Bodily Injury Liability Coverage

Bodily injury liability coverage helps pay for another partys accident-related expenses in the event that you are at fault for an auto accident. This type of coverage will provide for a portion of the other partys short- and long-term accident-related costs, such as:

- Medical bills: Costs related to the other partys hospitalization, follow-up care, and all related healthcare

- Lost wages: The lost income of the harmed party, if theyre unable to work as a result of their injury

- Legal fees: Legal defense if youre sued by the other party, paid for under your own bodily injury coverage

Why Is Maryland Insurance So High

Car insurance in Maryland is expensive because minimum liability requirements are so high and both personal injury protection and uninsured motorist coverage are required. As the cost of providing insurance goes up, the premiums insurers charge also rise. All insured drivers share the increasing cost of insurance.

How To Find Cheap Maryland Auto Insurance Quotes

If you want to find cheap car insurance coverage in Maryland, we have a few tips for you.

- Comparison shop: We always recommend getting a minimum of three auto insurance quotes. This shopping process helps you find the best deal. Dont be afraid to shop periodically to make sure you are still with the best provider.

- Look at discounts: Each company has its own list of available discounts. Make sure you get everything you qualify for.

- Consider the car you insure: Some vehicles cost more to insure, while some models are the cheapest cars for insurance. Before you buy a car, get a quote to see where it will stand.

- Work on your credit: Having good credit gets you a lower rate because you are seen as responsible. Pay your bills on time and improve your credit score.

- Play with policy terms: Change the deductible and coverage limits to see if you can find a better rate. Just dont alter the policy in a way that will hurt you after an accident.

It might take you an hour to get all of the rates you want, but it will be well worth it when you see the savings you have been missing.

You can use the tool below to collect and compare auto insurance quotes from providers available in your state:

