How To Calculate Ohio Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 5.75%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $50,000 with the state sales tax of 5.75%. The trade-in value of your vehicle is $5,000 and you have a $2,000 incentive. The total taxable amount is $45,000 since trade-ins are not taxable, but incentives/rebates are.

In this example, multiply $45,000 by .0575 to get $2,587.50, which makes the total purchase price, $45,587.50 .

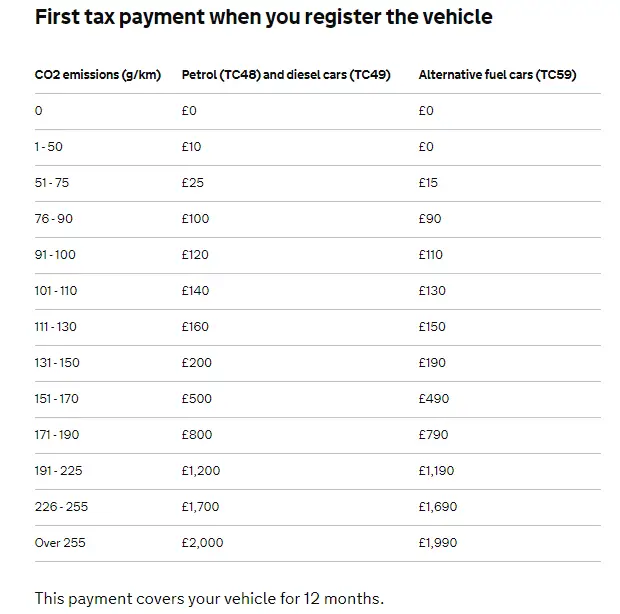

Cars First Registered On Or After 1 April 2017

The cars first vehicle licence rates will be based on the carbon dioxide emissions of the vehicle.

| CO2 emissions |

|---|

|

£165 |

For cars above £40,000, youll pay an additional £355 for the next five years from the second time the vehicle is taxed. You do not have to pay this as of April 2020 if you have a zero emission vehicle. After six years from the date of the first registration, youll pay the standard annual rate depending on what fuel your vehicle uses.

So, for example, a petrol car with a list price of over £40,000 would pay £520 for the next five years.

The list price is the published price before any discounts at the first registration. Check the list price with your dealer so you know how much vehicle tax youll have to pay.

| Fuel type |

|---|

Vehicle excise duty costs are slightly different if you pay monthly, every six months, or via Direct Debit. You can read about the different ways to pay on the GOV.uk site

How Much Tax Will I Pay For A Car

The taxman will certainly get his share from your car purchase, but the amount youll owe depends on where you live.

To calculate how much this rate will amount to, look up the sales tax percentages for your state, county and city, then combine them for a total percentage. For example, car buyers who live in Chicago will pay 6.25% for state sales tax, 1.75% for county sales tax, 1.25% for city sales tax and a 1% special tax totaling 10.25% of the cost of the vehicle. So, some people will be paying steeper sales taxes than others based on location, but dont think you can save money by searching cars in low-tax areas sales tax is applied by where the vehicle will be registered, not where its bought.

Another consideration that affects sales tax is whether youre trading in a car. Some states allow you to subtract your current cars value from the price of the car youre buying to arrive at the total taxable price, which would lessen the amount you owe in sales tax. Of course, this requires you to make the trade-in at the dealership where youre buying your new car, but you should consider the entire transaction as negotiable and hold out for a fair trade-in value.

Don’t Miss: Which Car Has The Best Gas Mileage

Why Do I Have To Pay Tax

Paying tax is a legal requirement the government uses this money for many projects that are intended to benefit all road users, including maintaining existing roads and building new roads.

Gerhard knew from a young age that he wanted to be an automotive journalist. He completely disappointed his parents by completing degrees in communication and English, as well as diplomas in graphic design and film and art appreciation. He later interned at various automotive publications, before landing a permanent position at a newspaper. He became the editor within two years, after which he landed a job as the deputy editor at a national publication, where he spent eight years traveling the world, driving, and writing. In his current role as senior editor, he writes news, reviews, scripts, and opinion pieces. When heâs not supposed to be working, youâll probably find him working. When heâs forced to take a break, youâll find him at the movies, or behind the wheel of a â92 NA Miata called Kimiko.

Tax Bands For Cars Registered After April 2017

From 1 April 2017, the system for taxing a new car in the UK changed. VED will still be calculated on a vehicles CO2 emissions, but only cars with 0g/km CO2 emissions will be exempt from paying tax.

The changes have been introduced in direct response to falling CO2 emissions levels, meaning many motorists are paying little or no VED. This has cost the Treasury millions of pounds in lost revenue, prompting the government to make changes.

The sliding scale of first-year showroom tax remains, but the standard rates have changed, except those emitting zero emissions, i.e., electric and hybrid vehicles. There is an additional £310 per year for all cars with a list price of over £40,000.

