How Can I Get An Affordable Car Insurance Rate

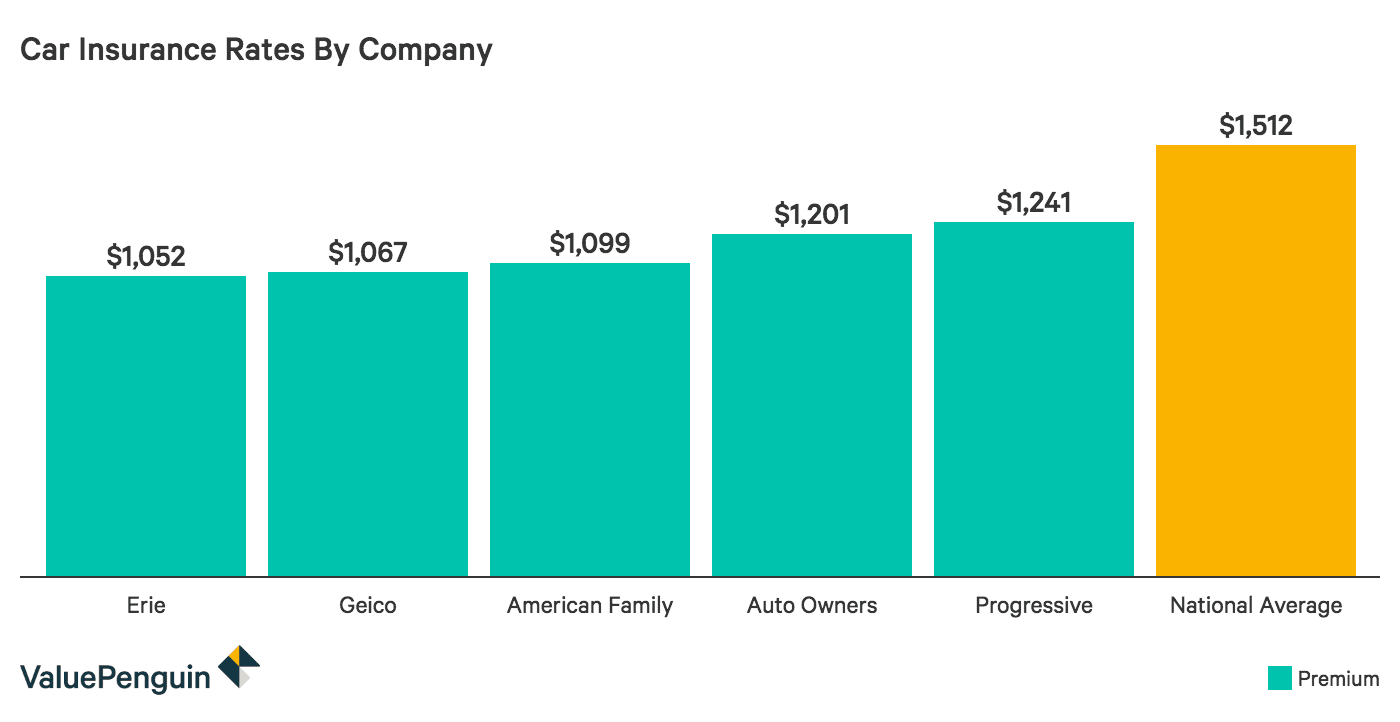

The above mentioned were the average car insurance rates based on different profiles and conditions. Now you might be thinking if the average insurance rates vary for everyone then how can I find the best insurance rates for me? The best solution for this is to shop around and compare the rates from different insurance providers.

Total: Almost $12k Over 3 Years

Over the course of our 36-month lease, we will pay a total of $7,139.64 to the dealership for the pleasure of using their car. With insurance, DMV fees and regular oil chances, weâll pay a grand total of nearly $12,000. For us, itâs worth it.

For other people, buying a car is the way to go. It’s usually cheaper in the long-term and the car is yours, so there’s no mileage penalties or restrictions to deal with. But buying usually requires a higher down payment and maintenance costs down the line. Read our guide to buying a car.

Image: Arslan Ozgur Sukan

How Much Is Car Insurance Qld

Key points. In 2019 Aussies were paying an average of $1,131 a year for their car insurance. The difference between the most expensive and the cheapest insurance plan across Australia was $1,047 on average. Things like age, gender and where you live factor very heavily in how much you pay.15 avr. 2021

Also, do you need car insurance in qld? What kinds of car insurance is available in QLD? Well for starters, you need to have Compulsory Third-party Insurance . Its against the law to drive without some form of CTP insurance. But other than that, its up to you whether or not you want additional insurance.11 déc. 2020

People ask , what is comprehensive car insurance Qld? Comprehensive carinsurance Cover for damage or loss caused by theft, attempted theft, collision, malicious damage and fire, up to your chosen amount covered.