Also Check: Does Carvana Buy Leased Cars

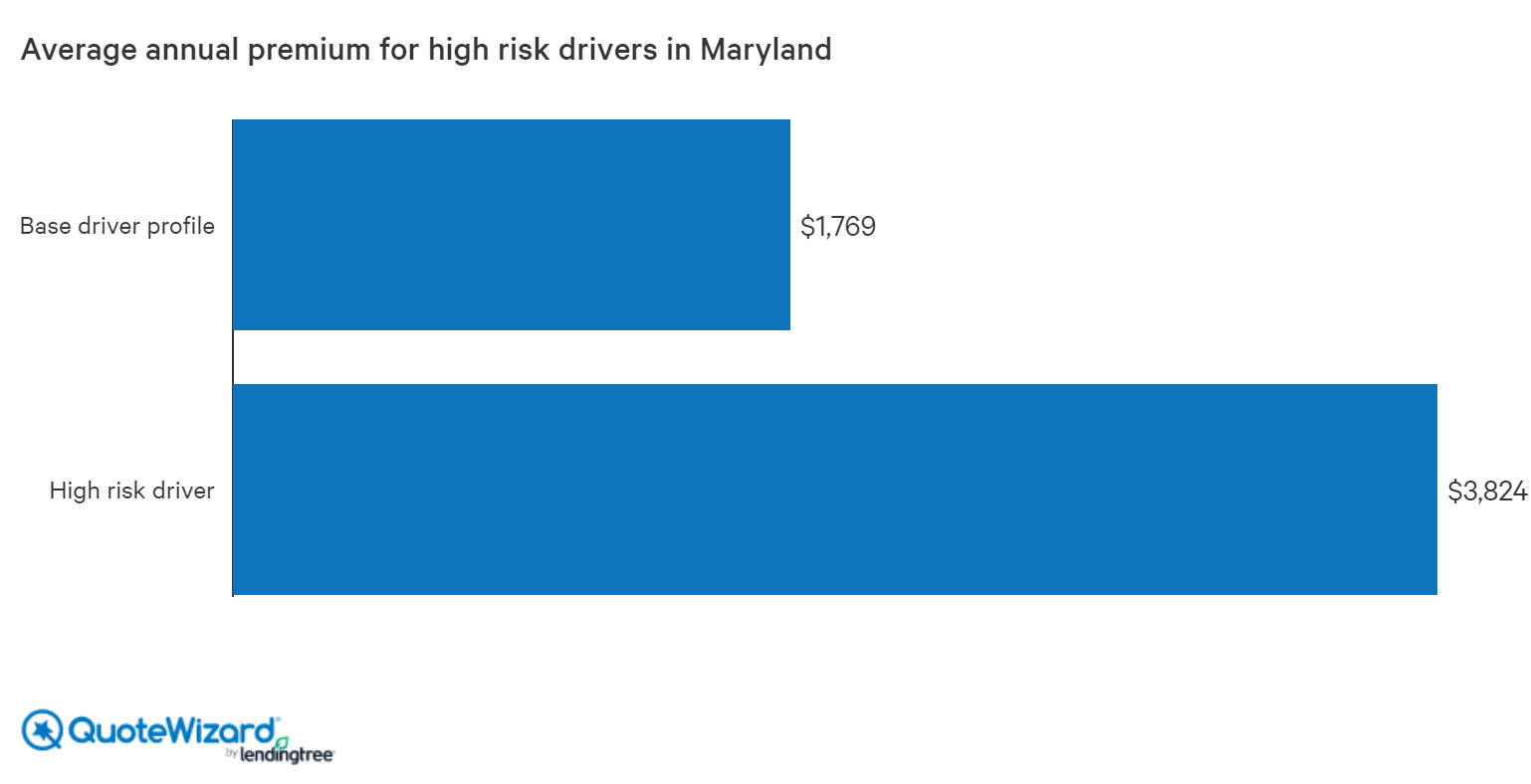

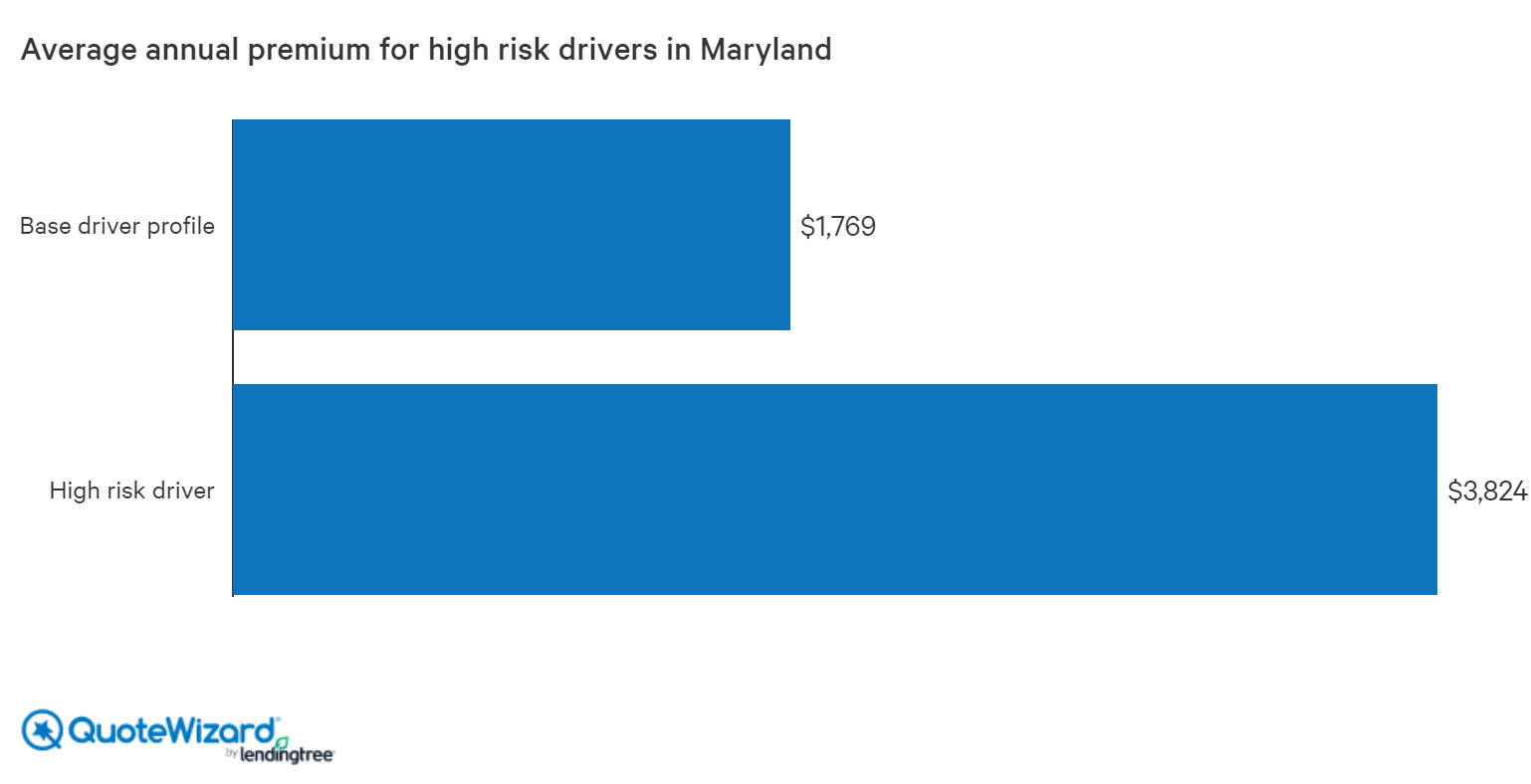

Other Factors That Can Increase Your Insurance Rates

There are multiple factors that have an effect on the cost of your car insurance. Living in Maryland by default probably means youre paying a bit more annually to insure your car than the national average, but there are other factors that can impact the amount youre spending. By knowing what impacts your premiums, you can try to reduce what your insurance costs by as much as possible

Average Car Insurance Costs In Maryland

How much is insurance in the Free State?

With a population of over 6 million, Maryland is the 19th most populated state in the country and features over 70,792 miles of road. There are many factors that go into calculating the rate you pay for car insurance. Below is a breakdown of how much drivers in Maryland pay for coverage based on different factors. To learn more about insurance requirements in Maryland, check out .

Don’t Miss: Carcareone Card Locations

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and reviewed by subject matter experts, who ensure everything we publish is objective, accurate and worthy of your trust.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most price, customer service, policy features and savings opportunities so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure were putting accuracy first.

How To Get Cheaper Car Insurance In Maryland

Multiple factors affect the cost of car insurance. Some things you can’t control, but you do have a say in most of the contributing factors. Driving safely, obeying traffic laws, and keeping a clean driving record are the best ways to keep your insurance costs down.

