Leasing A Car For Too Long

Make sure that the lease period either matches or is shorter than the cars warranty period. Warranties vary from manufacturer to manufacturer, but they typically last up to three years or 36,000 miles, whichever comes first.

If you keep the car for longer than the warranty period, you may have to consider an extended warranty. Otherwise, you could be responsible for maintenance and repair costs for a car you dont own while still making monthly lease payments.

Its probably better to buy the car if youre planning to lease it for an extended period, says Barbara Terry, a Texas-based automobile expert and columnist.

If the driver owns the car, hed have to pay for the car and pay for maintenance, but then he could continue to drive it for several years without having to worry about a required monthly lease payment, Terry says.

Use an auto lease calculator to figure out whether leasing or buying a car will save you more money over the long haul.

Will Car Servicing Be Included In My Lease

Many lease providers offer maintenance packages for an extra fee on top of the monthly payments. If you choose to have one, you simply inform the provider that the car needs servicing and theyll arrange for it to be serviced at a convenient time. It may even be collected and delivered back, so you never have to go to the dealer yourself!

If you dont pay for a maintenance package, youll have to arrange and pay for servicing yourself. The provider will insist that you use a manufacturer-approved garage.

Should I Buy My Leased Car

Just as you consider many factors when you lease a car, you should analyze the costs and benefits of buying the car at the end of the lease.

First, do you like the car? Do you enjoy driving it and does it suit your needs? That may seem like a funny question, but consider your lifestyle. If you leased a small, compact car so you can easily maneuver through traffic, and are moving to a rural area where you may need a vehicle that has sturdier road handling capabilities, you may find the compact car unsuitable for your new location. On the other hand, you may not want to drive a large SUV if you are moving to a congested urban area.

Are you happy with the cars performance? How is the gas mileage? Is the car often in the shop for warranty work? Analyze how much the cars upkeep will cost you if you do buy it.

If you decide youd like to buy your leased car, look at the residual value. How much is the car worth and how much would you pay to get out of your lease before it expires?

There are various strategies to help save money when buying your leased car, including financing through your bank or working directly with the lender . If you decide to buy the leased car, explore all your options.

As with most personal financial decisions, the pros and cons of leasing a car come down to a host of factors. Analyze your needs and budget and then shop to make sure you make the right decision for you.

Recommended Reading: Where Can I Get Tags For My Car

Canceling Your Lease Agreement Early

Usually, you cannot cancel a lease agreement before the end of the term, unless you’re willing to pay a substantial penalty.

Canceling a lease. If you want to cancel your lease, look carefully at the provision describing what happens if you default or want to terminate the lease early. Ask the dealer or lessor to calculate how much it would cost you to terminate the lease early.

Breaking a car lease if you’re in the military. Under certain circumstances, if you’re a member of the military and you’re ordered to move or you’re deployed, the federal Servicemembers Civil Relief Act allows you to cancel a car leaseand you won’t have to pay an early termination charge or penalty.

To learn more about leasing a car, see Nolo’s Encyclopedia of Everyday Law, by the Editors of Nolo.

Why I Put Zero Down On My Leases

I put zero down on my leases and when I say zero, I mean not even a penny. Cash down on a lease just reduces the cost of the vehicle to the lease company and if the vehicle were ever declared a total loss, that money that you had put down is lost forever. A lease down payment is not covered by your auto insurance. They only cover the value of the vehicle, not the value of the cash that you put down.

Whatever money you are thinking about putting down, deposit it into a separate investment account and draw from it monthly when you are making your lease payments. This way your money is still making money each month until you need to draw from it.