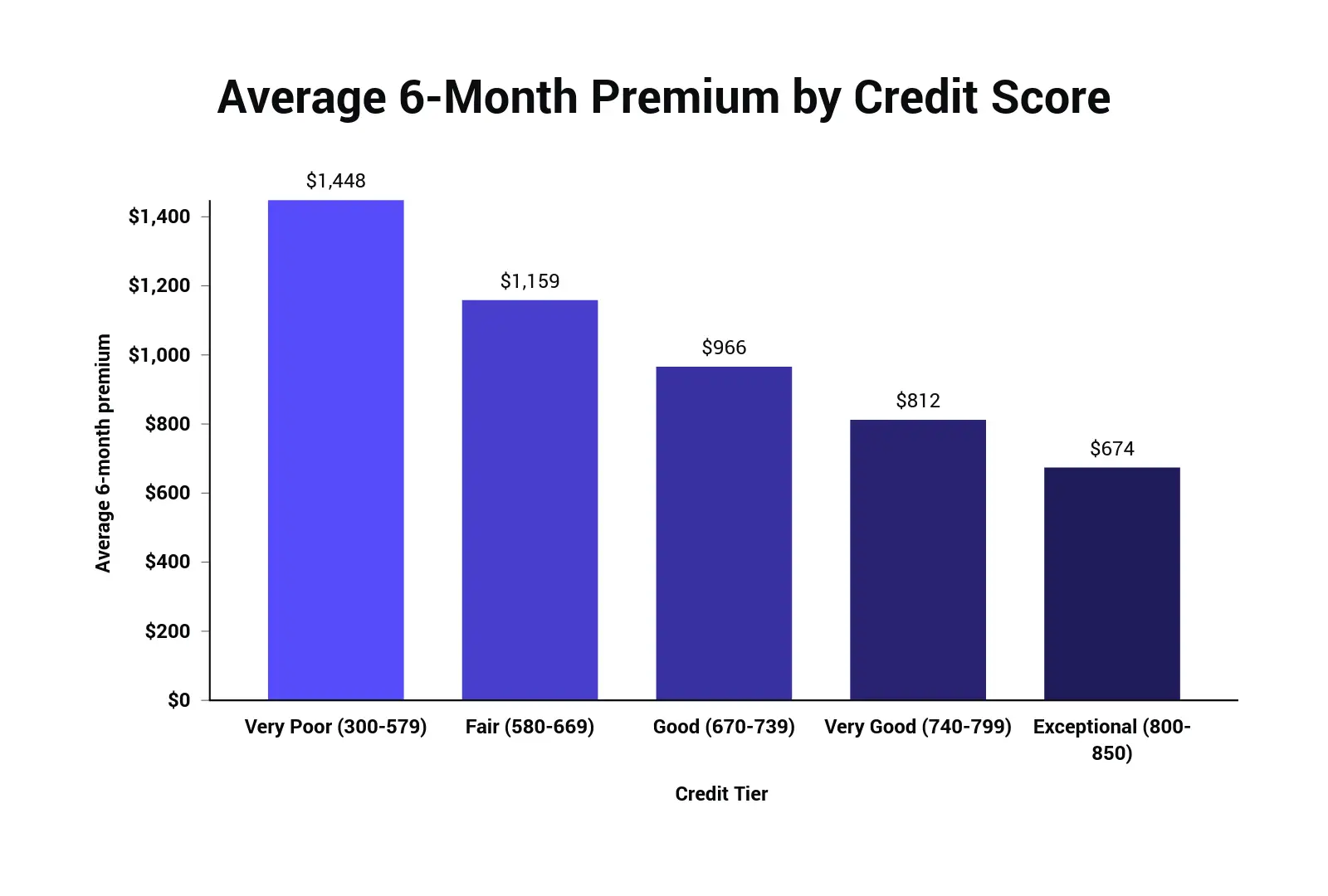

, how much average is car insurance? In the United States, the average cost of full coverage car insurance is $1,674 per year, or $139.50 per month. However, the cost varies significantly based on location and personal factors, like your age and credit score.16 jui. 2021

, how much is insurance on a 100K car? CALIFORNIA AUTO insurance RATES BY COVERAGE LEVELCoverage LevelAverage Annual Premium$100K/$300K/$100K Bodily Injury/Property Damage Liability-Only$802$100K/$300K/$100K Bodily Injury/Property Damage $1,000 Comprehensive/Collision$1,5277 autres lignes

Contents

Don’t Miss: Fl Replacement Title

Shop Around For Better Car Insurance Rates

If your policy is about to renew and the annual premium has gone up markedly, consider shopping around and obtaining quotes from competing companies. Also, every year or two it probably makes sense to obtain quotes from other companies, just in case there is a lower rate out there.

