Shop Around For Quotes

- Jerry will never sell your personal information to a third party

- Jerryâs insurance agents will handle all your paperwork and even help you cancel your old policy

- You donât need to get on the phone to shop with Jerry

- Jerry will send you new quotes when your policyâs up for renewal, so you always know youâre getting the best rates

Colorado Auto Insurance Requirements

Most states require you to have certain types of coverage with minimum liability limits as a matter of law. When selecting how much to buy, think about what assets you want to cover and how much you can afford.

In Colorado, limits for physical injury are $25,000 per person and $50,000 per accidentcommonly referred to as “25/50.”

How Much Is Car Insurance In Colorado In 2022

With prices on almost everything going up nowadays, its more important than ever to find the best prices. Luckily, youre not locked to a single insurance provider in Colorado. This means that you can shop around.

Remember that shopping around doesnt necessarily guarantee a better deal. However, if you take the time to shop around, youll know that you arent missing out on any potential savings.

This article explores some average prices from several insurance providers in Colorado. It also discusses some things that affect your rates and what you can do to ensure youre getting the best prices possible.

Don’t Miss: How To Clean Car Seat Belts

How Can I Find The Cheapest Car Insurance In Colorado Springs

While getting familiar with what the average costs are for drivers like you can be helpful as you get an idea of what you might pay, the only way to know exactly what your rate will be is by requesting a quote from car insurance companies.

Fortunately, Compare.com will handle the heavy lifting for you. Just put in your ZIP below, respond to a few questions, and you’ll be comparing the cheapest quotes from the many car insurance companies offering auto coverage in Colorado Springs.

What Is The Average Premium In Colorado For Cheap Full Coverage Car Insurance

On average, Colorado drivers pay $168 per month for full coverage. Full coverage consists of liability, plus collision car insurance and comprehensive car insurance. If your car is financed, your lender will require you to carry full coverage insurance in order to protect its ownership stake until you pay off the vehicle.

Car insurance premium rates vary depending on the deductible amount, the amount of coverage included, age, driving history and much more.

Don’t Miss: How To Tell What Month Your Car Was Made In

Which Chevy Colorado Trims Are Cheap To Insure

The cheapest trim levels of Chevy Colorado to insure are the WT Extended Cab 4WD, the WT Crew Cab 4WD, and the LT Extended Cab 4WD all at around $1,154 per year, or about $96 per month

The two most expensive trim levels of Chevrolet Colorado to insure are the Z71 Crew Cab 2WD and the LT Crew Cab 2WD at $1,322 per year. Those will cost an extra $214 per year over the cheapest WT Extended Cab 4WD model.

The next table displays the average annual and 6-month policy costs, plus a monthly amount for budgeting, for each 2022 Chevy Colorado package and trim level.

| Chevrolet Colorado Trim Level |

|---|

Get Rates in Your AreaWhy is this important?

Table Data Details:

Cheap Car Insurance Quotes In Co

Geico had the cheapest quotes for Colorado drivers, based on CarInsurance.coms data analysis of up to six major carriers in every ZIP code of the state. State Farm was second for cheap rates, just about $90 more than Geico for state minimum and standard liability coverage, and $184 more for full coverage. After that the gap increases Progressive, ranking third, is around $330 more than Geico for minimum and standard liability and about $625 more for full coverage.

Below youll see average annual rates for Colorado, ranked cheapest to most expensive, for three coverage levels:

- State minimum liability requirements

- Liability limits of $50,000 per person/$100,000 per accident and $50,000 property damage

- Liability of $100,000 per person/$300,000 per accident and $100,000 property damage, with comprehensive and collision at $500 deductible

| Company | |

|---|---|

| $695 | $1,762 |

As you can see, rates vary quite a bit, which is why it pays to compare car insurance quotes at least once a year. Based on the rates above, for example, if you bought a Nationwide policy for $700 without shopping around, youd pay almost twice as much you should for the exact same policy. Note that these are averages your rate will depend on your own driver profile and how thats reviewed by your insurer.

