Make Sure All Information On The Title Checks Out

To streamline your Illinois title transfer, ask yourself the following questions as you examine the new title:

- Are there any co-owners who haven’t signed off on the title, including a friend or family member?

- Do the signatures match the owners listed on the title?

- Does the VIN listed on the title match the car?

- Are there erasures, mark-throughs, or correction tape on the title that would make it invalid? If you have a corrected title, it must be an official copy.

- Is the mileage section accurate?

- Is the information readable?

S For Completing An Out

Completing the out of state title transfer in person in Illinois is the standard method of converting an out-of-state title to one issued by the SOS. However, prior to visiting an SOS location in order to finalize the new state resident car title transfer process, you can utilize the option of expediting the application process via the official SOS website.

Note: To learn whether completing an out of state title transfer as a new state resident by mail is an available option, contact the SOS.

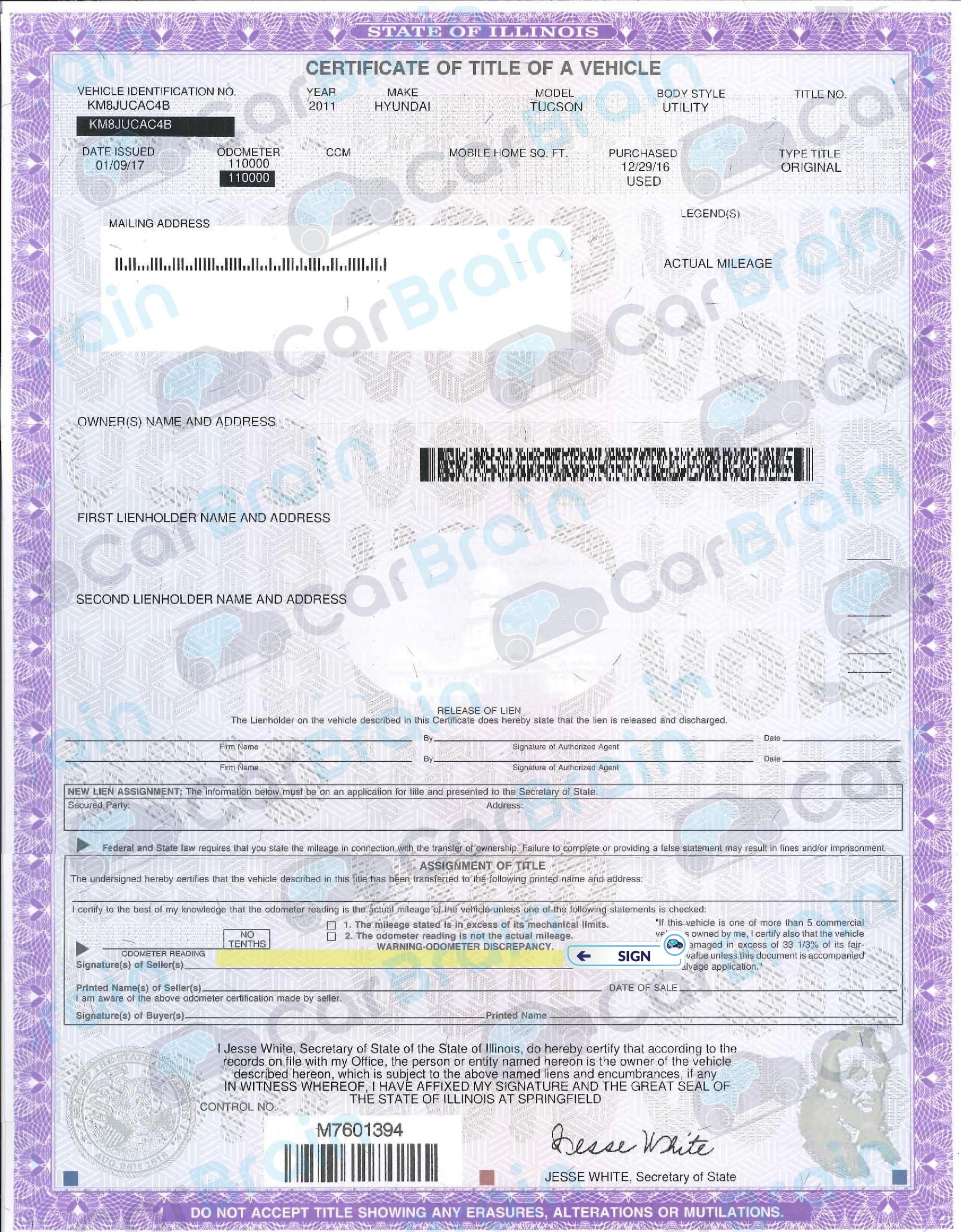

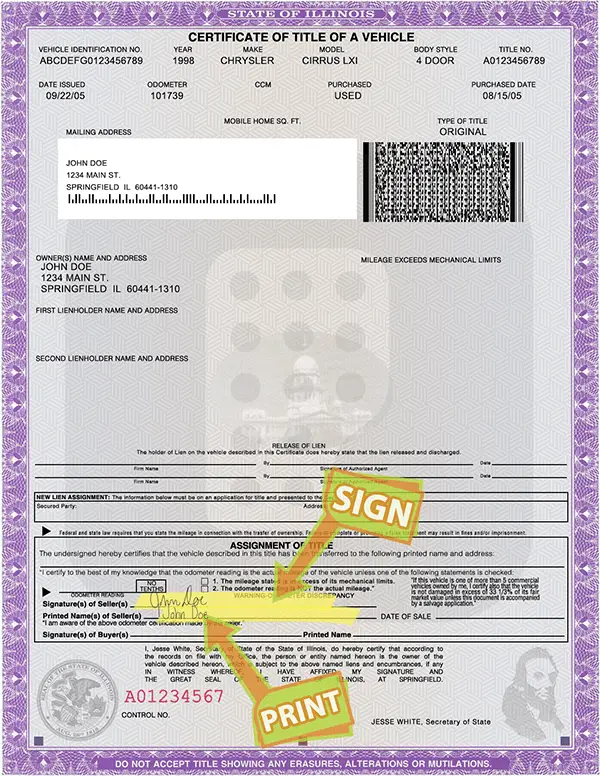

Where Do I Sign An Illinois Title

Sign on the front of the title on the lower left side where it is marked “Signature of Seller.

Print your name on the front of the title above Printed Name of Seller.

Remember to always sign your title in blue or black ink. You can view our Illinois title examples to see where to sign and print your name specifically.

You May Like: How To Get Freon Out Of Car Ac

Gifted Vehicle Title Transfer

When you give or receive a vehicle as a gift, you must complete a car title transfer in order to transfer ownership of the vehicle.

In most cases, the car title transfer will be similar to a title transfer for a private sale.

Contact the IL SOS at 261-7864 for specific information about title transfers for gifted vehicles.

How To Transfer Ownership Of A Vehicle Without A Title In Illinois

If you have lost your vehicles title, or it has been stolen or damaged, you must request a duplicate vehicle title by completing an Application for Vehicle Transaction. This form is available at your local Illinois SOS office.

