Can I Rent A Car Without Insurance

Yes, if you donât have a car or auto insurance and you want to rent a car for a trip, you can still rent a car, and you may not need to purchase rental car insurance. If you pay for your rental car with a credit card, the card may offer you a limited amount of insurance coverage on the rental.

The insurance offered by your credit card is usually collision damage waiver coverage, not liability coverage. In most cases, if you buy the rental car companyâs insurance product, your credit cardâs CDW benefits will not apply.

To access the coverage through your credit card, you need to charge the cost of the rental car to your credit card if you get into a covered accident or the car is stolen, the credit card company will reimburse you up to a certain dollar amount. Some credit cards also offer towing coverage.

Many Factors Help Determine The Cost Of Car Insurance

The amount you’ll pay for car insurance is impacted by a number of very different factorsfrom the type of coverage you have to your driving record to where you park your car. While not all companies use the same parameters, here’s a list of what commonly determines the bottom line on your auto policy.

- Your driving record The better your record, the lower your premium. If you’ve had accidents or serious traffic violations, it’s likely you’ll pay more than if you have a clean driving record. You may also pay more if you’re a new driver without an insurance track record.

- How much you use your car The more miles you drive, the more chance for accidents so you’ll pay more if you drive your car for work, or use it to commute long distances. If you drive only occasionallywhat some companies call pleasure use”you’ll pay less.

- Location, location, location Due to higher rates of vandalism, theft and accidents, urban drivers pay a higher auto insurance price than those in small towns or rural areas. Where you park your car and anti-theft features may impact the bottom line as well.

Other factors that affect premium price that can vary from one area or state to another are: cost and frequency of litigation medical care and car repair costs prevalence of auto insurance fraud and weather trends.

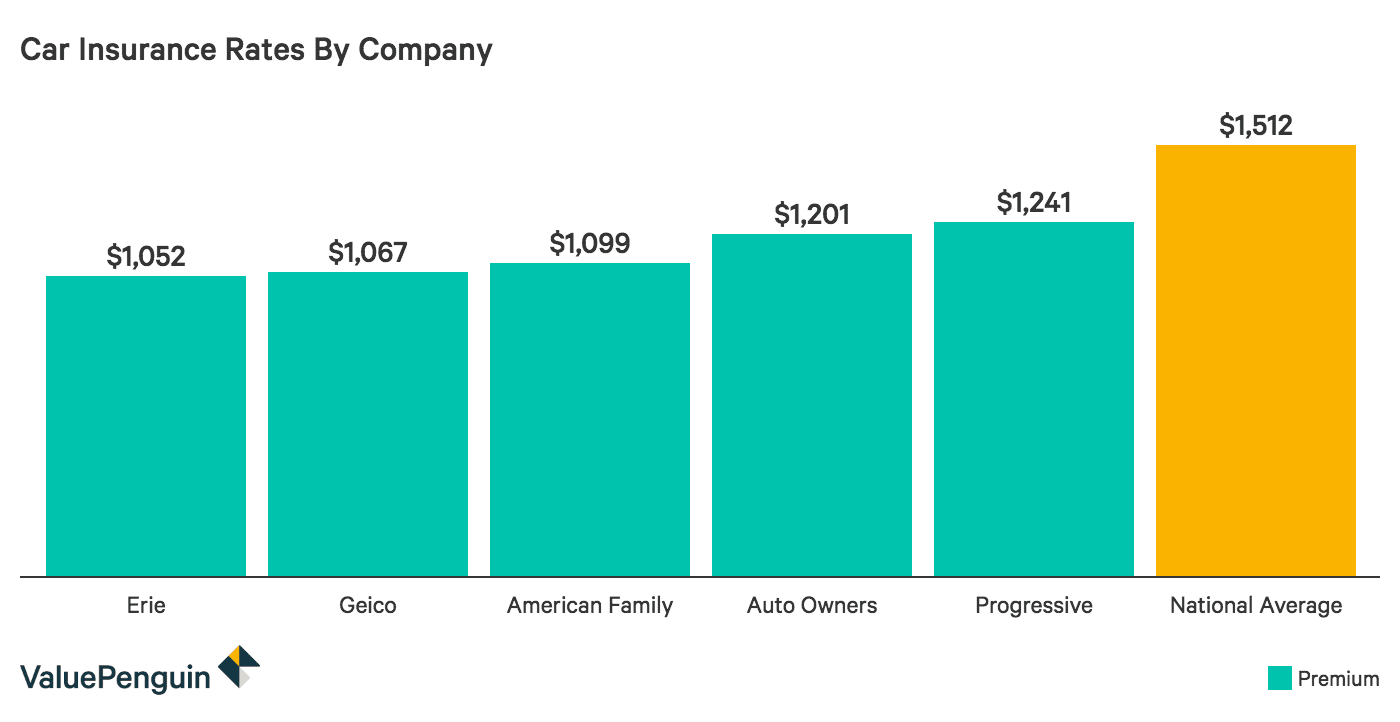

Shop Around For Better Car Insurance Rates

If your policy is about to renew and the annual premium has gone up markedly, consider shopping around and obtaining quotes from competing companies. Also, every year or two it probably makes sense to obtain quotes from other companies, just in case there is a lower rate out there.