Also Check: How To Replace A Car Battery

A Little Research Could Save Drivers In Colorado A Lot Of Money

Follow these tips for comparing car insurance companies in Colorado.

Apples to apples: When determining which car insurance company is right for you, be sure that the quotes you get from each company include the same number of cars and drivers, and the same levels of coverage. In other words, compare apples to apples to get a clear picture of what your Colorado car insurance premium will be.

Protect yourself: While each state has their own minimum required coverage, when it comes to protecting yourself, your passengers, and your own vehicle, additional coverage could well be worth higher monthly premiums. For example, snow and ice in Colorado can make driving dangerous. If you slide through an intersection and strike a sign, having only the required state minimum car insurance in Colorado wonât help pay for repairs to your car, but having Collision coverage will.

Timing: There are certain times when it makes sense to consider switching your car insurance company: when you move, need to add or remove a car, or when you need to add or remove a driver. Why? These changes will likely impact your premium anyway, so take the opportunity to really consider your options and see if switching could save you money on Colorado car insurance.

Chevrolet Colorado Insurance Cost By Model Year

There are quite a few factors that help determine how much youll pay to insure your Colorado. One of those is the age of the vehicle.

The table below shows average insurance rates on the Colorado back to the 2015 model year. These rates are for full-coverage insurance , so rates for liability-only coverage on older models is considerably cheaper.

Chevrolet Colorado Insurance Cost for 2015-2022 Models| Model Year |

|---|

Get Rates in Your AreaWhy is this important?

Table Data Details:

You May Like: How To Find Gps Tracker On Car

Colorado Vehicle Registration Fees And Other Costs

If youre in the market for a new or used car, you need to budget for more than just the vehicles sticker price. Youll also be on the hook for basic DMV fees like title, license plate, and registration no matter where or how you purchase your new car, truck or SUV. You must also buy a new car insurance policy for your vehicle.

Some buyers will also find themselves responsible for additional fees such as sales tax, documentation fees, personal property tax, emissions and inspection fees, hybrid and electric vehicle fees, lien recording fees and a slew of other costs.

Check out Compare.coms comprehensive vehicle costs breakdown to make sure you account for all the added fees you might be on the hook for when buying a car in Colorado.

Cover Your Vehicle With Comprehensive And Collision Coverage

If you’re leasing or financing your vehicle, most lenders mandate physical damage coverages. If you own your vehicle outright, comprehensive and collision coverage can still be vital in protecting your vehicle against damage, vandalism, and theft.

The Progressive Snapshot® discount program personalizes your rate based on your driving habits. The safer you drive, the more you could save. See more on our Snapshot program.

Recommended Reading: What Coolant Does My Car Need

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Cheapest Minimum Coverage Car Insurance In Colorado For 50

Drivers in Colorado who opt for the state minimum coverage may want to consider the following companies, with the lowest average rates:

American National: $180 per year, or about $15 per month.

Geico: $246 per year, or about $20 per month.

Grange Insurance Association: $257 per year, or about $21 per month.

Colorado Farm Bureau: $283 per year, or about $24 per month.

State Farm: $384 per year, or about $32 per month.

You May Like: How To Get A Copy Of Car Title

Cheapest Car Insurance For People With A Speeding Ticket: State Farm

Of all the incidents in this study, a speeding ticket costs drivers the least. Rates for full coverage increase by only 26% far less than the 52% after an at-fault accident and 46% after a DUI citation.

State Farm also has the cheapest insurance for Denver drivers who have received a speeding ticket. The citywide average for these drivers is $4,440 per year, but an annual policy from State Farm is just $1,202 per year. That’s less than a $100 increase from the rate the company charges before a speeding ticket.

| Rank |

|---|

*USAA is only available to current and former military members and their families.

Where Can I Find Cheap Car Insurance For 18

The cheapest rates for minimum-coverage car insurance for 18-year-olds in Colorado are available from State Farm, $277 a month, and USAA, $290 a month. The next-lowest rate is available from GEICO, $334 a month.

State Farm and USAA charge $320 and $321 a month, respectively, for full-coverage car insurance for 18-year-olds. The next-best rate jumps to $429 a month from GEICO.