Residents of Illinois are required to pay a $95 fee for a duplicate vehicle title. If you require expedited services, you must pay an additional $30 to receive a duplicate vehicle title within one business day.

If you require a lien removal from your duplicate vehicle title, you can do so by submitting an official lien contract letter stating the debt was paid in full or by submitting a court order stating the lien was paid in full.

Recommended Reading: Does Carvana Buy Leased Cars

How To Transfer A Title To Family Members In Illinois

An automobile title transfer between family members in Illinois is handled in the same way as any title transfer with the exception that the tax fee is a set amount versus a sliding rate. The title transfer turns ownership of the auto over to another family member. Title transfers are handled through the Illinois Secretary of State offices. Options for the transfer include going to a branch office of the Secretary of State or mailing the required forms and fees to the main branch.

Step 1

Obtain copies of the VSD-190 title transfer form and the RUT-50 tax form. Fill out both completely. Forms are available at Secretary of State offices or may be requested over the phone by calling 800-252-8980.

Step 2

Record the current odometer reading on the odometer line of the title. The current owner should sign the title and have the family member sign the form as the new owner. Make sure the Vehicle Identification Numbers matches the VIN on the car. VIN information can be found on the inside driver door.

Step 3

Go to a Secretary of State office in person to handle the required paperwork. You can also mail the completed forms, signed title, $15 tax fee and the $95 title transfer fee to the Secretary of State, Vehicle Services Department, 501 S. Second St., Room 014, Springfield, IL 62756.

Receive the new title. Store the title in a safe location somewhere that is not in the vehicle itself.

References

Transferring A Title After A Lease Buyout

After you pay off your vehicle, you are required to obtain this documentation in order to transfer the vehicles title:

- Proof of ownership

- Bill of sale

- Odometer disclosure statement

The vehicles current title is accepted as your application form when you complete the section of the vehicle title titled Application for Title and Registration.