Other than that, the best way to lower your car insurance costs is to compare rates from at least three insurance companies. Ideally, you should check your rates every 6-12 months, when you renew your policy. But at a minimum, be sure to check your record and shop for rates every three to five years, since you may be able to get a lower rate if a traffic violation falls off your record.

In Maryland, the most expensive policies cost roughly $2,223, and the least expensive coverage costs around $1,071, when all driver profile information is the same. That means you could save as much as $1,152 simply by shopping around. Be sure to confirm you’re getting all the discounts you’re eligible for, too.

The cheapest states for car insurance are Iowa, Vermont and Nebraska, according to WalletHub’s Cheap Car Insurance Study. They are the cheapest states for auto insurance in large part because they have low population density and relatively few uninsured motorists. In contrast, New York, Florida and New Jersey are the most expensive states for car insurance.

Also Check: Www Getmycartitle Com

Average Cost Of Car Insurance In Maryland By Category

- Clean driving record: $1,115 per year

- After an at-fault accident: $1,693 per year

- Driver with poor credit: $1,756 per year

- Teen driver: $3,846 per year

- After a DUI: $1,882 per year

There are several factors that affect how much you’ll pay for car insurance in Maryland, including your driving record, age, location, the amount of coverage that you purchase, and the insurance company you buy it from. On average, the cheapest insurance companies in Maryland are Travelers, Geico, and Erie. But every insurer has their own way of calculating premiums, so it’s a good idea to get quotes from at least three different companies to make sure you find the best deal.

Finally, it’s worth noting that car insurance premiums in Maryland are average, compared to the cost of coverage in neighboring states like Delaware and Virginia. You can find more details in the table below.