Remember, cheap doesnt always mean good, and going with the lower-priced company isnt always the wisest decision. Thats because the insurers should also be considered. After all, what good is a policy if the company doesnt have the wherewithal to pay an insurance claim?

To run a check on a particular insurer, consider checking out a site that rates the financial strength of insurance companies. The financial strength of your insurance company is important, but what your contract covers is also important, so make sure you understand it. Insure.coms site bases its insurance company ratings on data assembled by Standard and Poors.

In general, the fewer miles you drive your car per year, the lower your insurance rate is likely to be, so always ask about a companys mileage thresholds.

Also Check: What Oil Do I Use For My Car

Marital And Family Status

Unfortunately, single drivers pay more than married drivers for car insurance. Married people with no kids, grown kids or kids too young to drive will typically have the lowest rates. And parents of teen driverswatch out! Your rates are about to go up.

Fortunately, there are plenty of ways to help your teen driver save on car insurance. You can even use this time to teach your kids about the financial responsibility of driving. Having them pay for some or all of their car insurance now prepares them to find and buy the right insurance on their own later.

If you do decide to foot some or all of the bill, hang on. Your rates will go back down when your teen leaves the nest.

Shop Around For The Lowest Insurance Premiums

Your premiums will vary from one insurance company to another. It’s important to shop around, ask for quotes, and compare prices before deciding on one insurance company. In some cases, you may be eligible for a discount by combining your home and car insurance.

When shopping for a car, check the insurance rating for the car you’re thinking of buying. Insurance companies assign ratings based on the claims made on different makes and models. Cars with better ratings are cheaper to insure. You can get rating information from:

- your insurance company, broker or agent

In most provinces and territories, an insurance company can charge higher premiums based on your credit rating.

Also Check: How To Get Rid Of Carpet Beetles In Car

What Is Rental Car Insurance

When you rent a car through a rental company, it will include the minimum amount of liability coverage required in that state. The rental car company also offers additional coverage you can purchase at an extra cost per day.

Like with standard car insurance, these coverages offer different types of protection. When you rent a car, youâll be offered four main categories of coverage to add on to your rental:

Compare Car Insurance Rates Today

You can compare car insurance premium to save money on your car insurance. If you are spending too much money on your car insurance for your budget, that means its time to compare insurance rates to find a new provider.

Here at Freeway Insurance, we understand that you dont have a ton of free time to research insurance rates. To make things easy for you, Freeway can quickly and easily provide you with an online quote.

Don’t Miss: How To Get Rid Of Carpet Beetles Permanently

Car Insurance For New Drivers

For new drivers who are young and are still working their way through Ontario’s Graduated Licensing program, insurance policies and costs will work differently than it will once they get their full G License.

First, their rates will be higher. This is because inexperienced and statistically at a greater risk of being in an accident. Each time they upgrade to a higher license level, their rates will be lowered. So the rates from when they have a G1 will drop when they get a G2, and will drop again when they get a full G.

However, the higher rates are can be mitigated if they do not have their own car. If they only drive their parents’ cars then they will not be insured as the main. Not being the main driver means they are not using the vehicle as much, and this lowers their rates.

Premium Calculation For Used And New Cars:

Every car insurance company uses its own set of parameters to calculate the premium for a policy. However, the factors that are considered by most insurers are listed below:

- Premium calculator for used cars – The online car insurance calculator tool helps you in procuring the most appropriate auto insurance policy for your vehicle in a transparent and convenient manner. To calculate the premium for used cars, you will have to provide the following details:

- Type of car

- Details of the existing car insurance policy

- Registration number of the car

- Details regarding change in ownership

- Claims for previous years, if applicable

The used car insurance calculator tool will show you the premium required to insure the vehicle in a matter of seconds.