Don’t Miss: How Long To Warm Up Car

Leasing Vs Buying A Car: Pros And Cons

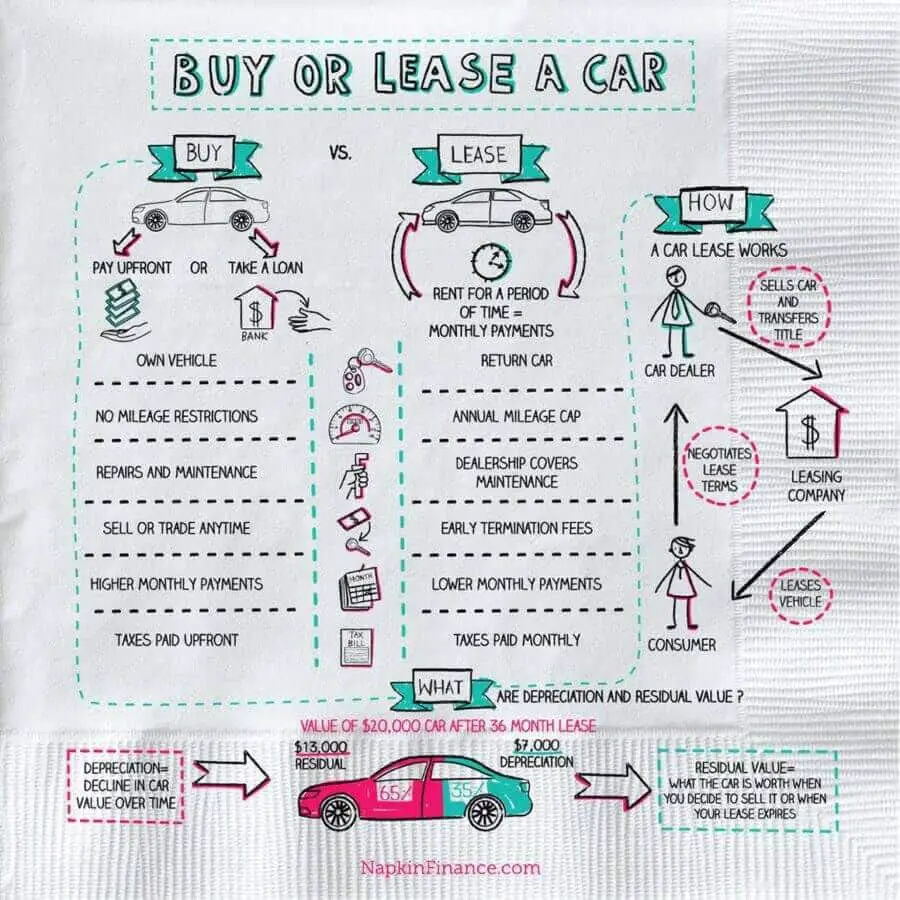

It can be a tough choice deciding whether to lease or buy a car. Leasing a car means youll have lower monthly payments and you can typically drive a vehicle that may be more expensive than you could afford to buy. On the other hand, if you decide to buy a car, youll own it in the end, even if it means youll pay a higher monthly loan payment in the meantime. Perhaps the best way to decide is to understand the pros and cons of leasing vs. buying a car, how leasing a car works and what tips for leasing a car might help you get a good deal.

Can I Pay For A Car Lease Up Front

Yes, in most cases customers can pay for a lease up front. Paying for an entire lease at the time of signing is called a one-pay, or single-pay lease. Some lenders will discount interest costs if you pay for the whole lease up front. Make sure to find out if there is any benefit to you before you commit to paying for a car lease up front.

Don’t Miss: How To Gift A Car

Why You Shouldnt Lease A Car

So, by now, hopefully you can see why leasing a car isnt a good move. But just in case youre still on the fence because the thought of driving around a brand-new Mercedes is just so hard to resist, here are a few more things to think about:

- Depreciation makes you lose money. All cars go down in value. Lets say a fancy new car loses $20,000 in value over a two-year period. If you lease it, that loss in value has to be factored into the lease payment or the leasing company loses money. And theyre not going to set themselves up to lose moneywhich means your bank account is going to take the hit.

- Its hard to get out of the lease early. You cant just return the car early if you get tired of it. Anyone who wants to break a car lease for any reason is in for a huge, expensive headache with a lot of other fees involved.

- Dealers make a ton of money on interest. If the financing comes from the dealer, they can easily mark up the interest rate by a small percentage that might seem insignificant to you, but it actually equals thousands more dollars in profit for them in the long run. In the industry, this is called dealer reserve, and its not cool.

What Do You Need To Know Before Leasing

Arguably the key concern when considering car leasing is how many miles you drive yearly. According to the United States Department of Transportations latest figures from 2020, most Americans drive an average of 12,724 miles yearly, and thats down from 14,263 in 2019.

Signing a lease binds you contractually not to exceed an established mileage limit. That limit, or mileage cap, is averaged over the number of years in the agreement.

Depending on the lease, agreements range from 10,000 miles per year to as many as 15,000 miles per year. Whatever the limit, the leasing company will penalize you for every mile above the limit. Generally, that penalty can be between $0.12 to $0.30 per excess mile. At $0.30, that works out to $300 for every 1,000 miles over the limit. It can add up.

Recommended Reading: What To Do For Dog Car Sickness

How To Find A Used Car To Lease

Used-car leases from dealerships are rare and arent widely advertised. The best way to find a leased used car is to do the legwork yourself. All major manufacturers, both mainstream and luxury, offer CPO vehicle leases. However, some automakers, including Stellantis, Ford, and Nissan, require outside financing, while Toyotas finance department does provide financing for used vehicle leases.

The best way to find a used lease is to decide what vehicle you are interested in, and call around to franchised dealerships to see if they offer used car leases on their CPO inventory.

How Is A Car Lease Different From A Car Loan

In many ways, a car lease is similar to an auto loan. For example, as the person leasing a vehicle also known as the lessee you may have to put cash down for the car, and youll make monthly payments just as you would with a typical car loan.

Leases often have lower monthly payments than a car loan but those lower payments have a downside. Instead of building equity in the car, youre only paying for the privilege of driving it for a set amount of time and miles.

While you can often apply for car-loan financing through a bank or other third-party lender in addition to a car dealership, its uncommon to arrange a car lease through a bank. Instead, youll most likely work directly with a dealership or a specialized vehicle-finance company.

At the end of the lease term typically two to four years youll return the car to the dealership and walk away from the car and monthly payments for good, unless your lease allows you to purchase the vehicle.