In general, the cost of teen car insurance is higher than car insurance for other age groups, primarily because teen drivers have the highest crash rates.

The average cost of minimum-coverage car insurance for an 18-year-old is $552 a month, which is more than double the average rate for all drivers. Most young drivers begin qualifying for better rates in their early to mid 20s.

Until then, teens usually get better rates when added to a parents or guardians car insurance policy. Teens who stay on their familys policy may also qualify for discounts that many insurance companies offer to good students, students away at college and/or young drivers who complete an approved driver education program.

| Company |

|---|

| $3,851 | $321 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

Don’t Miss: How Does Trading In A Financed Car Work

Cheapest Full Coverage In Colorado

Full coverage car insurance policies consist of comprehensive and collision insurance. It protects against accidents, theft, vandalism, and natural disasters.

Ideally, full coverage means you have insurance thats appropriate for your income, assets, and risk profile. Lenders require full coverage from those who finance their cars.

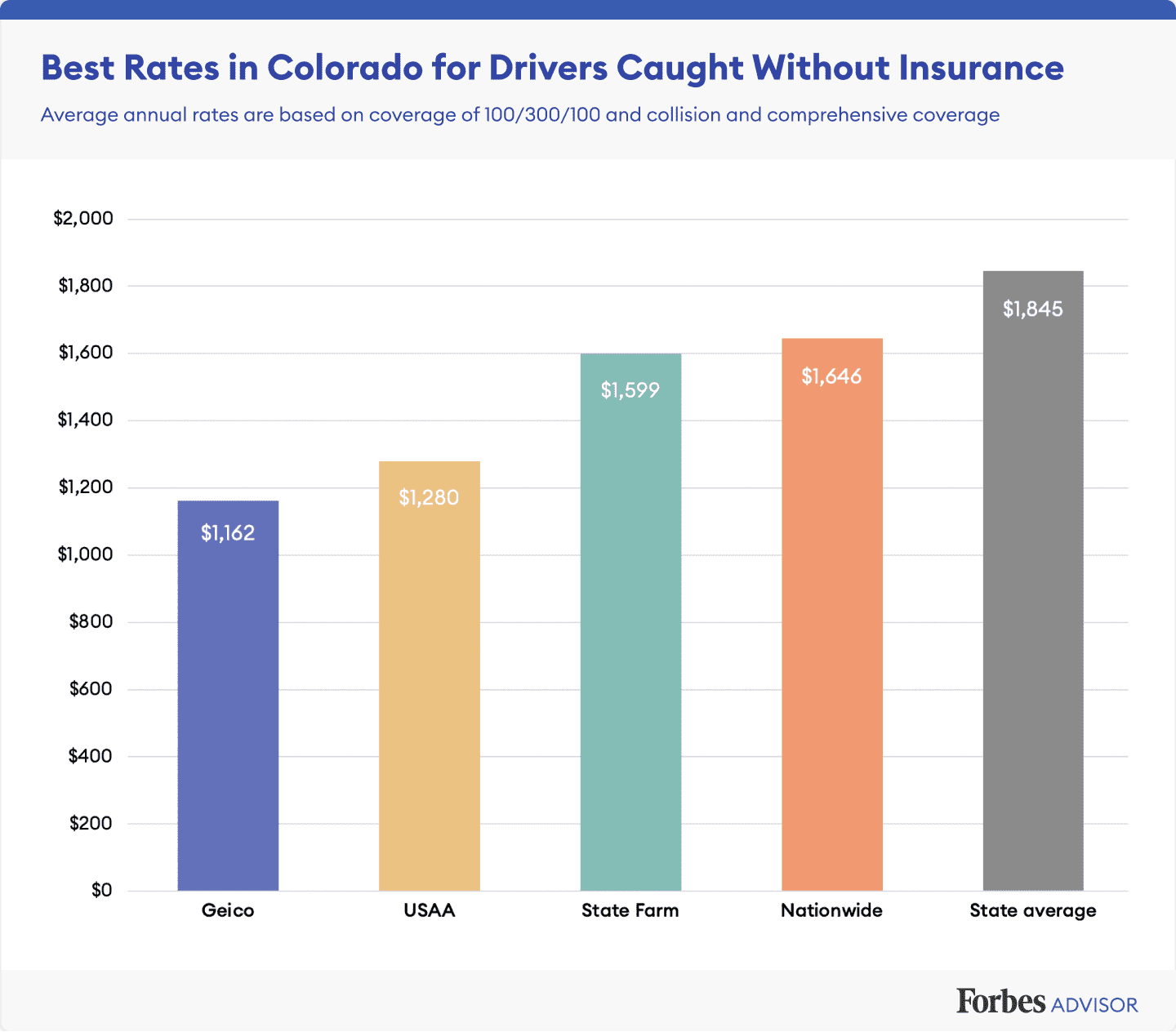

The table below shows the average annual rates from major insurance providers in Colorado, ranked cheapest to expensive for a full coverage policy of $100,000 for bodily injury per person, $300,000 for bodily injury per accident, and $100,000 for property damage, with comprehensive and collision coverage, and a $500 deductible.

| Company |

|---|

How Do Chevrolet Colorado Insurance Rates Compare

