What Does That Mean For You

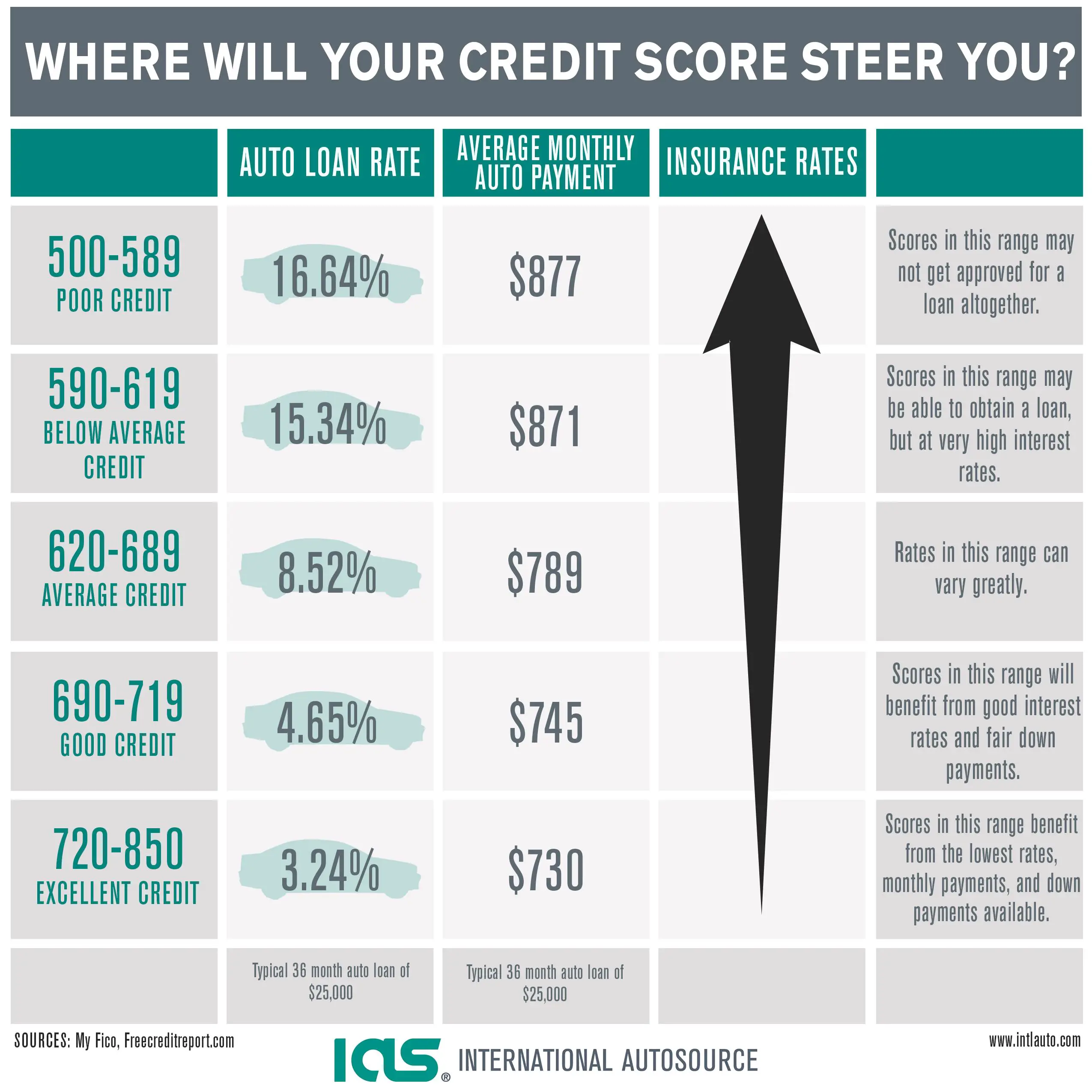

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

Below 700 Be Prepared To Explain

If your score is below about 700, prepare for questions about negative items on your credit record and be able to document your;answers, says Mike Bradley, internet sales manager at Selman Chevrolet in Orange, California. Matt Jones of the automotive shopping site Edmunds.com says the number may be closer to 680.

Both men say theyve seen people get financing sometimes even top-tier financing with scores that are much lower.

Although its possible to get a loan with a low score, anything under 500 is a flashing red light, says Dave Cavano, who manages the car-buying service for Auto Club of Southern California.

That means you wont qualify for an attractive interest rate, but it doesnt mean you cant get a car.

» MORE:;What Credit Score Do You Need to Lease a Car?