The full changes to tax coming into affect this year have been outlined in our , below is a table to show the new car tax bands and rates for new cars registered from April 2017.

| CO2 emissions | |

|---|---|

| £2365 | £165 |

*Cars with a list price of over £40,000 when new pay an additional rate of £310 per year on top of the standard rate, for five years.

Don’t Miss: Can I Refinance My Car With The Same Lender

How Much Is The Car Sales Tax In Missouri

The current state sales tax on car purchases in Missouri is a flat rate of 4.225%. That means if you purchase a vehicle in Missouri, you will have to pay a minimum of 4.225% state sales tax on the vehicle’s purchase price.

There may be an additional local tax rate as well, which can go as high as 6.125% or as low as 0.5%. However, the average local tax rate is 2.796%, making the average total tax rate in Missouri 7.021%.

We have seen instances that Missouri can only charge a maximum of $725 in taxes, but we could not verify it through Missouri’s DMV site. It might be worth bringing up at the dealership but plan on paying more than the quoted $725 figure in taxes.

Who Is Responsible For This Tax

A person who purchases a motor vehicle in Texas owes motor vehicle sales tax.

A Texas resident, a person domiciled or doing business in Texas, or a new Texas resident who brings into Texas a motor vehicle that was purchased or leased out of state owes motor vehicle use tax, the new resident tax or the gift tax, as applicable.

Don’t Miss: How Often Can You Refinance Your Car

How Are Vehicle Taxes Calculated

There is no one-size-fits-all formula for calculating vehicle tax, as it’s subject to state, county, city, and municipalities, and there are more than 10,000 different tax areas in the USA.

The tax rate is calculated according to your home address, so you can’t buy a vehicle in a state that charges a lower percentage unless you also own a home in that state. If you’re looking for a calculator for taxes when buying a car, we suggest you search for your particular state’s DMV online calculator to find out what the requirements are. If you know the percentage taxed by your state, simply multiply the car’s price by taking the percentage and converting it to a decimal figure. For example, Idaho charges a 6% tax, which means you multiply the cost of the car and multiply it by 0.06. In this case, it’s 37,851 x 0.06 = 2,271,06. That means Idaho charges a sales tax of $2,271 on a $37,851 car. To find out more about calculating the true cost of buying a new car, read our blog post on this, here.

When buying a used car, taxes are a bit trickier. Some states allow you to work on a percentage of what you paid for the car, while others will demand a valuation from a reputable source. Some states will also tax according to weight and fuel efficiency.

How Much Is Sales Tax On A Used Car In Ohio

Ohio collects a 5.75% state sales tax rate on the purchase of all vehicles. There are also county taxes that can be as high as 2%. Some dealerships may also charge a 199 dollar documentary service fee. In addition to taxes, car purchases in Ohio may be subject to other fees like registration, title, and plate fees.

Recommended Reading: How To Remove Water Stains From Car

Commercial Vehicle Emissions Scheme For Private Buses Registered From 1 April 2021 To 31 March 2023

Under the CVES, vehicles are classified into Bands A, B, or C by their worst-performing pollutant among the following: carbon dioxide , hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter . For example, if your vehicle has a CO2 emission of 300g/km, but no emission for all other pollutants, i.e. HC, CO and NOx and PM , it would be classified as Band C, as its worst-performing pollutants of CO2 puts it in Band C.

In addition, if you register an electric or plug-in hybrid private bus, fossil fuels will need to be burnt to generate the electricity to charge your vehicle. Burning of fossil fuels generates CO2. As such, you will need to add these additional CO2 emissions, before referring to the table below. Your total CO2 emissions would be the CO2 emissions for the vehicle plus the CO2 generated from electricity consumption.

How Much Is Tax And Title On A Car In Ohio

Ohio collects a 5.75% state sales tax rate on the purchase of all vehicles. There are also county taxes that can be as high as 2%. Some dealerships may also charge a 199 dollar documentary service fee. In addition to taxes, car purchases in Ohio may be subject to other fees like registration, title, and plate fees.

What is the sales tax on new cars in Ohio?

- Ohio collects a 5.75% state sales tax rate on the purchase of all vehicles. There are also county taxes that can be as high as 2%. The average doc fee in Ohio is $2501, and Ohio law caps dealers doc fees at $250 or 10% of the sales price, whichever is less.

Read Also: How To Clean Car Seats

How To Calculate California Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 7.25%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%. $20,000 X .0725 = $1,450. $1,450 is how much you would need to pay in sales tax for the vehicle, regardless of if it was used, purchased with trade-in credit, or included an incentive.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

About Phil Long Dealerships

If you want to know how to avoid paying sales taxes on usedcars, you can look through our guide above, but this is one area that’s hard toget around. Instead, focus on getting the best price possible on your next usedcar at first. This way, you can use the savings you receive to pay the sales tax bill or personal property tax .At Phil Long Dealerships, we provide high-quality new, certified pre-owned, and used vehicles at thelowest price possible. That’s why we’ve become the trusted source for Coloradocar buyers’ needs. Contact us for sales, service, and parts.