- Premium calculator for new cars – The new car insurance calculator tool provides a listing of top insurers and their car insurance products in a few simple steps. This offers a new car owner the much needed guidance in narrowing down on an appropriate auto insurance policy for his/her prized set of wheels. The details you would have to provide to calculate the premium for insuring a new car are:

- The name of the car manufacturer

- The model of the vehicle

- Year of manufacture

- Personal details of the owner-driver

- State of registration of the vehicle

Also Check: How To Program Car Computer

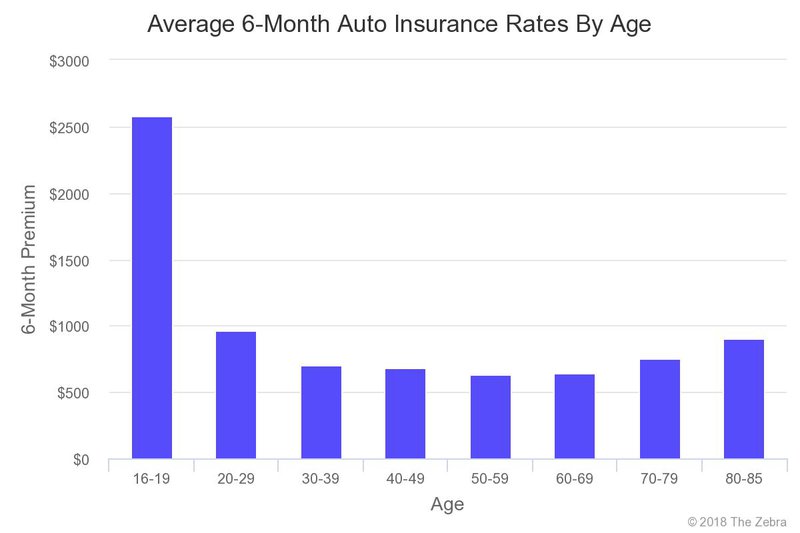

Average Cost Of Car Insurance By Age

According to Statista.com, the average cost of car insurance for those in their 20s was the highest out of the age ranges with an average of £851. The lowest average age group for car insurance in the UK was for those in their fifties with the average cost of £468. This doesnt mean that the older you get, the cheaper your insurance gets though, as the price goes up again once you hit your 60s.

Average car insurance cost by age:

20 year olds: £851

65 year olds: £491

75 year olds: £752

Figures from Statista. These figures are an average of the quotes from a selection of major UK insurers and assume five years driving experience and five-year no claims discount.

Car Insurance Premium Calculated On The Below Mentioned Factors:

A Package Policy has two main components namely own damage premium and liability premium. It is important to note that liability premium is fixed by the insurer. It is the minimum statutory premium to be paid as fixed by IRDAI . The liability premium amount depends on the engine power of your car. More the cubic capacity, more will be the premium.

The third-party liability premium chart released by the IRDAI for the financial year 2017-18 is as follows:

| Engine Capacity |

|---|

Let us look at some important components that influence the premium of a comprehensive/package policy:

- Insured Declared Value or IDV of the Vehicle

- At any point, your car is worth some value. Assuming you had insurance for your car, the value will help the insurance company decide on the compensatory amount. IDV will decide the value of your vehicle at any given point of time under a comprehensive car insurance cover.

- Simply put, IDV is the maximum amount that you can claim for any loss or accident of the vehicle. It is one of the important factors that greatly affect the premium.

- IDV = Ex-showroom price of your car + cost of accessories depreciation value as per IRDAI

- Depending on the age of the vehicle, the depreciation ranges from 5% to 50% of the ex-showroom price.

Read Also: How To Make Car Freshies

Average Car Insurance Costs For Good And Bad Credit

Having bad credit has a surprisingly large impact on auto insurance rates in most states. On average, car insurance rates for drivers with poor credit are more than 75% higher than for people with good credit.

Average car insurance rates for a driver with poor credit are:

-

$2,812 per year for full coverage.

-

$984 per year for minimum coverage.

What To Do If Your Car Insurance Premiums Increase

In some cases, your car insurance premiums may increase.

Re-evaluate your needs

Review your insurance needs with your insurance company. You may want to consider asking about the following options for lowering your car insurance premiums:

- raising your deductible

- dropping collision coverage if your car has a low resale value

- a package deal for insuring your home and car, or more than one car, with the same insurance company

Shop around

Shop around, get quotes and compare prices from different companies and brokers to make sure you’re getting the best deal.

Recommended Reading: How To Protect Car From Hail

Average Cost Of Car Insurance By Gender

We know what youre thinking – you cant discriminate based on sex anymore! Yet despite the EU directive which prohibits insurers from assessing a drivers risk based on their gender, male drivers are still paying more on average than female drivers. According to Confused.com, male drivers are edging closer to the £900 mark and are paying £878 on average for their car insurance – £114 more than female motorists who are paying £764 on average.

Average Cost Of Auto Insurance Summary

The average costs of car insurance depend, in part, on how you pay: annually or monthly. The figures below are based on the average annual premium, but be aware that drivers may pay more if they opt for monthly payments. This is because theres usually a discount for paying in full. Thats why its essential to get a personalized quote to understand your options fully.