Read Also: What Credit Bureau Do Car Dealerships Use

My Car Title Was Signed But Never Transferred What Do I Do

When you sign your title over to a buyer, its the buyers responsibility to make the arrangements with the appropriate SOS office. If they dont, you could potentially be held liable for driving infractions or even crimes that the buyer commits with the vehicle.

Sellers should hold onto all of their correspondence with the buyer, including copies of the title and the bill of sale. These items will serve as proof that the seller relinquished control of the vehicle on a certain date .

From title transfer fees to the DMV title transfer form, Illinois residents have to plan ahead to successfully transfer their title. The exact title transfer requirements will vary depending on the ownership status of the car, but the process and fees are similar across the board.

In Illinois, its easy to find forms online and fill them out before your appointment to make your visit to the SOS office as painless as possible.

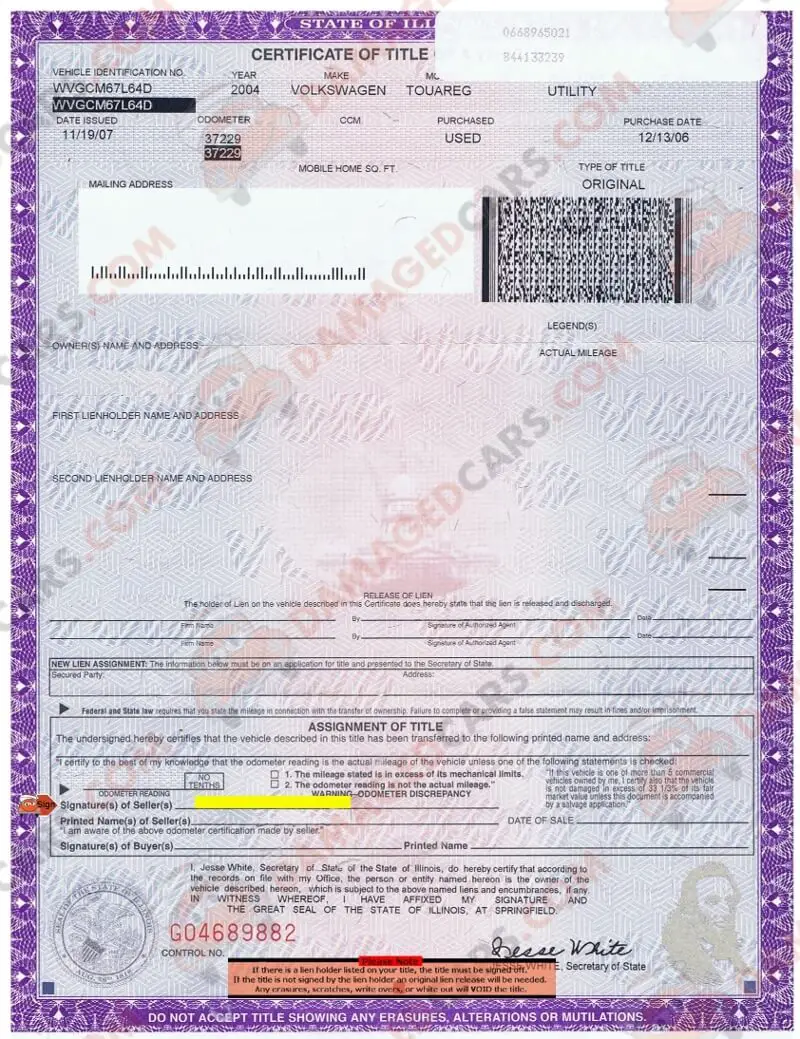

How To Remove A Lien From A Title

If youve paid off your car loan, youll want to take the necessary steps to remove the lienholders name from the title.

In Illinois, you can do this by waiting to receive the lien release notice and original title from the lienholder after making your final payment.

Once you receive the lien release, youll be able to submit it along with a title application to get the car titled in your name.