The Chevy Colorado ranks #1 out of 10 total comparison vehicles in the 2022 midsize truck class. The Colorado costs an average of $1,256 per year for full coverage insurance, while the segment median rate is $1,464 annually, making the Colorado $208 cheaper per year.

When average rates are compared to other midsize trucks, insurance for a 2022 Chevy Colorado costs $158 less per year than the Toyota Tacoma, $98 less than the Ford Ranger, $196 less than the Nissan Frontier, and $242 less than the Jeep Gladiator.

The chart below ranks the cost to insure all midsize pickups for the 2022 model year, with the Chevrolet Colorado ranking #1 at an average annual cost of $1,256 .

| $1,938 | $682 |

The 2022 Chevy Colorado has an average MSRP of $35,276, ranging from the cheapest WT Extended Cab 4WD model at $31,780 to the most expensive Z71 Crew Cab 2WD costing $35,995.

Using this average purchase price value, we can compare the Chevy Colorado to other vehicles in the midsize truck segment that have the most similar MSRP values.

The four trucks that are most similar in price to the Chevy Colorado are the Toyota Tacoma, GMC Canyon, Nissan Frontier, and Ford Ranger.

The next list shows how they compare to a Colorado for overall price and the cost of insurance.

You May Like: How Often Change Air Filter Car

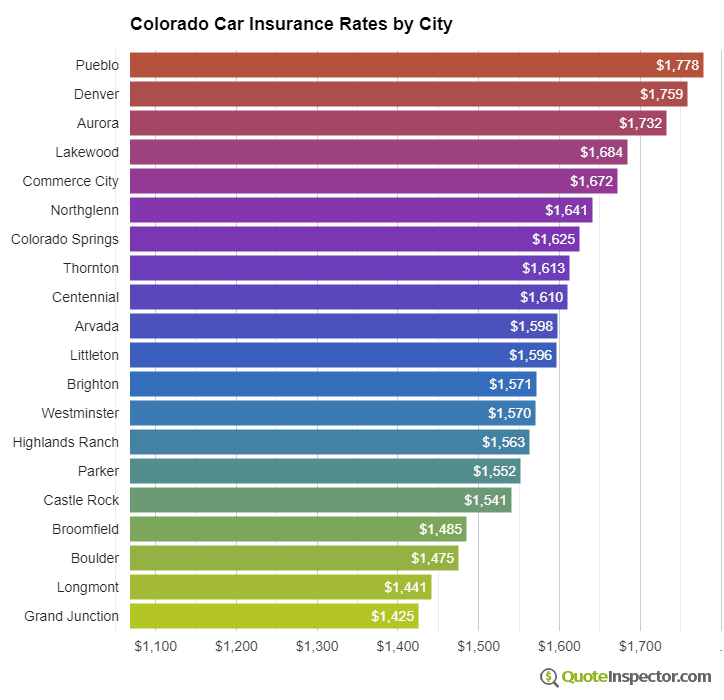

Are Car Insurance Rates Expensive In Colorado

Yes, Colorado car insurance rates are relatively high compared to the rest of the country. Colorado ranks as the 15th most expensive state for minimum coverage and the 10th most expensive state for a full coverage policy. Colorado car insurance rates are expensive because of the extreme weather conditions and densely populated cities.