Average Car Insurance Rates

- $1,633

Don’t Miss: What Do Car Detailers Do

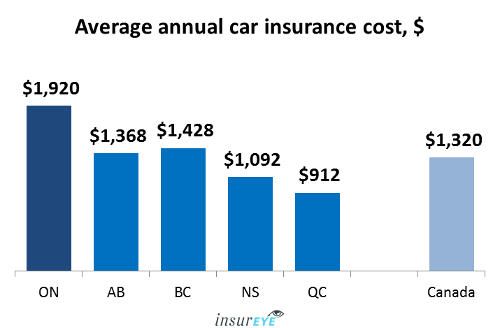

Cost Of Car Insurance In Ontario

The cost of car insurance in Ontario depends on several factors. In general, the main things taken into account when setting someone’s policy cost include:

- Driving Experience how long you’ve been driving in Canada

- Driving History how many accidents or speeding tickets you have

- Age the older you are the lower your rates in general

- Gender women typically get lower rates than men

- Location there are more accidents in crowded cities like Toronto than in smaller towns

- Vehicle cars that are cheaper and have higher safety ratings do not cost as much to insure

- Vehicle Usage the more you drive the higher chance you get into an accident

- Winter Tires a new Ontario law allows for drivers to get an insurance discount for using winter tires during the snowy season.

Ontario has the highest average insurance rates in Canada out of any other province. This is due to a greater concern for insurance fraud compared to any other province, but also due to the nature of insurance laws. Ontario mandates better standard coverage and accident benefit laws, so the extra cost at least has extra benefits as well.

Did You Know?

Car Insurance Settlement Options

Your insurance company will review your claim and decide how it will settle your claim.

When you make a claim, you’re always responsible for paying the deductible. How much money you get from your claim depends on your insurance benefits.

Remember that the amount of your deductible may reduce the amount you get from a claim.

You May Like: How Much Does A Car Salesman Make Per Car

Why Is Car Insurance For 18

Unfortunately, 18-year-olds have to pay higher car insurance premiums than older drivers. But why? Auto insurance rates are based on how much risk certain drivers present, and younger drivers tend to have higher accident rates, be involved in more expensive accidents, have worse driving records, etc. One particularly sobering statistic: Per mile driven, drivers aged 16-19 are almost three times as likely to be in a fatal crash as drivers aged 20 or older.

In other words, 18-year old drivers and young, inexperienced drivers in general are statistically much riskier to insure. So premiums reflect that risk.

Average Car Insurance Costs By Car Model

Certain car models can be extremely expensive to insure, but most car models will alter a drivers rates by less than a few hundred dollars per year. For example, the top selling sedan , truck and SUV models in the country all cost our sample driver an average of $1,266 to $1,414 to insure.

On the other hand, sports cars and electric car models can be much more expensive to insure than the average car. MoneyGeek found that the most expensive car to insure is a Nissan GT-R. The cheapest car model to insure is a Honda CR-V.

| Model | |

|---|---|

|

Honda CR-V |

$1,172 |

Read Also: How Much Does A Car Salesman Make Per Car

Car Insurance Cost For A 16

The average cost for insurance for a 16-year-old female is $6,562. Thats for a policy of her own that includes comprehensive and collision coverage, with liability limits of 100/300/100. Teen female drivers age 16 pay $920 less than males their age. Below youll see average insurance costs by state for a 16-year-old female, and how that compares to the price of a parent policy with the child added on. You’ll see that adding a teen is much less expensive. That’s because when teens get their own policy, they qualify for few discounts compared to their parents. Also, teens are commonly listed as a secondary driver on parents’ policies.

| State |

|---|

| $2,902 |

Take Advantage Of Multi

If you obtain a quote from an auto insurance company to insure a single vehicle, you might end up with a higher quote per vehicle than if you inquired about insuring several drivers or vehicles with that company. Insurance companies will offer what amounts to a bulk rate because they want your business. Under some circumstances they are willing to give you a deal if it means youll bring in more of it.

Ask your insurance agent to see if you qualify. Generally speaking, multiple drivers must live at the same residence and be related by blood or by marriage. Two unrelated people may also be able to obtain a discount however, they usually must jointly own the vehicle.

If one of your drivers is a teen, you can expect to pay more to insure them. However, if your childs grades are a B average or above or if they rank in the top 20% of the class, you may be able to get a good student discount on the coverage, which generally lasts until your child turns 25. These discounts can range from as little as 1% to as much as 39%, so be sure to show proof to your insurance agent that your teen is a good student.

Incidentally, some companies may also provide an auto insurance discount if you maintain other policies with the firm, such as homeowners insurance. Allstate, for example, offers a 10% car insurance discount and a 25% homeowners insurance discount when you bundle them together, so check to see if such discounts are available and applicable.

Read Also: How To Burn Mp3 Cd For Car