How Is This Score Different From A Credit Score And Which Is Used For Car Loans

FICO scores are related to your credit score, but they are far more useful than that. They are used by over 90% of top lenders, and the widespread nature of their use brings uniformity to the loan approval process, which leads to more informed financial decisions.;

Non-FICO credit scores can differ by as many as 100 points. The amount of variance can distort your belief in your likelihood in getting approved. If you think you qualify for a better line of credit or a low interest rate when you dont, it can lead to some damaging consequences in the future.;;

There are also different types of scores. For instance, FICO Auto Scores are generally used for car loans.

Recommended Reading: What Is The Safest Car For Teenage Drivers

Whether You Buy A New Car Can Also Affect Your Interest Rate

Your interest rate will also change depending if the vehicle is new or used, says Ron Montoya, senior consumer advice editor at Edmunds. He says new car loans often have lower interest rates because automakers subsidize interest rates for finance firms as a motivation to sell more cars.

“When you look at used cars, it’s more of a risk for a lender,” he says. “You don’t know what things may break down.”

Car shoppers with higher credit scores tend to have more financing options available to them, like longer terms and better rates from multiple lenders,regardless if the car they purchase is new or used, says Melinda Zabritski, Experian’s senior director of automotive financial solutions.

How Does Fico Differ From Other Credit Score Models

VantageScore is another popular credit scoring model. Like FICO, VantageScore 3.0 grades credit on a 300 to 850 point scale and takes credit utilization, credit inquiries, and on-time payments into account. However, the two models differ in a few ways, with one major difference. FICO penalizes all late payments the same way, while VantageScore penalizes late mortgage payments higher than other late payments.

FICO and VantageScore also differ in how they handle combining similar credit inquiries. With FICO, you have a 45 day grace period where similar credit inquiries for auto loans, mortgages, and student loans are combined into one inquiry. VantageScore gives you a smaller 14 day grace period, which can make comparison shopping for loans harder.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Don’t Miss: How Long Before I Can Refinance My Car

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

While Theres No Universal Minimum Credit Score Required For A Car Loan Your Scores Can Significantly Affect Your Ability To Get Approved For A Loan And The Loan Terms

In the second quarter of 2020, people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657, according to the Q2 2020 Experian State of the Automotive Finance Market report.

Lower credit scores could result in fewer offers and higher interest rates. But that doesnt necessarily mean you should throw in the towel if your scores arent where you want them to be.

Read on to learn more about how your credit scores affect your odds of getting a car loan and ways you can increase your chances of approval and potentially receive better offers.

Also Check: What Can Be Draining My Car Battery

What Is The Lowest Credit Score To Buy A Car Experian

Sep 26, 2020 When it comes to buying a car, there is no minimum score needed to be approved. Having a higher score may improve your chances of getting;

May 12, 2021 How do my credit scores affect my car loan? · Ways to increase your odds of approval and a better interest rate · Which credit score is used for;

Aug 2, 2019 A good credit score to buy a car is usually above 660, which is the minimum score to be considered a prime borrower by Experian.

Checking Your Credit Score

For ongoing credit monitoring, free scores like those from Credit Karma, Credit Sesame, and WalletHub are useful for seeing where your credit stands.

Sometimes, your credit card issuer will also provide a free copy of your FICO score with your monthly billing statement. Make sure to check before purchasing a credit score.

If you’re preparing to apply for a loan in the next several months, it’s worth buying a FICO Score 1B Report, or the ongoing monitoring product. A one-time, three-bureau report is currently priced at $59.85 from myFICO. Purchasing directly from FICO gives you the option to look at the scores your auto lender is most likely to receive.