Don’t Miss: What’s The Fastest Car In Forza Horizon 3

Video Result For How To Transfer Car Title In Illinois

How to Sign Your Illinois Title Transfer in 3 Steps

Illinois Title Transfer SELLER Instructions

How To Transfer A 1995 Car Title In Illinois – He Did…

trendwww.onlinedmv.com

titleininintitleintitletransferininininto

greatilsos.gov

transferinintototransfer

totitletransferininintitletransferintitletransfertototransferin

tipidswater.com

tocartitleinintointotitletitletransferto

trendwww.ilsos.gov

totoin

hotwww.dmv.org

inininintotitleintototitleincarcar

newwww.dmv.com

toincartitletoininincartitletoin

intotransfertitleintointitle

topilsos.gov

intotitleinto

hotwww.dmv.com

incartitletransferinintotitletotitleintotransfercartitletotointoin

titletransfertotransfercartitleinintitletransferin

tointointoin

titletransfertohowinintitletransferintotransfertitleinin

newcarbrain.com

titletransferininintitletitlecarininintitletransfer

greatwww.dmv.com

inincartitletransferinincartitletransferininintitletransferinin

inintitlecarintitle

inincartitlecartocarcarinin

How to Sign Your Illinois Title Transfer in 3 Steps

Illinois Title Transfer SELLER Instructions

How To Transfer A 1995 Car Title In Illinois – He Did…

re-done / re-edited How To Transfer A Car Title In…

Can I Gift A Car To A Family Member

Yes! You can gift a vehicle to a relative. In order to gift a vehicle to a family member, you will follow the same steps as a standard vehicle title transfer process, except for the fee tax that is a set amount. The vehicle title transfer process is handled by the Illinois Secretary of State offices.

You need to obtain a VSD-190 vehicle title transfer form and the RUT-50 tax form. They must be filled out completely before they will be accepted. These forms are available at the Secretary of State offices. You can also request these forms over the phone by calling 800-252-8980.

Residents of Illinois must record the current odometer reading on the odometer line of the vehicle title. The current owner of the vehicle needs to sign the vehicles title and have their relative sign the title as the new owner. You also need to make sure the VIN provided on the vehicle title matches the VIN on the vehicle. The VIN is located on the inside of the drivers door of the vehicle.

You must visit the Secretary of State office in person to complete the required paperwork and pay the necessary fees. There is a $95 title transfer fee and a signed title fee of $15. You can also mail these forms to:

Secretary of State

- The vehicles odometer reading

- A description of the vehicle

- The names and addresses of the lien holders

Read Also: How To Remove Scuff Marks From Plastic Car Interior

What Do You Need To Transfer A Car Title In Illinois

If youre registering a car in Illinois from another state, youll need the original title and registration, an Application for a Vehicle Transaction, and proof of residency. If you have a lien on the car, youll need a copy of the title and the bill of sale. Youll also need either the certificate of origin or a copy of the loan agreement.

Owners will need the VIN, date of purchase, and tax forms to prove all taxes were paid on the vehicle. If you purchase from a dealership, theyll typically take care of the paperwork on their end.

Is There A Grace Period For Vehicle Registration In Illinois

i) Section 3-801 of the Illinois Vehicle Title and Registration Law of the Illinois Vehicle Code provides a 24 hour grace period applicable only to vehicle sales between individuals to allow the buyer to drive the vehicle from the point of sale to the individuals residence or to a facility to obtain

Read Also: Car Rental Discounts Through Aarp

Private Party Vehicle Tax Exemptions

- Vehicles used only for a tax-exempt organization

- Vehicles used only as farm or manufacturing equipment

- Railway vehicles

- Cars that were in another state for at least 90 days of the year and whose owner recently moved to Illinois.

- Vehicles passed from a deceased owner to a surviving spouse or relative.

- Vehicles assigned from one person to another within the same organization.

Those who fall into one of these exemption categories will still have to pay a small fee, usually $15-$20, depending on which bracket you fall in. For more information on Illinois vehicle tax rates and exemptions, check out this tax chart from the Illinois Department of Revenue.

If you’re still unsure about how much you owe, to estimate your tax liability. Things like use tax and registration fees can be difficult to understand, but it pays to get them right.

Create A Bill Of Sale

Although not mandatory, most people choose to create a bill of sale when making a large purchase. This document serves as a record of the transaction and may even offer legal protection and serve as proof of ownership in some circumstances. Drawing up a bill of sale doesn’t take long, and there are many free templates online.

Recommended Reading: Who Owns Avis

How Long Does It Take To Transfer Title In California

You can now transfer a title online. Learn more about the steps and get started. Anytime theres a change to a vehicle or vessels registered owner or lienholder, that change needs to be updated in DMVs records within 10 days and the California Certificate of Title needs to be transferred to the new owner. A change in ownership is usually due to:

You have 30 days to transfer your out-of-state title and register your vehicle with the Illinois Secretary of State when you move to Illinois.

When Do You Not Have To Pay Illinois Tax On A Vehicle

If you had the vehicle titled in another state for more than three months, no Illinois tax is due, but you still must file Form RUT-50 to reflect that fact. On Forms RUT-25 and RUT-50, the exemption for using the vehicle outside Illinois for more than three months applies only to individuals moving into Illinois.

