles and car brands that have good reputations for not breaking down, and you should consider the needs of your family: A minivan isnt a great option if you dont have a massive gang of kids, and a pickup truck is not practical if you mostly want to do city driving.

Also Check: Where Is Columbo’s Car Now

How Much Should You Spend On A Car Based On Your Income

As a rule of thumb, you should never spend anything more than 100% of your income. Generally, it is advisable to spend between 10-15% of your annual income, and if you want to buy the car of your dream you can consider spending 15-30% of your income.

Here’s an example for you. Let’s say that your annual income is around $60,000. Then you should spend around $9,000 on buying a car. This kind of rule helps you in limiting your finances and prevents you from borrowing more than you need.

Also, because purchasing the car is not the only cost involved in owning a car , not spending too much on it will leave you some kind of buffer to afford such costs.

How Much To Spend On A Car

Owning a car is a great luxury, but in many parts of Australia it can also be pretty essential. A car can help you get to work on time and give you the freedom to explore the open roads – but it can come at a high price.

Because buying a car is such a big investment, youll want to make sure you take the time to find the perfect car for you. One of the biggest questions youll need to address is how much you should spend on your new car. The answer will vary greatly depending on what type of vehicle youre looking for, and well as your annual income and expenses. But have no fear, were here to arm you with helpful knowledge that will allow you to proceed confidently on your vehicle search journey with a set budget in mind. And if you decide youd like to finance your new set of wheels with a car loan, we can help with that too!

You May Like: How To Bake Car Freshies

Decide Between Private Vs Dealership

If you want to know what the difference is between buying from a private seller or from a car dealership, there are pros and cons for each that you should keep in mind.

- Condition

- Private seller used vehicle comes “as is” so any issues that exist when you buy it are your responsibility

- Dealership used vehicles are usually cleaned and fixed up before being sold

So in general, a privately sold car might be a bit less expensive but they are less flexible in their selection and purchasing options and you as the buyer take on far greater risk of getting scammed.

Example!

To Borrow Or Buy Outright

When deciding whether to borrow money for your car or pay cash and buy it outright, a good first step is to revisit your estimate of the financial bracket your desired car falls within. From there, reassess how much you are willing to spend from each payslip. If you can save the initial figure in a short amount of time then buying the car outright is a viable option. If these two figures are fairly mismatched and it will take you a long time to save the desired amount, then borrowing money to finance the car is likely a better alternative. Financing your new vehicle with a car loan will mean that you can get on the road sooner, with no need to wait months or even years to accrue savings, and without having to compromise on your must-have features. If you decide to finance your car with a loan, you will be making the same decision as the majority of car owners – in Australia, 90% of car sales are financed through car loans.

You May Like: How Much Do Armored Car Guards Make

How Much Of Your Income Should You Spend On A Car In The Uk

TL:DR: You should try to never spend more than 20% of your annual income on car costs. We recommend keeping it lower at 10%-15%.

Your choice of car has a huge effect on both personal freedom and your finances. For many people, a car is the second most expensive item in their budget, second to housing expenses.

But, buying a car is essentially a necessity in some parts of the country. For many of us, it could also be a crucial part of being able to do our job.

The thing is buying a car can put a huge dent in your budget if not done properly. If you are lucky and live in an area with good public transit, you could feasibly manage without a car, but this is not a reality for most people.

When buying a car, it is important to realise you will be paying for more than just the price of the car. You must also factor in:

- Maintenance costs

- Petrol costs

- Paperwork like insurance and registration.

As it stands, a car is far from being a one time purchase. A car is a long term investment.

You also need to factor in the amount that the car depreciates in value every year. In general, a more expensive car will depreciate faster than a cheaper car.

Today we are going to talk about budgeting for a car in the UK and how you can calculate the amount of money you should spend on a car.