Remember, cheap doesnt always mean good, and going with the lower-priced company isnt always the wisest decision. Thats because the insurers should also be considered. After all, what good is a policy if the company doesnt have the wherewithal to pay an insurance claim?

To run a check on a particular insurer, consider checking out a site that rates the financial strength of insurance companies. The financial strength of your insurance company is important, but what your contract covers is also important, so make sure you understand it. Insure.coms site bases its insurance company ratings on data assembled by Standard and Poors.

In general, the fewer miles you drive your car per year, the lower your insurance rate is likely to be, so always ask about a companys mileage thresholds.

Average Cost Of Car Insurance By Gender

Although insurance companies using gender as a factor in determining car insurance rates is an ongoing controversial issue, only seven states have banned it.

In all other states, gender is a determining factor for car insurance rates. Statistics support the theory that men are a higher risk to insure and are involved in more accidents, speeding and DUI convictions than women.

As age increases, the gender insurance gap decreases for several decades. In quotes collected by Insure.com and Quadrant Information Services in 2018, a 20-year-old man was quoted at $523 higher than a 20-year-old woman. By age 55, there was only a $36 difference, but the gap started to widen again after age 55.

| Gender |

|---|

| $1,148 |

Also Check: Where To Copy Car Key

Take A Defensive Driving Course

Sometimes insurance companies will provide a discount for those who complete an approved defensive driving course. Drivers may also be able to reduce the number of points they have on their licenses by taking a defensive driving, accident prevention, or other course.

Make sure to ask your agent/insurance company about this discount before you sign up for a class. After all, its important that the effort being expended and the cost of the course translate into a big enough insurance savings. Its also important that the driver sign up for an accredited course. Every state has its own rules about accredited defensive driving courses, and GEICO allows you to check what they are by state on its website.

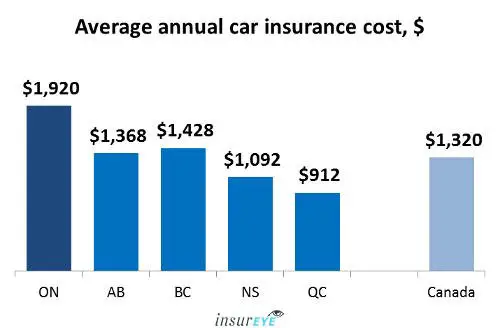

What Is The Ontario Car Insurance Average By Location

Your location plays a huge role in your insurance costs. Depending on where you live your rates could vary by hundreds of dollars annually. For example, the average cost for Toronto car insurance is just over $2,000 annually.

In Brampton it is about $2,400 annually, which is the highest in the province.

The lowest area in Ontario is the north eastern area of the province. Cities such as Kingston and Belleville average about $1,000 per year.

Here are the average car insurance costs for Ontario cities :

- Ottawa is about $1,150 annually.

- London is about $1,400 annually.

- Mississauga is over $2,000 annually.

- Hamilton is approximately $1,600 annually.

Rates can vary significantly by driver age, driving record and insurance history.

Drivers can check out our car insurance calculator to learn more about determining insurance costs in Ontario.

Recommended Reading: How To Add Bluetooth To Car

The Most Expensive States For Car Insurance

Florida, Louisiana, Michigan, New Jersey, and New York are the states with the most expensive average car insurance rates.

Just because you live in one of the most expensive states for auto insurance doesnât mean youâll automatically have to pay super high rates â comparing quotes from multiple insurance companies through Policygenius can help you choose the coverage thatâs best for your budget.

How Are The Average Auto Insurance Rates Calculated

To get an average figure, the IBC took the total amount for premiums based on the province and divided it by the total number of vehicles owned by residential drivers in that province.

Heres how it works:

- Alberta has $3,640,470,499 / 2,766,202 = $1,316 average auto insurance premiums.

- British Columbia has $5,575,221,831 / 3,043,436 = $1,832 average auto insurance premiums.

- Ontario has $11,673,687,017 in premiums) / 7,759,059 = $1,505 average auto insurance premiums.