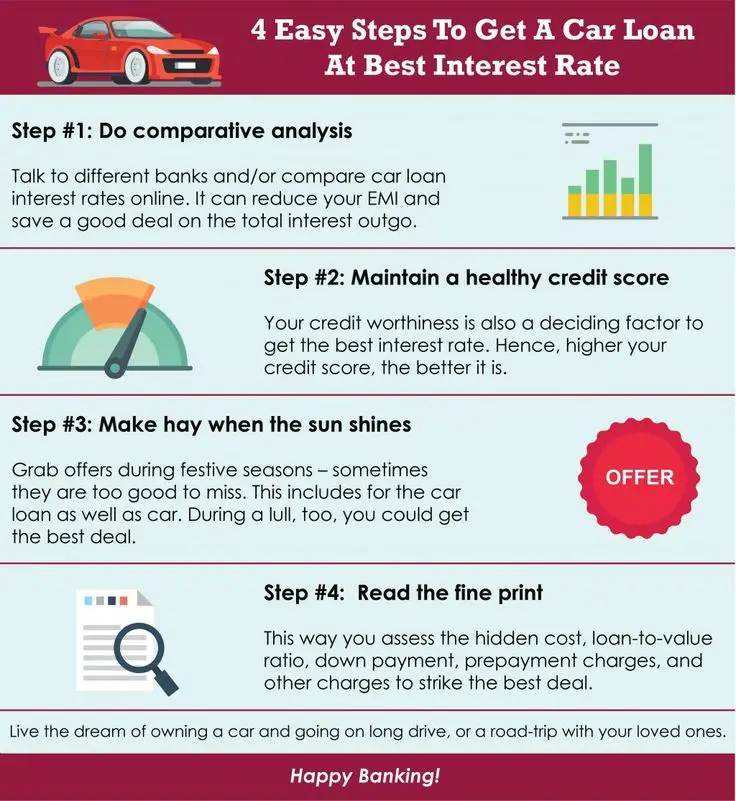

Doing research before you go car shopping can help you optimize your credit score before applying for an auto loan, and improve your overall understanding of the complex variables in the loan approval process. Above all, you should ensure that the information in your credit report is verifiable and accurate, and dispute any errors you find. If you’re diligent about building and maintaining your credit, your report will show that you have excellent standing, regardless of what scoring model an auto lender might choose.

Also Check: What Happens When You Refinance A Car

Does A Car Loan Build Credit

Having a car loan can build credit in two important ways: payment history and credit mix.

Payment history is your track record of paying bills on time. It accounts for more of your credit score than any other single factor. Traditional lenders report your payments to the three major credit bureaus, which provide the data to calculate your credit scores.

What Are The Average Minimum Fico Scores Needed To Borrow Money Or Get Loans

So, if we understand the FICO score is and how it calculated. Let us try to dissect what a minimum FICO score required to apply for different types of loans like mortgages, personal loans, auto loans, etc.

A higher credit score means that you are less vulnerable to debt default, and vice versa. Therefore, lenders usually give borrowers with high credit scores the best offers on loans than the low ones.

Also Check: What Is The Invoice Price Of A Car

Go To A Dealer That Specializes In Buyers With Poor Credit

If you cannot qualify for a loan at a traditional dealership, you may be able to get financing from one that specializes in buyers with poor credit. Typically advertised as buy here, pay here dealerships, they offer in-house financing for used vehicles.;

However, these dealers tend to charge very high interest rates to offset the risk of lending to borrowers with lower scores. As of 2020, the average interest rate offered by independent dealers to deep subprime borrowers was 21.31%.

If I Shop Around For An Auto Loan Wont Multiple Pulls Lower My Credit

Many people are nervous to shop around for auto loans since theyve heard that multiple credit pulls can negatively impact their credit score.

While there is certainly truth to this assumption, for the sake of comparing rates, the law states that all credit pulls that occur within 14 days must be combined into a single credit pull so that it doesnt negatively impact your credit score. So make sure to wait to compare loans and to have your credit pulled by a lender until you know you are ready to purchase a vehicle.

Starting April 20,2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through April 20, 2022 at AnnualCreditReport.com to help you project your financial health during the sudden and unprecedented hardship caused by COVID-19.

Recommended Reading: What To Do When Your Car Overheats

What Role Do Credit Scores Play In Used Car Loan Rates

The first thing you need to know is that your credit score is the biggest determining factor in the interest rate you get when buying a used car. That might seem obvious, but theres more to it than that.

Your traditional credit score, or FICO score, sits on a scale between 300 and 850. People with a higher score will usually be able to get a more favorable interest rate than people with mediocre or poor credit scores. Thats true whether youre applying for a mortgage or a credit card, too.

What you might not know is that car dealers and others in the automotive industry get a different report from the one you can get for free from the three major credit bureaus. Its called a FICO Auto Score and it assigns a score between 250 and 900. Its designed to do the best possible job of determining how likely you are to repay an auto loan.

The tricky thing about FICO Auto Scores is that you cant get a copy of yours unless youre in the automotive industry. So, the best we can do is to estimate the rate youll be able to get based on your FICO score.

Credit Requirements For Auto Loans Cars Money Under 30

Jul 12, 2021 When you apply for a car loan, your credit score plays an important Bankcard Score 5, the auto lender might be using FICO Auto Score 8,;

May 28, 2021 Theres already so much confusion surrounding credit scores that you may not know there is a specific score used to determine your car loan.