Recommended Reading: How To Get Internet In The Car

S For Performing A Transfer Of Title In Illinois

Motorists who want to perform a transfer of car title in Illinois need to know that the procedure consists of several steps that must be satisfied. Individuals may perform a title transfer online, by mail or in person at a local IL SOS office.

Completing a title transfer online may be accomplished through the Electronic Registration and Title service available at the IL SOS website. Drivers who are performing a title transfer online by using the ERT service may also be required to provide a completed Private Party Vehicle Tax Transaction as part of the process.

However, if motorists choose to perform a vehicle title transfer in person at the IL SOS or by mail, they may be required to:

- Get the certificate of title from the previous owner.

- Collect the mandatory documentation for title transfer.

- Pay the applicable fees.

Fill Out A Private Party Vehicle Tax Transaction Form

With any private car sale in the state, buyers must submit Tax Form RUT-50 and pay the 6.25% state sales tax to the county tax collector. This rate doesn’t include any additional county taxes or title transfer fees. The total amount of tax collected depends on the car’s model year, and the price paid. Cars worth more than $15,000 fall into a different tax bracket than those less than $15,000.

Keep in mind that the tax rate is based on the “reasonable worth” of the vehicle. Simply put, even if you buy a car for way less than it’s worth, you’ll still be charged a tax rate based on its market value. This document is used to estimate the tax owed on the vehicle based on the price paid or fair market value, as determined by a licensed dealer.

You can pick up the tax transaction form at any SOS facility. Return the completed form and payment within 30 days of the sale. You can submit this form either in person at your local office or by mail to the SOS Vehicle Services Dept in Springfield, IL.

Owners of vehicles acquired from other states are required to complete a RUT-25 Vehicle Use Tax Transaction Return unless they fall into one of the exception categories.

Read Also: Synchrony Car Care Gas Locations

How Do I Transfer A Car Title To A Family Member In Illinois

How to Transfer a Title to Family Members in Illinois

Illinois Dmv Hours And Contact Information

For more information regarding how to transfer a car title in the state of Illinois or to find the nearest IN DMV location to you, visit the official state website by clicking here.

Common Questions About Illinois Title Transfer

Are there any questions about transferring a car title that we didnt cover?

We are constantly updating our content and welcome your feedback. Leave us a comment and let us know any other questions you might have regarding how to transfer a car title in the state of Illinois.

eTags Vehicle Services

Recommended Reading: How To Fix A Cigarette Burn In A Car Seat

How To Perform A Title Transfer In Illinois

A process of car title transfer in Illinois is a mandatory action that two legal entities must perform when they transfer the ownership rights over a motor vehicle to another legal entity. Drivers may be able to perform the process of title transfers for cars through the Illinois Secretary of State by using one of the available methods.

Motorists need to learn the mandatory steps that must be taken when selling or purchasing a vehicle so that they are ready to begin this procedure. Moreover, drivers are encouraged to satisfy certain title transfer requirements in order to successfully perform a title transfer at the IL SOS. For more detailed information about how to complete the process of a title transfer in Illinois or how to satisfy the requirements, continue reading the sections below.

How To Transfer A Vehicle Title In Illinois

Dealers handle the title transfer process so what likely brought you to this page is either buying or selling a vehicle in a private sale. The title transfer process in a private sale is quite simple if both parties are present and paperwork ready.

Its recommended you request a duplicate title if youre having trouble locating the original or if its been damaged beyond use. You must get the vehicle registered else you cannot legally drive.

In-person vehicle transfer process:

Congratulations! You bought and registered a vehicle!

Those selling will largely follow this process placing the burden of registration on the buyer. Always file a bill of sale for tax/legal reasons. The IL SOS recommends both parties complete this process on-location, making the process easy and quick.

You can also mail these forms and fees to:

Secretary of State

501 S. 2nd St, RM 014

Springfield, IL 62756

Also Check: What Keeps Squirrels Away From Car’s

Why Did I Get A Temporary Sticker In Illinois 2020

The state is replacing the oldest license plates first. When drivers go to the DMV to renew their sticker, if they qualify for a new plate, they should get a temporary sticker while their new plates are sent in the mail, Druker said.

Smog Check Exemptions In Illinois

There are different smog check exemptions in the state of Illinois. Within the testable counties listed above, these vehicles are exempt from emissions testing:

- Vehicles model year:

- 1967 or older

- 1995 or older if compliant with the IL Vehicle Emissions Inspection Law as of February 1, 2007

Double-check to determine if your vehicle meets any of the above-stated criteria.

Also Check: How To Fix Cigarette Burns In Car Upholstery