ICBC 2019 Service Plan

Average Car Insurance Rates by Province

- British Columbia: $1,832

- Ontario: $1,505

- Alberta: $1,316

- Saskatchewan: $1,235

- Newfoundland and Labrador: $1,168

- Manitoba: $1,080 in 2017

- $891

- New Brunswick: $867

- Prince Edward Island: $816

- Quebec: $717

Recommended Reading: What Year Is My Club Car Golf Cart

Comparison Shop To Save

Regardless of what insurance cost youve read about here that matches your situation, you can save money by comparison shopping.

You can also use our car insurance estimator tool to see a customized rate for your particular driver profile. And, the average car insurance rates by ZIP code shows costs for three different coverage levels for various ages and locations, for three coverage levels.

What’s The Difference In Average Car Insurance Cost For Men And Women

Gender does influence car insurance, at least in states that allow insurers to consider it. And from Business Insider’s data, car insurance companies tend to charge women more.

Business Insider collected quotes from Allstate and State Farm for basic coverage for male and female drivers with an identical profile in Austin, Texas. When swapping out only the gender, the male profile was quoted $1,069 for coverage per year, while the female profile was quoted $1,124 per year for coverage, costing the woman driver 5% more. That held true in other cities and states across the country, including Seattle, Miami, Chicago, and Columbus, Ohio. On average, the profiles for women were quoted $172 higher.

But, there is a relationship between age and gender. According to data from The Zebra, young men tend to pay about 14% more for coverage. The gap in costs for coverage gets smaller as young men approach their mid-20s.

However, six states California, Hawaii, Massachusetts, Pennsylvania, North Carolina, and Montana don’t allow gender as a factor in premium pricing.

For transgender and nonbinary individuals, auto insurance pricing is generally calculated by the gender marker indicated on a driver’s license. In states where X is a gender option on driver’s licenses including Oregon, California, Maine, and soon New York insurers are still determining how to calculate costs.

Don’t Miss: How To Get Scuff Marks Off Car Interior

How Much Does Car Insurance Cost In My State

Where you live can have an enormous impact on auto insurance rates, because each state has different regulations for auto insurance. Average prices in the most expensive states are at least two times higher than those in the cheapest ones.

How much insurance you have matters, too: Full coverage car insurance is more than double the price of minimum coverage, on average, according to our analysis.

Heres what our state-by-state analysis of 2021 car insurance rates shows for drivers with good credit and no recent accidents:

-

Maine is the cheapest state for full coverage car insurance with an annual average rate of $963, followed by Ohio and Idaho.

-

Louisiana is the most expensive state for full coverage auto insurance at $2,762 per year on average, followed by Michigan and Kentucky.

-

Iowa is the cheapest state for minimum required coverage, at an annual average car insurance rate of $255, followed by South Dakota and Idaho.

-

For minimum required coverage, Michigan is the most expensive state at $1,128 per year, on average, followed by New York and Louisiana.

Average Car Insurance Rates After A Dui

Getting caught drinking and driving will mean significantly higher prices for car insurance. On average, auto insurance rates go up about 87% for a driver with a recent DUI, NerdWallets analysis found.

For a 40-year-old driver, average car insurance rates after a DUI are:

-

$3,114 per year for full coverage.

-

$1,152 per year for minimum coverage.

Recommended Reading: Florida Dmv Replacement Title

Why Safer Cars Aren’t Always Less Expensive To Insure

You’d think that safer cars would mean lower car insurance costs, but as reported by NPR, advanced safety features that reduce crash risk can actually drive premiums up.

Safety features like autonomous braking and lane departure warning in newer cars can reduce the number and severity of injuries, but they also make vehicles more expensive to repair when accidents happen. External mirrors, fenders and bumpers house sensors that help to avoid crashesand carry higher repair costs than their conventional counterparts.

There are other factors that determine how much you pay for auto insurance. For example, the total annual mileage you drive, changes in your driving record, marital status, your age, and/or moving to a different neighborhood can cause you to pay more for car insurance.

Average Car Insurance Costs With Tickets Or Accidents

Your accident and ticket history is another factor insurance companies consider when setting rates and determining if they can insure you.

- A driver with a clean record pays an average of $1,424 per year for car insurance.

- The same driver with a ticket on their record pays an average of $1,836 per year.

- If that driver were at-fault for an accident, he pays an average of $2,237 per year.

There are things that can combat increases or lower the costs to your car insurance after an accident. In some states, attending traffic school can get violation points taken off your record. That, in turn, can impact your premiums. And, depending on the insurer, you may get a break if its your first violation. Its worth discussing your options with your insurance agent.

Car Insurance Premiums With Tickets and Accidents

Scroll for more

- $2,237

Recommended Reading: How Do I Get My Car Title In Florida

Average Car Insurance Rates After An Accident

After you get in a car accident, your insurance premium will also go up, even if the accident wasnt your fault. Providers view drivers who are in accidents as a much higher risk to insure. If its your first accident recorded by the insurer, your provider might provide accident forgiveness and keep your premium the same.