Recommended Reading: Why Did My Car Insurance Go Up

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Your Fico Score And Why It Matters

The interest rate you pay … your monthly payments … what cars you can afford — your FICO® score determines it all. Fill out the form above and get your score ASAP.

Get it free

You can access your FICO® Auto Score for free here on the Fishers Imports website. No need to purchase your full credit report.

It’s all about FICO®

There are all the other credit scores and then there’s FICO®. FICO® scores are used by over 90% of today’s lenders. it’s the industry standard for determining how much money you can borrow.

Pinpoint your interest rate

Your FICO® Auto Score determines the exact interest rate you’ll pay. Knowing this in advance helps you budget properly and eliminates any big surprises. No matter where your score falls, Fishers Imports will find you the best car loan possible.

Faster loans. Faster cash.

Don’t wait on credit. Apply for your free FICO® Auto Score right now and you’ll have it in less than 24 hours.

Get it free

You can access your FICO® Auto Score for free here on the Fishers Imports website. No need to purchase your full credit report.

It’s all about FICO®

There are all the other credit scores and then there’s FICO®. FICO® scores are used by over 90% of today’s lenders. it’s the industry standard for determining how much money you can borrow.

Pinpoint your interest rate

Faster loans. Faster cash.

Don’t wait on credit. Apply for your free FICO® Auto Score right now and you’ll have it in less than 24 hours.

Also Check: Which Is The Fastest Car In The World

Why Are There Different Fico Scores

When you apply for credit, whether its your first credit card or a second mortgage, lenders need to decide whether youre enough and likely to repay the money. To do this they check your credit scores or get credit reports from one or more of the major credit bureaus: Equifax, Experian, and TransUnion. Each has its own credit score that is developed by FICO, and these scores are calculated based on your credit history and other information that goes into your credit report.;

There are also multiple versions of FICO scores, reflecting the evolution of the credit market and consumer behavior since the scores first became a tool for lenders back in 1989. Just in terms of the amount of credit we use, theres been a big increase over the past few decades, with consumer borrowing rising by approximately 15% over the last four years. A typical borrower today probably would have been considered a higher credit risk under older methods of calculating credit scores.;

FICO has rolled out 10 versions of its base score over the years, and most of them are still in use by lenders to some extent. Lenders can choose from the following base versions:;

- FICO 2

- FICO 9

- FICO 10 and 10T

So What Credit Score Do You Need To Buy A Car

There’s no official industry standard minimum credit score that you need to secure a car loan. Like other loans though, the higher your score the better your terms will be, and moving into a better “tier” of credit score could lead to substantial savings.

To understand how auto lenders may tier their loan interest rates based on FICO Scores, review this example: Assume you want to secure a $22,000 car loan with a 4-year term, and your current FICO Auto Score is 652.

| FICO Score |

|---|

| $8,314 |

Source: Loans Saving Calculator based on rates from June 2020

Based on the interest rate table above, your monthly payment would be $566, and you would pay a total of $5,147 in interest over the life of the loan. If you increase your score to 720+, your monthly payment would be $67 lower, and you could save an extra $3,218 in interest fees over the 4-year term.

Knowing your FICO Auto Scores can help you understand what kinds of terms you may expect for an auto loan, and armed with this information, you can approach the financing interactions with more insights and confidence.

Tom Quinn

Tom Quinn is the Vice President of Business Development for myFICO and has over 25 years of experience working with consumers, regulators, and lenders regarding credit related questions and initiatives.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

You May Like: What Is The Most Affordable Car

What To Expect In The Finance Office

If youre concerned about approval, prepare by focusing on the positives in your financial life. Remember, people with major blemishes on their credit are routinely approved for car loans.

For example, someone who has a low score from a business debt but hasn’t missed a car payment in 20 years may be approved. You’re also more likely to get financing if you have a stable job, own a home and/or put down a substantial down payment.

Buyers may need to show pay stubs, proof of residence, cellphone bills and proof of current full-coverage auto insurance, he says. If you come in with all your ducks in a row, we can get you a car, Bradley says.

Cavano says if you have a low score, be prepared to document that you’ve been paying bills on time for the past six to eight months. If you were late in the past, be ready to explain why, he advises. Lenders want to hear that youve overcome issues and can prove it, he says.

If;one dealer tells you your score isn’t strong enough, you still might be able to get financing elsewhere, Jones says. A big dealership with a lot of sales is likely to have arrangements with lenders that specialize in finding financing for people with credit challenges, he says.