Read Also: Where Can I Find The Vin On My Car

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

When To Buy A Car

Clearly, there are advantages and disadvantages to leasing a car vs. buying a car. In the long run, however, buying a car may be the more economical choice. Despite the higher upfront cost and monthly payments of buying a car, this option saves you money over time. If you finance your vehicle, be sure to understand how auto loans work.

Buying a vehicle also comes with the freedom to change it, but with this freedom comesyou guessed itresponsibility. Taking care of your car through regular maintenance and repairs keeps your vehicle safe and could help you resell it when the time comes.

Whats the maximum monthly car loan payment you can afford? Use our auto loan calculator to find out.

Read Also: What Is The Best Car Insurance

Mileage Allowance And Charges

Part of all car leases is a stated maximum number of miles that the lessee can drive the vehicle per year, known as the mileage allowance. The standard mileage allowance for a private driver lease normally ranges from 10,000 to 15,000 miles per year. If a driver exceeds the mileage allowance, they’ll be charged an additional fee per mile. All figures here can be negotiated by the parties.

A Quick Guide On The Basics Of Leasing

If you’re new to leasing, you probably have some questions about how it works. This overview is meant to explain the basics, including the answers to these questions:

- What is a lease?

- What key numbers do I need to know if I’m going to lease?

- How can I quickly determine if I’m getting a good deal?

This article won’t cover all aspects of leasing, but it should be enough information to get you started. If you want to get into the nitty-gritty, we’ve got 10 Steps to Leasing a New Car, a comparison of leasing, buying a new car and buying a used car and a deep dive into calculating your own lease payment

Leases have their own lingo. By understanding some key terms, such as residual value, money factor and mileage allotment, you’ll be more comfortable signing on the dotted line.

You May Like: How To Return A Car You Can’t Afford

Negotiating With The Dealer

This is another step in the process when the dealer can try to negotiate the lease price and interest in whatever way makes them the most money. Then the lessee makes a down payment, which also has an effect on the size of the monthly payments . Sometimes the lessee is required to pay the first and last months payments up front tooyikes.

Research New Car Inventory Of Your Make And Model At Three To Four Other Dealerships

Now you can start thinking about color, interior, and packages/options that you want. Request quotes for the vehicles you are interested in and ask the dealer to quote you the total drive-off, monthly payment after tax, as well as the MSRP, capitalized cost including the acquisition fee, money factor, and residual value. Specify that you only want to pay the first months payment and the registration fees as your down payment. Youll be using these new quotes for your negotiation with the dealer where you did your test drive.

Leasing Pro Tip: Avoid putting money towards capitalized cost reduction

Do not put any money down that goes towards capitalized cost reduction. Dealers often use larger down payments to make monthly payments appear lower. This is almost always not in the best interest of the customer. If the car gets stolen or totaled the day after you lease it, you will not get any of your down payment back. I recommend you do not take this risk.

You May Like: When Did The First Car Come Out

How Does A Lease Buyout Work

All lease dealerships will mention a buyout price and the methodology for arriving at it when you are signing the agreement. When the return date of the lease is approaching, the lessor or dealership will get in touch with you to discuss buyout options. If you dont want to exercise the option, you can always return the car to the dealership.

But before you commit to buying the car, make sure that it makes financial sense. For example, imagine that the lease buyout price listed in your agreement is $15,000, and you have already exceeded the mileage limit. If you choose to return the car to the dealership, you might have to pay $1500 in excess mileage fees and $700 in wear-and-tear fees.

But if the car is in a good condition and its current market value is indeed $15,000, it makes better sense to buy it and save yourself the $2200 in excess fees. Plus, you get the added advantage of owning a car you love!

On the other hand, lets imagine another situation in which the buyout price is $15,000, you have no excess fees, but the current market value of the car is only $10,000. It doesnt make sense to buy the car because even without the excess fees you will be overpaying by $5000! If you really like the car so much, you could even get a used car for $10,000 at a used car dealership but a lease buyout will be a bad idea.

The next question you may have is What if I dont have the money to pay for a lease buyout?

How Does A Lease Work

Leasing a car involves signing a lease agreement, a document that outlines the terms and conditions of the leasing arrangement. This agreement should specify, among other things, the period of time you will keep the car, monthly payments you will make and mileage limits. Other fees and charges should be included in the agreement, like the disposition fee, acquisition fees, excess wear and use and other end-of-term charges, and termination fees that may apply if you end your lease early.

If your vehicles mileage at the end of the lease term exceeds the allowable limit, you may be subject to an excess mileage penalty. You should find information on maintenance and wear and use standards within the lease agreement.

The lease agreement should also outline your option to purchase the vehicle from the lessor if a purchase option is offered. Depending on your lease, at the end of the lease term you may have the option to return the vehicle, extend your lease, or buy the car.

The decision to purchase your leased vehicle may be influenced by how satisfied you are with the vehicles performance, your budget, and the purchase option price compared to the vehicle’s market value. If the purchase option price is less than or equal to the market value, the purchase option may be a good deal.

Also Check: How Do I Register My Car In Colorado