The table below shows the cost of insurance for a driver with a clean record versus the cost of insurance for a driver whos been in an accident. Because car accidents are considered a major factor in determining risk, insurance prices increase by 30 percent or more, on average.

| Average annual premium with clean driving history | Average annual premium with one at-fault accident | Difference |

|---|

| $8 |

Average Car Insurance Costs By Car Model

Certain car models can be extremely expensive to insure, but most car models will alter a drivers rates by less than a few hundred dollars per year. For example, the top selling sedan , truck and SUV models in the country all cost our sample driver an average of $1,266 to $1,414 to insure.

On the other hand, sports cars and electric car models can be much more expensive to insure than the average car. MoneyGeek found that the most expensive car to insure is a Nissan GT-R. The cheapest car model to insure is a Honda CR-V.

| Model | |

|---|---|

|

Honda CR-V |

$1,172 |

You May Like: How Much Is Car Registration In Texas

How Average Car Insurance Rates By State Have Changed Over Time

At a national level, car insurance rates have been fairly stable over the last half decade. From 2015 to 2021, average car insurance rates have only increased by 2.7% in other words, less than $50. In fact, in the last year car insurance rates have fallen by 2.2%.

But changes in car insurance rates are not uniform, and certain states have seen large changes over the last five years. The five states that have seen the biggest decrease in car insurance rates in recent years are New Jersey, Arkansas, Illinois, Oregon and Connecticut. All five of these states saw average car insurance rates fall by at least 23%.

States With the Biggest Decreases in Rates – Last Six Years

Scroll for more

Which Providers Have The Best Auto Insurance Ratings In California

‘The way to find the carrier with the best auto insurance ratings in California and save on your insurance premiums is to compare quotes from all companies in your area. Use a car insurance quotes comparison site like Insurify to compare up to 10+ real quotes for your specific driver profile and unlock savings and discounts. Rates can fluctuate greatly based on whether you”re a safe driver or a high risk one, but you should never overpay. Insurify provides the cheapest car insurance quotes and companies in your area in just a few seconds.’

Read Also: How To Protect Car From Hail

How Much Would My Car Insurance Be / Temple Tower Stairs Angkor Wat

Insurance.com’s car insurance calculator is a quick way to find the right car insurance levels and options for you. Jun 14, 2021 · how much will my rate go up based on my car insurance company? That’s nearly $420 more than the average car insurance rate nationwide for all vehicles. Aug 25, 2021 · to insure a 2021 tesla model 3, the average driver would pay $2,257 a year. It’s a tad more than standard car insurance, $93 more, but higher than the cost to insure other car models, with the exception of convertibles.

How Surex Helps Ontarians Find The Best Car Insurance Rates

Shopping for insurance can be a challenge. Even though you know the average auto insurance rates in Ontario, individual providers weigh various factors differently, which means your rates will likely vary substantially from company to company.

At Surex, well help you find the most affordable policy based on your situation. Our brokers have helped thousands of Ontario residents. This experience allows us to help you find the best rates promptly.

Learn more about how our service works here.

Read Also: How To Buff Out Scratches On Your Car

Average Car Insurance Costs By Gender

On average, car insurance costs differ little by gender compared with differences we see by company, state, credit score and driving history. That doesnt mean that a cost difference due to your gender would be insignificant, only that its not a pricing factor well-illustrated by national statistics.

Gender-based pricing is banned by law in seven states: California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania.

In states where the practice is allowed, we averaged rates for men and women separately and found that on average:

-

At age 25, men pay about $98 more than women per year.

-

At age 40, women pay about $4 more than men per year.

The Insurance Coverage You Choose

The type of auto coverage you select will also have a big impact on your commercial auto insurance costs. You can choose auto liability only, or comprehensive coverage.

Auto liability coverage is required by law in most states and protects you if you or your employee are to blame for an accident in your commercial vehicle. Auto liability is your lowest cost option, and provides limited coverage to help pay for:

- Physical damage to other vehicles or property damage

- Medical expenses from bodily injury to another party

If you opt for comprehensive auto insurance, your coverage will increase but so will your insurance rates. In addition to whats covered under auto liability coverage, comprehensive commercial auto insurance covers theft and damage due to weather, vandalism, or fire.

Additional coverage options like roadside assistance, rental reimbursement, or collision coverage can further increase your premium. For an accurate auto insurance quote, make sure to provide details about your insurance needs.

Recommended Reading: Charging A Completely Dead Battery