Cheapest Auto Insurance In Colorado For 60

Drivers with poor credit in Colorado can look at the following companies with the lowest average rates for full coverage:

Geico: $1,490 per year, or about $124 per month.

Esurance: $1,762 per year, or about $147 per month.

American National: $2,103 per year, or about $175 per month.

Grange Insurance Association: $2,222 per year, or about $185 per month.

State Farm: $2,470 per year, or about $206 per month.

You May Like: How Much To Replace Radiator In Car

Do You Need Car Insurance In Colorado

Like pretty much everywhere in North America, youre required to have valid insurance on your vehicle. This protects you and anyone you may be in an accident with financially. However, there is only a minimum requirement. Some insurances are optional but, in many cases, are just as advisable.

These are the required insurances in Colorado¹:

- $25,000 for bodily injury or death to any one person in an accident

- $50,000 for bodily injury or death to all persons in any one accident and

- $15,000 for property damage in any one accident.

Keep in mind that you can always get higher coverage than these. For example, if you were in an accident and injured someone, they could sue you. If they sue you for more than the $25,000 of coverage, you would be responsible for paying the difference.

Additionally, you can purchase other insurances that pay for vehicle repairs and replacements or a loaner vehicle while youre getting the claim sorted out.

Cheap Car Insurance After An Accident

State Farms monthly rate on full-coverage insurance for Colorado drivers with an accident is $126 a month, which is considerably lower than the rates available from USAA, $197 a month, and Progessive, $198 a month.

Statewide, an accident raises the average rate of full-coverage car insurance 54% to $284 a month. This is about $100 more per month than the rate available to drivers with a clean record.

Cheapest car insurance for drivers with an accident history| Company |

|---|

| $3,371 | $281 |

| Note: Average rates are based on non-binding estimates provided by Quadrant Information Services. Your rates may vary. |

Recommended Reading: Rattling Sound In Car When Driving

Cheapest Full Coverage Car Insurance In Colorado For 20

Drivers in Colorado with clean driving records may want to consider the following companies, which had the lowest average rates:

American National: $1,432 per year, or about $119 per month.

Geico: $1,520 per year, or about $127 per month.

Colorado Farm Bureau: $2,262 per year, or about $188 per month.

State Farm: $2,752 per year, or about $229 per month.

Esurance: $2,858 per year, or about $238 per month.

Mandatory Automobile Insurance In Colorado

Automobile owners in Colorado are required to carry liability insurance. Liability insurance covers bodily injury to another person or property damage to another’s vehicle or property when the insured is at fault for an accident. The following minimum coverages are required by the state, although higher coverages may be purchased:

- $25,000 for bodily injury or death to any one person in an accident

- $50,000 for bodily injury or death to all persons in any one accident and

- $15,000 for property damage in any one accident.

Selfinsurance. Any individual who has over 25 vehicles registered to his or her name may qualify as a selfinsurer by applying for a certificate of selfinsurance from the state Insurance Commissioner. The Insurance Commissioner must ensure that the individual will be able to pay the minimum coverages required by the state. For more information on selfinsurance, contact the state’s Division of Insurance within the Department of Regulatory Agencies .

Also Check: How To Calm Cat In Car

How Does Driving History Affect Car Insurance Costs In Colorado

People with car accidents or traffic violations on their record are considered high-risk by insurance providers and face higher car insurance costs in Colorado. However, by looking around, those with a bad driving history can easily get affordable rates in Colorado.

MoneyGeeks research finds that getting a speeding ticket might cost you around $251 more per year compared to someone with a clean driving record. The cost difference climbs in proportion to the severity of the violation.

Average Costs of Full Coverage Car Insurance in Colorado – By Driving History

Scroll for more