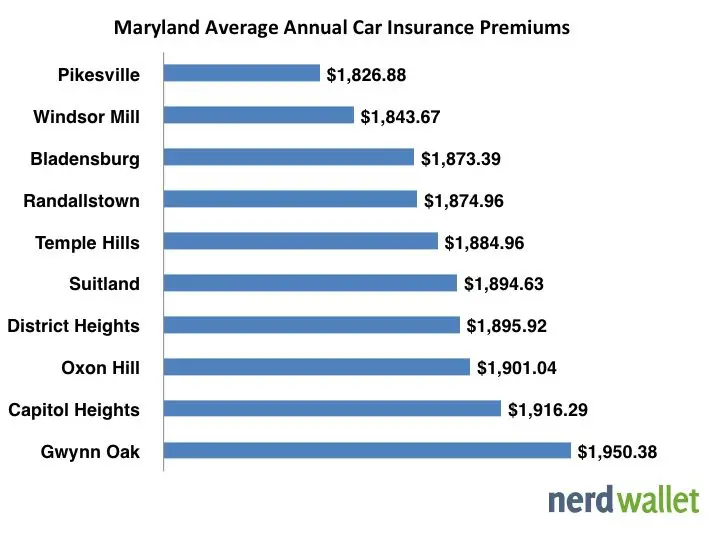

Average Car Insurance Cost In Maryland By City

Car insurance costs can vary widely depending on where you live and drive. In Maryland, the cost of full coverage insurance fluctuates by over $1,700 a year depending on the city where you reside.

Drivers in Leitersburg pay the lowest auto insurance rates in the state at $1,446 per year for full coverage insurance. Gwynn Oak residents pay $3,202 a year, making it the most expensive city in Maryland.

| City |

|---|

| Personal injury protection | $2,500 |

Maryland drivers are required to carry $2,500 in PIP insurance, though you may choose a limited PIP option that essentially waives coverage. A limited PIP policy prevents you from receiving PIP benefits under any policy issued in the state of Maryland.

For example, if you carry limited PIP coverage and are injured in an accident while driving your friend’s car, you cannot receive PIP reimbursement through the car insurance policy affiliated with that vehicle.

Recommended Reading: Car Care One Credit Card Accepted

How Does The Annual Cost In Maryland Compare To The Rest Of The Country

- High population density: With the 10th highest population density in the country, Maryland has a higher rate of accidents.

- Severe weather: Maryland is increasingly prone to flooding, which can drive up auto insurance rates.

- Auto theft: Maryland has seen an increase in car insurance rates, particularly in cities

| All Coverage Before Jerry |

|---|

| $2,432 | $1,963 |

Cheapest Auto Insurance In Maryland For 30

Drivers with poor credit in Maryland should consider the following companies with the lowest average rates for full coverage:

Nationwide: $1,947 per year, or about $162 per month.

Geico: $2,299 per year, or about $192 per month.

Encompass: $2,952 per year, or about $246 per month.

Progressive: $3,013 per year, or about $251 per month.

Penn National: $3,226 per year, or about $269 per month.

Also Check: Removing Scuff Marks From Car Interior

How Much Are Auto Insurance Rates For Drivers With Bad Credit

The average car insurance cost for drivers with bad credit is $1,050 a year, according to CarInsurance.coms expert rate analysis. Thats 71% higher than what a driver with good credit pays.

Nearly all states allow car insurance companies to take into account your credit history when setting auto insurance rates. .

Using credit history to determine the cost of car insurance is a controversial topic. Insurers say their research shows that drivers with bad credit file more claims, and are therefore a higher risk. Critics say that its discriminatory and that car insurance costs should be based solely on driver performance.

While the debate continues, some states have started drafting legislation that would ban the use of credit in underwriting policies. For now, though, it is still a common practice among carriers.

Tips To Get Cheap Car Insurance In Maryland

Although some auto insurance companies are less expensive than others, there are additional ways to save money on car insurance:

Compare car insurance in Maryland: Several factors influence a driver’s car insurance rates, so take the time to thoroughly investigate all available choices and compare prices from different providers.

Maintain a good credit score: Your credit score is an essential factor in deciding how much insurance you will need. Paying down loans and making regular payments will help raise a poor credit score and help customers get a better car insurance rate.

Inquire about discounts: Some insurance companies can have additional rewards or savings that may reduce premiums, such as low mileage discounts for infrequent drivers or student discounts for good grades.

Improve your driving record: Drivers with tickets, injuries, or violations on their record will most likely pay higher car insurance rates, but many insurance providers will give you a discount if you complete a safe driving or driver’s education course.

Raise the premiums: Increasing the deductible on an insurance policy usually results in a lower monthly payment. Keep in mind that while higher deductibles can result in lower monthly premiums, they also result in higher out-of-pocket expenses in the event of a claim.

Read Also: Notarizing A Car Title In Az

Is Car Insurance In Maryland Expensive

Car insurance in Maryland is more expensive than the national average, which is around $1,500 annually for full coverage and about $600 per year for minimum coverage. As the cost of providing insurance goes up, the premiums insurers charge also rise. All insured drivers share the increasing cost of insurance.