You May Like: What Car To Buy In 2020

Do You Have To Pay Taxes On A Car You Buy From A Private Owner

When you purchase a vehicle through a private sale, you must pay the associated local and state taxes. In most states, youll need to bring your Bill of Sale and signed title to the Department of Motor Vehicles or motor vehicle registry agency to pay your taxes and obtain your registration, new title, and plates.

Commercial Vehicle Emissions Scheme For School Buses Registered From 1 April 2021 To 31 March 2023

Under the CVES, vehicles are classified into Bands A, B, or C by their worst-performing pollutant among the following: carbon dioxide , hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter . For example, if your vehicle has a CO2 emission of 300g/km, but no emission for all other pollutants, i.e. HC, CO and NOx and PM , it would be classified as Band C, as its worst-performing pollutants of CO2 puts it in Band C.

In addition, if you register an electric or plug-in hybrid school bus, fossil fuels will need to be burnt to generate the electricity to charge your vehicle. Burning of fossil fuels generates CO2. As such, you will need to add these additional CO2 emissions, before referring to the table below. Your total CO2 emissions would be the CO2 emissions for the vehicle plus the CO2 generated from electricity consumption.

Also Check: What Questions To Ask When Buying A Car

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Taxing A Car The Basics

Save time – tax your vehicle online

You can tax your vehicle online, or check if the tax is up to date, 24 hours a day using the Vehicle tax rates calculator on the GOV.UKYoull need details for your vehicle like its make and model.

Car tax must be paid on all vehicles registered in the UK, driven on or kept on a public road. Choosing the right car can make a big difference to your tax costs.

Plus, choosing a low-tax car could mean it holds its value better as itll have lower running costs in future, too.

A vehicle kept off-road must also be taxed or have a Statutory Off Road Notification .

You can check how much road tax will be due on new and older models of car on one of the links below.

Find out how to calculate vehicle tax rates

Find out what VED you should be paying using your V5C reference number

You May Like: What Is Wrapping A Car

When Sales Tax Is Exempt In North Carolina

A highway use tax can be exempt for the following reasons:

- Salvage vehicle title purchased by an insurance company

- Vehicle title transferred to a will

- Vehicle title being transferred in a divorce agreement

- Vehicle title is being transferred to a revocable trust from an owner who is the sole beneficiary of the trust

How Do You Transfer The Title Of A Car

To transfer a car title, the seller needs to sign the title and fill out any required information. The buyer can then take the signed title to the appropriate government office to transfer the car title into their name. If there is a lien on the vehicle, then the lender will usually need to sign an affidavit as well.

Recommended Reading: Can I Refinance My Car

Are There Other Car Buying Fees

Yes. Here are a few other car buying fees that frequently arise and that buyers should know about:

Uncommon dealer fees: Some dealers write additional fees into the contract and give them official-sounding names, such as “S& H,” “PDI,” “dealer prep” or even “shipping.” Find out early what extra fees you will be charged and negotiate accordingly before you sign the contract. As with doc fees, you might decide to go along with added dealer fees if you’re saving money on other aspects of the deal. When in doubt about an unknown fee or term, don’t hesitate to ask the dealer finance person.

In the current vehicle shortage we’re in, you’re very likely to find an “addendum” sticker, somewhere on a new car. This is the dealership essentially saying that the vehicle in question is in short supply, and it’s raising its price to make some extra profit. This can range from $1,000 to upward of $50,000 on some highly anticipated vehicles. Note that you don’t have to pay this fee, but at the same time, the dealer doesn’t have to sell a vehicle to you at MSRP. This fee can be negotiated down in some cases, but it will differ based on the dealership. Similarly, there are a number of dealerships that do not believe in marking up a vehicle. Ask if a vehicle has been “marked up” before visiting it and be willing to expand your search if need be. For more information, read: “Should You Pay More Than MSRP for a Car?“

Commercial Vehicle Emissions Scheme For Omnibuses Registered From 1 April 2021 To 31 March 2023

Under the CVES, vehicles are classified into Bands A, B, or C by their worst-performing pollutant among the following: carbon dioxide , hydrocarbons , carbon monoxide , nitrogen oxides and particulate matter . For example, if your vehicle has a CO2 emission of 300g/km, but no emission for all other pollutants, i.e. HC, CO and NOx and PM , it would be classified as Band C, as its worst-performing pollutants of CO2 puts it in Band C.

In addition, if you register an electric or plug-in hybrid omnibus, fossil fuels will need to be burnt to generate the electricity to charge your vehicle. Burning of fossil fuels generates CO2. As such, you will need to add these additional CO2 emissions, before referring to the table below. Your total CO2 emissions would be the CO2 emissions for the vehicle plus the CO2 generated from electricity consumption.

Read Also: How Long Can You Rent A Car