Recommended Car Insurance Coverage

The cheapest car insurance may not provide sufficient protection, so how much insurance should you buy? Bare-bones coverage may be a good choice if you have few assets or have an old car and dont drive much. But if you have a home and investments, consider buying more insurance. If you dont, youre at risk for having your money and house taken to cover the cost of an accident. If you financed your car you will be required to get additional comprehensive and collision coverage.

Use our How Much Car Insurance Do You Need? tool to get a recommendation.

Recommended Reading: How To Repair Clear Coat On Car Paint

Is Car Insurance More Expensive In Maryland

Car insurance in Maryland is more expensive than the national average, which is around $1,500 annually for full coverage and about $600 per year for minimum coverage. As the cost of providing insurance goes up, the premiums insurers charge also rise. All insured drivers share the increasing cost of insurance.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Walmart Duplicate Car Keys

What Is It Like Driving In Maryland

At 15-and-three-quarters years old, a teen can get a learners permit in Maryland. That teenager driver must then complete 60 hours of training with a licensed driver 21 years or older. The minimum age to receive the provisional license is 16-and-a-half years old.

While the teen is under the age of 18, there may not be any other non-family member passengers under the same age. Then, the driver may have the provisional license converted to a full drivers license at the age of 18.

What Is The Average Cost Of Car Insurance In Maryland

The average cost of car insurance in Maryland is $1,440 per year according to thezebra.com.2 Thats 3% lower than the national average. Of course, your auto insurance cost will depend on many different factors including your age, where you live, and your driving history.

Some people get the bare minimum coverage, while others prefer the comfort and security of more protection. Liberty Mutual customizes your Maryland auto insurance, so you only pay for what you need.

Don’t Miss: How To Make Vent Clip Freshies

Car Insurance In Maryland: What You Need To Know

All drivers in Maryland need insurance for their vehicles. The state’s Motor Vehicle Administration uses capital letters for emphasis on its website: “All Maryland vehicles MUST be insured at ALL times by a vehicle company licensed in Maryland.” In other words, you can’t cancel insurance on a car just because you aren’t driving it.

How Can I Make My Insurance Cheaper In Maryland

There are many waves to save on auto insurance in Maryland. For instance, if you have an older car, you may consider removing full coverage if you can pay for the costs to fix your car or replace it out of pocket. You could also increase your deductible to reduce the premium, but make sure you can pay the higher deductible if you need to file a claim. Keeping a high credit score will also likely get you cheaper premiums in Maryland.

Read Also: How To Clean Car Door Panels

Cheapest Full Coverage Car Insurance In Maryland For 40

Drivers in Maryland with clean driving records may want to think about the following companies, which had the lowest average rates:

Geico: $1,382 per year, or about $115 per month.

Nationwide: $1,410 per year, or about $118 per month.

Erie: $1,539 per year, or about $128 per month.

Penn National: $1,569 per year, or about $131 per month.

State Farm: $1,836 per year, or about $153 per month.

Cheapest Insurance Companies In Maryland

Shopping around for your car insurance and doing some research can seriously make a difference when it comes to how much you pay annually. Its a good idea to take a look at a number of different auto insurance companies in your area to find out who can offer you the lowest and most competitive rates. If you want a head start, here are the car insurance companies that offer the cheapest rates in Maryland:

Also Check: Tips For Car Wash Attendants

Get Quotes From Other Car Insurance Companies

Different have different rate structures, which is why you can get a different quoted premium for the same coverage. If you get a speeding ticket in Maryland, shopping around for car insurance from different companies may help you save.

| Car insurance company |

|---|

| 6% |

*Premiums are average annual full coverage premiums for 40-year-olds

When comparing car insurance companies, you might want to consider other factors in addition to price to find the best company for your circumstances. Things like coverage offerings, available discounts, third-party customer service reviews and financial strength ratings can also be important aspects of a company to investigate.

Car Insurance Requirements In Maryland

- Bodily injury per person: $30,000

- Bodily injury per accident: $60,000

- Property damage liability per accident: $15,000

While the required limits may seem adequate, long hospital stays or legal cases can hit them quickly. Given the high cost of cars now, $15,000 will probably not cover full replacement if you total another person’s vehicle. If you hit your liability coverage limit, you’ll have to pay the rest out of your own pocket. To avoid this scenario, consider raising your car insurance limits to the following:

- Bodily injury per person: $100,000

- Bodily injury per accident: $300,000

- Property damage liability per accident: $100,000

Don’t Miss: How Long Should My Car Last